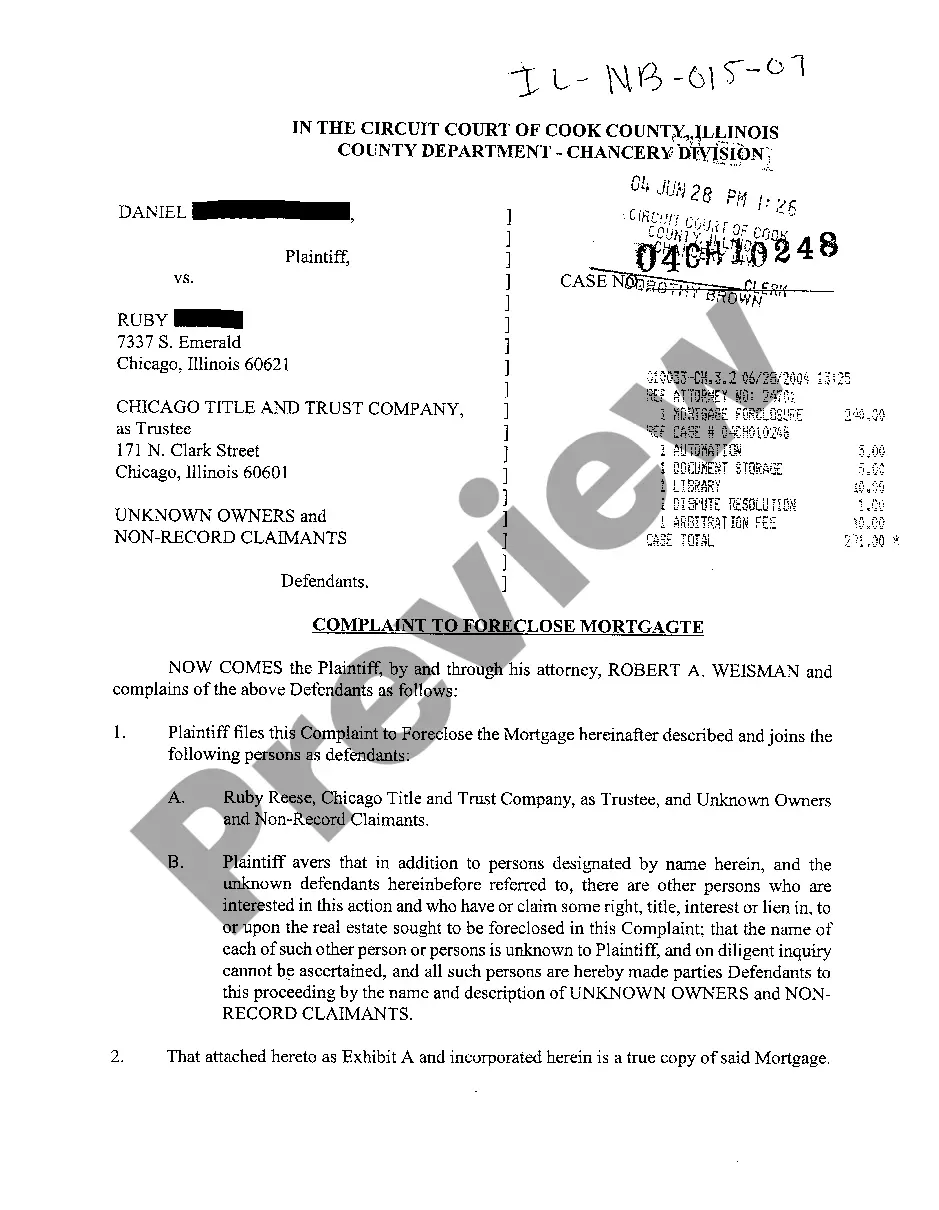

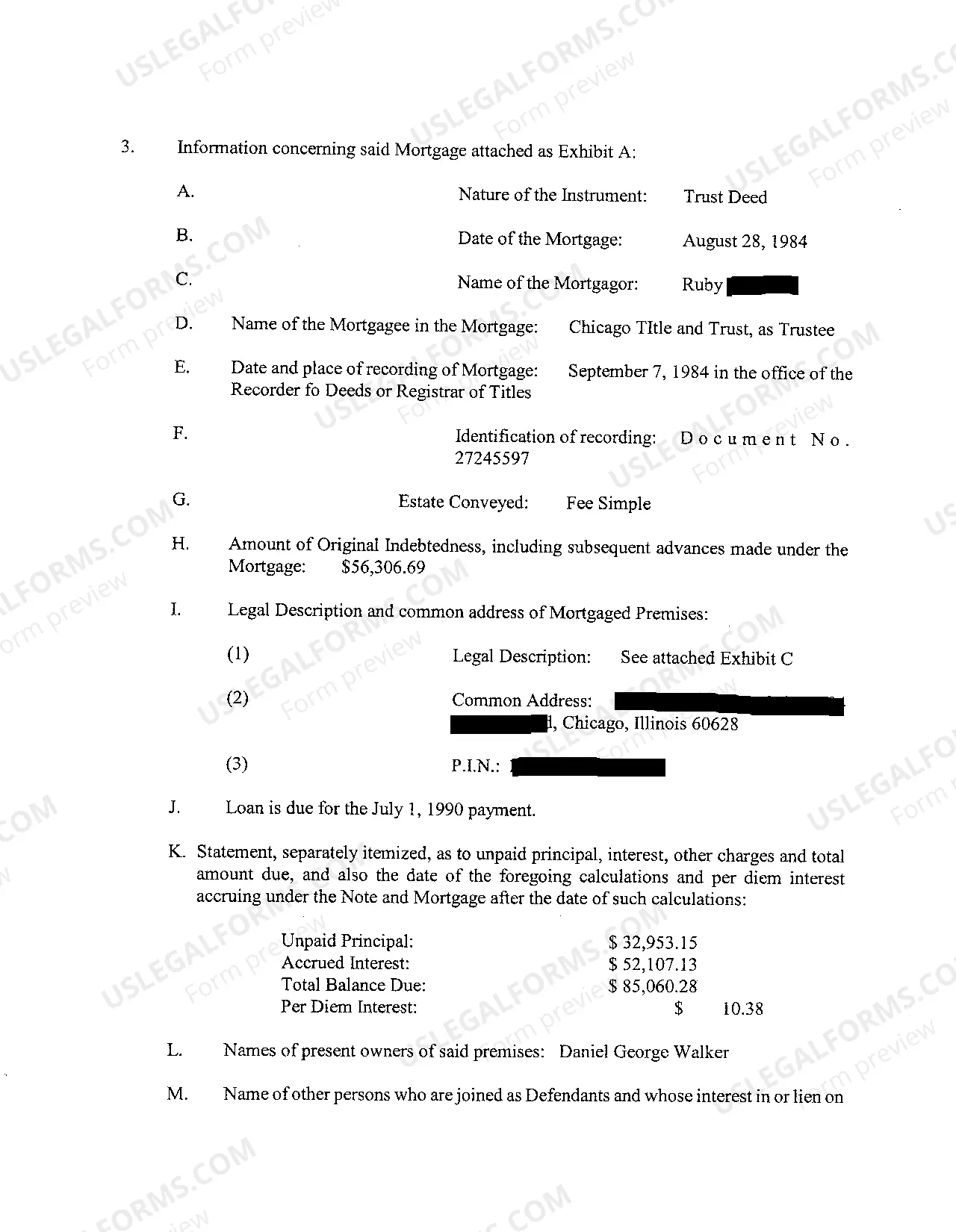

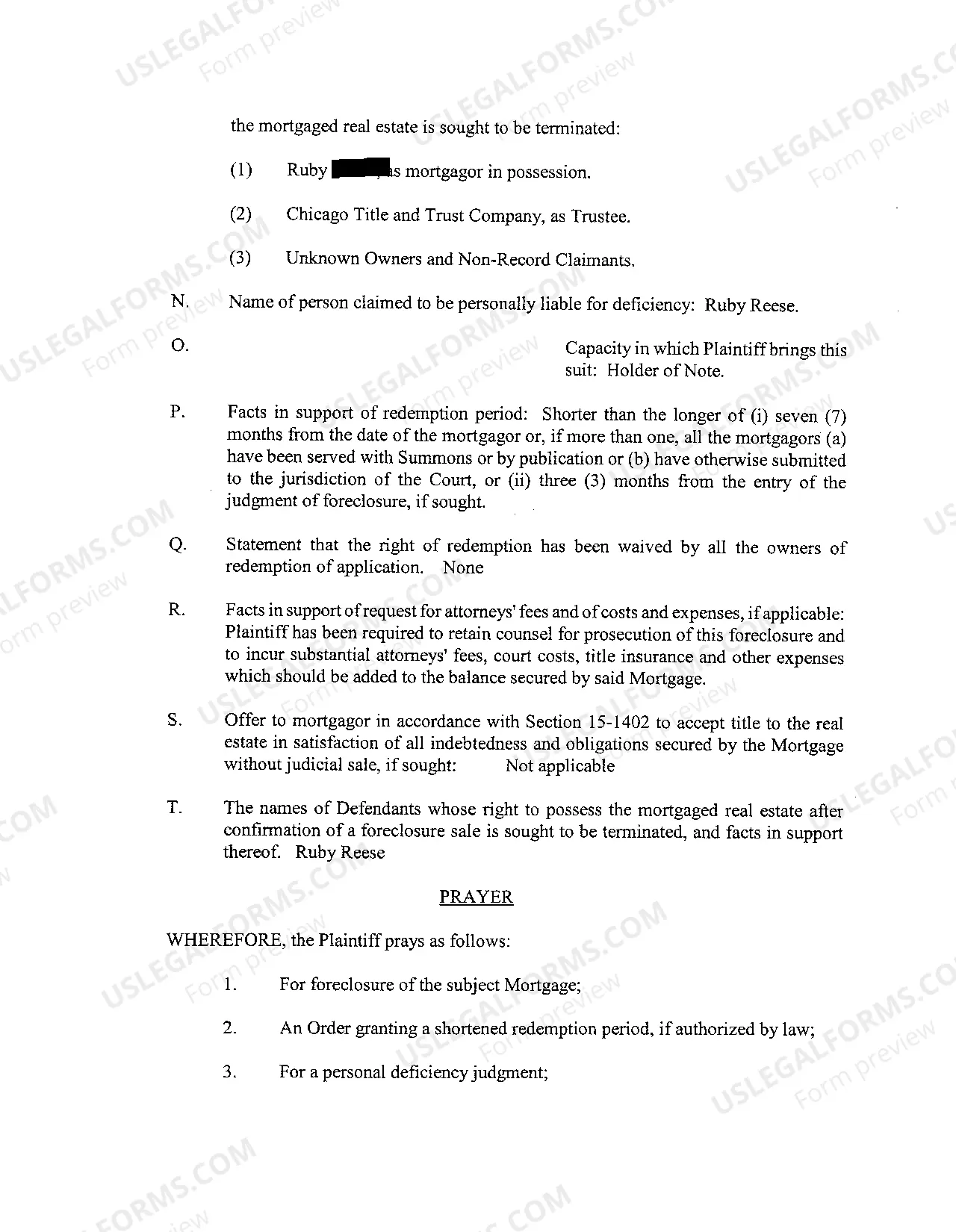

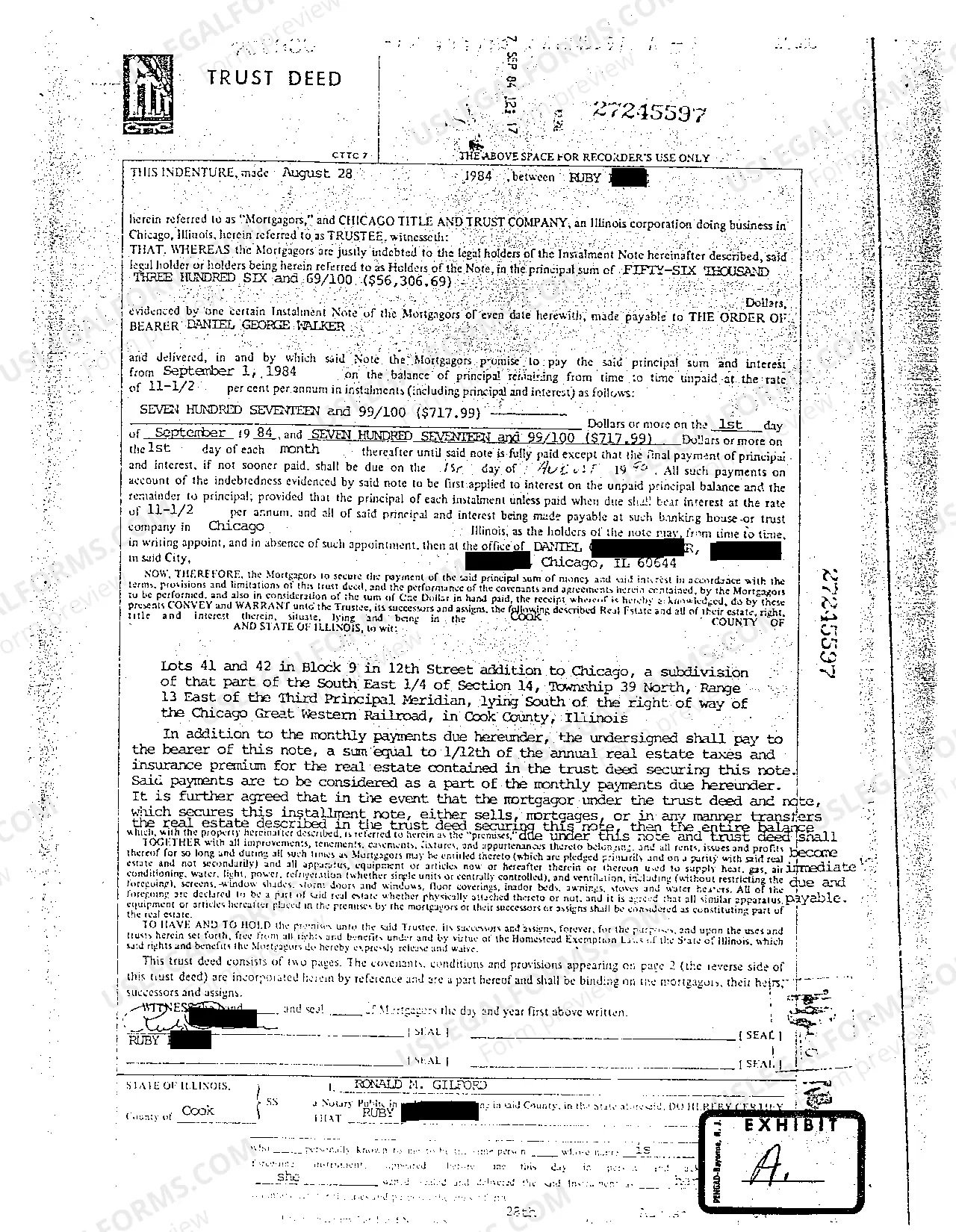

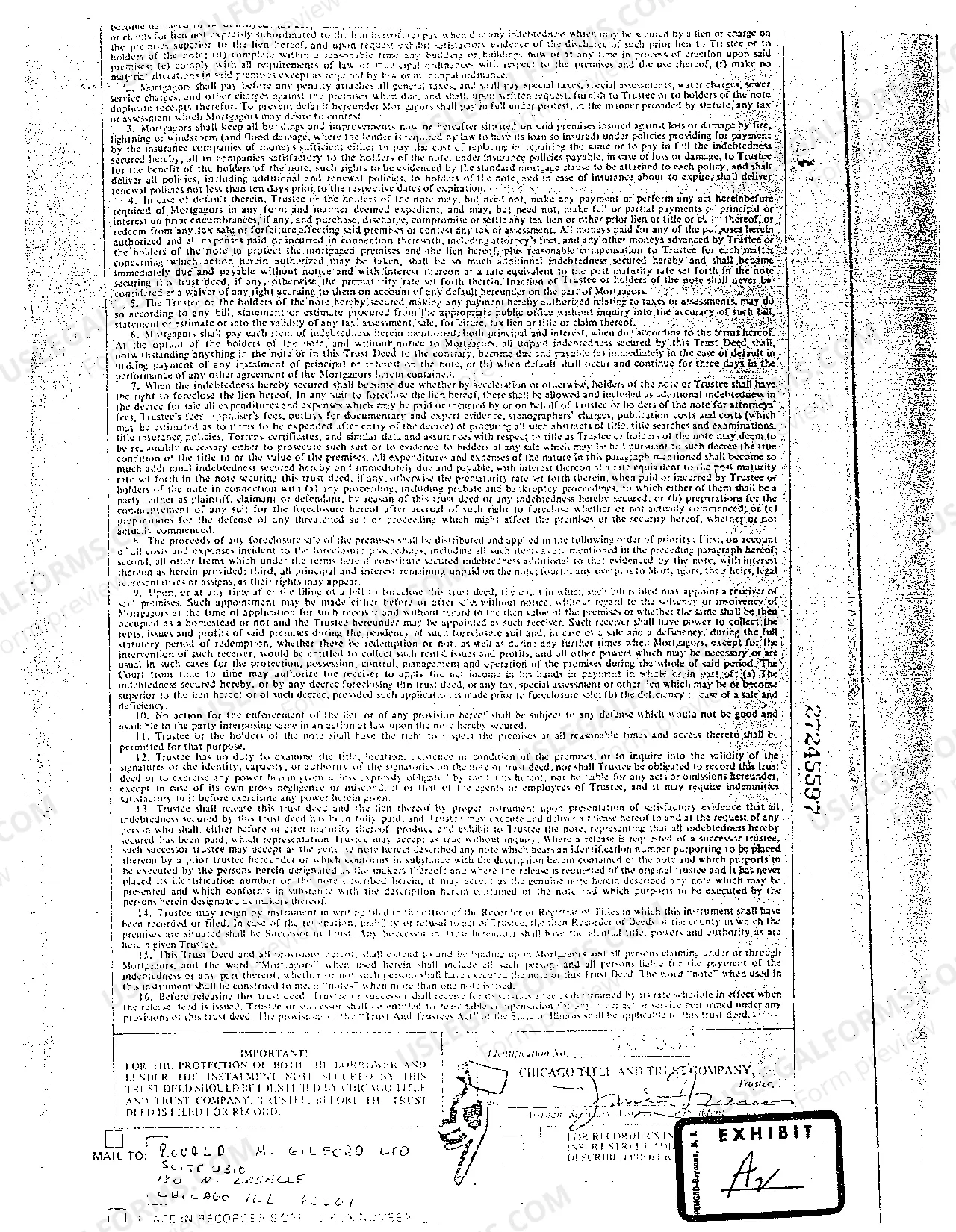

Cook Illinois Complaint to Foreclosure Mortgage is a legal process that occurs when a borrower fails to make mortgage payments on a property located in Cook County, Illinois, leading the lender to initiate foreclosure proceedings. This detailed description will provide an insight into the intricacies of Cook Illinois Complaint to Foreclosure Mortgage, explaining the process, key parties involved, and potential types of complaints. Foreclosure is a legal action taken by the lender, often a bank or mortgage company, to recover the outstanding loan amount when a borrower defaults on mortgage repayments. Cook County, located in the state of Illinois, has specific laws and regulations governing the foreclosure process. When a borrower