Elgin Illinois Deed in Trust, also known as a land trust or Illinois land trust, is a legal arrangement that allows property owners in Elgin, Illinois, to transfer the legal title of their property into a trust. This type of trust offers numerous benefits to property owners, including privacy, asset protection, and estate planning advantages. One of the main benefits of utilizing a Deed in Trust in Elgin, Illinois, is the ability to maintain personal privacy. When a property is transferred into a trust, the ownership is held by the trust rather than the individual, keeping the owner's name confidential. This can be particularly beneficial for individuals who wish to protect their identities or maintain a low profile. Additionally, Elgin Illinois Deed in Trust provides asset protection for property owners. By titling the property in the name of the trust, it shields it from potential legal claims, liens, or bankruptcy issues. In the event of financial difficulties or legal disputes, the property held in the trust may be safeguarded, reducing the risk of losing valuable assets. Furthermore, estate planning advantages are also associated with Elgin Illinois Deed in Trust. Property owners can designate beneficiaries in the trust agreement, specifying who will inherit the property upon their death. This allows for a smoother and more efficient transfer of assets and can potentially avoid the often lengthy and costly probate process. Different types of Elgin Illinois Deed in Trust include: 1. Revocable Living Trust: A trust that can be modified or revoked by the property owner during their lifetime. It provides flexibility and allows for changes in beneficiaries or trustees as needed. 2. Irrevocable Trust: A trust that cannot be modified or revoked once established. This type of trust may offer additional asset protection benefits but lacks flexibility compared to a revocable living trust. 3. Charitable Remainder Trust: A trust that enables property owners to donate their property to a charitable organization while retaining income from the property during their lifetime. This type of trust provides tax advantages for individuals who wish to support a cause they care about. It is important to consult with an experienced estate planning attorney or a trust professional for guidance and assistance in establishing an Elgin Illinois Deed in Trust. They can provide personalized advice based on an individual's specific circumstances and goals.

Elgin Illinois Deed In Trust

State:

Illinois

City:

Elgin

Control #:

IL-LR171T

Format:

Word;

