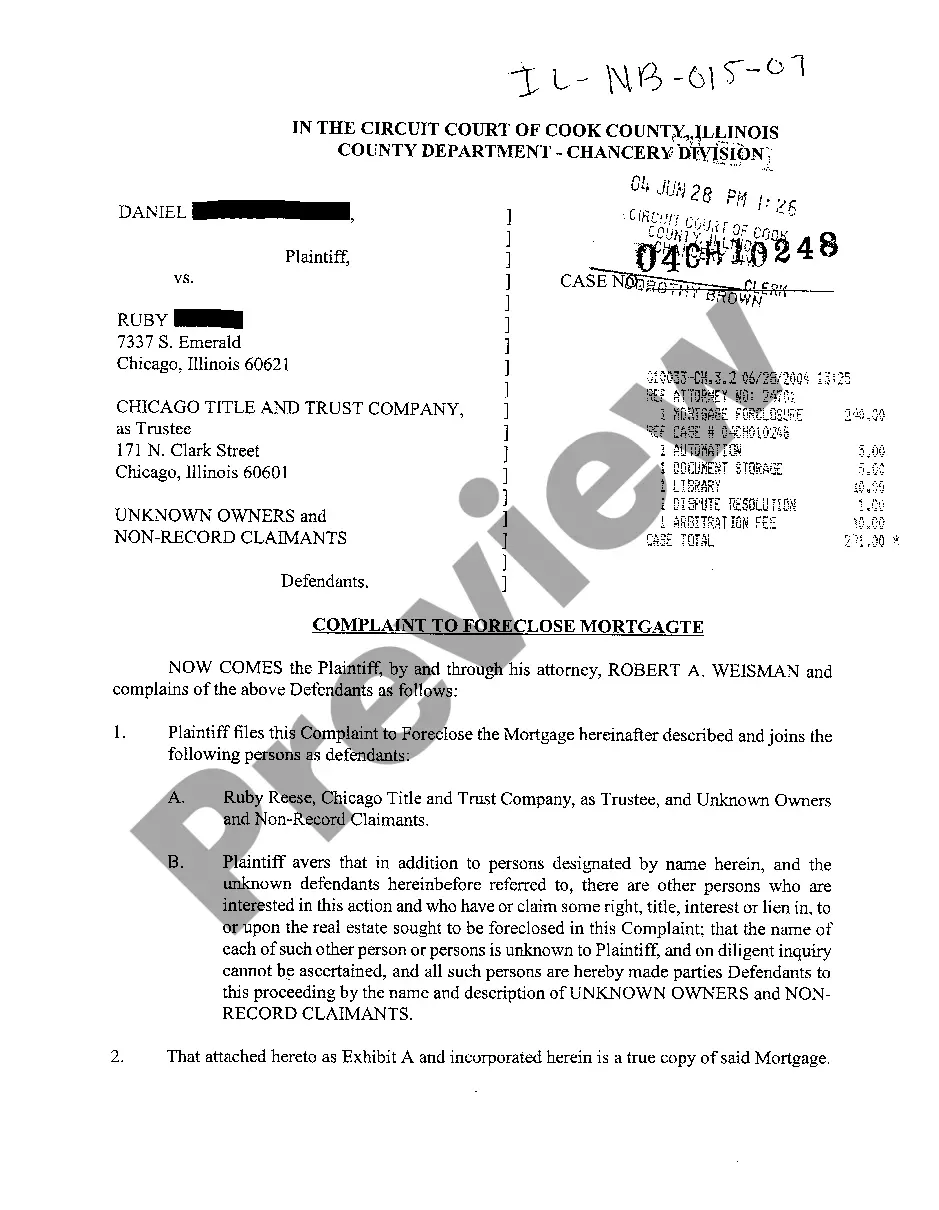

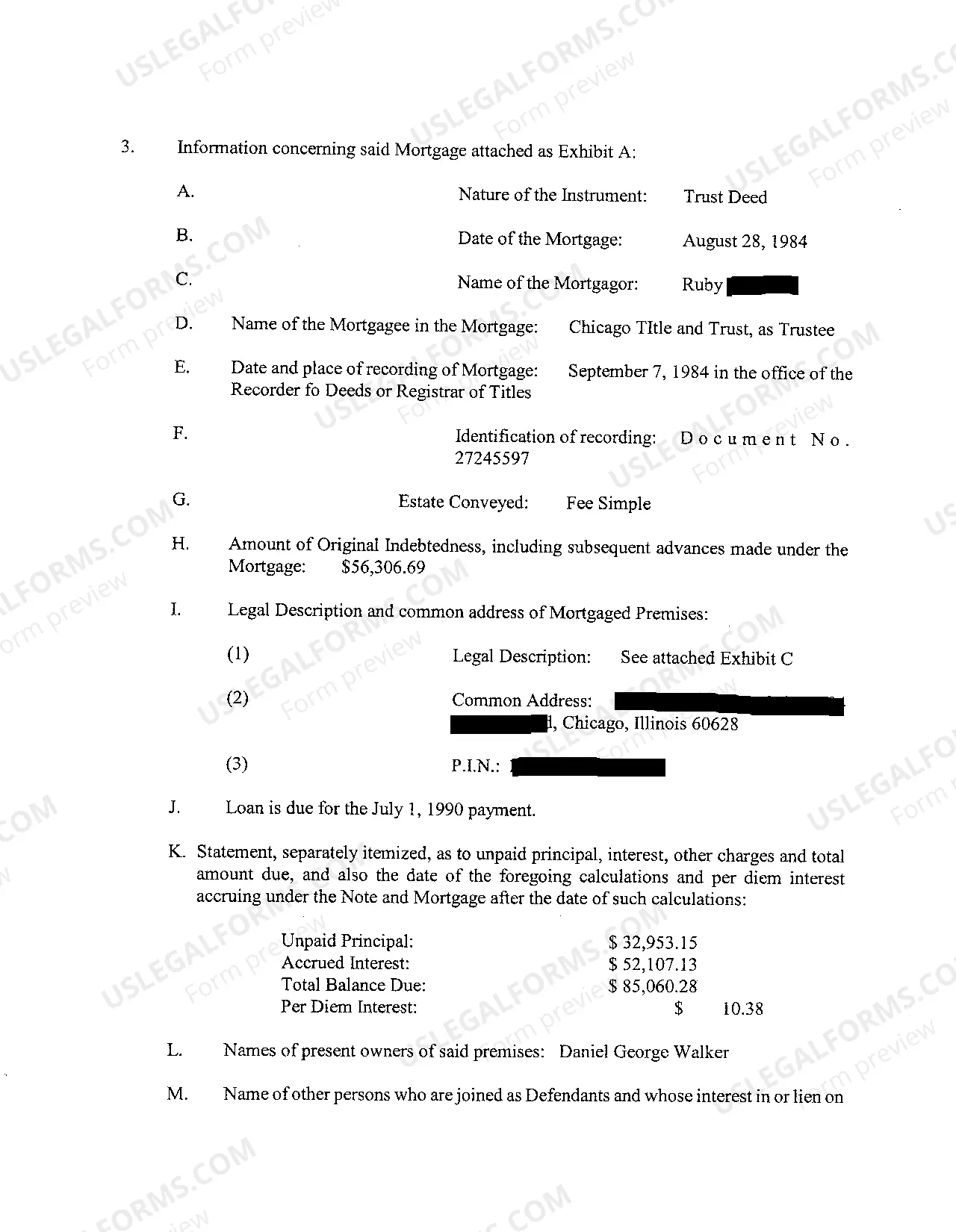

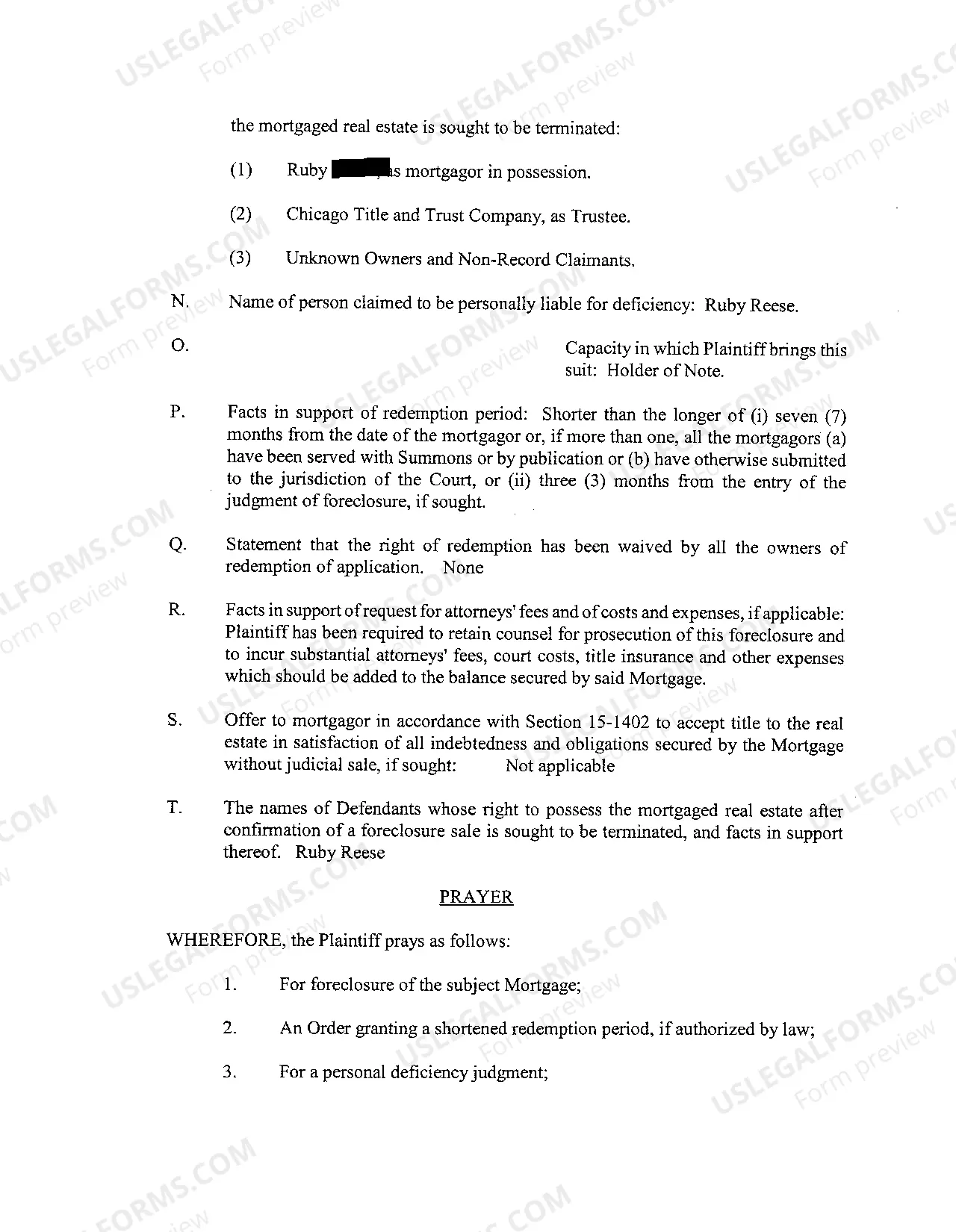

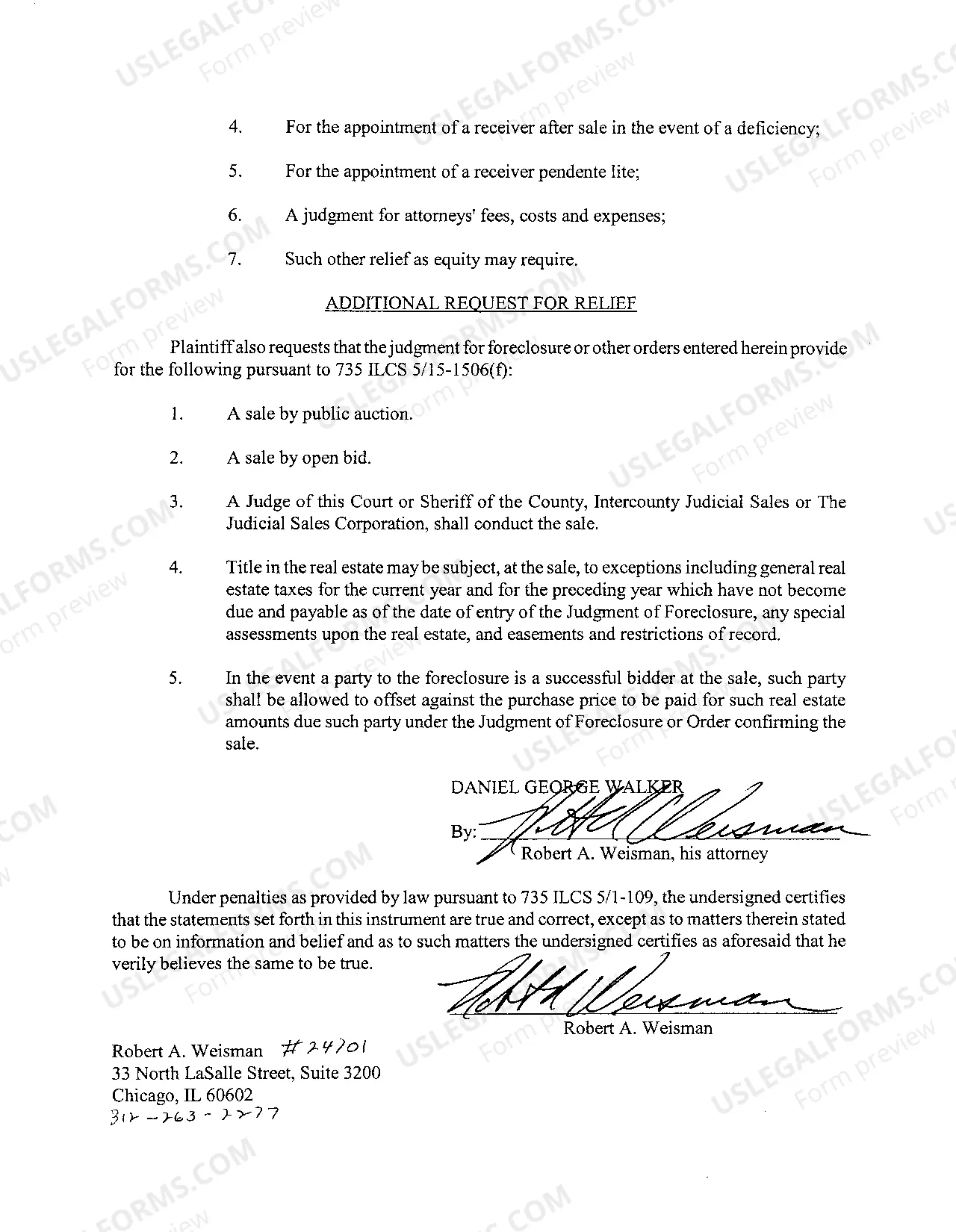

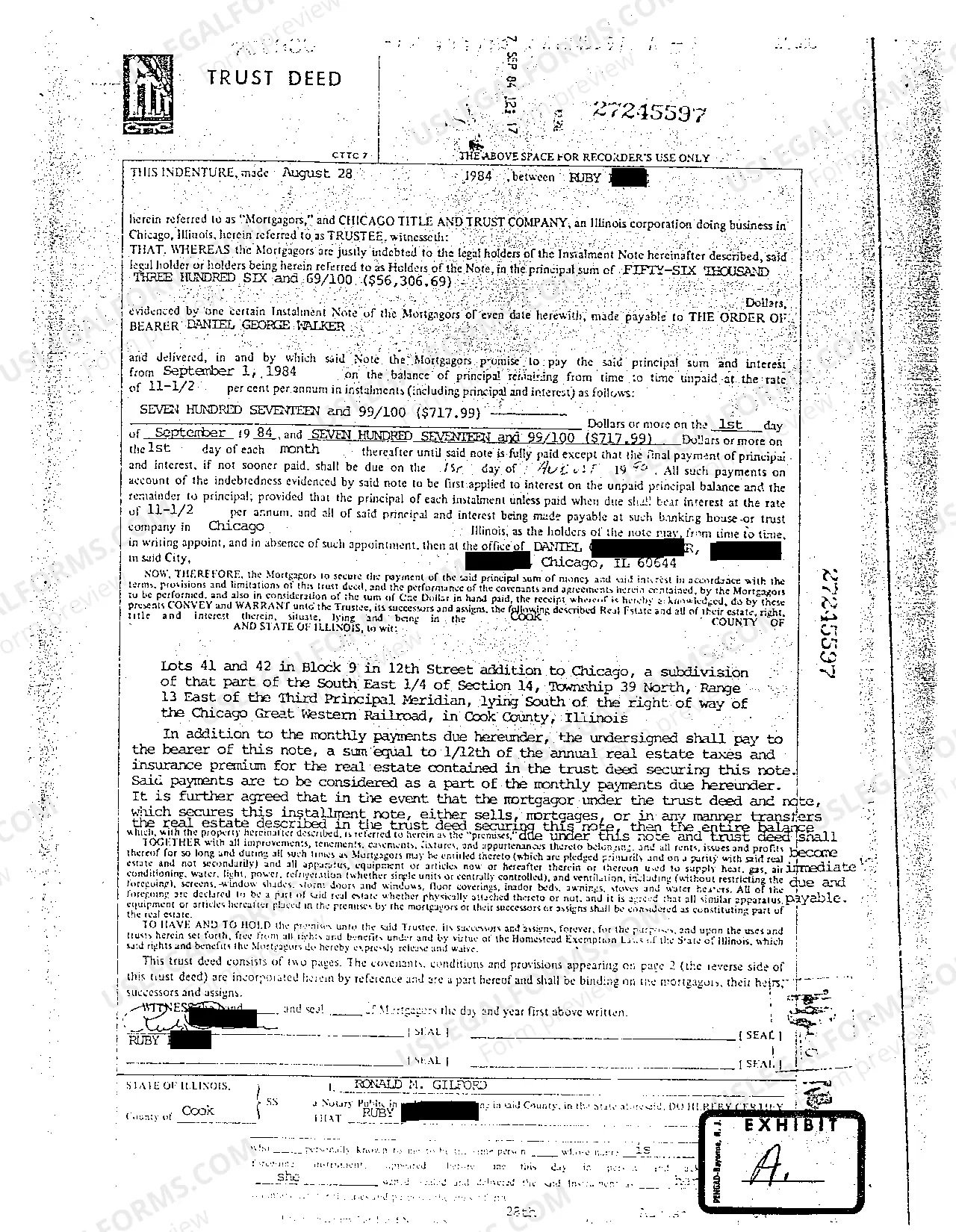

Chicago Illinois Complaint to Foreclosure Mortgage is a legal process initiated by a mortgage lender in the state of Illinois to recover outstanding loan amounts from delinquent borrowers through the forced sale of their property. It involves filing a complaint in court to request a foreclosure decree, which eventually leads to auctioning the property to repay the mortgage debt. This process may vary depending