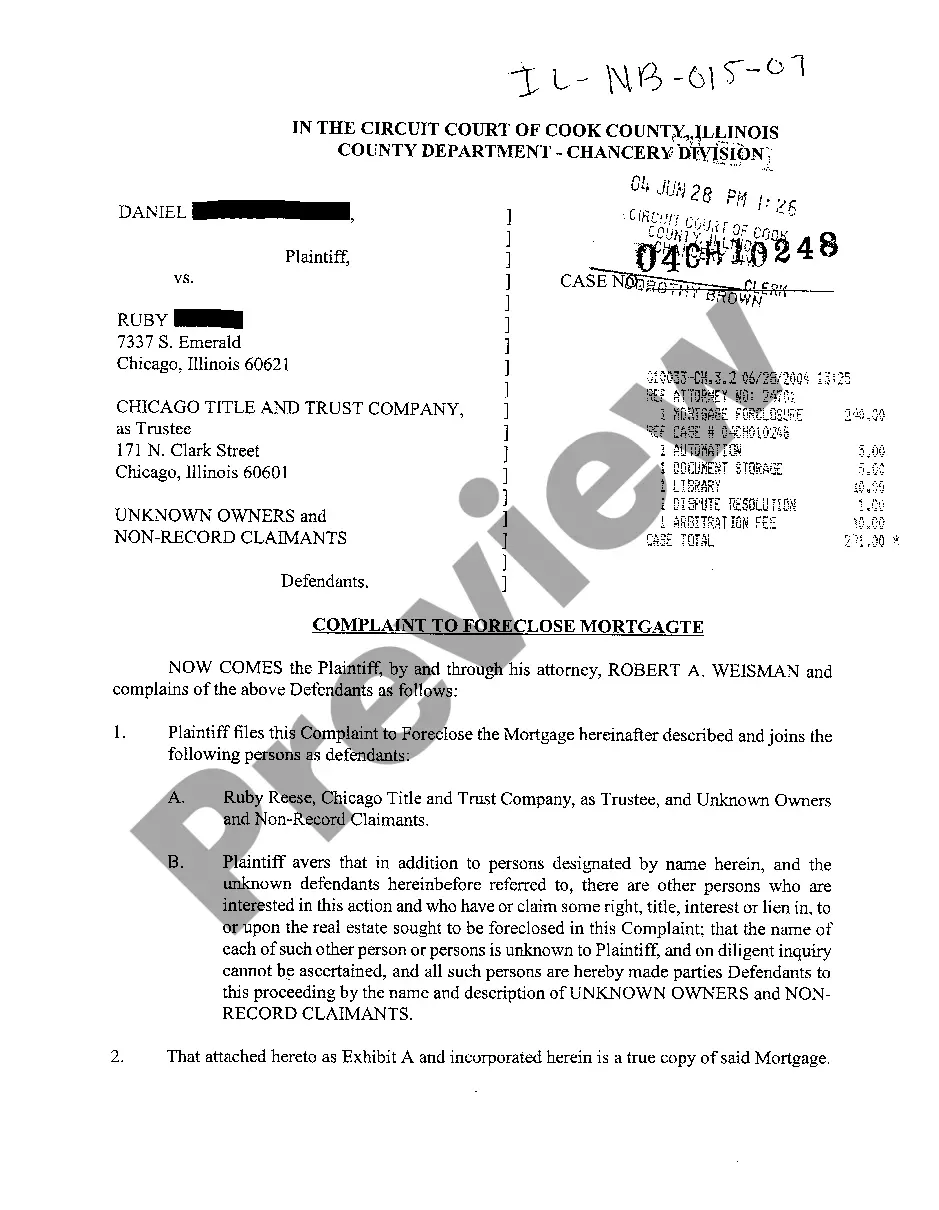

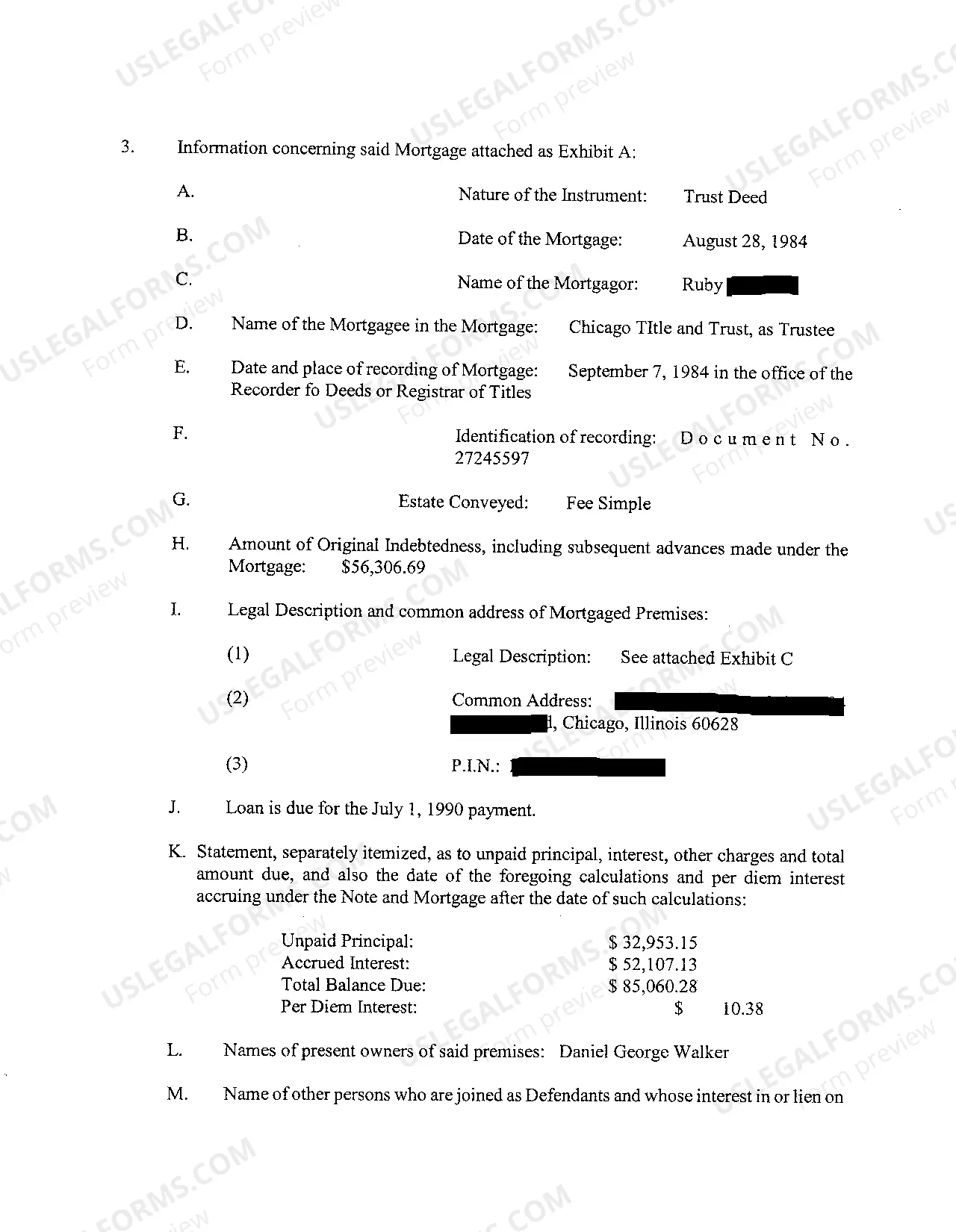

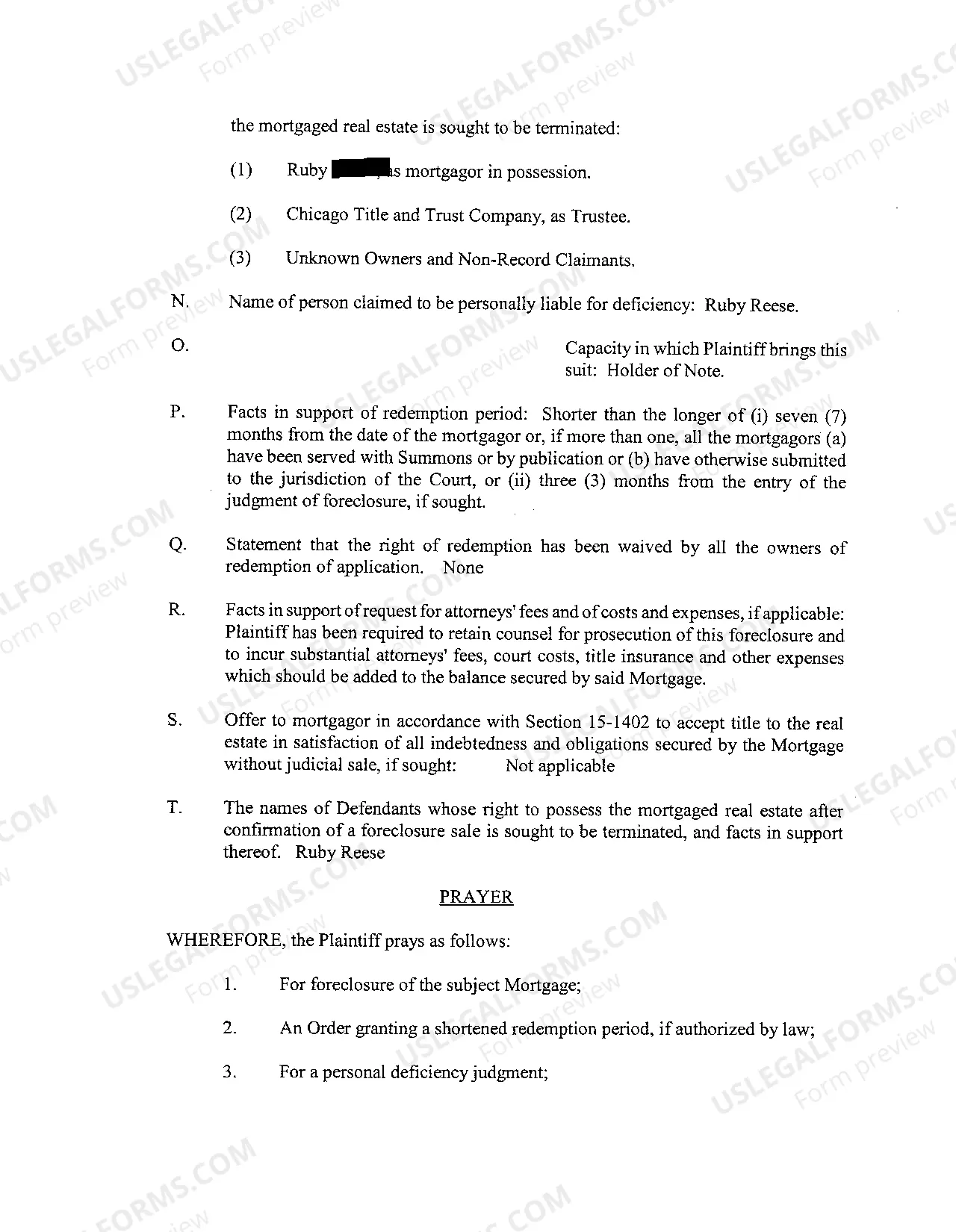

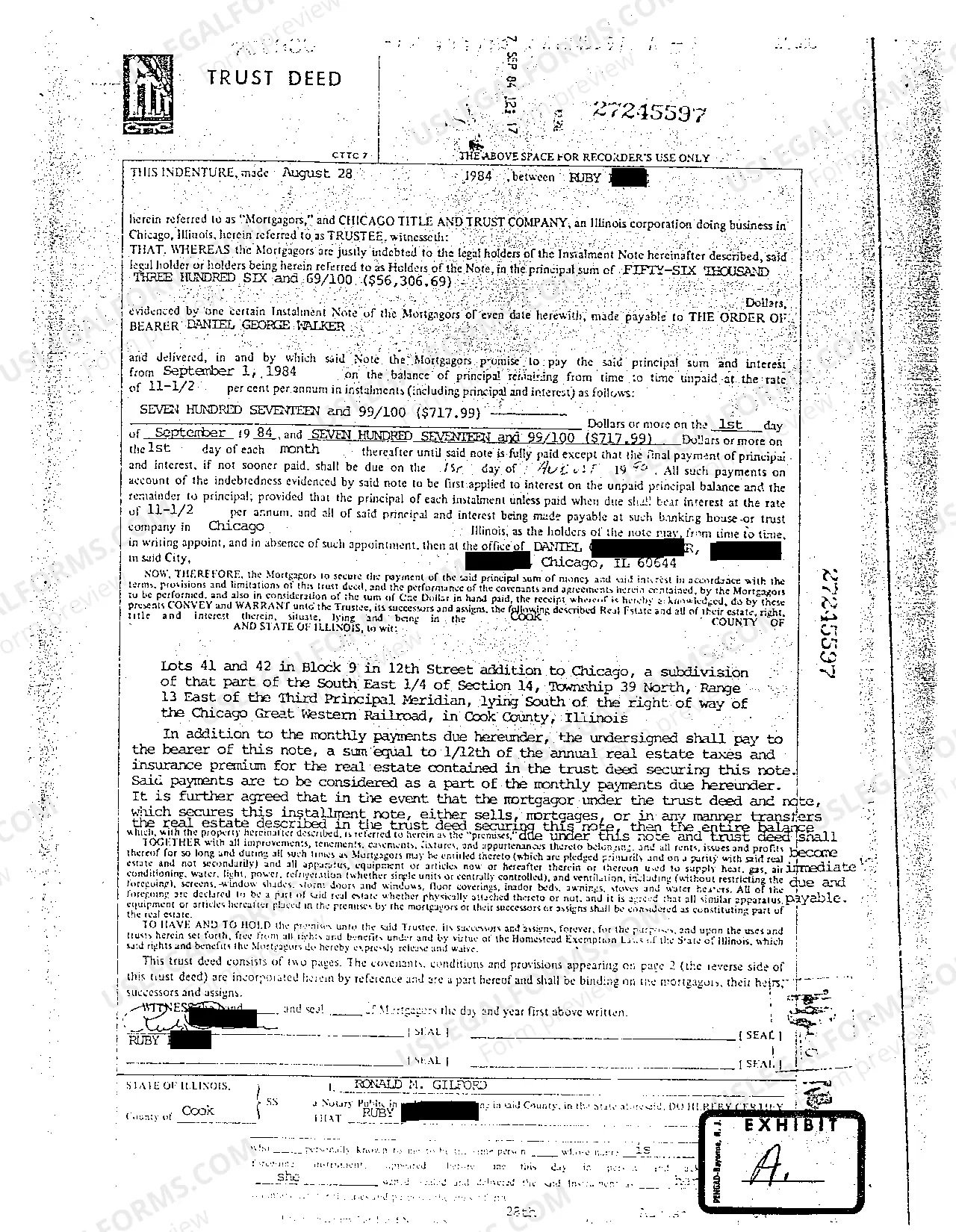

Description: Joliet Illinois Complaint to Foreclosure Mortgage is a legal process initiated by a lending institution or mortgage holder when a homeowner defaults on their mortgage payments. This procedure allows the lender to seize the property and sell it to recoup the outstanding loan amount. Foreclosure is seen as a last resort by lenders when all attempts to work out an alternative solution, such as loan modification or short sale, have failed. It is a complex legal process that involves various stages and timelines. Understanding the different types of Joliet Illinois Complaint to Foreclosure Mortgages can help homeowners navigate their options and possibly avoid foreclosure. 1. Judicial Foreclosure: In Joliet, Illinois, judicial foreclosure is the most common type of foreclosure process. It requires the lender to file a lawsuit against the homeowner, and the case proceeds through the court system. The court then issues a judgment, and if the lender wins, the property is sold at a foreclosure auction. 