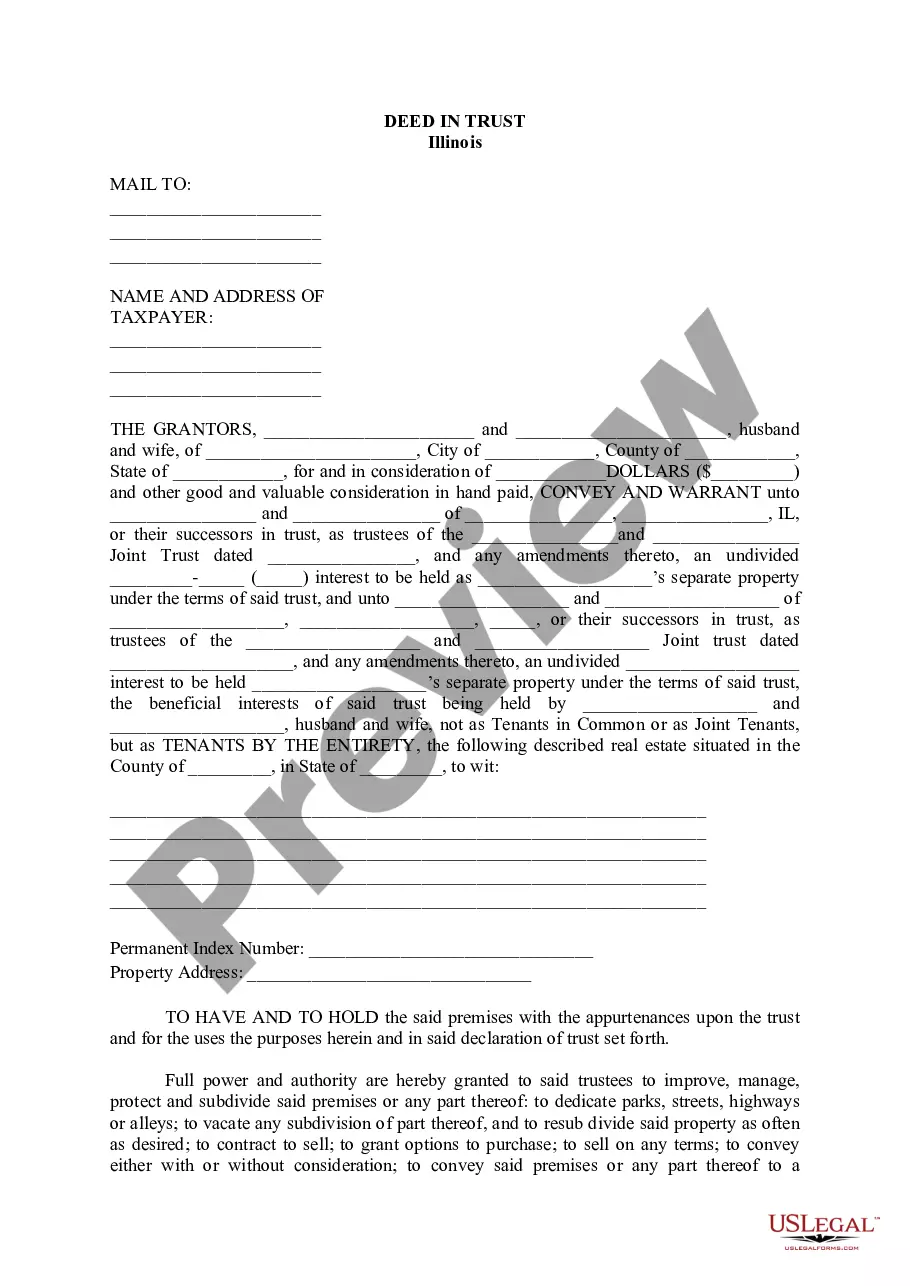

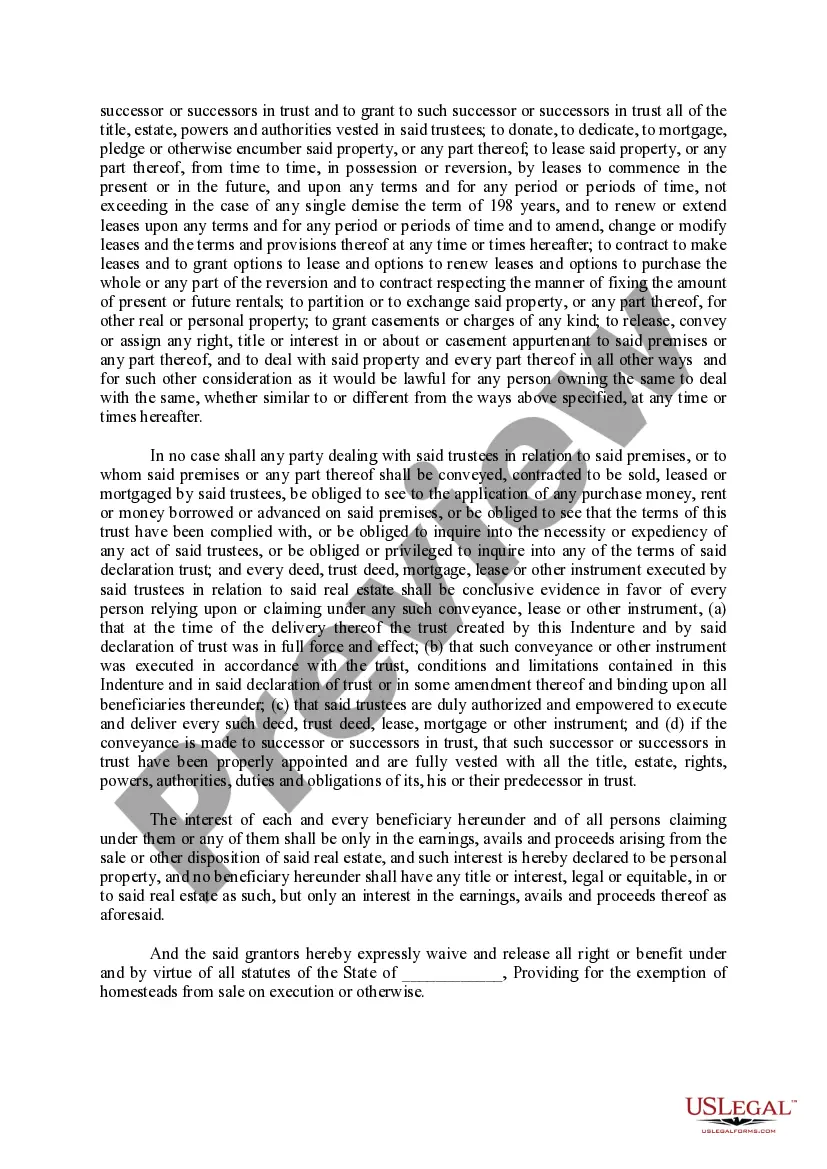

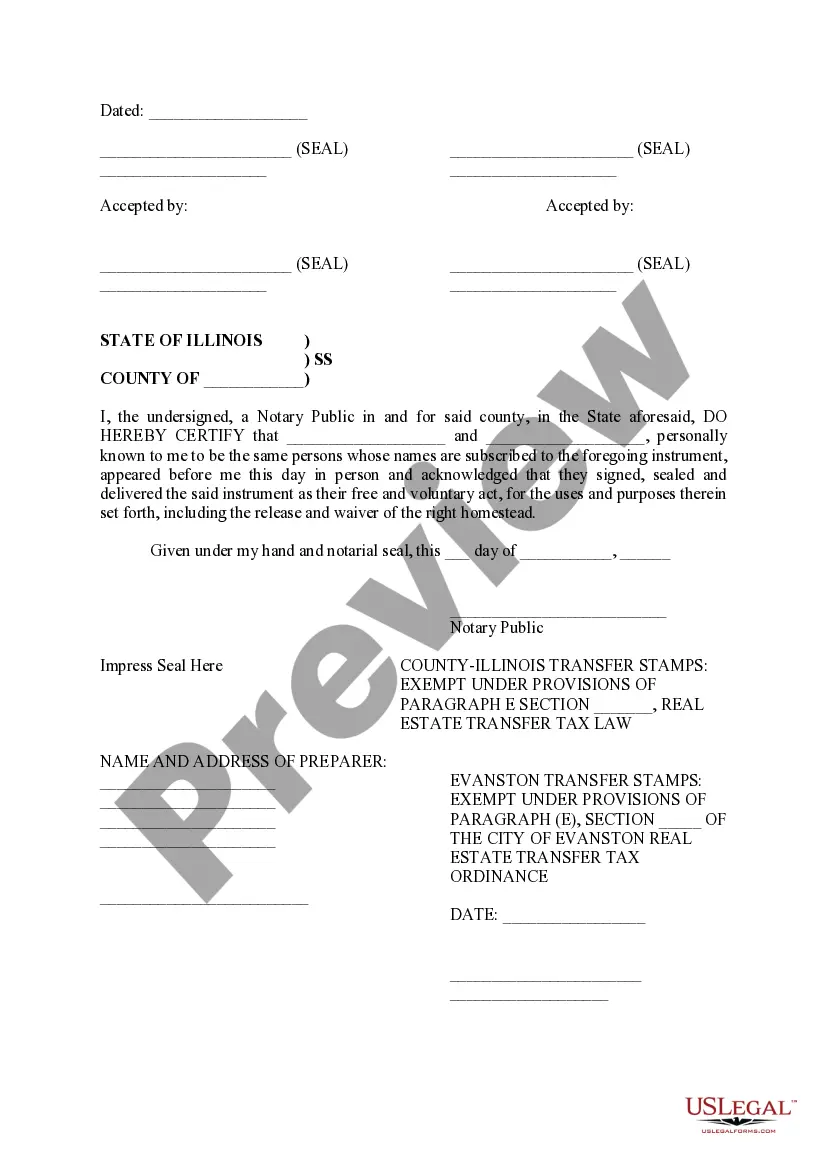

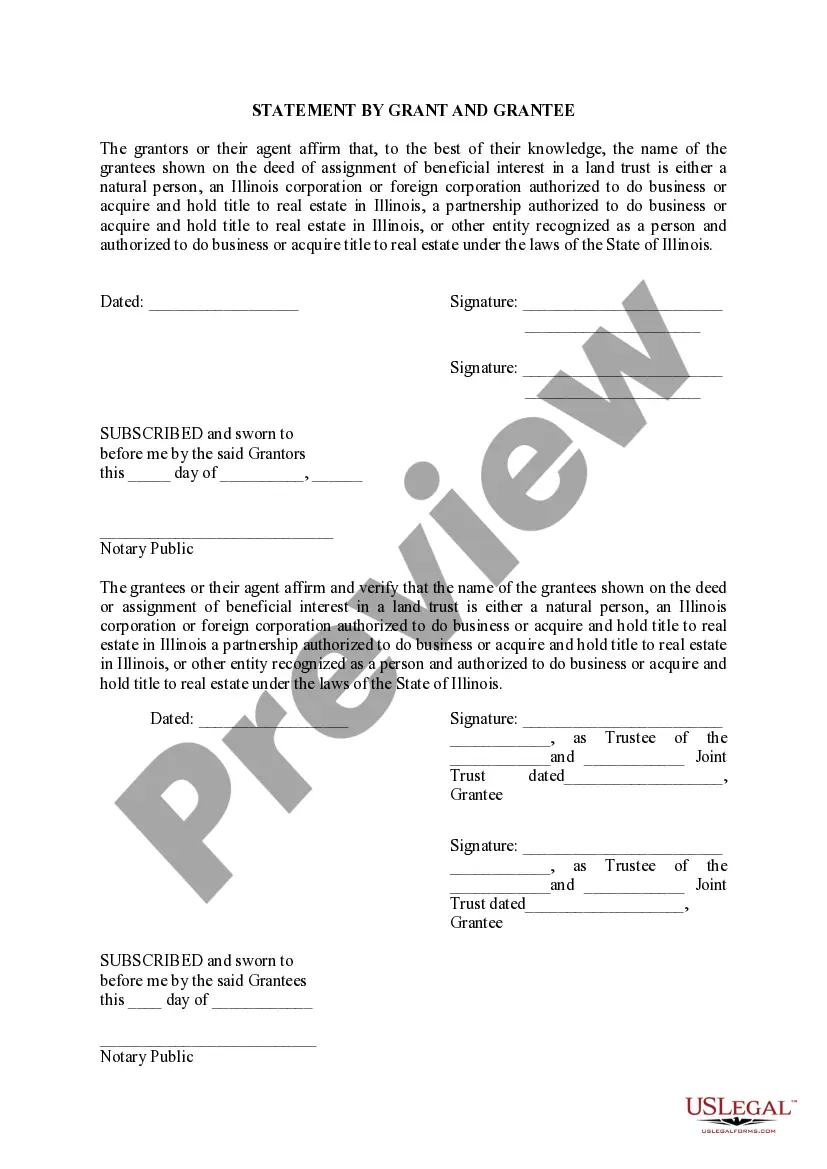

Cook Illinois Deed in Trust is a legal document that involves transferring ownership of real estate properties in Cook County, Illinois, to a trustee who holds the property on behalf of a beneficiary. This type of trust is commonly used to protect assets, ensure proper estate planning, or to fulfill specific purposes defined by the granter. The Cook Illinois Deed in Trust serves as a binding agreement between the granter (property owner) and the trustee, outlining the terms and conditions of the trust arrangement. By placing the property in trust, the granter retains control over the property during their lifetime while also establishing clear instructions for its management and distribution after