Cook Illinois Transfer on Death Instrument Revocation

Description

How to fill out Illinois Transfer On Death Instrument Revocation?

Are you searching for a reliable and economical provider of legal forms to purchase the Cook Illinois Transfer on Death Instrument Revocation? US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish rules for living with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have you covered. Our site offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic and are structured in accordance with the regulations of specific states and counties.

To obtain the document, you must Log In to your account, locate the necessary form, and click the Download button next to it. Please remember that you can access and download your previously purchased form templates at any time from the My documents section.

Is it your first visit to our site? No problem. You can create an account in just a few minutes, but first, make sure to do the following.

Now you can establish your account. Then select the subscription plan and proceed to payment. Once the payment is processed, download the Cook Illinois Transfer on Death Instrument Revocation in any format available. You can revisit the site anytime to redownload the document without any additional fees.

Acquiring current legal documents has never been simpler. Give US Legal Forms a try today, and stop wasting your precious time searching for legal paperwork online.

- Check if the Cook Illinois Transfer on Death Instrument Revocation complies with the laws of your state and locality.

- Read the form's description (if available) to understand who and what the document is meant for.

- Restart your search if the form doesn’t fit your legal situation.

Form popularity

FAQ

To record a transfer on death instrument (TODI) in Cook County, you must file the completed document with the Cook County Recorder of Deeds. Make sure the TODI meets all legal requirements and is signed as necessary. This ensures your wishes regarding the Cook Illinois Transfer on Death Instrument Revocation are accurately documented and recognized.

Filling out a transfer on death designation affidavit requires you to provide specific information about the property, including the owner's details and the designated beneficiary's information. Clear instructions accompany the form, guiding you on how to properly execute the document to ensure proper transfer. Using resources like USLegalForms can simplify this process, making it easier to handle your Cook Illinois Transfer on Death Instrument Revocation precisely.

