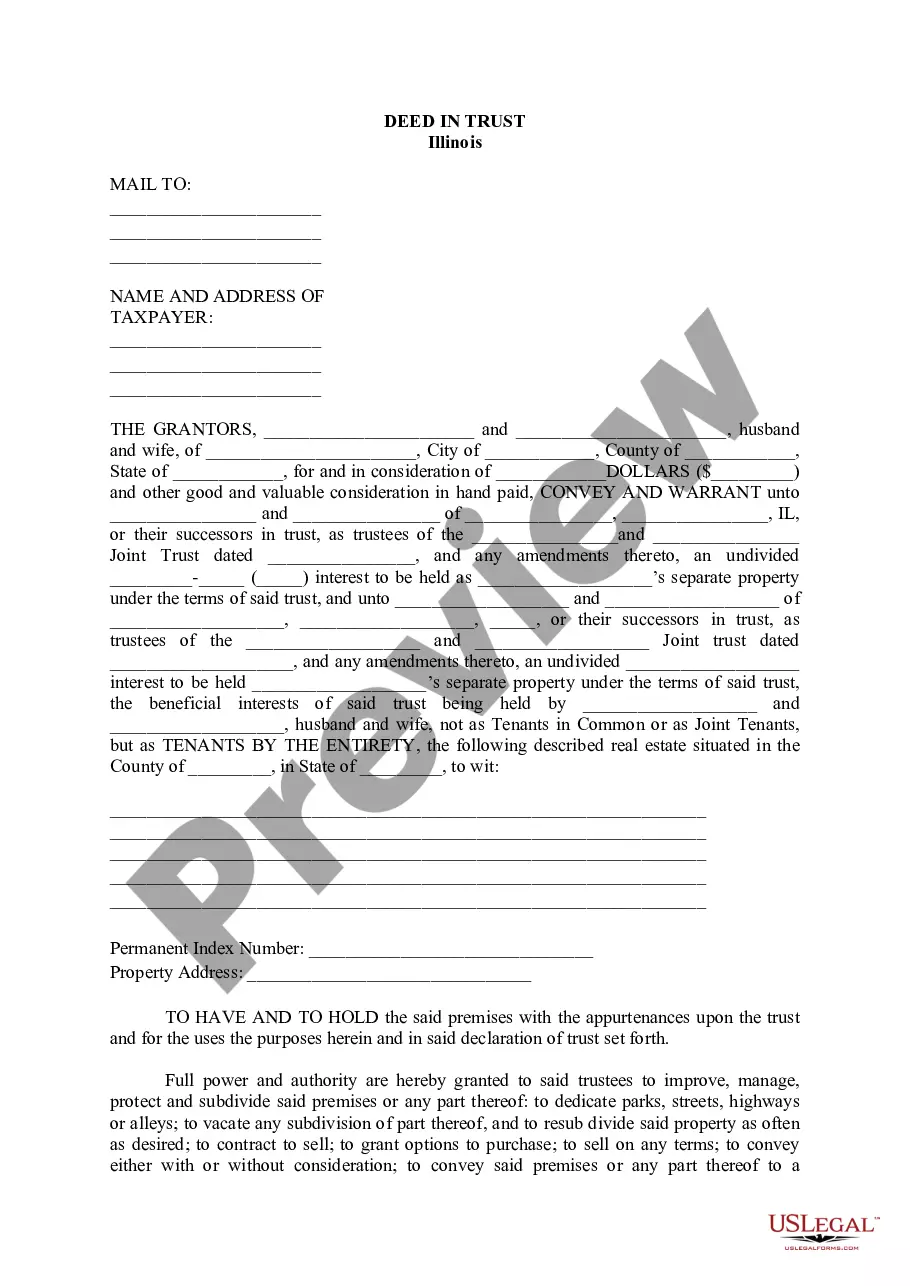

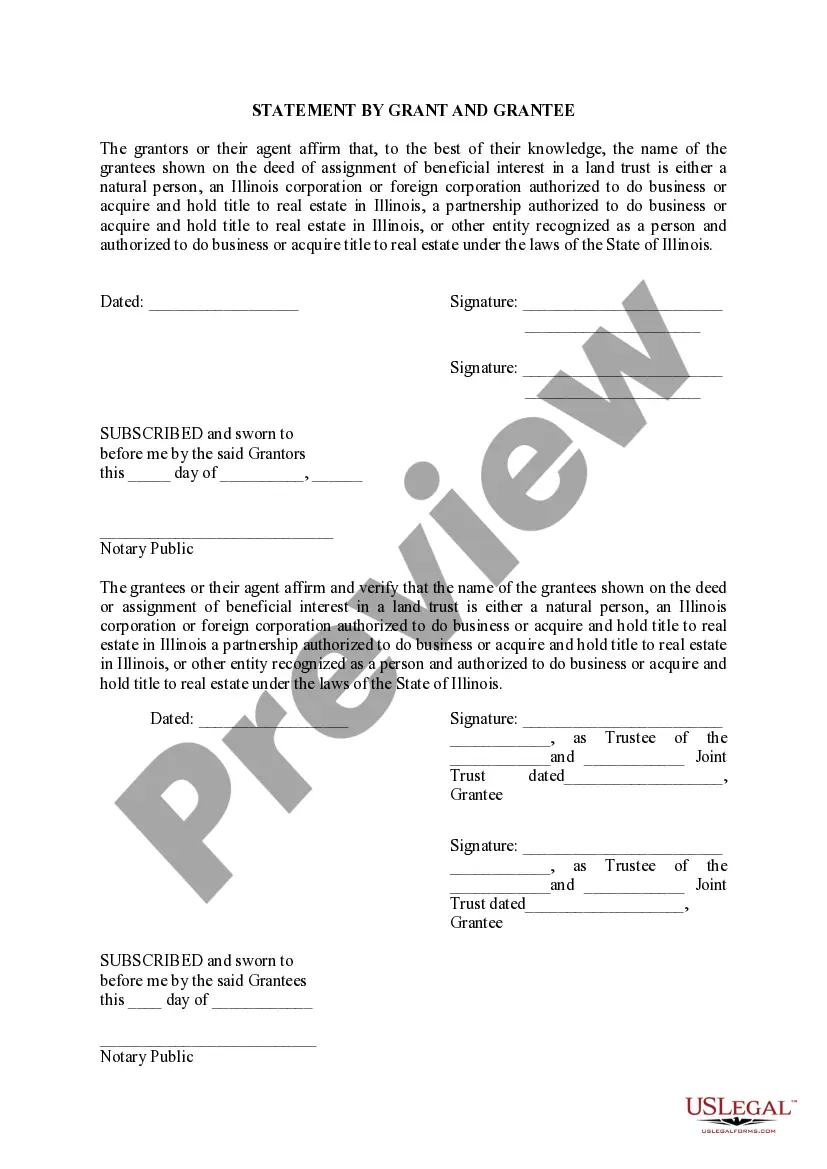

Rockford Illinois Deed In Trust is a legal instrument used in the state of Illinois to transfer property ownership to a trustee, who holds the property for the benefit of another party. This arrangement provides several benefits and is commonly used in estate planning, asset protection, and real estate transactions. One type of Rockford Illinois Deed In Trust is the Revocable Living Trust. This type of trust allows the granter (the person transferring the property) to retain control over the assets during their lifetime. They can amend or revoke the trust at any time, making it a flexible and versatile option. Additionally, it allows for the seamless transfer of assets to beneficiaries upon the granter's passing, avoiding the need for probate. Another type of Rockford Illinois Deed In Trust is the Irrevocable Trust. In this trust, the granter permanently transfers ownership of the property to the trustee, relinquishing their control over the assets. This type of trust is often used for Medicaid planning, as it helps protect assets from being counted towards the granter's eligibility for healthcare benefits. Rockford Illinois Deed In Trust offers several advantages to both the granter and the beneficiaries. It provides privacy, as trust documents are not filed with the court and remain confidential, unlike wills and probate proceedings. It also enables the avoidance of probate, saving time and costs associated with the court process. Moreover, it allows for greater control over the property, as the granter can specify the conditions under which the trustee must distribute the assets to the beneficiaries. To create a Rockford Illinois Deed In Trust, the granter must draft a trust document outlining the terms and conditions of the trust, including the appointment of a trustee and beneficiaries. The document must comply with the Illinois Trust and Trustees Act and be signed and notarized by the granter. In conclusion, Rockford Illinois Deed In Trust provides a valuable tool for property owners to transfer ownership and establish trusts for various purposes. Whether utilizing a Revocable Living Trust or an Irrevocable Trust, individuals can protect their assets, retain control, and provide for their loved ones in an efficient and private manner.

Rockford Illinois Deed In Trust

Description

How to fill out Rockford Illinois Deed In Trust?

If you’ve already utilized our service before, log in to your account and download the Rockford Illinois Deed In Trust on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Rockford Illinois Deed In Trust. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!

