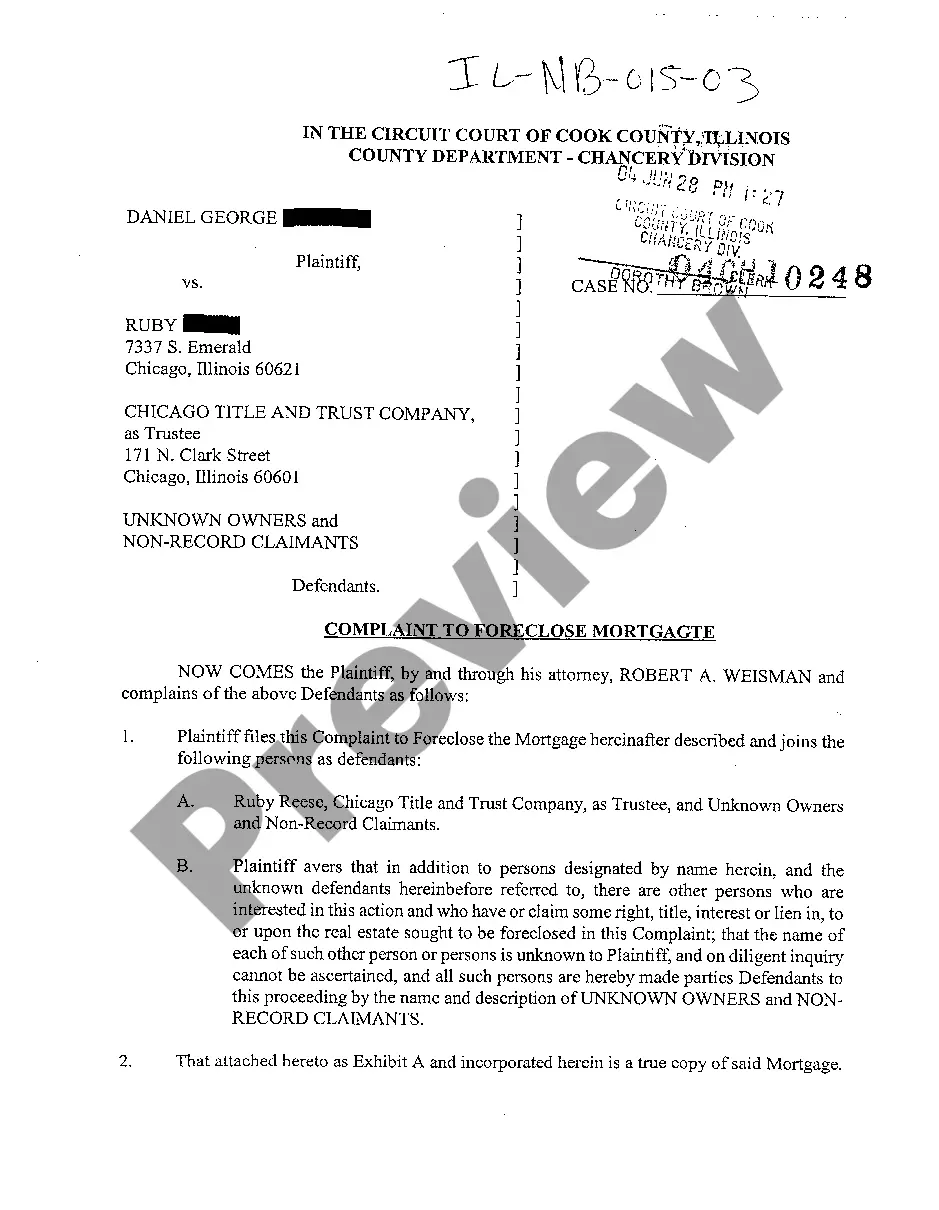

Naperville, Illinois Complaint to Foreclose Mortgage: Understanding the Process, Types, and Key Considerations Keywords: Naperville Illinois, Complaint to Foreclose Mortgage, Process, Types, Key Considerations Introduction: Naperville, situated in Illinois, is a vibrant city known for its affluent residential areas and thriving business community. However, just like anywhere else, homeowners in Naperville may face unfortunate circumstances that could lead to a foreclosure on their mortgage. When a borrower fails to meet mortgage payment obligations, the lender may resort to filing a complaint to foreclose the mortgage. This article aims to provide a detailed description of what a Naperville Illinois Complaint to Foreclose Mortgage entails, its various types, and essential considerations related to the process. Understanding the Process: 1. Initiation of the Complaint: A Naperville Illinois Complaint to Foreclose Mortgage begins when the lender files a legal document called a "complaint" with the court. The complaint outlines the borrower's default, outstanding debt, and the lender's intent to proceed with foreclosure. 2. Summons and Response: Once the complaint is filed, the court issues a summons to the borrower, notifying them of the proceeding and providing an opportunity to respond within a specified timeframe. It is crucial for the borrower to seek legal counsel during this stage to protect their rights and explore possible options. 3. Pretrial Process: After the borrower responds, the pretrial process starts. This phase involves various steps like discovery, where both parties exchange information and evidence, negotiations for potential loan modifications or settlement, and potential mediation. 4. Foreclosure Judgment: If the borrower and lender fail to reach an agreement during the pretrial process, the court may issue a foreclosure judgment. This legal document grants the lender the right to sell the property at a foreclosure sale if the borrower does not resolve the default within a specified period. 5. Foreclosure Sale: If the borrower does not cure the default within the specified time frame, the lender will proceed with a foreclosure sale, typically conducted as a public auction. The property is sold to the highest bidder, and the proceeds are used to repay the outstanding mortgage debt. Types of Naperville Illinois Complaint to Foreclose Mortgage: 1. Judicial Foreclosure: This type of complaint involves a lawsuit filed by the lender, requiring court intervention throughout the foreclosure process. Judicial foreclosure is the standard method in Illinois. 2. Non-Judicial Foreclosure: In rare cases, if the mortgage includes a "power of sale" clause, the lender can proceed with a non-judicial foreclosure. It involves following a specific process outlined in the mortgage agreement, without court involvement. Key Considerations: 1. Seek Legal Representation: Engaging an experienced foreclosure attorney in Naperville is crucial to protect your rights and navigate the complex legal process effectively. 2. Communication with Lender: Maintaining open lines of communication with the lender is vital to explore options like loan modifications or repayment plans, which may help resolve the default and prevent foreclosure. 3. Timely Response: Responding to the summons within the specified timeframe is crucial. Failure to respond can result in a default judgment, making it challenging to contest the foreclosure later. 4. Loan Modification or Refinance: Consulting with a housing counselor or a mortgage professional can help explore possibilities for loan modification or refinancing, potentially allowing the borrower to retain the property. Conclusion: Navigating a Naperville Illinois Complaint to Foreclose Mortgage can be a complex and challenging process. It is crucial for homeowners facing foreclosure to fully understand the process, seek legal guidance, and explore possible alternatives to resolve the default. By doing so, borrowers can potentially avert the negative consequences associated with foreclosure and work towards securing their financial future.