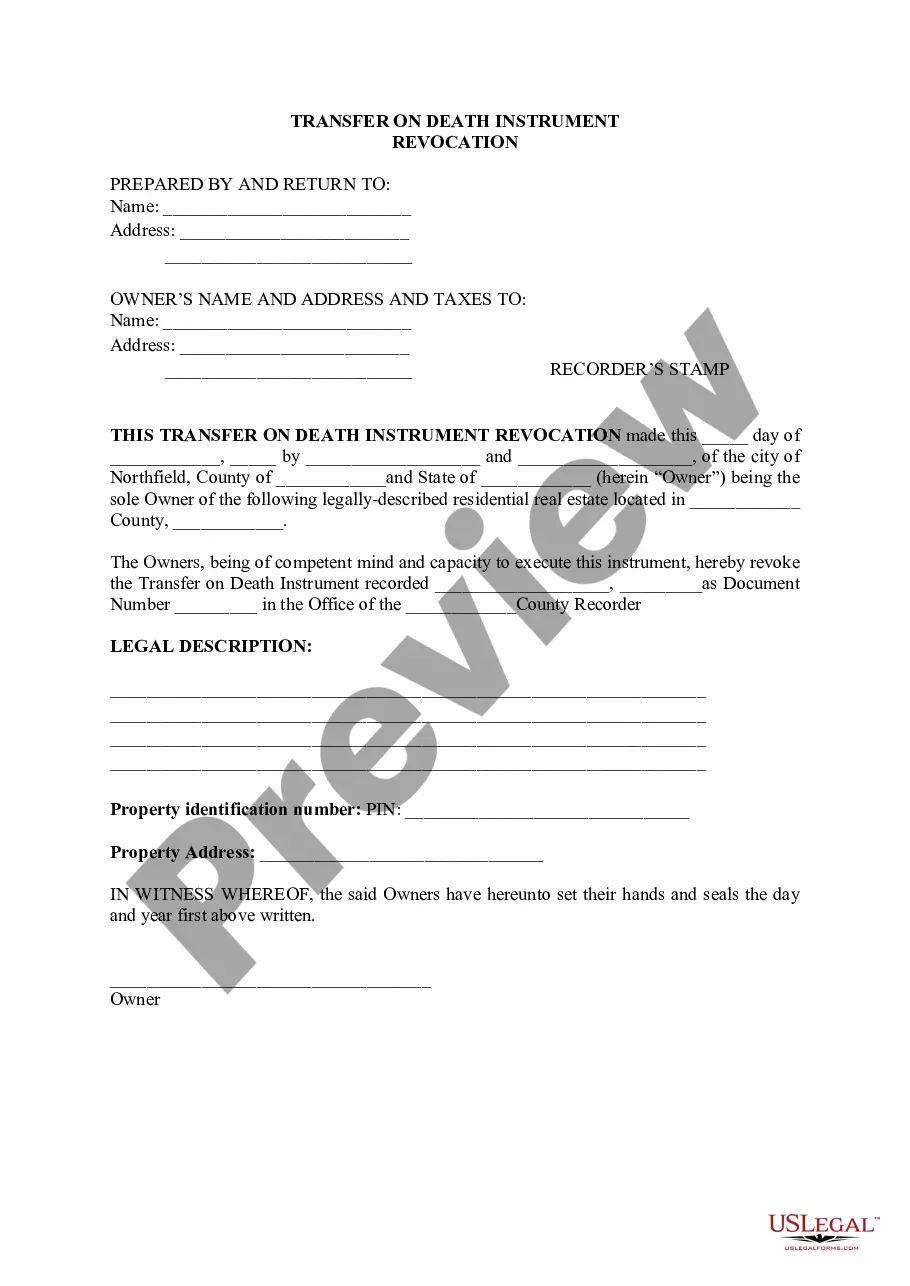

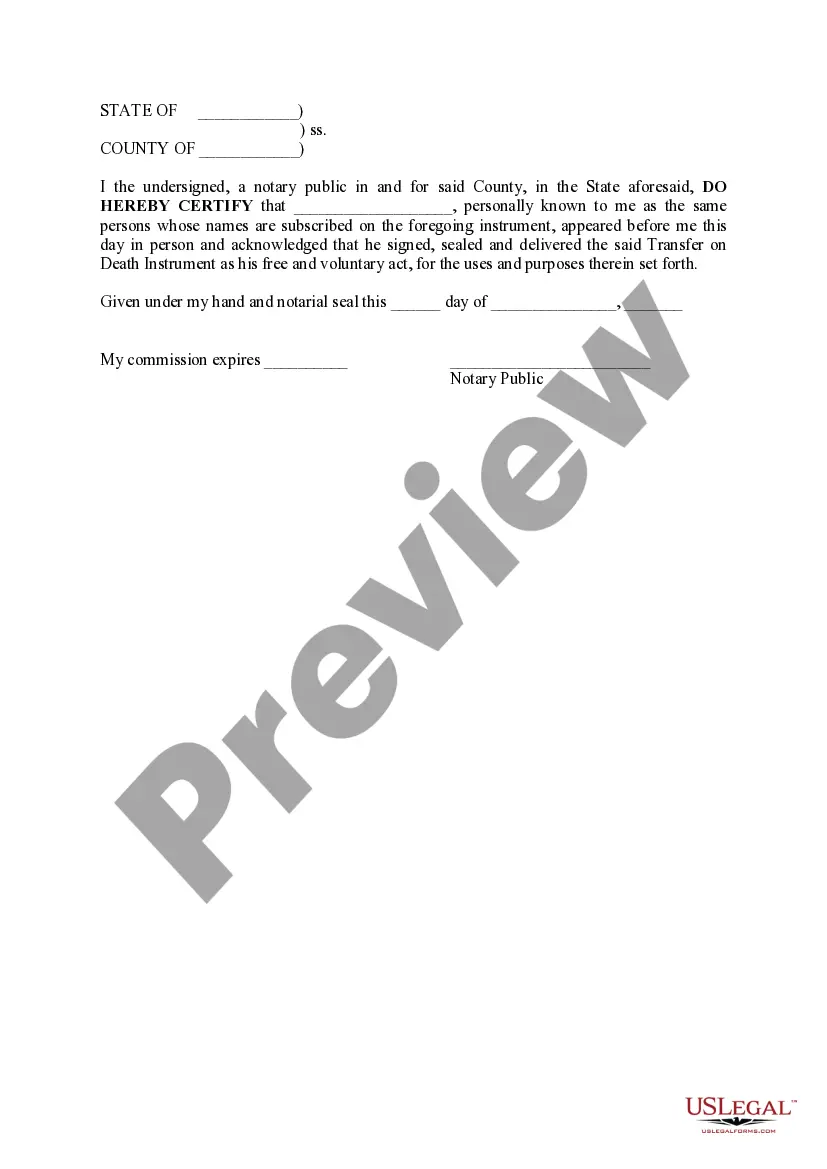

Revoking a transfer on death instrument (TODI) in Illinois involves preparing a new revocation document that clearly states your decision. This revocation must be signed and should ideally be notarized to support its validity. Ensuring the revocation process complies with Illinois law is crucial for an effective Cook Illinois Transfer on Death Instrument Revocation.

A power of attorney typically cannot revoke a transfer on death deed unless it specifically grants such authority. Generally, the individual who executed the deed must take action to revoke it personally. It's advisable to consult with a legal expert when navigating Cook Illinois Transfer on Death Instrument Revocation to ensure all actions meet legal standards and respect your intentions.

To revoke a transfer on death instrument in Illinois, you must create a new document that explicitly states your intent to revoke the existing instrument. This new document should be signed and notarized, following the same formalities as the original. It's essential to properly execute this process to ensure the effective Cook Illinois Transfer on Death Instrument Revocation and avoid any confusion regarding your wishes.

