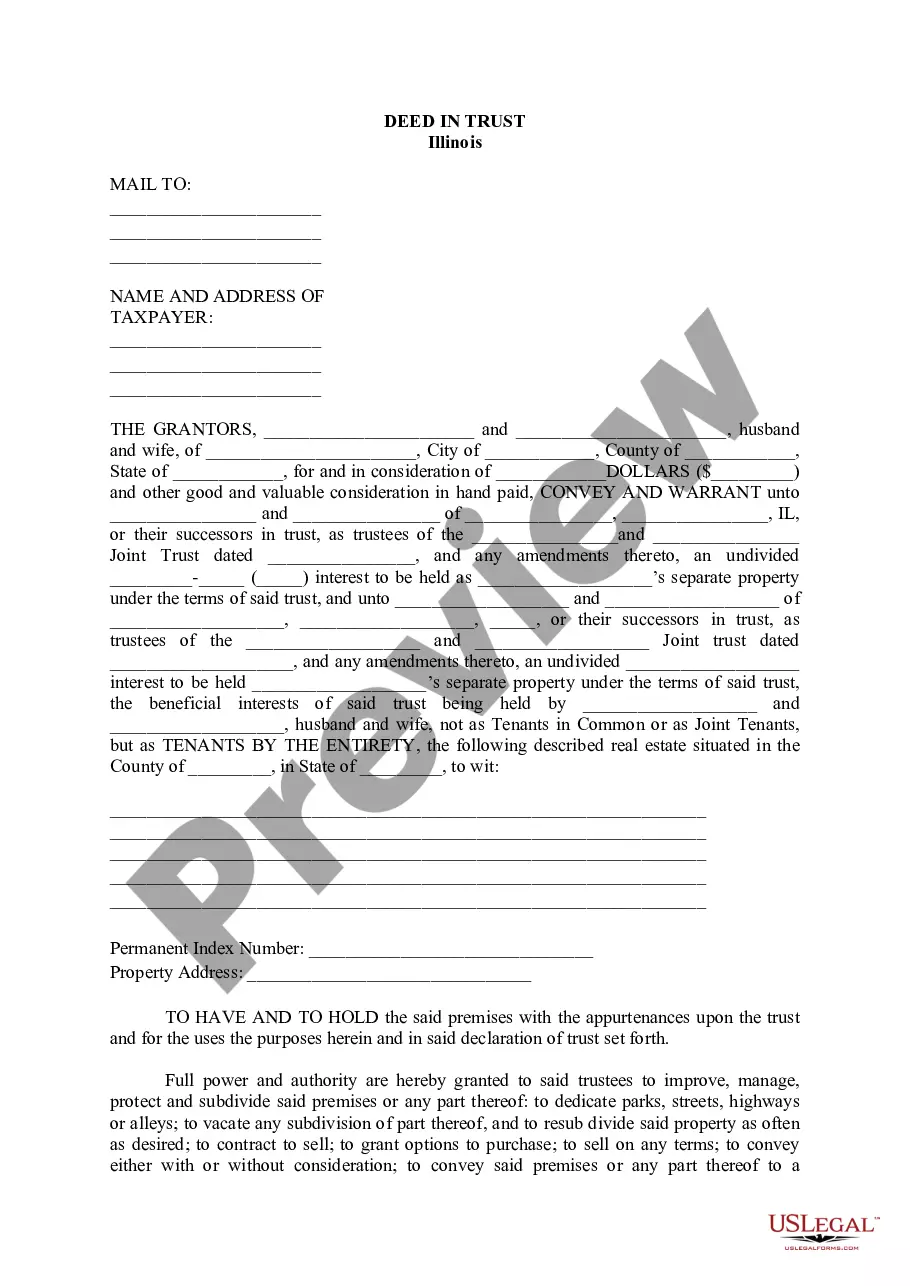

Elgin Illinois Deed In Trust, also known as a land trust, is a legal arrangement in which a property title is transferred to a trustee for the benefit of a beneficiary. This type of trust is commonly used in real estate transactions in Elgin, Illinois, as it offers various benefits to the parties involved. One of the key benefits of an Elgin Illinois Deed In Trust is privacy. By placing a property in a trust, the owner's name is shielded from public records, providing an additional layer of confidentiality. This can be particularly useful for high-profile individuals or those seeking anonymity. Another advantage is the ease of transferring beneficial interests. In traditional real estate transactions, transferring ownership can be cumbersome and time-consuming. With an Elgin Illinois Deed In Trust, however, transferring the beneficial interest is a simple process, as it involves transferring ownership of the trust rather than the property itself. This can save both time and money for the parties involved. There are a few different types of Elgin Illinois Deed In Trust, each with its own specific characteristics: 1. Revocable Trust: This type of trust allows the granter (property owner) to retain control and make changes to the trust terms during their lifetime. The granter has the power to dissolve the trust or make amendments as they see fit. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be altered or revoked by the granter once it is established. This type of trust offers enhanced asset protection and may have tax benefits. 3. Charitable Trust: A charitable trust is created for the purpose of benefiting a charitable organization or cause. Property placed in this type of trust can provide tax benefits for the granter. 4. Land Conservation Trust: This type of trust is specifically designed to preserve and protect natural areas and open spaces. It is commonly used in Elgin, Illinois, to safeguard environmentally sensitive land from development. Overall, an Elgin Illinois Deed In Trust offers various advantages, including privacy, flexibility in transferring beneficial interests, and potential tax benefits. Whether it's a revocable, irrevocable, charitable, or land conservation trust, each type serves different purposes and can be tailored to meet the specific needs and goals of the property owner.

Elgin Illinois Deed In Trust

Description

How to fill out Elgin Illinois Deed In Trust?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Elgin Illinois Deed In Trust becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Elgin Illinois Deed In Trust takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Elgin Illinois Deed In Trust. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!