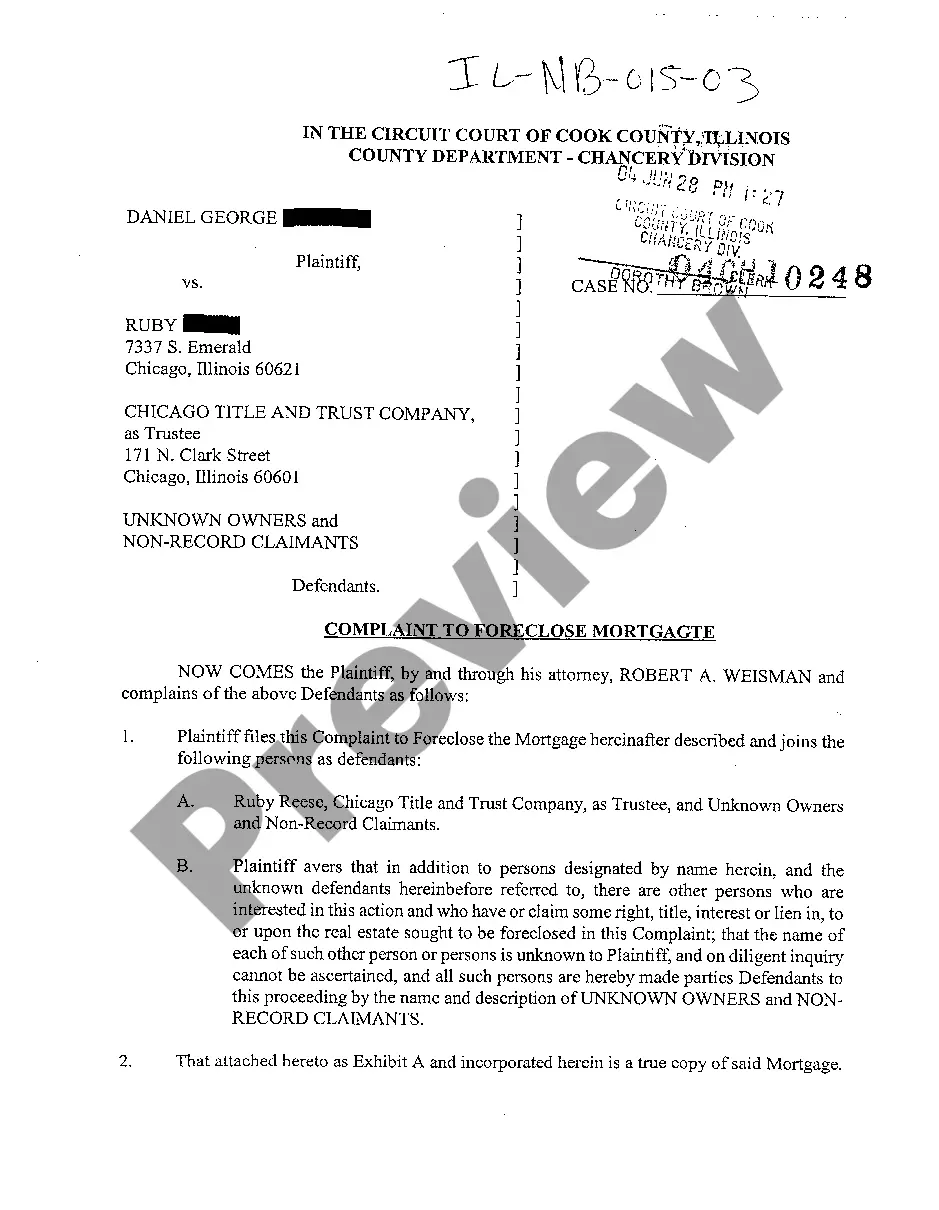

Rockford Illinois Complaint to Foreclose Mortgage: A Rockford Illinois Complaint to Foreclose Mortgage is a legal document filed by a lender or mortgage holder against a borrower who has defaulted on their mortgage payments in Rockford, Illinois. This legal action is pursued to recover the outstanding loan amount by forcing the sale of the property through a foreclosure process. The purpose of a Complaint to Foreclose Mortgage is to initiate a legal proceeding, usually in the state court, which enables the lender to take possession of the property and sell it to recover the unpaid debt. The lender is represented by an attorney who files the complaint detailing the non-payment, the amount owed, and the specific terms of the mortgage agreement. Different types of Complaints to Foreclose Mortgage in Rockford, Illinois may include: 1. Residential Mortgage Foreclosure Complaint: This type of complaint is filed when the property in question is a residential property, such as a single-family home, condominium, or townhouse. 2. Commercial Mortgage Foreclosure Complaint: In cases where the defaulted property is a commercial property, such as an office building, retail space, or industrial property, a commercial mortgage foreclosure complaint is filed. 3. Judicial Foreclosure Complaint: A judicial foreclosure complaint is filed when the lender chooses to pursue a foreclosure through the court system rather than utilizing a non-judicial foreclosure method (such as a power of sale clause). 4. Non-Judicial Foreclosure Complaint: In some cases, mortgage agreements may include a power of sale clause, which allows the lender to proceed with a non-judicial foreclosure. This means that the lender does not have to file a complaint in court but can follow a specific statutory process to initiate the foreclosure. The Complaint to Foreclose Mortgage typically includes the following information: — Parties involved: The complaint identifies the lender/mortgagee as the plaintiff and the borrower/mortgagor as the defendant. — Property information: The complaint provides a detailed description of the property, including the legal description, address, and any unique identifiers. — Mortgage details: The complaint outlines the terms of the mortgage, including the loan amount, interest rate, payment schedule, and any default provisions. — Non-payment evidence: The complaint highlights the borrower's failure to make payments as agreed upon, citing specific instances of delinquency and the outstanding balance. — Requested relief: The complaint concludes with the lender's request for relief, usually seeking judgment for the outstanding loan amount, interest, penalties, and costs, as well as an order to foreclose the mortgage and authorize the sale of the property. It is important to note that the information provided in this content is for informational purposes only and should not be considered legal advice. Consulting with an attorney experienced in foreclosure law is recommended for specific guidance and understanding of Rockford Illinois Complaint to Foreclose Mortgage procedures.

Rockford Illinois Complaint To Foreclose Mortgage

Description

How to fill out Rockford Illinois Complaint To Foreclose Mortgage?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, as a rule, are very expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Rockford Illinois Complaint To Foreclose Mortgage or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it in the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Rockford Illinois Complaint To Foreclose Mortgage adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Rockford Illinois Complaint To Foreclose Mortgage would work for you, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!