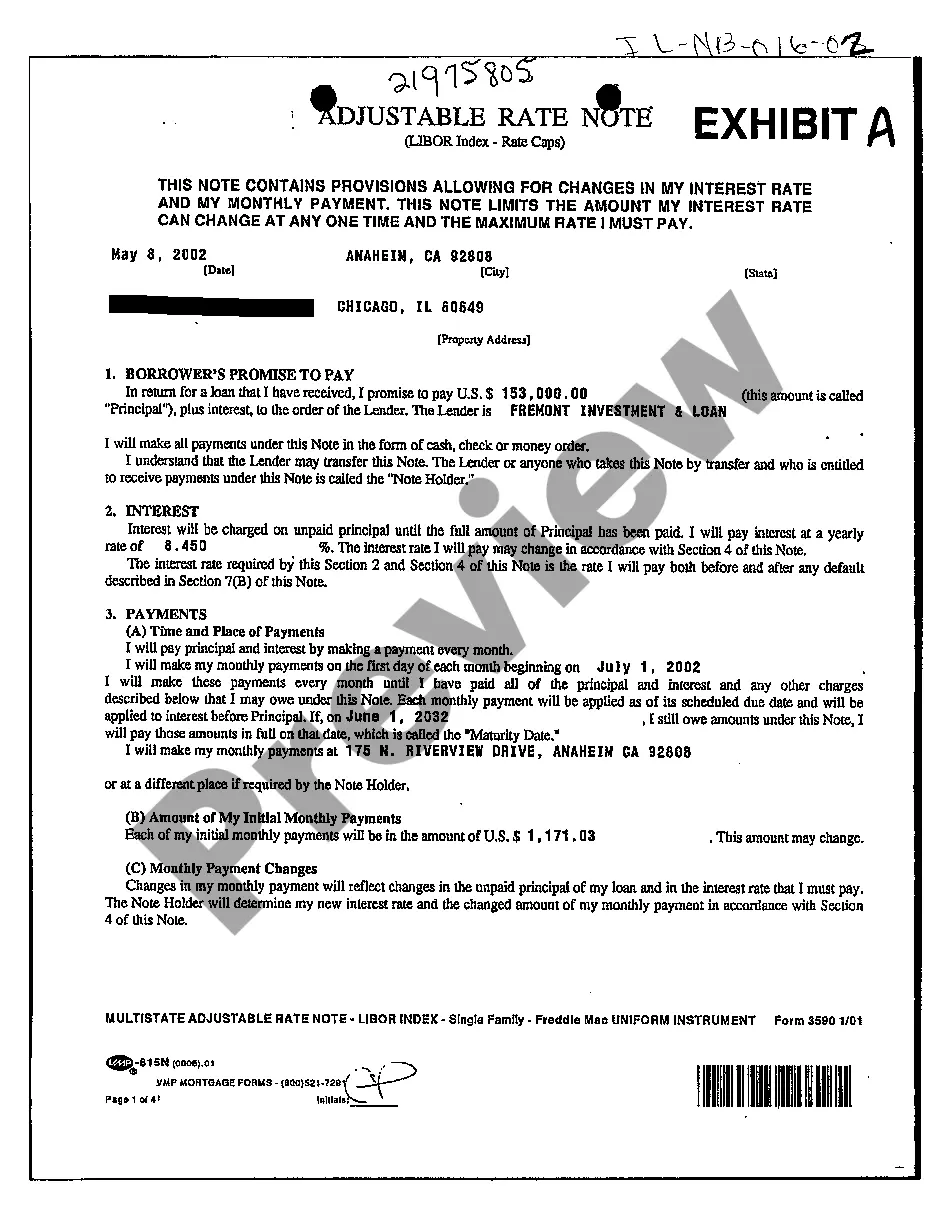

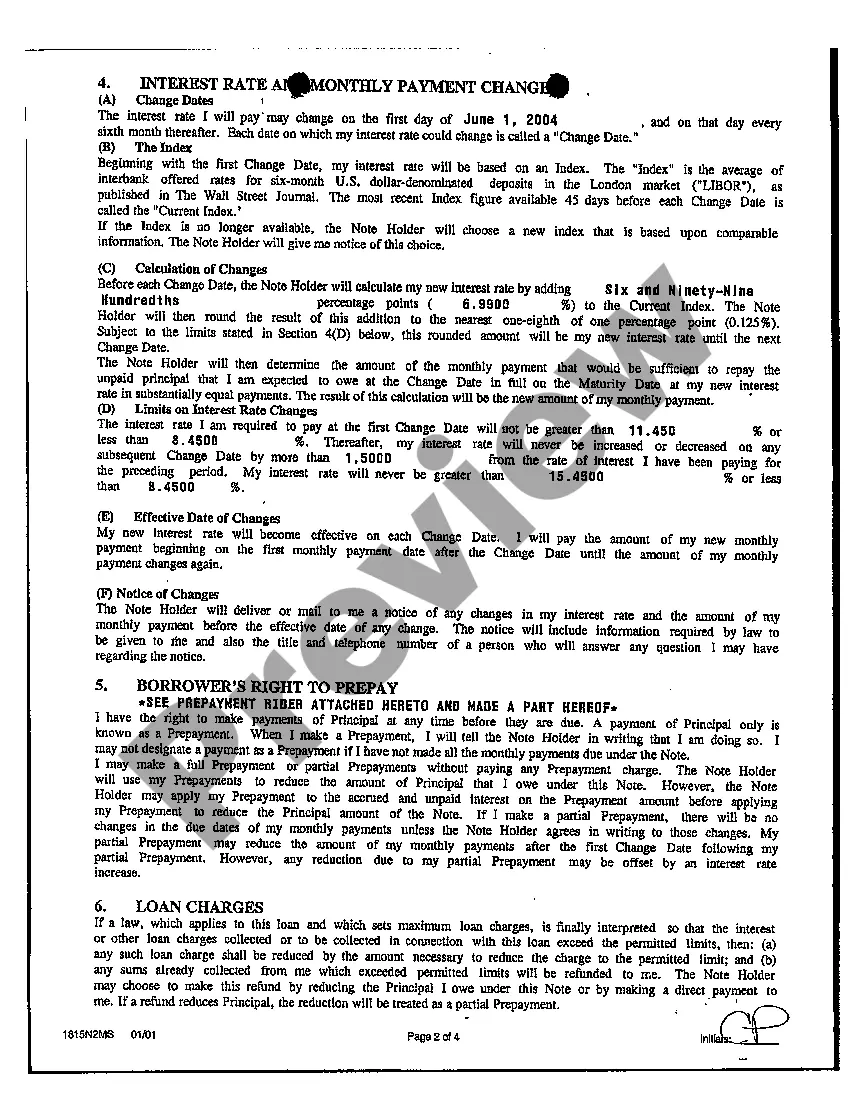

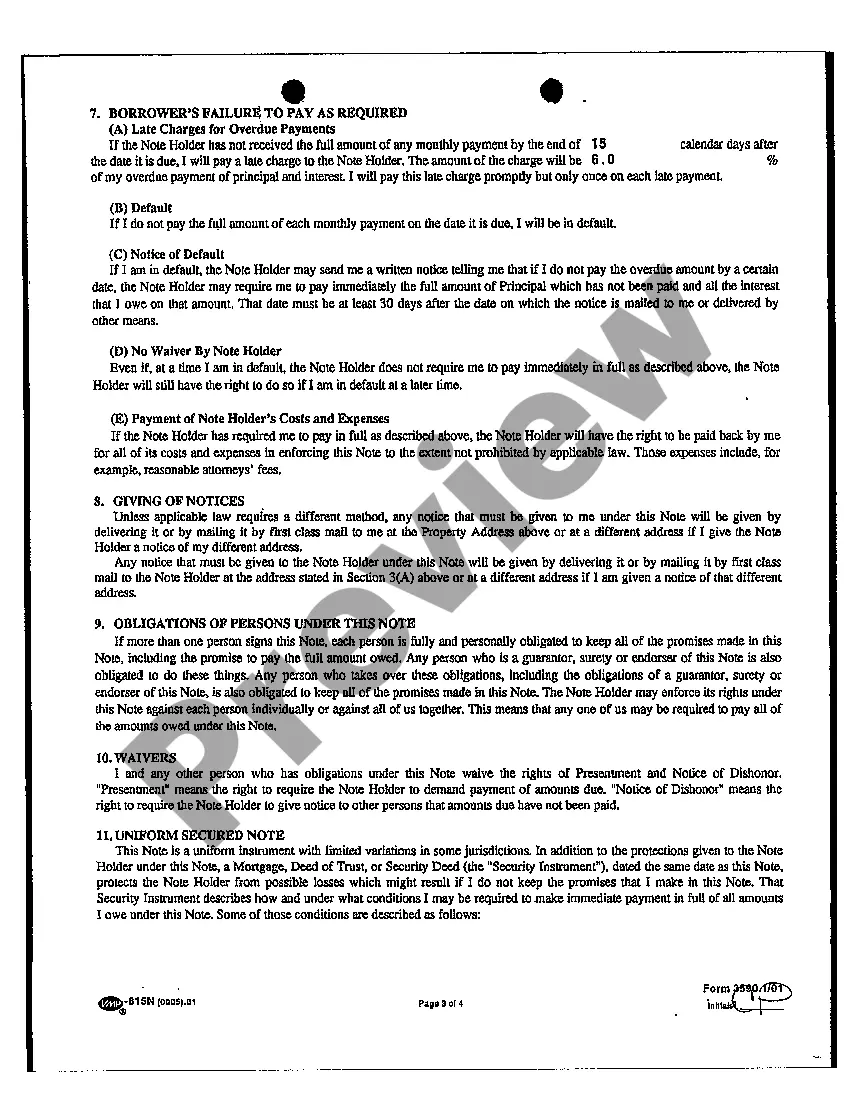

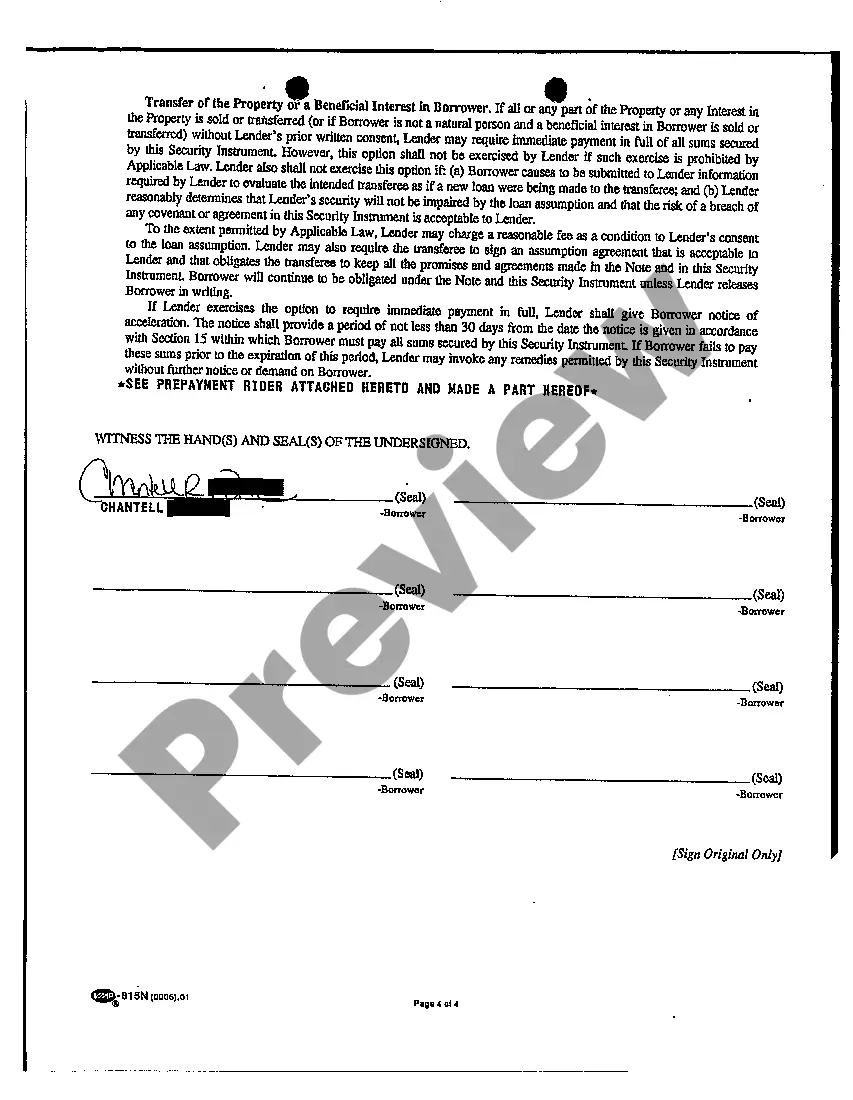

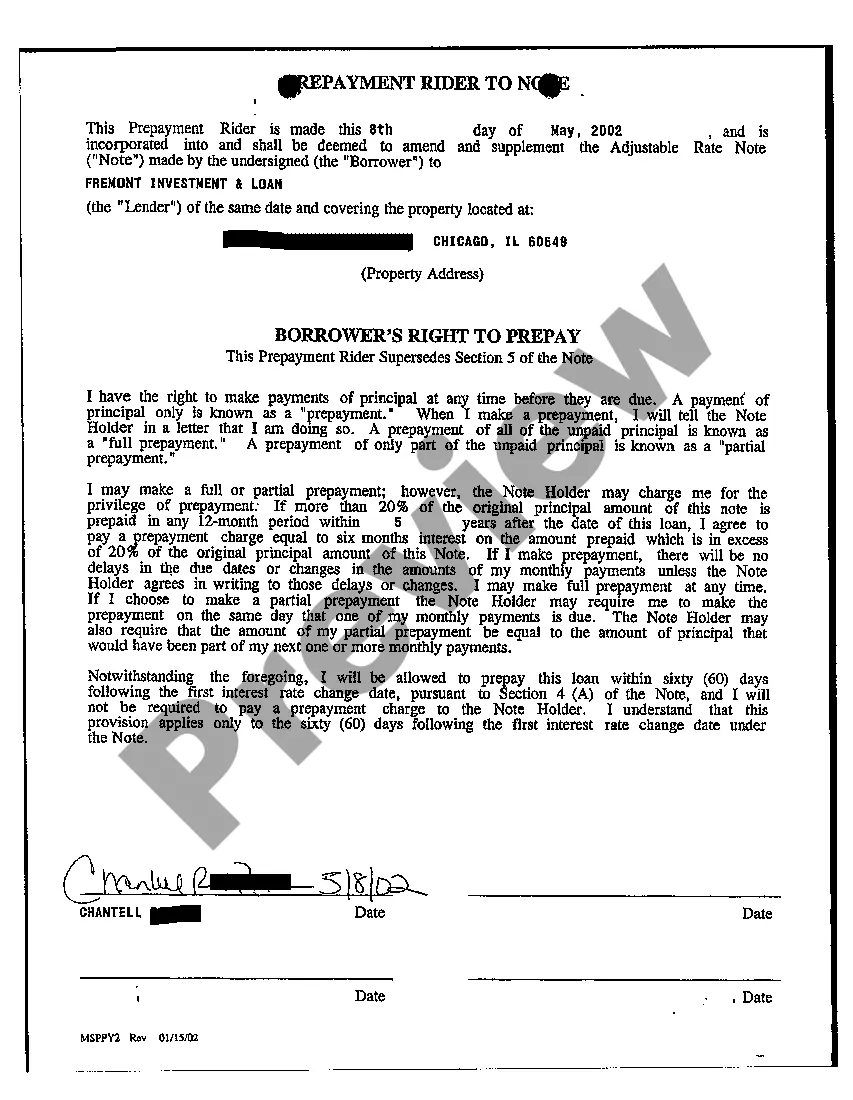

The Chicago Illinois Exhibit A Adjustable Rate Note is a legal document used in the real estate industry in the state of Illinois, particularly in the city of Chicago. It outlines the terms and conditions of an adjustable rate mortgage (ARM) loan. This type of note is commonly used when purchasing or refinancing a property in Chicago, and it offers borrowers the flexibility of an adjustable interest rate. The adjustable rate note is an important component of the loan agreement, as it establishes the basis for how the interest rate will be calculated and adjusted over the life of the loan. The Chicago Illinois Exhibit A Adjustable Rate Note typically includes the following key elements: 1. Adjustable Interest Rate: The note specifies that