on the type of mortgage and specific circumstances. There are several types of Chicago Illinois Complaint to Foreclosure Mortgage, including judicial foreclosure, non-judicial foreclosure, and strict foreclosure: 1. Judicial Foreclosure: This is the most common type of foreclosure in Chicago and involves a lawsuit filed by the lender against the borrower. The court holds a hearing where both parties present their case, and if the court rules in favor of the lender, a foreclosure decree is issued. The property is then sold at auction, and the proceeds go towards repaying the outstanding mortgage debt. 2. Non-Judicial Foreclosure: In some cases, the mortgage agreement may contain a power of sale clause, allowing the lender to initiate foreclosure without court involvement. The lender follows a specific process outlined in the mortgage agreement, including providing notice to the borrower and publishing a foreclosure sale advertisement. The property is then auctioned to recover the overdue mortgage debt. 3. Strict Foreclosure: This type of foreclosure is less common in Illinois and requires the lender to prove that the borrower is significantly in default of the mortgage agreement. The court sets a redemption period during which the borrower may repay the outstanding debt. If the borrower fails to do so, ownership of the property transfers directly to the lender. Strict foreclosure does not involve auctioning the property, but rather, the lender gains ownership. In any type of foreclosure process, it is crucial for the borrower to respond to the complaint and seek legal representation to protect their rights and explore options such as loan modification or short sale to avoid foreclosure. Additionally, borrowers must be aware of their rights, including the right to request a reinstatement, redemption, or confirmation of the sale process. Failure to address the complaint adequately may result in the loss of the property and potential legal implications.

Chicago Illinois Complaint To Foreclosure Mortgage

Description

How to fill out Chicago Illinois Complaint To Foreclosure Mortgage?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Chicago Illinois Complaint To Foreclosure Mortgage becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Chicago Illinois Complaint To Foreclosure Mortgage takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Chicago Illinois Complaint To Foreclosure Mortgage. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!