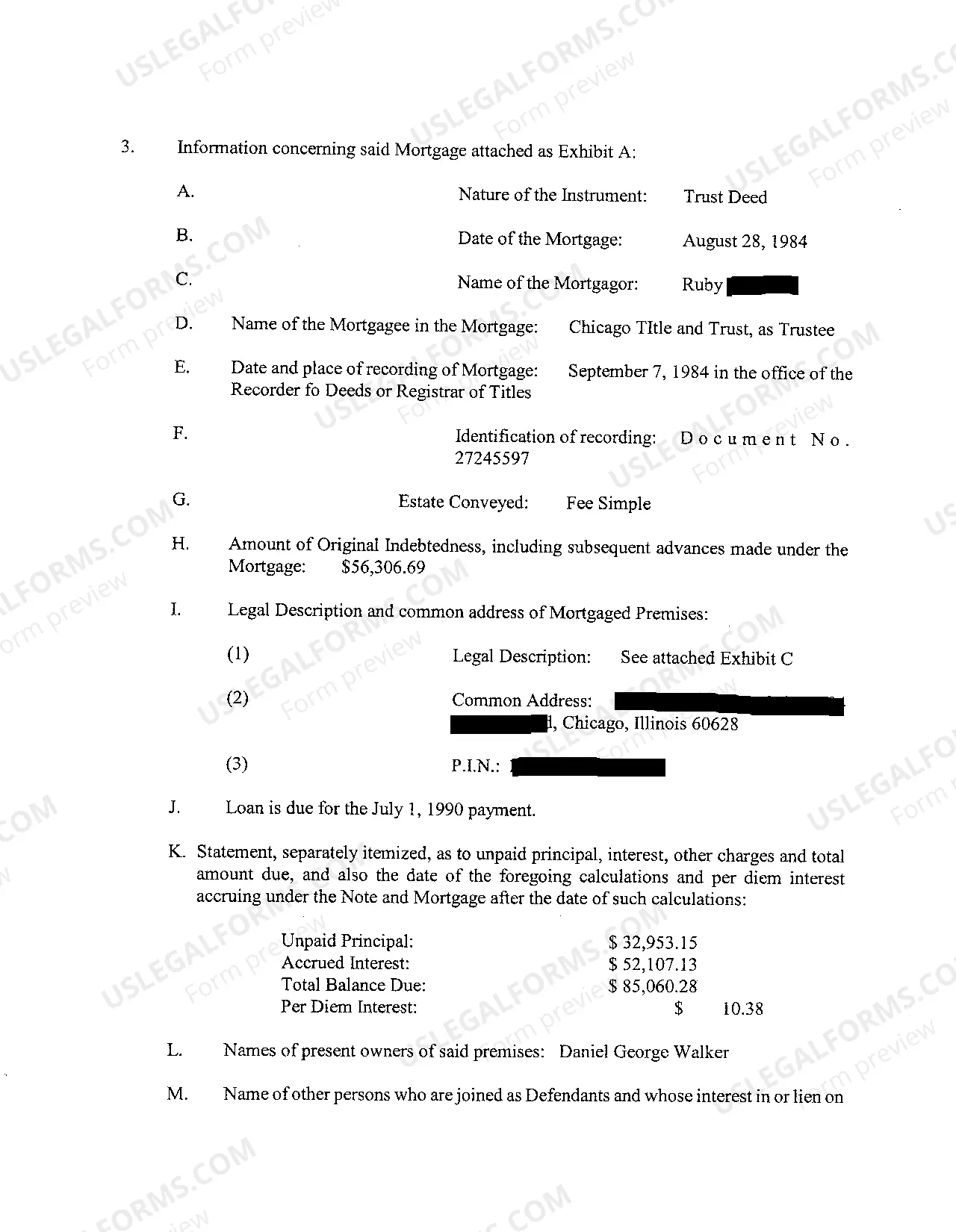

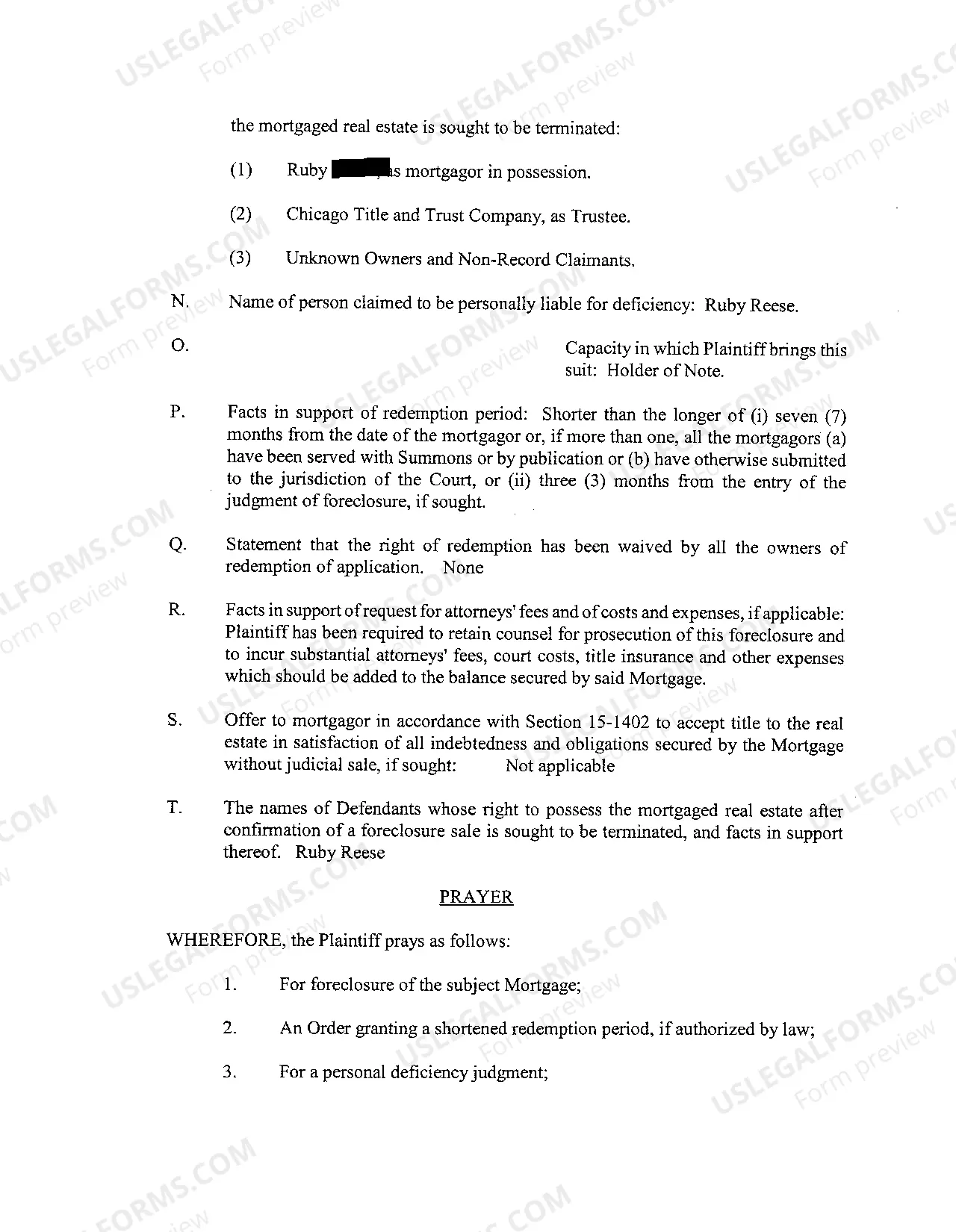

Naperville Illinois Complaint To Foreclosure Mortgage refers to the legal process initiated by a lender or financial institution to recover ownership of a property in Naperville, Illinois when the homeowner fails to make mortgage payments. This procedure typically involves a series of legal actions that aim to resolve the default and either obtain payment or regain possession of the property to sell it to recover the unpaid mortgage balance. Below are the different types of Naperville Illinois Complaint To Foreclosure Mortgage: 1. Judicial Foreclosure: This is the most common type of foreclosure process in Naperville, Illinois. The lender files a complaint with the local court, starting a legal proceeding against the homeowner. The court oversees the foreclosure process, ensuring the lender adheres to all relevant laws and regulations. 2. Non-Judicial Foreclosure: Unlike judicial foreclosure, non-judicial foreclosure does not involve court intervention. It is frequently used when the mortgage contract contains a "power of sale" clause, granting the lender the ability to sell the property in the event of default. The lender follows a specific foreclosure process outlined by state law, and the property is sold at a public auction. 3. Strict Foreclosure: In some cases, a Naperville lender may opt for strict foreclosure. This process requires the lender to prove that the property value is equal to or greater than the outstanding mortgage balance. If successful, the lender assumes ownership of the property without the need for a public auction. 4. Deed in Lieu of Foreclosure: A deed in lieu of foreclosure is an alternative solution where the homeowner voluntarily transfers ownership of the property to the lender to satisfy the mortgage debt. This option can be mutually agreed upon to avoid the lengthy and costly foreclosure process. 5. Short Sale: A short sale occurs when the homeowner sells the property for less than the outstanding mortgage balance with the lender's consent. This option is often pursued when the property's market value is lower than the amount owed on the mortgage. By accepting a short sale, the lender forgives the remaining balance, and the foreclosure process is avoided. It is important to note that each type of Naperville Illinois Complaint To Foreclosure Mortgage follows specific legal procedures, timelines, and requirements. Homeowners facing foreclosure should consult with legal experts or housing counselors to understand their rights, obligations, and potential options to mitigate the impact of foreclosure.

