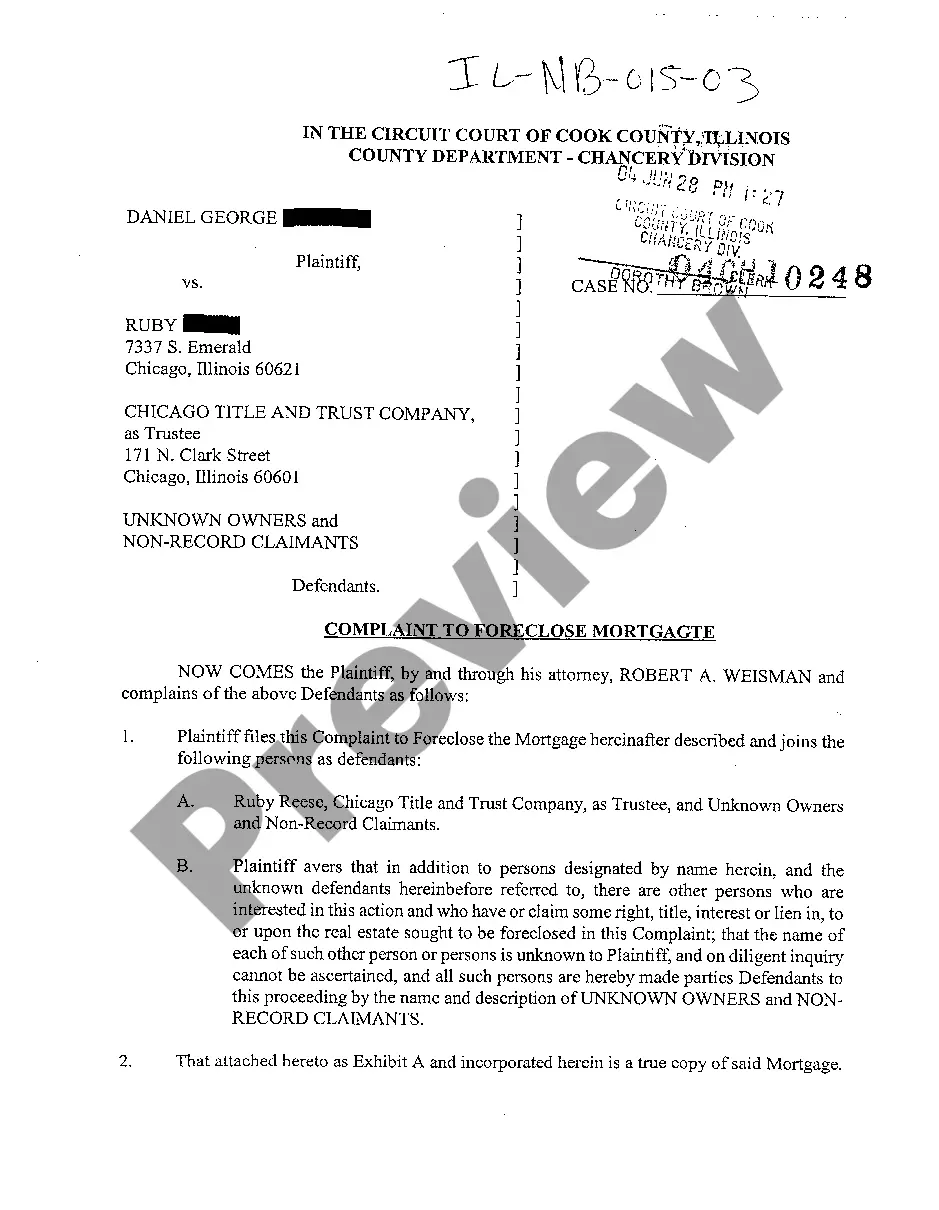

The Chicago Illinois Complaint to Foreclose Mortgage is a legal document filed by a lender or mortgage holder to initiate foreclosure proceedings against a borrower who has defaulted on their mortgage payments. This complaint serves as a formal written notice to the borrower that legal action will be taken to recover the outstanding debt on the mortgage. Keywords: 1. Foreclosure: The legal process by which a mortgage lender takes possession and/or sells a property due to the borrower's failure to make mortgage payments. 2. Mortgage: A legal agreement between a borrower and a lender, typically a financial institution, where the borrower obtains funds to purchase a property and pledges the property as collateral to secure the loan. 3. Complaint: A formal legal document that outlines the claims and allegations made by one party against another, in this case, the lender against the borrower. 4. Default: Failure to fulfill the financial obligations specified in the mortgage agreement, specifically failing to make timely mortgage payments. 5. Lender: The financial institution or entity that provides the loan to the borrower for the purchase of the property and holds a security interest in the property until the mortgage is paid off. Types of Chicago Illinois Complaint to Foreclose Mortgage: 1. Strict Foreclosure Complaint: In some cases, the lender may file a strict foreclosure complaint when the borrower has defaulted on the mortgage. In this type of complaint, the lender requests the court to transfer ownership of the property directly to them without a public sale or auction. 2. Judicial Foreclosure Complaint: This type of complaint is typically filed when the lender seeks to foreclose on the property through a court-supervised process. The complaint outlines the details of the mortgage, the borrower's default, and requests the court to authorize the foreclosure and subsequent sale of the property. 3. Non-Judicial Foreclosure Complaint: This type of complaint may be used if the mortgage contains a power of sale clause, which allows the lender to foreclose on the property without court involvement. The complaint provides notice to the borrower about the impending foreclosure sale. It is important to note that the specific types and requirements of the Complaint to Foreclose Mortgage in Chicago, Illinois may vary, so consulting with a legal professional or reviewing local foreclosure laws are recommended to ensure accuracy and compliance.

Chicago Illinois Complaint To Foreclose Mortgage

Description

How to fill out Chicago Illinois Complaint To Foreclose Mortgage?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for attorney services that, usually, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Chicago Illinois Complaint To Foreclose Mortgage or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Chicago Illinois Complaint To Foreclose Mortgage complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Chicago Illinois Complaint To Foreclose Mortgage would work for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!