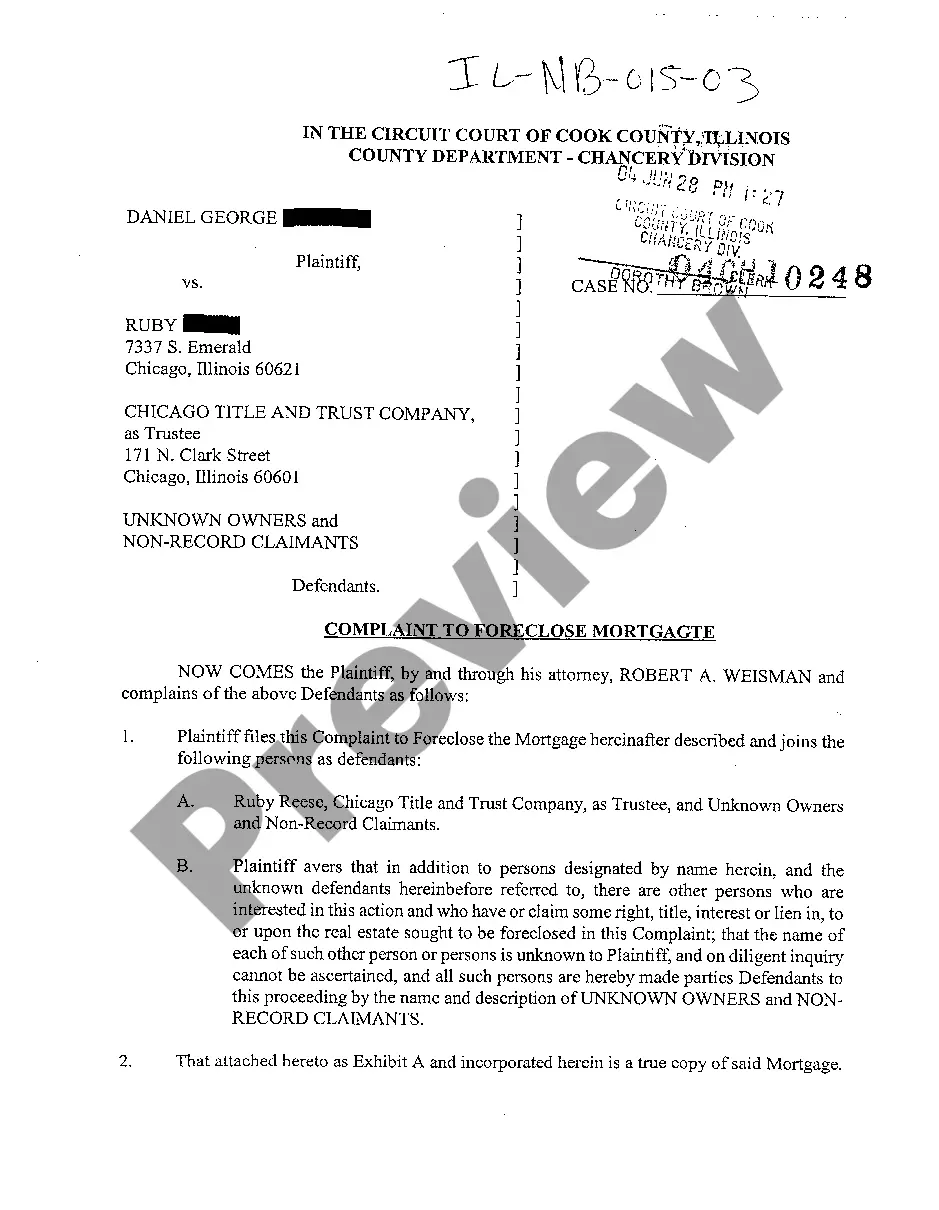

The Elgin Illinois Complaint to Foreclose Mortgage is a legal action initiated by a mortgage lender or service against a homeowner who has defaulted on their mortgage payments. This complaint is filed in the circuit court and seeks a court order to foreclose on the homeowner's property in order to satisfy the outstanding debt. In Elgin, Illinois, there are typically two types of Complaints to Foreclose Mortgage that can be filed: judicial and non-judicial foreclosure. 1. Judicial Foreclosure: In a judicial foreclosure, the lender files a Complaint to Foreclose Mortgage with the circuit court. The complaint will outline the details of the loan, the borrower's default, and any other relevant information. Once the complaint is filed, the borrower is served with a summons and given a specific period of time to respond. If the borrower fails to respond or cannot present a valid defense, the court may grant a judgment in favor of the lender, allowing them to proceed with the foreclosure process. 2. Non-Judicial Foreclosure: In some cases, lenders may choose to pursue a non-judicial foreclosure. This process does not involve filing a formal Complaint to Foreclose Mortgage with the court. Instead, the lender follows a specific sequence of steps outlined in the mortgage agreement or state law to foreclose on the property. Non-judicial foreclosure is generally faster and less costly than judicial foreclosure, but it requires strict adherence to the statutory requirements. The Elgin Illinois Complaint to Foreclose Mortgage serves as a crucial legal document that initiates the foreclosure process. It must include specific information such as the borrower's name, property description, loan details, default amount, and evidence of default. The complaint may also include additional counts, such as a request for a deficiency judgment if the sale of the foreclosed property does not fully satisfy the debt. Homeowners facing an Elgin Illinois Complaint to Foreclose Mortgage should consult with an attorney specializing in foreclosure defense to understand their legal rights and options. It is important to respond within the specified timeframe and present any valid defenses, such as improper notice, predatory lending practices, or other violations of the law. Overall, the Elgin Illinois Complaint to Foreclose Mortgage is a critical legal document that begins the process of foreclosure, whether through a judicial or non-judicial method. Homeowners should seek appropriate legal advice to navigate this complex process and protect their rights.

Elgin Illinois Complaint To Foreclose Mortgage

Description

How to fill out Elgin Illinois Complaint To Foreclose Mortgage?

We always want to reduce or prevent legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, usually, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Elgin Illinois Complaint To Foreclose Mortgage or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Elgin Illinois Complaint To Foreclose Mortgage complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Elgin Illinois Complaint To Foreclose Mortgage would work for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!