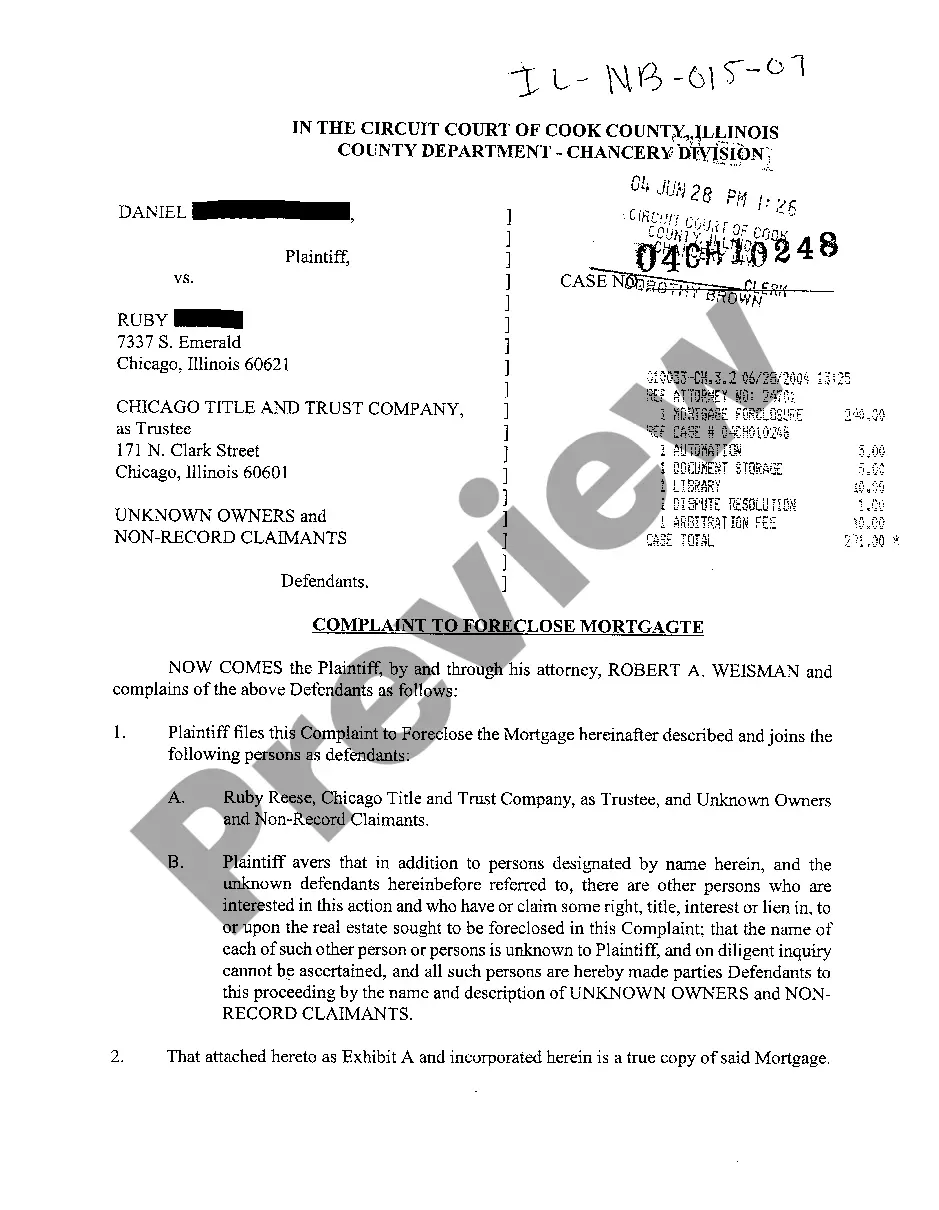

Naperville Illinois Complaint To Foreclosure Mortgage

State:

Illinois

City:

Naperville

Control #:

IL-NB-015-07

Format:

