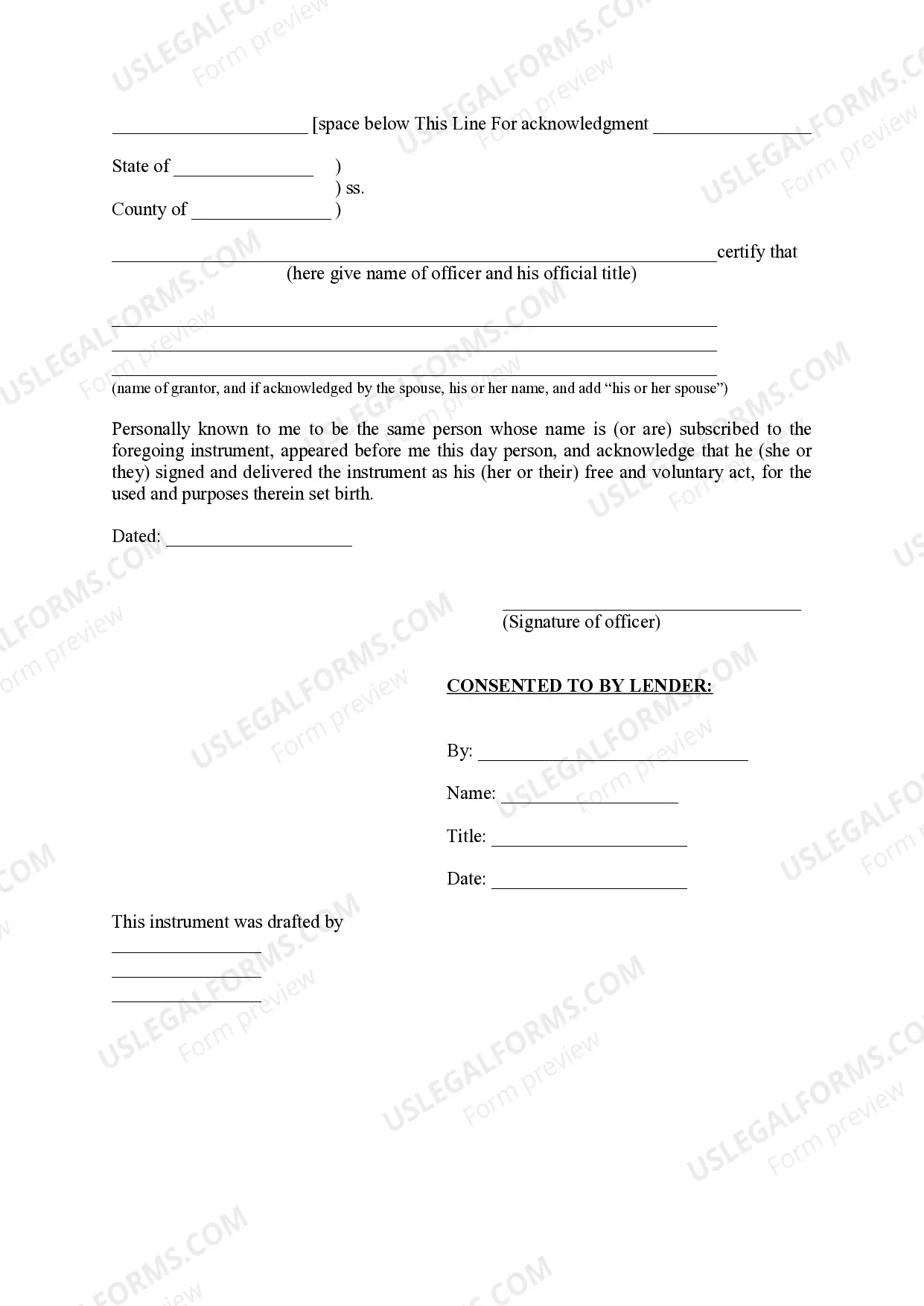

The Chicago Illinois Assumption Agreement refers to a legal document specific to the state of Illinois in the United States, more specifically, the city of Chicago. This agreement is typically entered into between two parties, where the second party agrees to assume the responsibilities and obligations of an existing agreement that was initially entered into between the first party and a third party. The purpose of the Chicago Illinois Assumption Agreement is to allow the transfer of obligations, rights, and duties from one party to another. This can occur in various contractual relationships, such as leases, loans, mortgages, or other types of agreements. The agreement essentially permits the substitution of the original party with a new party who agrees to carry out the terms and conditions specified within the original agreement. There are several types of Chicago Illinois Assumption Agreements depending on the nature of the original agreement being assumed. Some commonly known types include: 1. Lease Assumption Agreement: This occurs when a tenant transfers their lease obligations, including rent payments, maintenance responsibilities, and adherence to lease terms, to a new tenant who takes over the lease. 2. Mortgage Assumption Agreement: In this type of agreement, a new buyer or borrower agrees to take over an existing mortgage and assume all the terms, conditions, and payment obligations associated with it. 3. Loan Assumption Agreement: This agreement is similar to a mortgage assumption agreement but applies to any type of loan, such as personal loans or business loans, where the borrower is substituted by a new borrower who agrees to repay the loan. 4. Partnership Assumption Agreement: This agreement enables a new partner to assume the rights, duties, and obligations of an existing partner in a business partnership. Regardless of the type of assumption agreement, it is important for both parties involved to carefully review the terms and conditions mentioned in the original agreement being assumed. This includes understanding the specific obligations, payment schedules, potential liabilities, and any other relevant terms. Additionally, it is advisable for both parties to seek legal counsel to ensure the agreement is valid, enforceable, and protects the interests of all parties involved. By using the above-mentioned keywords, this detailed description provides an overview of what the Chicago Illinois Assumption Agreement is and highlights various types of assumption agreements that can be encountered in different situations.

Chicago Illinois Assumption Agreement

Description

How to fill out Chicago Illinois Assumption Agreement?

Do you need a reliable and affordable legal forms supplier to buy the Chicago Illinois Assumption Agreement? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Chicago Illinois Assumption Agreement conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the form is good for.

- Start the search over if the form isn’t suitable for your specific situation.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Chicago Illinois Assumption Agreement in any provided format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal paperwork online for good.