Naperville Illinois Complaint To Foreclose Mortgage

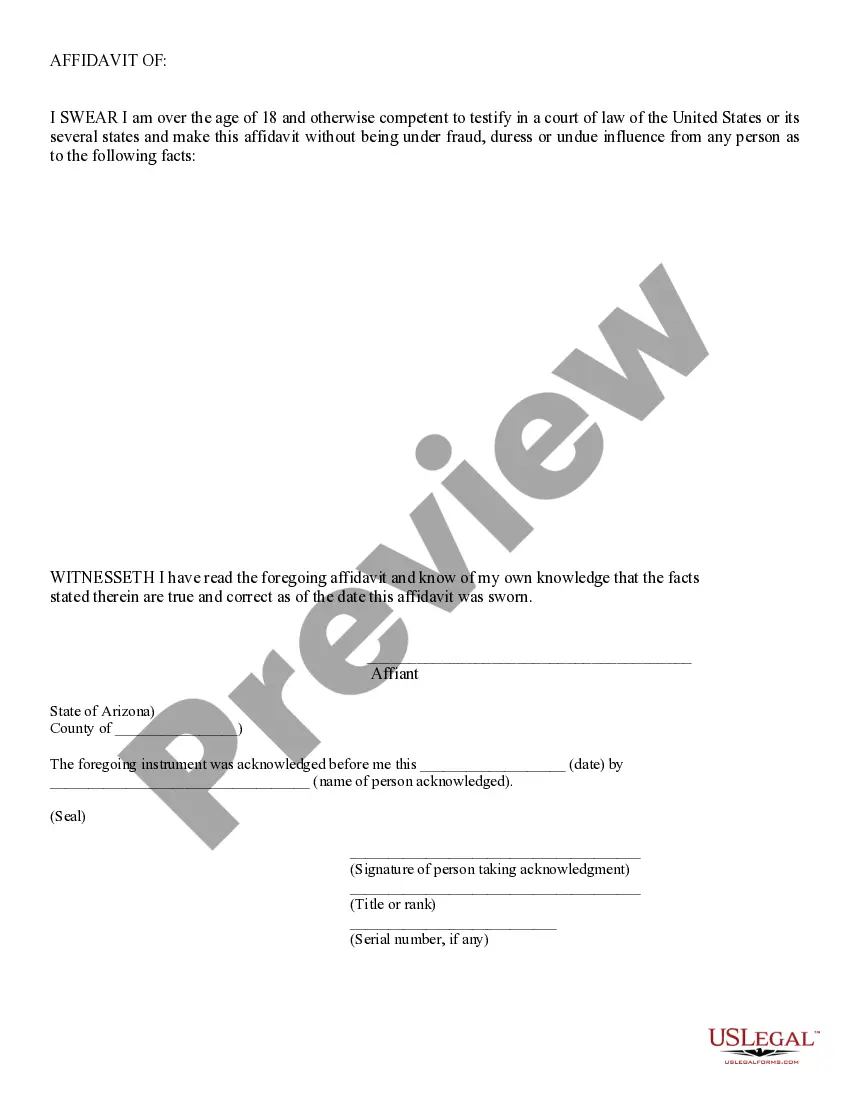

Description

How to fill out Naperville Illinois Complaint To Foreclose Mortgage?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone without any legal background to create such papers cfrom the ground up, mainly due to the convoluted jargon and legal nuances they entail. This is where US Legal Forms can save the day. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Naperville Illinois Complaint To Foreclose Mortgage or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Naperville Illinois Complaint To Foreclose Mortgage quickly using our trustworthy platform. If you are presently a subscriber, you can go on and log in to your account to download the needed form.

However, if you are a novice to our library, make sure to follow these steps prior to downloading the Naperville Illinois Complaint To Foreclose Mortgage:

- Be sure the template you have found is suitable for your area since the regulations of one state or county do not work for another state or county.

- Preview the document and go through a quick outline (if provided) of scenarios the document can be used for.

- In case the one you chosen doesn’t meet your needs, you can start again and look for the needed form.

- Click Buy now and choose the subscription option you prefer the best.

- utilizing your credentials or create one from scratch.

- Choose the payment method and proceed to download the Naperville Illinois Complaint To Foreclose Mortgage once the payment is through.

You’re all set! Now you can go on and print the document or complete it online. If you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.