their passing. One notable advantage of utilizing a Cook Illinois Deed in Trust is the minimization of probate expenses and delays when transferring the property to designated heirs or beneficiaries. The trust remains intact regardless of changes in the granter's circumstances, ensuring the property's smooth distribution without court involvement. There are different types of Cook Illinois Deed in Trust that cater to specific needs and goals. Some common variations include: 1. Revocable Living Trust: This type of trust allows the granter to retain control over the property while alive, making amendments or revoking the trust if necessary. It becomes irrevocable upon the granter's death, providing seamless transition and management of the assets. 2. Irrevocable Trust: Once established, this trust type cannot be altered or revoked without the consent of all beneficiaries involved. By relinquishing control, the granter may gain potential tax benefits or protect assets from creditors, making the irrevocable trust an attractive option for estate planning purposes. 3. Charitable Remainder Trust: This type of trust allows the granter to provide for both charitable causes and individual beneficiaries. The granter designates specific assets to be placed into the trust, and during their lifetime, they and/or their designated beneficiaries receive income from the trust. After their passing, the remaining assets are donated to the designated charitable organization or cause. 4. Special Needs Trust: This trust type aims to protect the interests of individuals with disabilities or special needs who are eligible for government assistance. It allows the granter to set aside funds for their care without affecting their eligibility for Medicaid or other support programs. In summary, a Cook Illinois Deed in Trust is a legally binding document that transfers the ownership of real estate in Cook County, Illinois, to a trustee. By utilizing different types of Cook Illinois Deed in Trust, individuals can protect assets, facilitate estate planning, ensure charitable contributions, and meet the unique needs of beneficiaries or family members.

Cook Illinois Deed In Trust

Description

How to fill out Cook Illinois Deed In Trust?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we apply for legal solutions that, usually, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Cook Illinois Deed In Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Cook Illinois Deed In Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Cook Illinois Deed In Trust is proper for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!