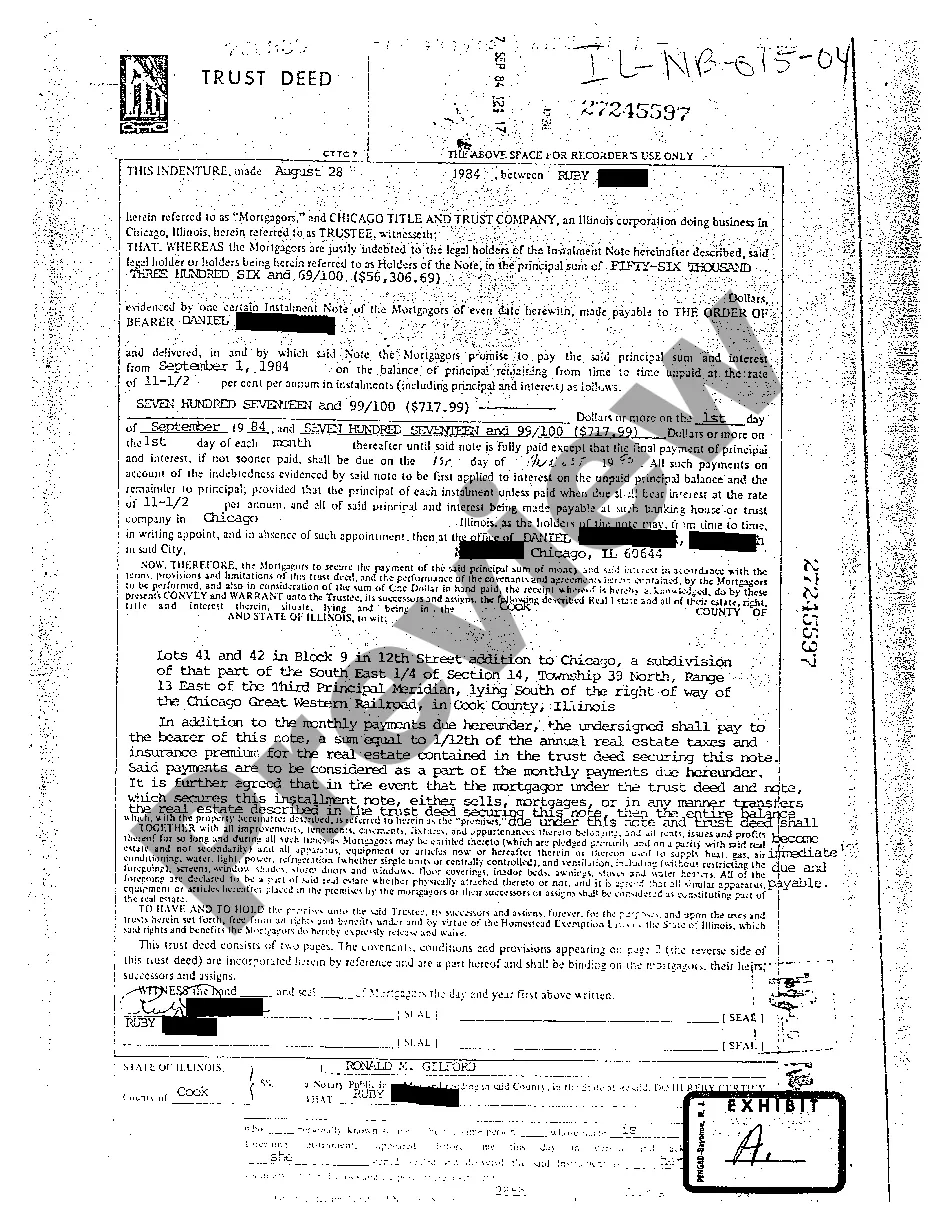

A Cook Illinois Trust Deed, often referred to as a land trust deed or simply a trust deed, is a legal document that establishes a trust relationship between three parties: the borrower (trust or), the lender (beneficiary), and a neutral third party (trustee). This type of trust deed is commonly used in Cook County, Illinois, and serves as a tool to secure a loan on real estate property. A Cook Illinois Trust Deed functions as a means of collateral for the lender and provides certain benefits to the borrower. Upon the creation of the trust deed, the borrower transfers the legal title of the property to the trustee, who holds it as security on behalf of the lender. The trustee has the power to sell or transfer the property to satisfy the debt if the borrower defaults on their loan. There are different types of Cook Illinois Trust Deeds, each serving specific purposes: 1. Traditional Trust Deed: This is the most common form of trust deed, where the term and repayment obligations are clearly defined, often with a fixed interest rate. The borrower retains the equitable interest in the property, while the legal title is held by the trustee until the loan is repaid. 2. Beneficiary Trust Deed: In this type of trust deed, the lender (beneficiary) also acts as the trustee. This arrangement gives the beneficiary greater control over the property. However, if the lender becomes the owner of the property due to default, they might face potential challenges to selling the property in certain situations. 3. Substitute Trustee Deed: This type of trust deed allows the original trustee to be replaced by a successor trustee who will handle the sale or transfer of the property in case of default. It offers flexibility to the lender if the original trustee becomes unavailable or uncooperative. When applying for a loan secured by a Cook Illinois Trust Deed, it is essential for borrowers to understand the terms, obligations, and the potential risks involved. Hiring a qualified real estate attorney or seeking advice from mortgage professionals can provide the necessary guidance to navigate the complexities of trust deeds and protect all parties' interests.

Cook Illinois Trust Deed

Description

How to fill out Cook Illinois Trust Deed?

Are you looking for a trustworthy and affordable legal forms supplier to get the Cook Illinois Trust Deed? US Legal Forms is your go-to option.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and county.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Cook Illinois Trust Deed conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is intended for.

- Start the search over in case the form isn’t good for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Cook Illinois Trust Deed in any provided format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours learning about legal papers online once and for all.

Form popularity

FAQ