the interest rate is subject to change periodically according to a pre-determined index, such as the Treasury index or the London Interbank Offered Rate (LIBOR). This allows the interest rate to increase or decrease based on market conditions. 2. Adjustment Period: The note outlines the frequency at which the interest rate will be reviewed and adjusted. Common adjustment periods include annually, semi-annually, or every three to five years. 3. Initial Interest Rate: This is the rate at which the loan begins. It is often lower than the prevailing fixed interest rate, making it an attractive option for individuals who plan to sell or refinance the property within a short period. 4. Caps and Limits: There may be caps or limits on how much the interest rate can increase or decrease at each adjustment period. The note specifies these limits to protect borrowers from sudden and substantial changes in their monthly payments. 5. Calculation of Interest Rate: The note provides details on how the interest rate will be calculated based on the chosen index and any margin assigned by the lender. The note typically includes a formula or a reference to a schedule that outlines the calculation. 6. Payment Terms: The note includes information about the borrower's monthly mortgage payments, including the due date, payment amount, and any late fees or penalties that may apply. While there may not be different types of Chicago Illinois Exhibit A Adjustable Rate Notes, there can be variations in the specific terms and conditions outlined within the note. These can be customized based on the agreement between the borrower and the lender, taking into consideration factors such as the loan term, the borrower's credit history, and the lender's policies. It is important for borrowers to thoroughly review and understand the terms outlined in the Chicago Illinois Exhibit A Adjustable Rate Note before signing it, as it will have a significant impact on their mortgage payments and financial obligations. Consulting with a legal professional or financial advisor can provide additional guidance and ensure that the borrower makes informed decisions regarding their mortgage loan.

Chicago Illinois Exhibit A Adjustable Rate Note

Description

How to fill out Chicago Illinois Exhibit A Adjustable Rate Note?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Chicago Illinois Exhibit A Adjustable Rate Note? US Legal Forms is your go-to solution.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of specific state and county.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Chicago Illinois Exhibit A Adjustable Rate Note conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Chicago Illinois Exhibit A Adjustable Rate Note in any provided file format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours researching legal paperwork online for good.