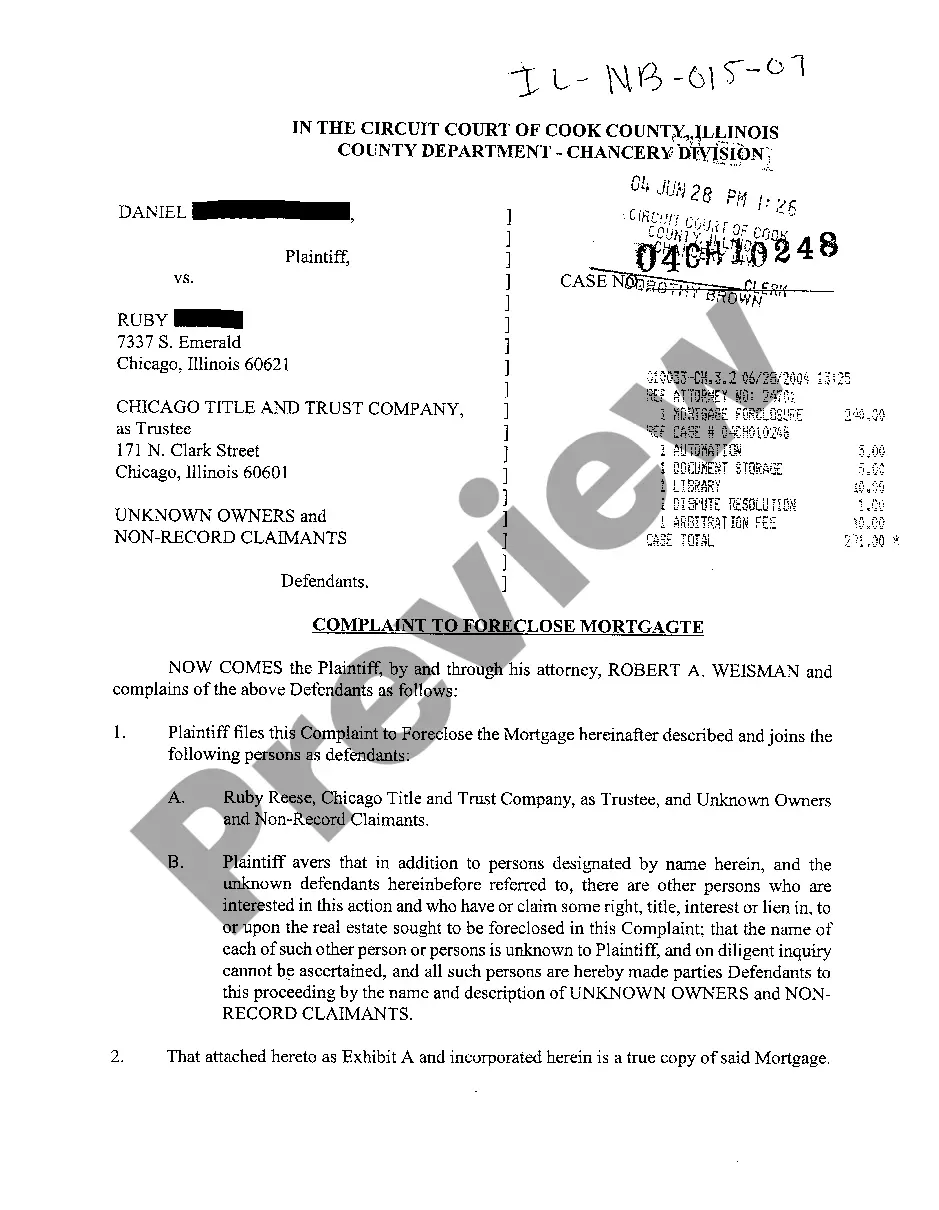

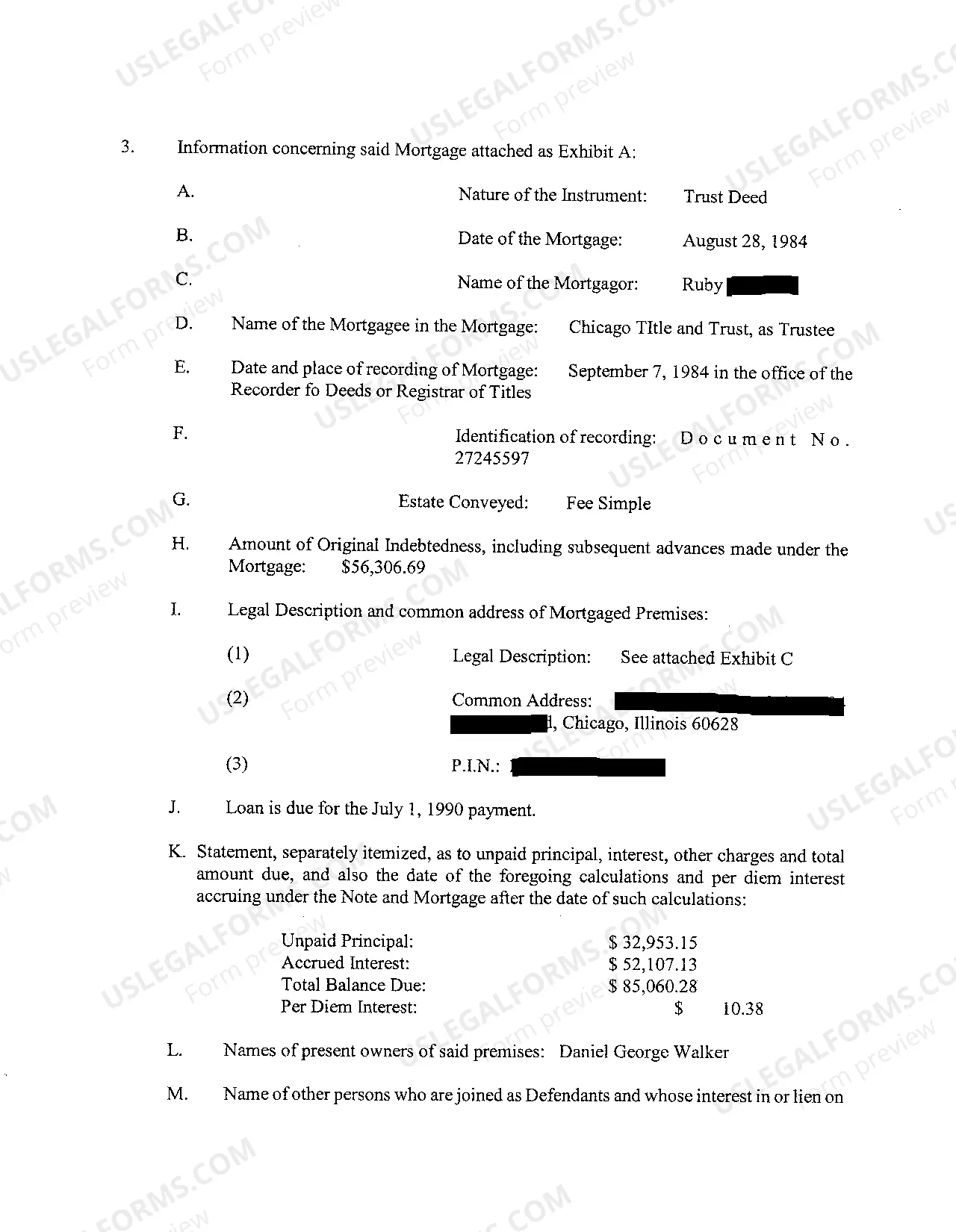

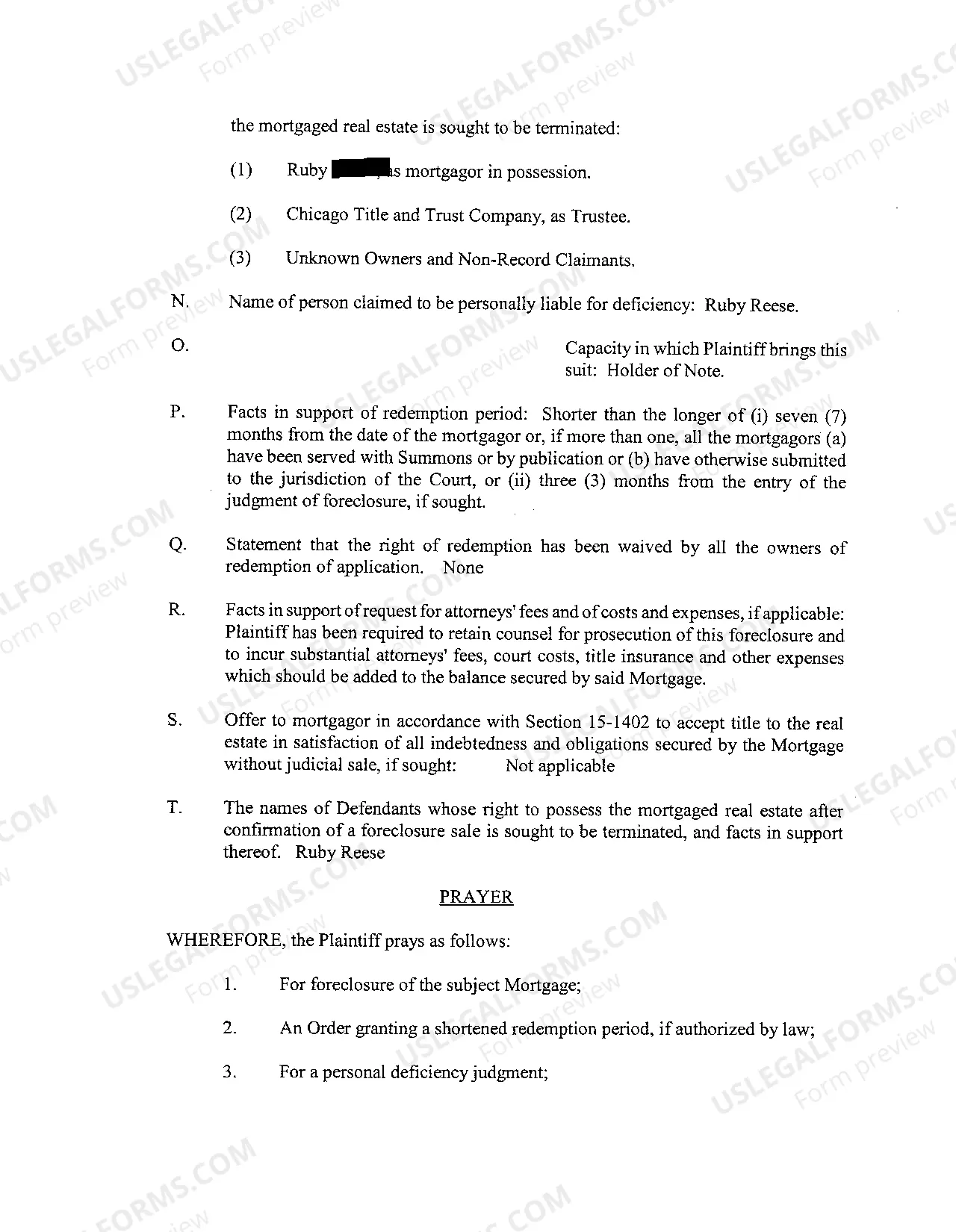

Elgin, Illinois Complaint To Foreclosure Mortgage involves a legal process where a lender files a complaint against a homeowner who has defaulted on their mortgage payments, seeking to foreclose the property to recover the unpaid debt. This detailed description will provide an overview of the complaint process, the types of complaints, and the foreclosure implications in Elgin, Illinois. In Elgin, Illinois, foreclosure complaints are typically filed by mortgage lenders or creditors in the Circuit Court of Kane County. The purpose is to address the non-payment or default situation and initiate the legal process for recovering the outstanding debt through the sale of the property. The complaint to foreclosure mortgage in Elgin, Illinois typically includes several essential elements. Firstly, it identifies the parties involved, including the lender or creditor (plaintiff) and the homeowner (defendant). The complaint describes the mortgage agreement, detailing the terms, conditions, and the loan amount. The complaint provides a detailed account of the borrower's default or non-payment, specifying the dates and amounts of missed payments. The lender may also include