Typically, homeowners can get a copy of their property deed by visiting their county deeds office. Cook County, Illinois' property records are easily searchable online through a property index number (known as a PIN) or a street address.

The public is able to access documents, such as deeds, birth and death certificates, military discharge records, and others through the register of deeds. There may be a fee to access or copy public records through the register of deeds.

A trust deed?also known as a deed of trust?is a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

Currently, our firm has experienced document delays in recording of up to 8 weeks from the date the document was submitted for recording.

Using the County's Online Search Portal The Cook County Clerk's online database allows individuals to view property deeds on record. After locating the right property deed, a person who wishes to order a copy will pay $5 to download the document.

How do I obtain a copy of my deed or other recorded document? You can request a copy from our office in person, by mail, fax, phone or email. If your request is by phone or fax you will need to pay with a credit card. Please call our office at 847-377-2575 if you wish to place an order.

History of office On November 8, 2016, Cook County voters approved a binding referendum to eliminate the office, merging its functions into the purview of the Cook County Clerk.

A trust avoids handing over valuable property, cash or investment while the beneficiaries are relatively young or vulnerable. The trustees have a legal duty to look after and manage the trust assets for the person who will benefit from the trust in the end.

Currently, our firm has experienced document delays in recording of up to 8 weeks from the date the document was submitted for recording.

How to obtain your Legal Description from Cook County Enter your property's PIN at the top of the page and click search. (On the left side of the screen you will see a list of the different documents and their dates.Now click ?View Images? circled in red.

Interesting Questions

More info

The Deed of Trust must be recorded at the Clerk of Court or a Clerk of Court-appointed recorder when the legal owner changes at death, except that the Deed of Trust does not automatically die when the legal owner changes as follows: Any person, other than a mortgagee, who has an interest in a parcel of land (either within the State of Illinois or outside of Illinois×, having the right to dispose of the parcel by sale or conveyance to one or more of his, her or their bona fide tenants, for a term of time to the first purchaser or transferee of the land, may sell, or offer to sell, the land without obtaining a Deed of Trust, provided that: The legal deed in proper legal form is filed with the County Clerk of the appropriate county in which the parcel of land is located. A valid power of attorney is in force between the holder and the mortgagee.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.