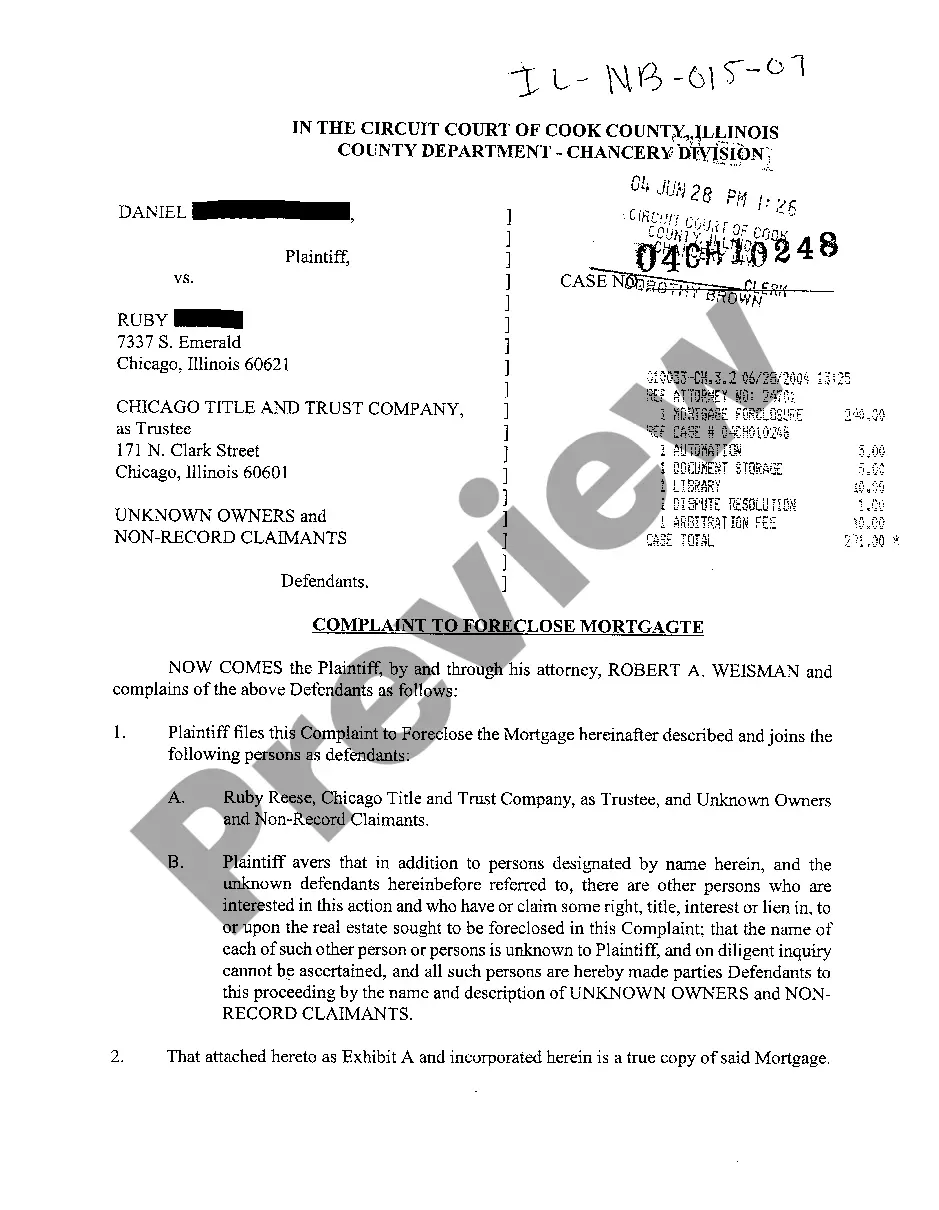

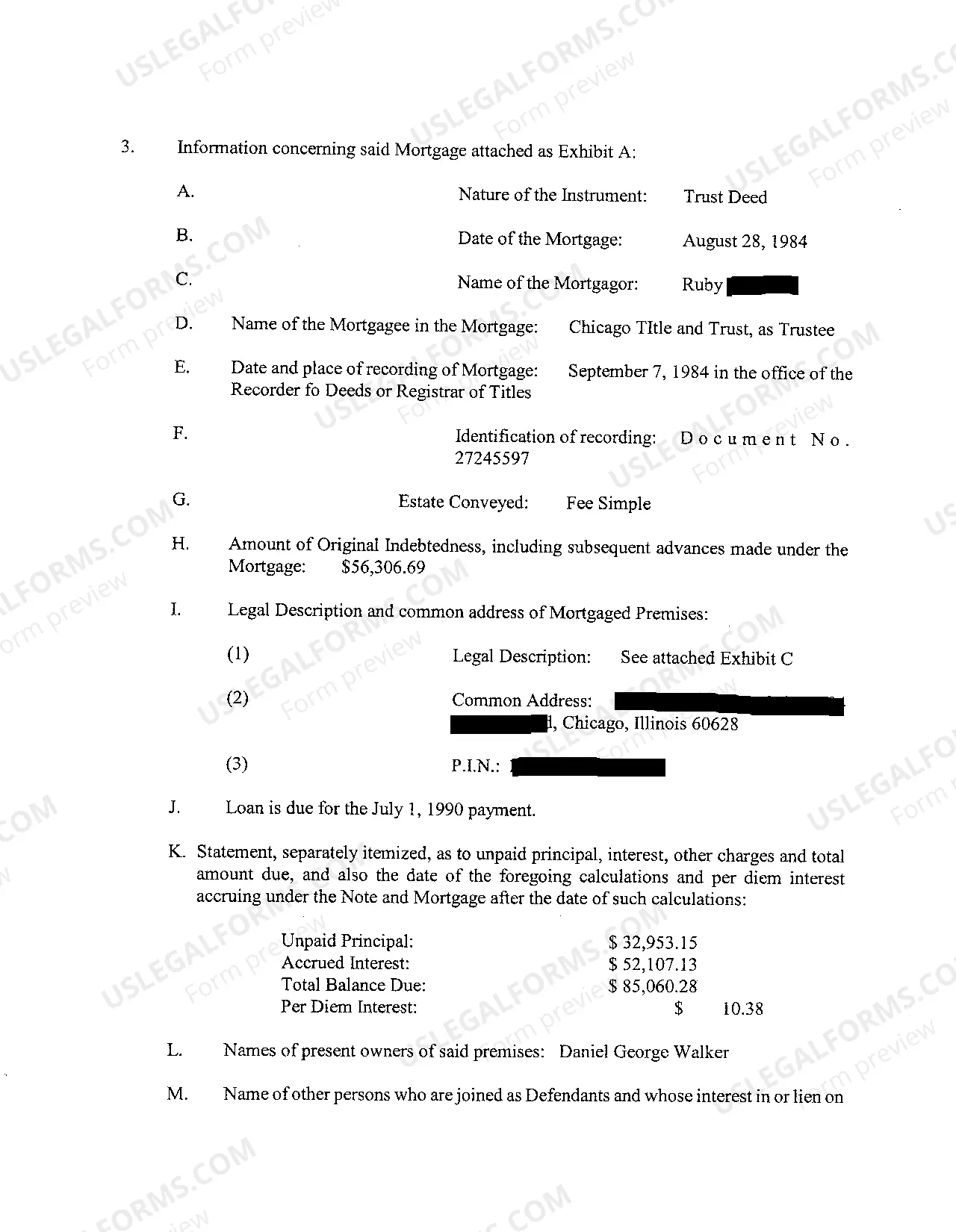

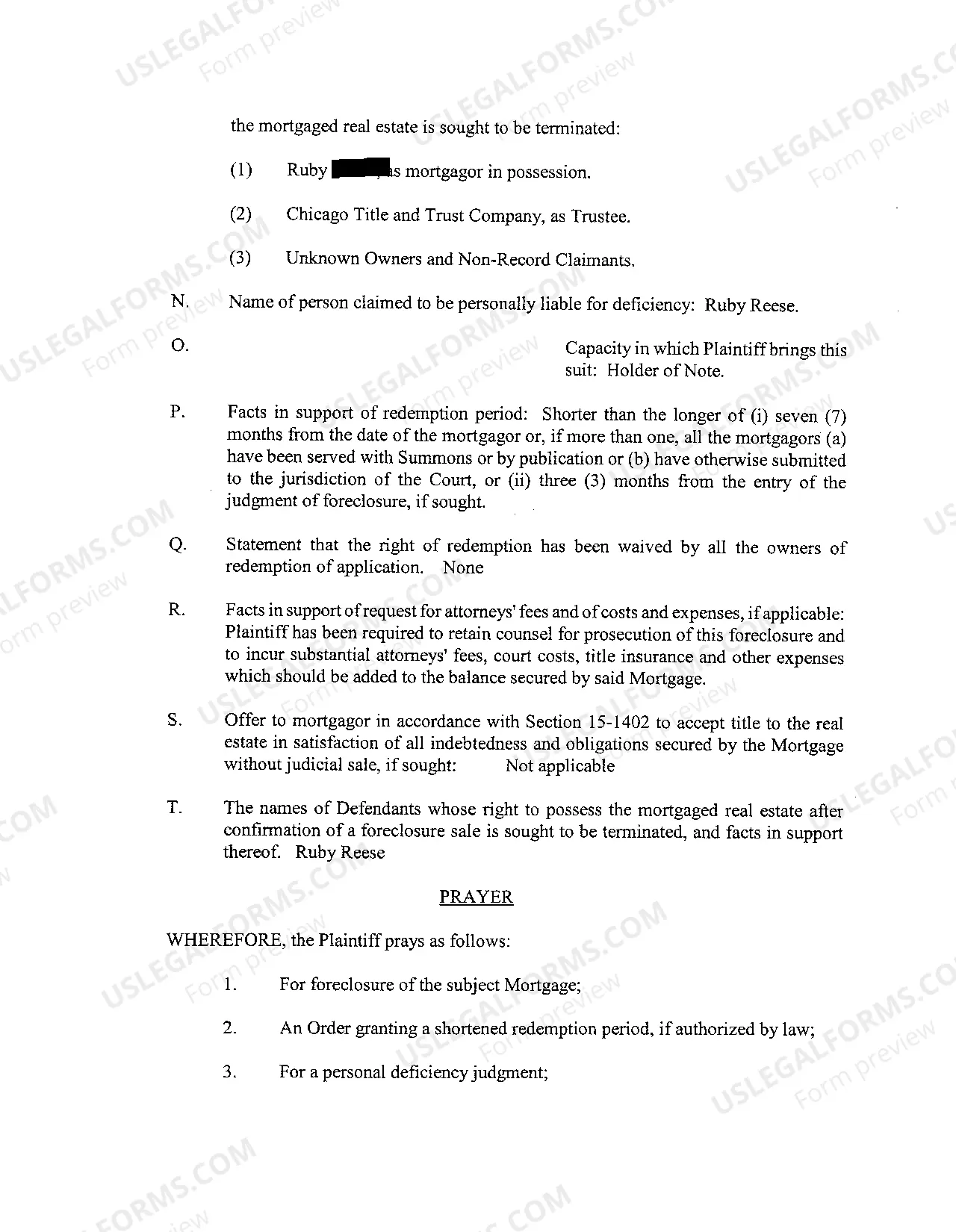

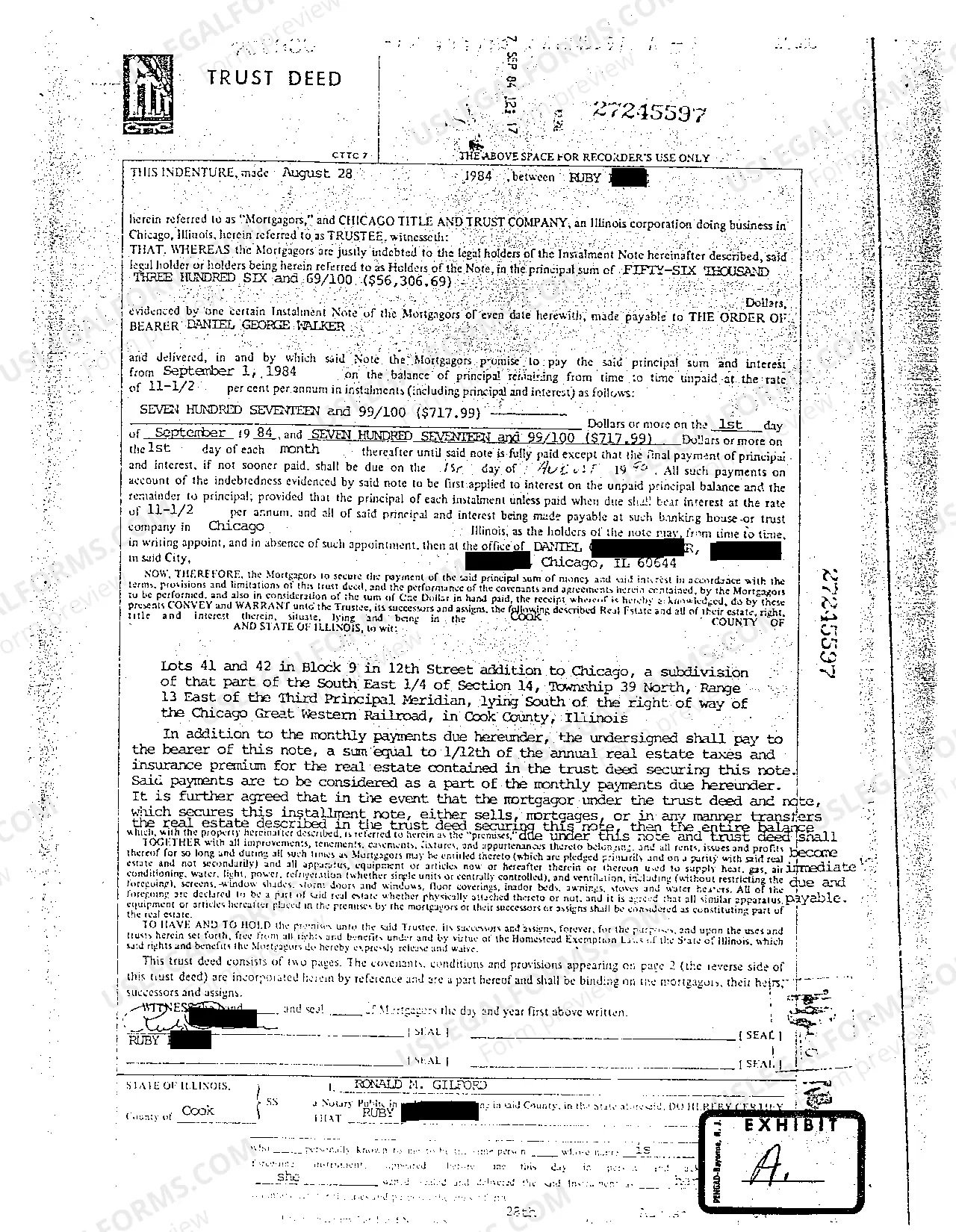

Rockford Illinois Complaint To Foreclosure Mortgage is a legal process initiated by a mortgage lender to recover the outstanding loan amount when a homeowner defaults on their mortgage payments. It involves filing a complaint with the court to foreclose on the property and ultimately sell it to satisfy the debt. Here is a detailed description and relevant keywords regarding the process: 1. Foreclosure process: The foreclosure process in Rockford, Illinois typically begins when the homeowner defaults on their mortgage payments. The lender must file a complaint with the court to initiate the legal proceedings. 2. Delinquency: Delinquency refers to the failure of the homeowner to make timely mortgage payments, leading to the initiation of foreclosure proceedings. 3. Complaint: The lender files a complaint with the court outlining the default, amount owed, and relevant details of the mortgage agreement. This legal document serves as formal notice to the homeowner about the foreclosure action. 