Form popularity

FAQ

Yes, Illinois recognizes deeds of trust as a legal instrument that provides security for loans. These deeds serve a similar function as mortgages and can be essential in property transactions. If you're looking to implement a Rockford Illinois Deed In Trust, understanding its implications is key to securing your investment.

To acquire a copy of your marriage certificate in Winnebago County, you should visit the County Clerk's office or check their online portal. You will need to provide identification and some basic details about the marriage. For anyone managing property under a Rockford Illinois Deed In Trust, having complete marital documentation is crucial for estate planning.

You can obtain a copy of your property deed in Illinois by contacting your local recorder of deeds office. Be prepared to provide details about your property, such as its address and any relevant owner information. Exploring online resources can also simplify your request for a Rockford Illinois Deed In Trust.

To get a copy of a deed in Illinois, you typically need the property's legal description, the address, and the names of the parties involved. This information helps local authorities locate the correct document efficiently. Utilizing platforms like UsLegalForms can streamline your request for a Rockford Illinois Deed In Trust.

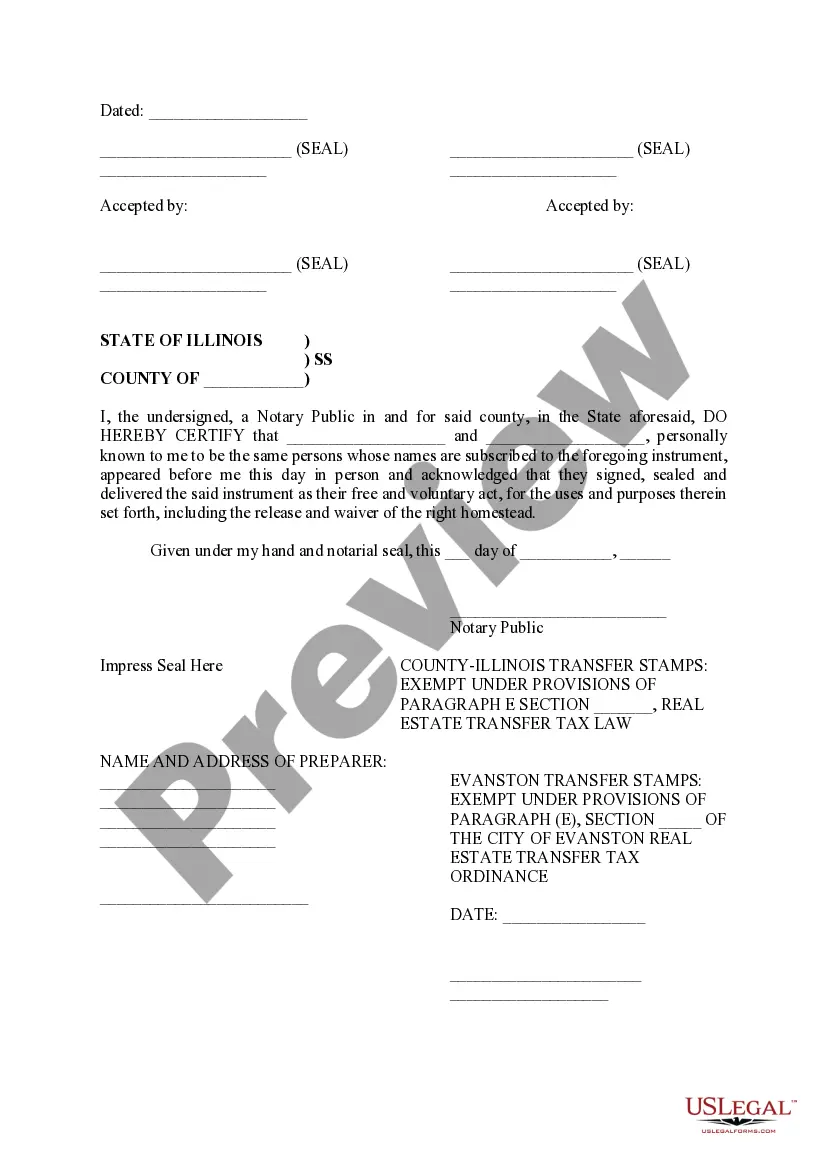

To place your property in a trust in Illinois, you need to create a trust document and formally transfer the property title into the trust. It’s best to work with an attorney to ensure compliance with state laws and to clearly outline the benefits of your Rockford Illinois Deed In Trust. Proper legal guidance will help you navigate this process smoothly.