2. Non-Judicial Foreclosure: Non-judicial foreclosure is less common in Joliet, Illinois, but it is still possible in certain circumstances. This type of foreclosure does not require the lender to file a lawsuit but follows a specific legal process outlined in the mortgage or deed of trust. The property is sold at a public auction, typically conducted by a trustee. 3. Foreclosure by Advertisement: This type of foreclosure is specific to Illinois and is also known as "statutory foreclosure." It is a non-judicial process where the lender publishes a notice of foreclosure sale in local newspapers for a specific period. After the statutory waiting period, the property is sold at a public auction. The Joliet Illinois Complaint to Foreclosure Mortgage process starts with the homeowner receiving a notice of default from the lender, indicating that they have fallen behind on their mortgage payments. To avoid foreclosure, homeowners can explore options like loan modifications, repayment plans, or selling the property. If the homeowner fails to resolve the default, the lender will file a complaint in the appropriate court, starting the foreclosure lawsuit. The homeowner will then receive a summons, and if they fail to respond, a default judgment can be issued against them. During the court proceedings, the lender must prove that the homeowner has defaulted on the mortgage and that they have the right to foreclose. If the court rules in favor of the lender, a foreclosure sale date is set, and the property is sold to the highest bidder at a public auction. It is essential for homeowners facing foreclosure to seek legal counsel and explore potential alternatives to foreclosure, as the process can have long-term consequences on their credit and financial well-being.

Joliet Illinois Complaint To Foreclosure Mortgage

Description

How to fill out Joliet Illinois Complaint To Foreclosure Mortgage?

Regardless of social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person without any law education to create such paperwork from scratch, mostly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Joliet Illinois Complaint To Foreclosure Mortgage or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Joliet Illinois Complaint To Foreclosure Mortgage quickly employing our trusted platform. If you are already an existing customer, you can proceed to log in to your account to get the appropriate form.

Nevertheless, if you are a novice to our platform, ensure that you follow these steps prior to downloading the Joliet Illinois Complaint To Foreclosure Mortgage:

- Be sure the form you have found is good for your location considering that the regulations of one state or county do not work for another state or county.

- Preview the document and go through a brief outline (if available) of cases the document can be used for.

- If the form you picked doesn’t meet your needs, you can start over and search for the needed form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Joliet Illinois Complaint To Foreclosure Mortgage once the payment is done.

You’re good to go! Now you can proceed to print out the document or complete it online. Should you have any issues getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.