To contest a transfer on a death deed, you must file a petition with the appropriate court. This process typically involves demonstrating that the deed is invalid due to fraud, lack of mental capacity, or improper execution. Engaging a legal professional who understands Cook Illinois Transfer on Death Instrument Revocation is crucial for navigating this challenging process and ensuring your rights are protected.

The transfer on death instrument statute in Illinois allows individuals to designate beneficiaries for their real estate to transfer ownership upon their death. This legal document avoids probate, making the process simpler for your loved ones. By utilizing this type of instrument, you can ensure your property directly passes to your chosen heirs, providing them with clarity and peace of mind.

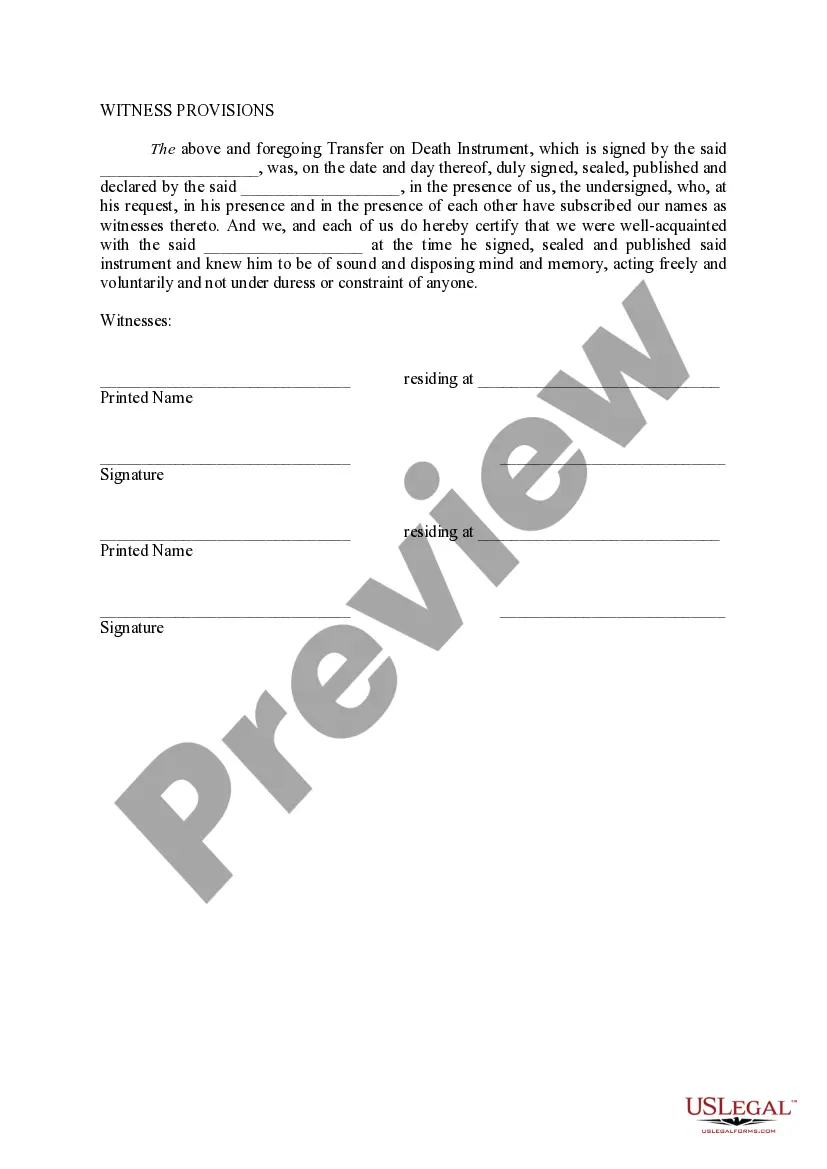

To create a valid transfer on death instrument in Illinois, it must include the names of the property owner and the intended beneficiaries. Additionally, it should detail the specific property involved and must be signed by the owner in the presence of a witness. Afterward, it needs to be recorded with the appropriate county office to ensure enforceability. Understanding the process surrounding Cook Illinois Transfer on Death Instrument Revocation makes these steps more straightforward.

One disadvantage of a transfer on death deed in Illinois is the potential for disputes among heirs, especially if the intentions are unclear. Furthermore, a TOD deed does not allow for real-time management of the property by the beneficiaries until the transferor has passed. Lastly, tax implications can arise if not properly planned. Addressing these issues, particularly with Cook Illinois Transfer on Death Instrument Revocation, can simplify estate management.

In Cook County, a transfer on death instrument must be in writing and signed by the property owner. It should also clearly describe the property and the beneficiaries. Additionally, the document must be recorded with the Cook County Recorder of Deeds to be effective. Properly handling Cook Illinois Transfer on Death Instrument Revocation ensures that your wishes are honored.