You can obtain a copy of your deed in Winnebago County by visiting the County Clerk's office or checking their official website. Additionally, you may also request a copy through mail by providing necessary details about the property. Accessing your Rockford Illinois Deed In Trust is straightforward, ensuring you have proper documentation for your records.

To create a valid trust deed, several requirements must be met. First, it should clearly identify the grantor, trustee, and beneficiaries. Additionally, it must describe the property involved and the terms governing the Rockford Illinois Deed In Trust. For full compliance, consider using reputable legal platforms like USLegalForms to access accurate templates and guidance.

A deed in trust in Illinois is a legal document that transfers property ownership to a trustee, who manages it for the benefit of specified beneficiaries. This arrangement is often used in estate planning to facilitate smooth asset distribution and reduce probate issues. Understanding how a Rockford Illinois Deed In Trust works can greatly improve your financial planning.

The trust deed is typically created by the grantor, who establishes the trust and outlines its terms. The grantor can be an individual or a couple aiming to protect their assets through a Rockford Illinois Deed In Trust. However, it is advisable to work with a legal professional to ensure all stipulations are valid and recognized under Illinois law.

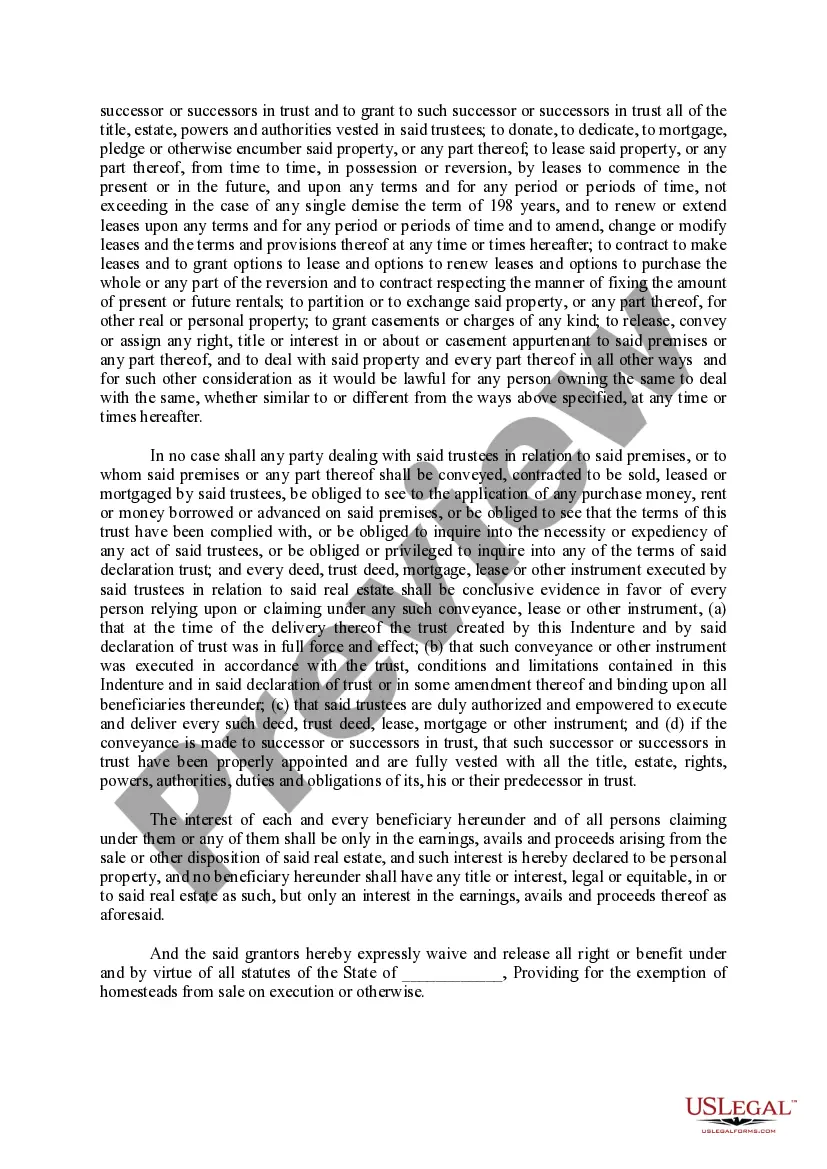

One key disadvantage of a trust deed is the possibility of losing control over the assets. When you transfer property into a Rockford Illinois Deed In Trust, the trustee legally holds the property and must act according to the trust's terms. This arrangement can limit your ability to manage or access the assets directly. It’s important to weigh these factors before proceeding.