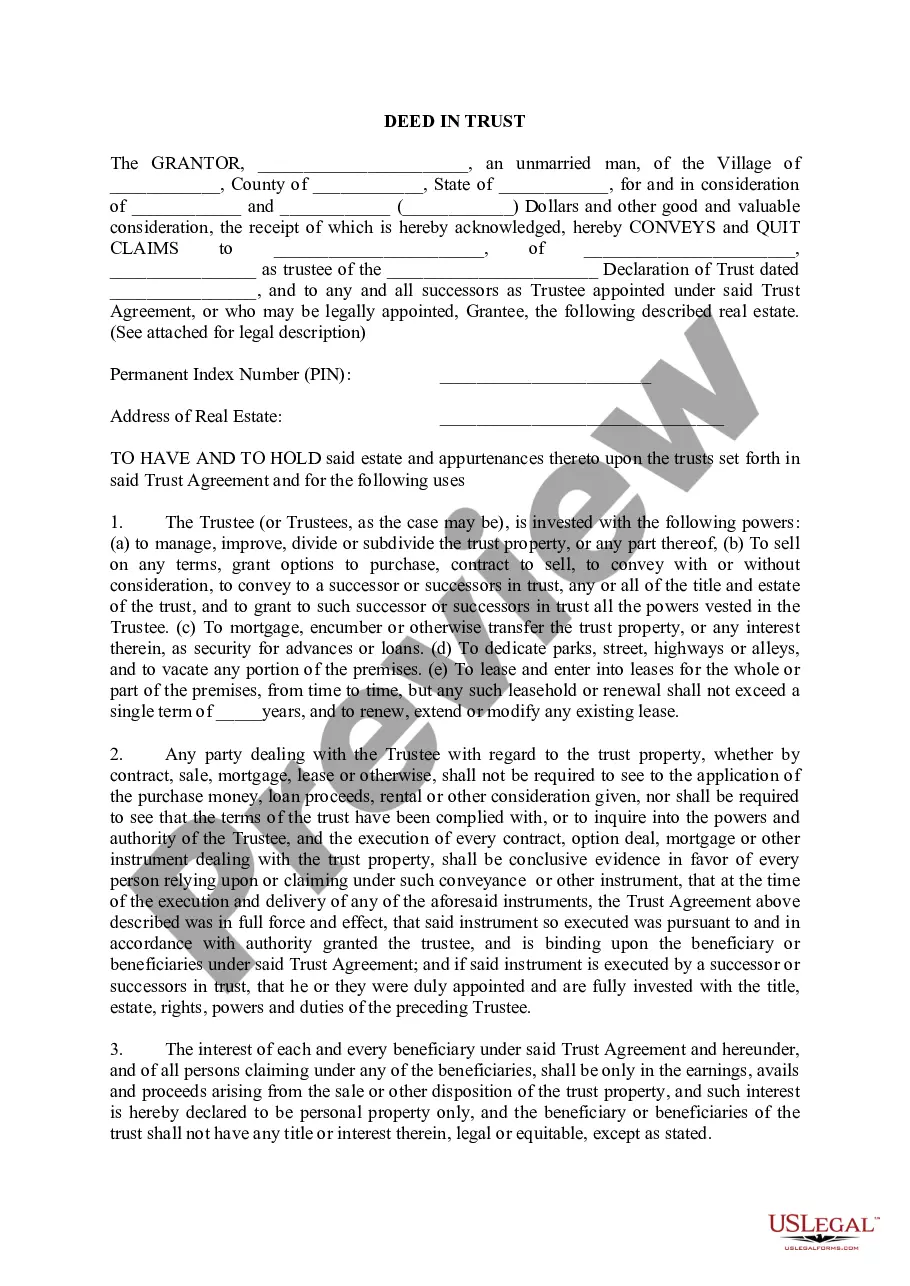

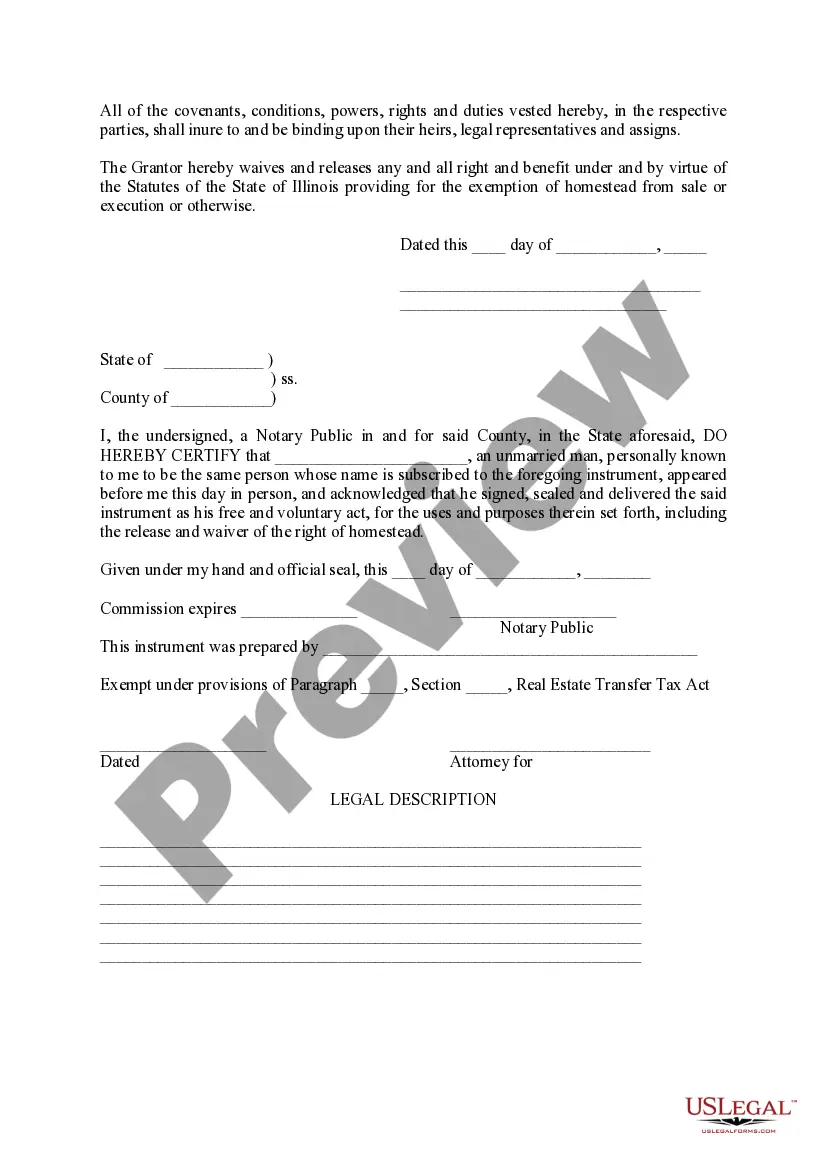

Rockford Illinois Deed In Trust, also known as a Land Trust or Illinois Land Trust, is a legal and widely used instrument for real estate ownership and transfer in the Rockford, Illinois area. It offers various advantages and benefits to property owners and investors. In a Rockford Illinois Deed In Trust, the property owner (known as the Granter) transfers the legal title of their property to a trustee, who manages and administers the property as per the Granter's instructions. The trustee, usually a bank or a trust company, holds the legal title, while the Granter retains all the beneficial rights, such as the ability to use, sell, lease or mortgage the property. The primary advantage of using a Rockford Illinois Deed In Trust is privacy. Since the trustee holds the legal title, the public records only show the ownership of the trust, keeping the granter's information private. This can be beneficial for high-profile individuals, celebrities, or anyone seeking to keep their property ownership details confidential. Additionally, the Rockford Illinois Deed In Trust provides estate planning benefits. By placing their property in a trust, the Granter ensures that their property will pass to their intended beneficiaries upon their death, avoiding probate. This can simplify the transfer of ownership and potentially save time and money. Furthermore, a Rockford Illinois Deed In Trust offers flexibility. The Granter has the ability to change the beneficiaries or terms of the trust easily, without involving the court. This flexibility ensures that the Granter can adapt to changing circumstances or preferences over time. Different types of Rockford Illinois Deed In Trust include: 1. Single Beneficiary Trust: A trust where there is only one beneficiary named by the Granter. This is commonly used in situations where a property owner wishes to ensure the property's smooth transfer to a chosen individual or entity. 2. Multiple Beneficiary Trust: A trust where the property owner names more than one beneficiary. This type of trust allows the Granter to divide the property's beneficial interests among multiple individuals, such as family members or business partners. 3. Revocable Living Trust: A trust that can be modified or revoked by the Granter during their lifetime. This type of trust is often used for estate planning purposes, allowing the Granter to maintain control over their property while alive and efficiently transfer it after their death. In conclusion, the Rockford Illinois Deed In Trust is a legal tool that offers privacy, estate planning advantages, and flexibility to property owners in Rockford, Illinois. With different types available, individuals can choose the one that best suits their specific needs and goals.

Rockford Illinois Deed In Trust

Description

How to fill out Rockford Illinois Deed In Trust?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Rockford Illinois Deed In Trust becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Rockford Illinois Deed In Trust takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Rockford Illinois Deed In Trust. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!