is unable to repay the mortgage debt as agreed upon, the lender may file a Cook Illinois Complaint to Foreclosure Mortgage with the appropriate court. The Cook Illinois Complaint to Foreclosure Mortgage is typically initiated by the lender's attorney, who prepares and files the complaint in the Circuit Court of Cook County. This complaint outlines the details of the mortgage, including the loan amount, interest rate, and the borrower's failure to make payments as stipulated in the loan agreement. It also states the lender's legal right to foreclose on the property and seek to sell it to recover the outstanding debt balance. Once the complaint is filed, it is served to the borrower, who becomes the defendant in the foreclosure case. The defendant/borrower must respond to the complaint within a specified time period, typically around 30 days, to contest the foreclosure or propose an alternative resolution. If the borrower fails to respond within this timeframe or is unable to reach a settlement with the lender, the foreclosure process progresses. During the foreclosure proceedings, the court assesses whether the borrower has defaulted on the mortgage and whether the lender has followed all required legal procedures in initiating the foreclosure. The court may schedule hearings to review the case, allowing both parties an opportunity to present their arguments and evidence. These hearings aim to determine whether the lender has substantiated their claim for foreclosure according to the Illinois law. Cook Illinois Complaint to Foreclosure Mortgage can take various forms depending on the specific circumstances of the case. Some different types or variations of foreclosure complaints within Cook Illinois include judicial foreclosure, non-judicial foreclosure, strict foreclosure, equitable foreclosure, and foreclosure by advertisement. Each type may have different