4. Judicial foreclosure: Rockford, Illinois follows a judicial foreclosure process, which means the foreclosure must go through the court system. This ensures that the homeowner has the opportunity to present a defense and challenge the foreclosure. 5. Notice of default: After the complaint is filed, the lender must provide the homeowner with a notice of default, informing them of their right to cure the default by paying the outstanding amount within a specified timeframe. 6. Li's pendent: A is pendent is a legal notice filed with the county recorder's office, publicly stating that a foreclosure lawsuit is pending against the property. It serves as a warning to potential buyers and others with an interest in the property. 7. Redemption period: In Rockford, Illinois, homeowners have a statutory redemption period after the foreclosure sale, during which they can reclaim the property by paying off the debt in full, including any associated costs and fees. 8. Deficiency judgment: If the foreclosure sale proceeds do not cover the full amount owed, the lender may seek a deficiency judgment against the homeowner. This allows them to pursue collection efforts for the remaining debt. 9. Deed in lieu of foreclosure: In some cases, the homeowner and lender may agree to avoid foreclosure by executing a deed in lieu of foreclosure. This means the homeowner voluntarily transfers the property to the lender to satisfy the debt, thereby avoiding the foreclosure process. 10. Loan modification: Homeowners facing foreclosure may explore options for loan modification, where the terms of the mortgage are adjusted to make the monthly payments more affordable. This can help prevent foreclosure and allow the homeowner to keep their property. It is essential to consult with legal professionals or housing counseling agencies for accurate and up-to-date information on Rockford Illinois Complaint To Foreclosure Mortgage processes and any potential options available to homeowners facing foreclosure.

Rockford Illinois Complaint To Foreclosure Mortgage

Description

How to fill out Rockford Illinois Complaint To Foreclosure Mortgage?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person without any law education to create this sort of paperwork from scratch, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Rockford Illinois Complaint To Foreclosure Mortgage or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Rockford Illinois Complaint To Foreclosure Mortgage in minutes using our reliable service. If you are already a subscriber, you can proceed to log in to your account to get the needed form.

However, in case you are a novice to our library, make sure to follow these steps before downloading the Rockford Illinois Complaint To Foreclosure Mortgage:

- Ensure the form you have found is suitable for your location because the rules of one state or county do not work for another state or county.

- Review the document and go through a short description (if provided) of cases the paper can be used for.

- If the form you selected doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account login information or register for one from scratch.

- Choose the payment method and proceed to download the Rockford Illinois Complaint To Foreclosure Mortgage once the payment is completed.

You’re all set! Now you can proceed to print the document or fill it out online. If you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.