Rich Text

Instant download

Description

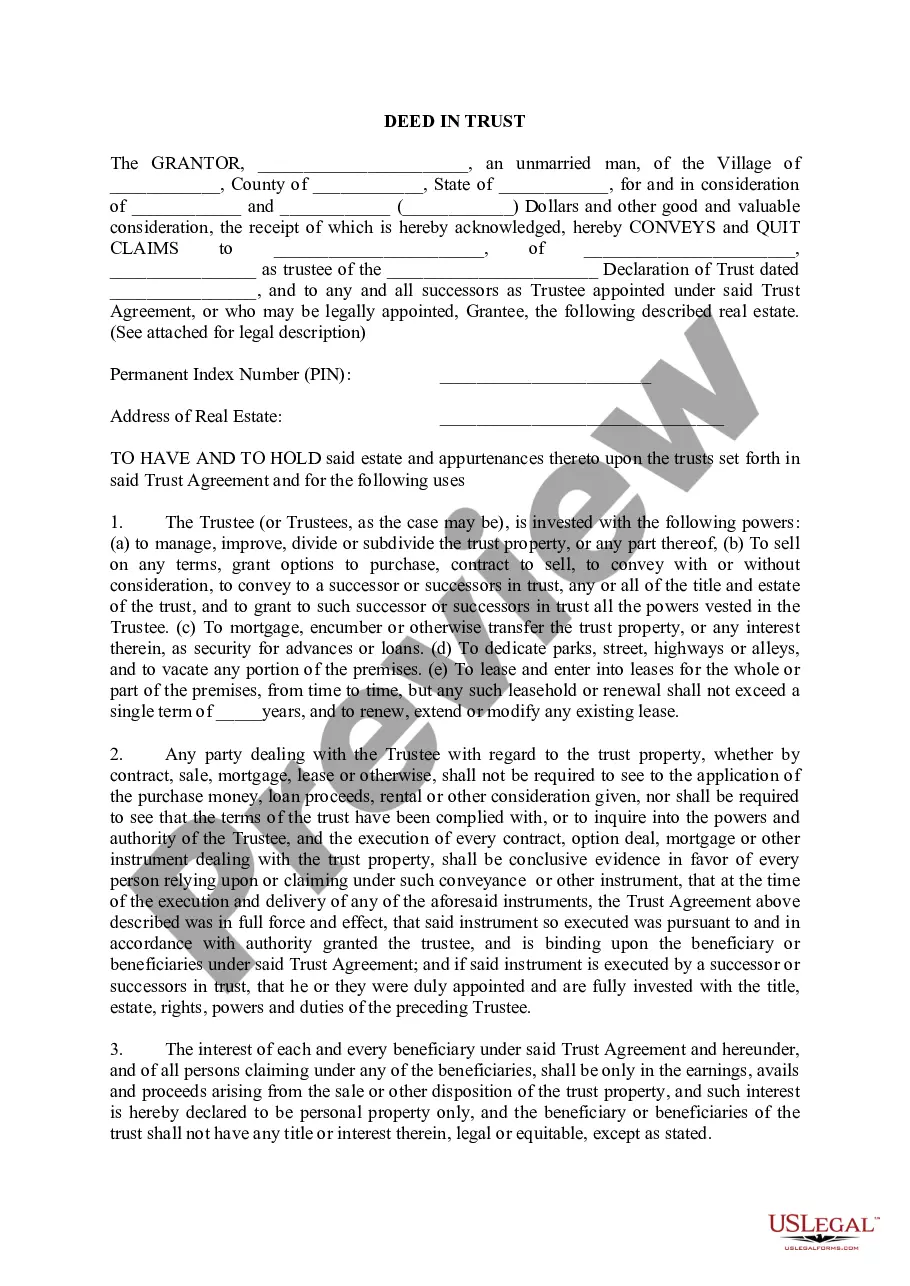

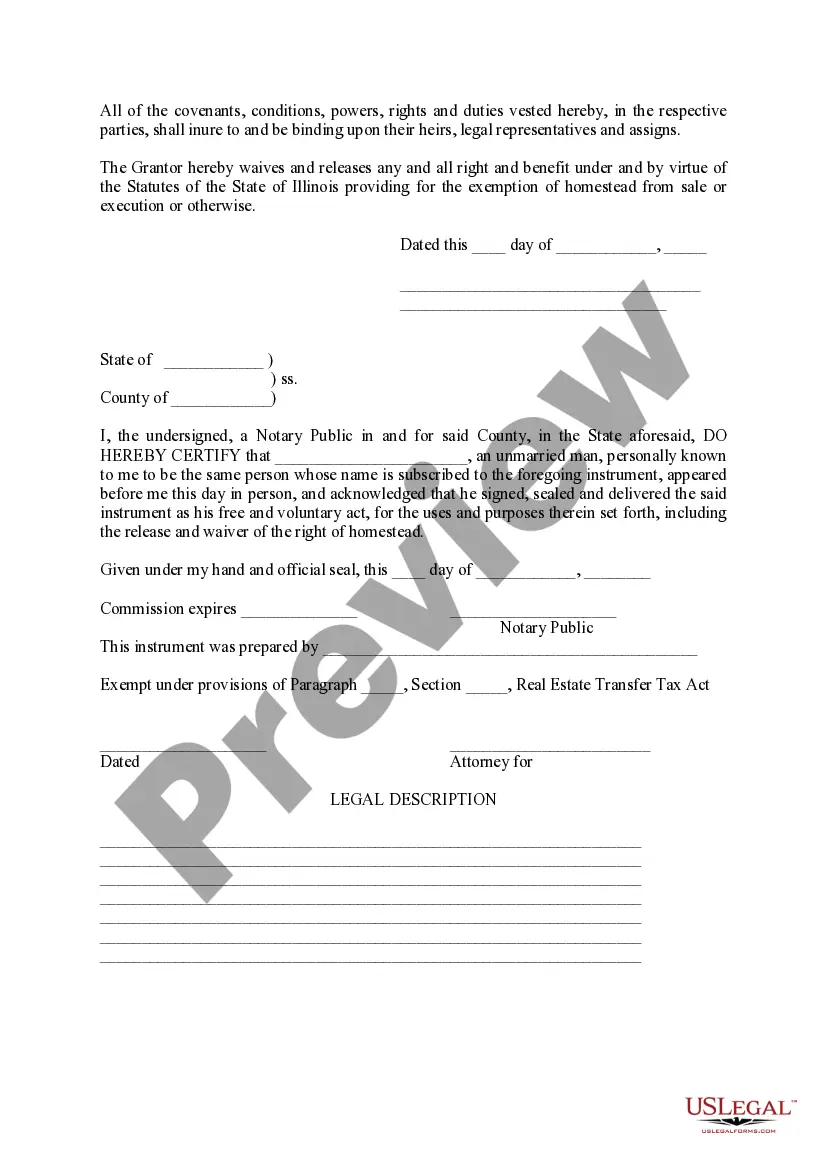

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee.

Elgin Illinois Deed in Trust, also known as a land trust or Illinois land trust, is a legal arrangement that allows property owners in Elgin, Illinois, to transfer the legal title of their property into a trust. This type of trust offers numerous benefits to property owners, including privacy, asset protection, and estate planning advantages. One of the main benefits of utilizing a Deed in Trust in Elgin, Illinois, is the ability to maintain personal privacy. When a property is transferred into a trust, the ownership is held by the trust rather than the individual, keeping the owner's name confidential. This can be particularly beneficial for individuals who wish to protect their identities or maintain a low profile. Additionally, Elgin Illinois Deed in Trust provides asset protection for property owners. By titling the property in the name of the trust, it shields it from potential legal claims, liens, or bankruptcy issues. In the event of financial difficulties or legal disputes, the property held in the trust may be safeguarded, reducing the risk of losing valuable assets. Furthermore, estate planning advantages are also associated with Elgin Illinois Deed in Trust. Property owners can designate beneficiaries in the trust agreement, specifying who will inherit the property upon their death. This allows for a smoother and more efficient transfer of assets and can potentially avoid the often lengthy and costly probate process. Different types of Elgin Illinois Deed in Trust include: 1. Revocable Living Trust: A trust that can be modified or revoked by the property owner during their lifetime. It provides flexibility and allows for changes in beneficiaries or trustees as needed. 2. Irrevocable Trust: A trust that cannot be modified or revoked once established. This type of trust may offer additional asset protection benefits but lacks flexibility compared to a revocable living trust. 3. Charitable Remainder Trust: A trust that enables property owners to donate their property to a charitable organization while retaining income from the property during their lifetime. This type of trust provides tax advantages for individuals who wish to support a cause they care about. It is important to consult with an experienced estate planning attorney or a trust professional for guidance and assistance in establishing an Elgin Illinois Deed in Trust. They can provide personalized advice based on an individual's specific circumstances and goals.

Free preview

How to fill out Elgin Illinois Deed In Trust?

If you’ve already utilized our service before, log in to your account and save the Elgin Illinois Deed In Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Elgin Illinois Deed In Trust. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!