any additional charges, such as interest, penalties, or fees, that have accrued due to the default. Elgin, Illinois offers various types of foreclosure complaints, depending on the circumstances of the mortgage default. Some common types include: 1. Judicial Foreclosure Complaint: This is the most common type filed in Elgin, Illinois, where the lender follows a court-supervised process to foreclose the property. The complaint initiates the legal proceedings and sets the stage for subsequent court hearings. 2. Non-Judicial Foreclosure Complaint: In some cases, if the mortgage agreement includes a power of sale clause, the lender may choose to proceed with a non-judicial foreclosure. This type of complaint bypasses the court system and follows a specific procedure outlined in the mortgage agreement or by Illinois state law. 3. Li's Pendent Complaint: A Li's Pendent complaint is filed to provide public notice of the pending foreclosure action. It serves as a notice to potential buyers, creditors, and other interested parties of the ongoing legal proceedings and the claim on the property. For homeowners facing a complaint to foreclosure mortgage in Elgin, Illinois, there are legal defenses and options available. It is crucial to seek legal advice promptly, as certain rights and timelines need to be navigated to protect one's interests. Foreclosure in Elgin, Illinois can have severe consequences, including the loss of one's home and potential damage to creditworthiness. Exploring alternatives, such as loan modification or short sale, may help homeowners avoid the foreclosure process entirely or mitigate the impact on their financial stability. In summary, Elgin, Illinois Complaint To Foreclosure Mortgage involves a lender filing a legal complaint against a homeowner who has defaulted on their mortgage payments. Various types of complaints exist, including judicial and non-judicial foreclosure complaints, each with its own specific procedures and implications. Seeking legal advice and exploring potential alternatives are vital for homeowners facing a foreclosure complaint in Elgin, Illinois.

Elgin Illinois Complaint To Foreclosure Mortgage

Description

How to fill out Elgin Illinois Complaint To Foreclosure Mortgage?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Elgin Illinois Complaint To Foreclosure Mortgage gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Elgin Illinois Complaint To Foreclosure Mortgage takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Elgin Illinois Complaint To Foreclosure Mortgage. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!