PDF

Instant download

This form is available by subscription

Description

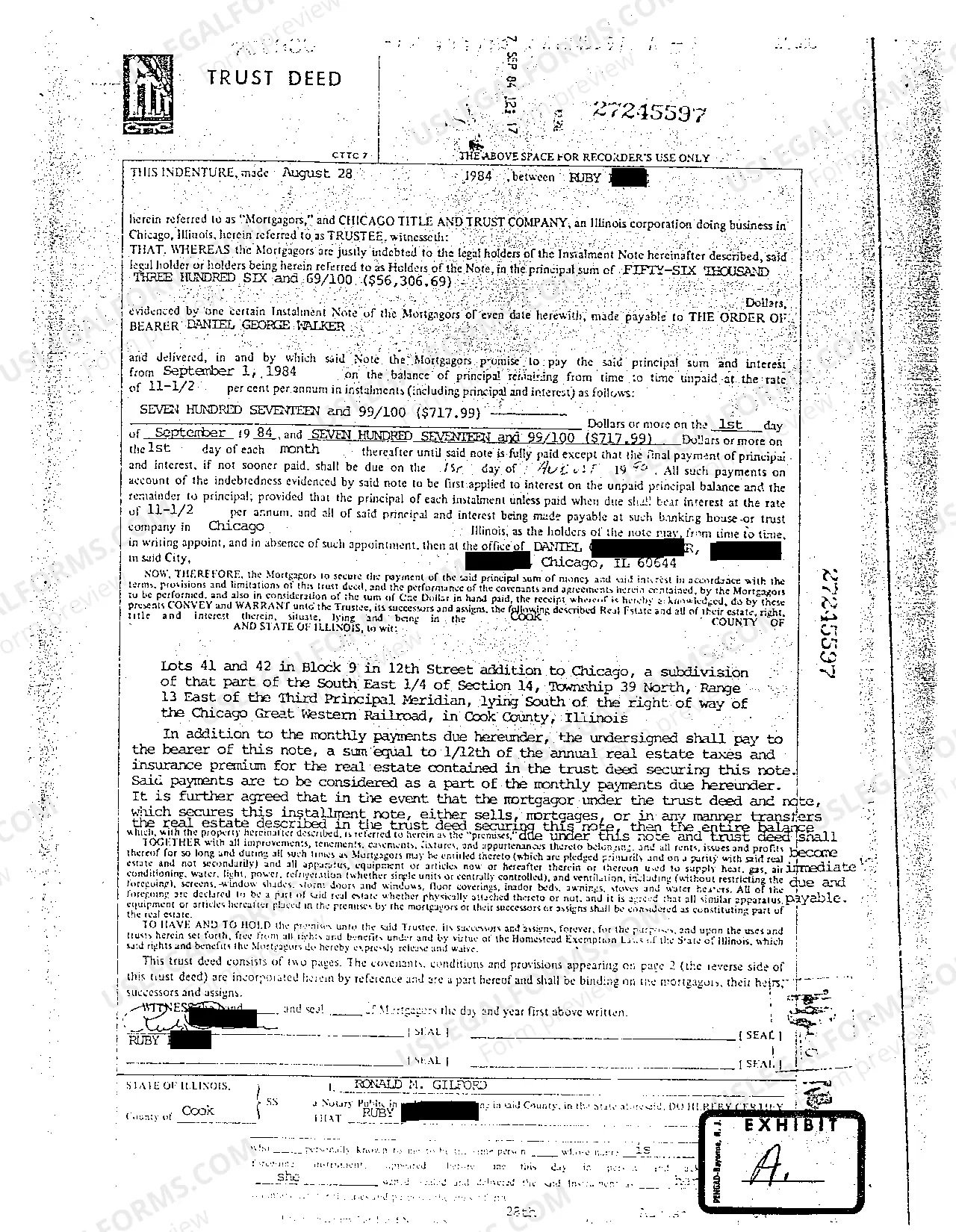

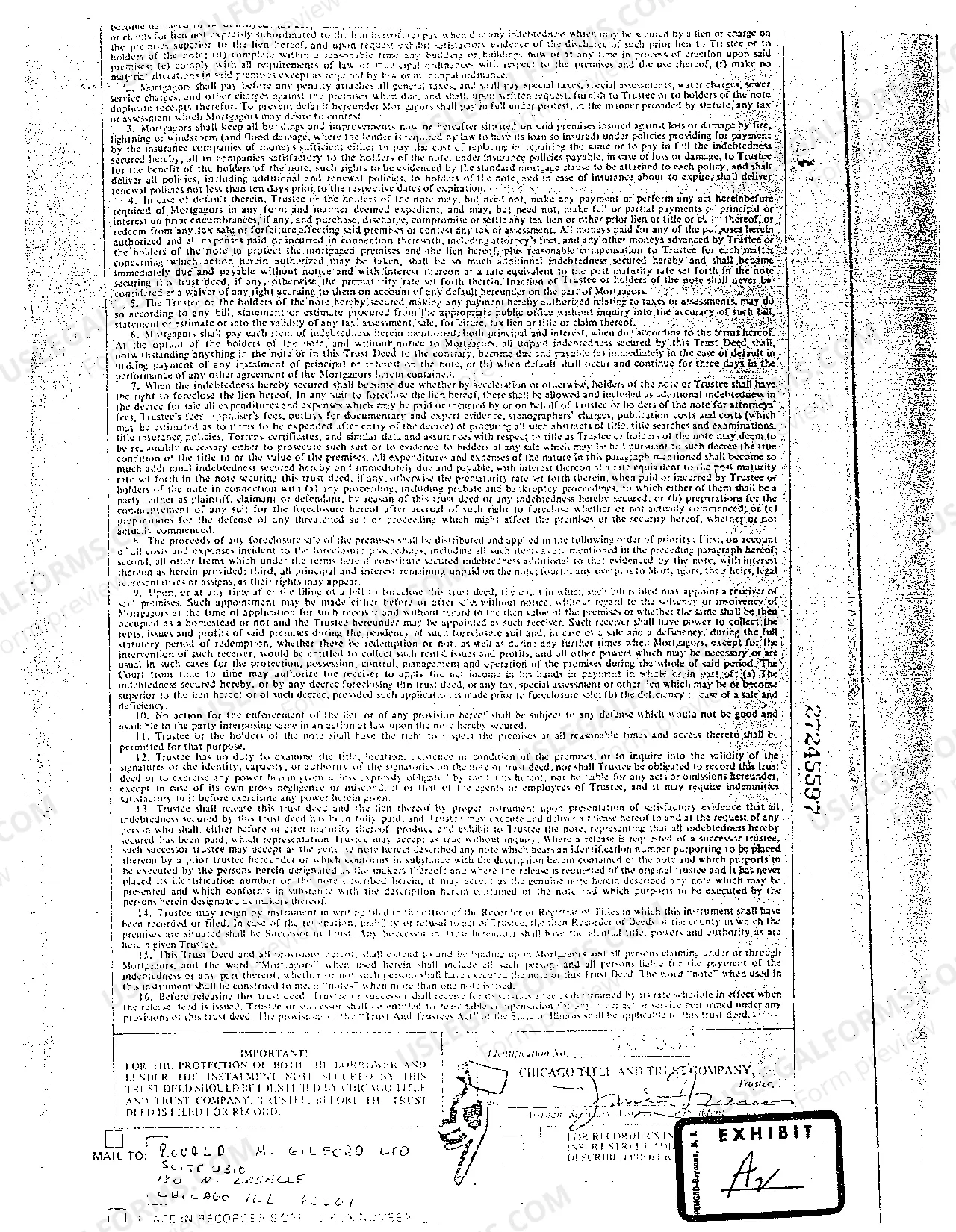

A07 Complaint To Foreclosure Mortgage

Naperville Illinois Complaint To Foreclosure Mortgage refers to the legal process initiated by a lender or financial institution to recover ownership of a property in Naperville, Illinois when the homeowner fails to make mortgage payments. This procedure typically involves a series of legal actions that aim to resolve the default and either obtain payment or regain possession of the property to sell it to recover the unpaid mortgage balance. Below are the different types of Naperville Illinois Complaint To Foreclosure Mortgage: 1. Judicial Foreclosure: This is the most common type of foreclosure process in Naperville, Illinois. The lender files a complaint with the local court, starting a legal proceeding against the homeowner. The court oversees the foreclosure process, ensuring the lender adheres to all relevant laws and regulations. 