procedural requirements, timelines, and remedies available for both the lender and the borrower. It is important to note that Cook Illinois Complaint to Foreclosure Mortgage involves a highly complex legal process, and borrowers facing foreclosure are advised to seek legal counsel to protect their rights and explore potential alternatives such as loan modifications, short sales, or deed in lieu of foreclosure. In summary, Cook Illinois Complaint to Foreclosure Mortgage is a legal action taken by a lender in Cook County, Illinois, to recover the outstanding mortgage loan balance when a borrower defaults on their repayments. The process involves filing a complaint in court, serving the borrower, and proceeding with the foreclosure case. Various types of foreclosure complaints exist, each with its own procedural requirements. Seeking professional guidance is crucial for borrowers facing Cook Illinois Complaint to Foreclosure Mortgage to navigate the process effectively.

Cook Illinois Complaint To Foreclosure Mortgage

Description

How to fill out Cook Illinois Complaint To Foreclosure Mortgage?

If you are searching for a relevant form, it’s extremely hard to find a better service than the US Legal Forms site – one of the most extensive online libraries. Here you can find a huge number of form samples for organization and individual purposes by types and states, or keywords. With our advanced search function, discovering the latest Cook Illinois Complaint To Foreclosure Mortgage is as easy as 1-2-3. Additionally, the relevance of each and every file is verified by a team of expert attorneys that on a regular basis review the templates on our website and update them according to the newest state and county requirements.

If you already know about our system and have a registered account, all you need to receive the Cook Illinois Complaint To Foreclosure Mortgage is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the sample you want. Look at its description and make use of the Preview feature to explore its content. If it doesn’t suit your needs, use the Search option at the top of the screen to get the appropriate file.

- Confirm your decision. Click the Buy now button. After that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the form. Choose the format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the acquired Cook Illinois Complaint To Foreclosure Mortgage.

Each form you save in your profile has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to get an extra duplicate for modifying or printing, you may return and export it again anytime.

Take advantage of the US Legal Forms extensive catalogue to get access to the Cook Illinois Complaint To Foreclosure Mortgage you were seeking and a huge number of other professional and state-specific templates on a single website!