2. Non-Judicial Foreclosure: Unlike judicial foreclosure, non-judicial foreclosure does not involve court intervention. It is frequently used when the mortgage contract contains a "power of sale" clause, granting the lender the ability to sell the property in the event of default. The lender follows a specific foreclosure process outlined by state law, and the property is sold at a public auction. 3. Strict Foreclosure: In some cases, a Naperville lender may opt for strict foreclosure. This process requires the lender to prove that the property value is equal to or greater than the outstanding mortgage balance. If successful, the lender assumes ownership of the property without the need for a public auction. 4. Deed in Lieu of Foreclosure: A deed in lieu of foreclosure is an alternative solution where the homeowner voluntarily transfers ownership of the property to the lender to satisfy the mortgage debt. This option can be mutually agreed upon to avoid the lengthy and costly foreclosure process. 5. Short Sale: A short sale occurs when the homeowner sells the property for less than the outstanding mortgage balance with the lender's consent. This option is often pursued when the property's market value is lower than the amount owed on the mortgage. By accepting a short sale, the lender forgives the remaining balance, and the foreclosure process is avoided. It is important to note that each type of Naperville Illinois Complaint To Foreclosure Mortgage follows specific legal procedures, timelines, and requirements. Homeowners facing foreclosure should consult with legal experts or housing counselors to understand their rights, obligations, and potential options to mitigate the impact of foreclosure.

Free preview

How to fill out Naperville Illinois Complaint To Foreclosure Mortgage?

If you’ve already used our service before, log in to your account and save the Naperville Illinois Complaint To Foreclosure Mortgage on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Naperville Illinois Complaint To Foreclosure Mortgage. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!