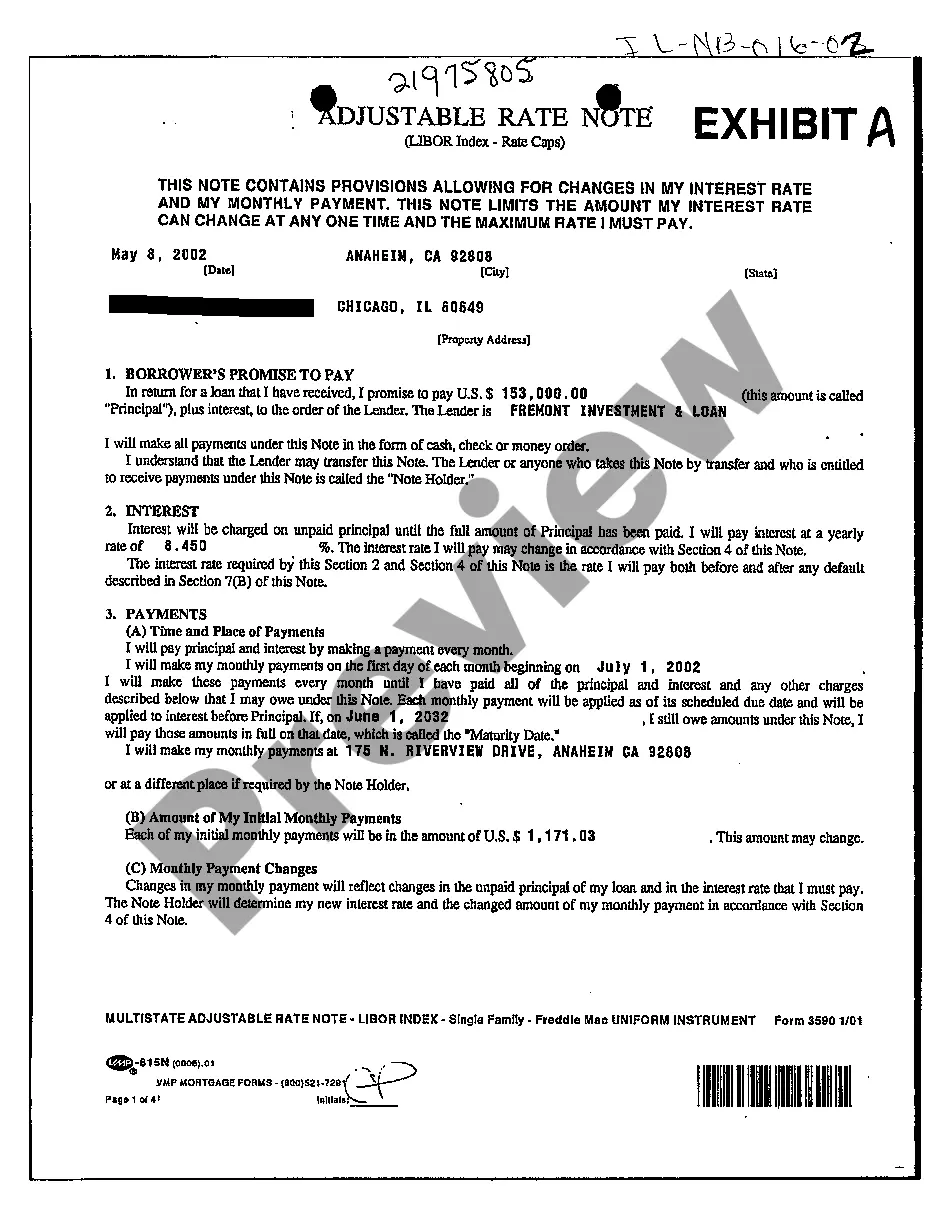

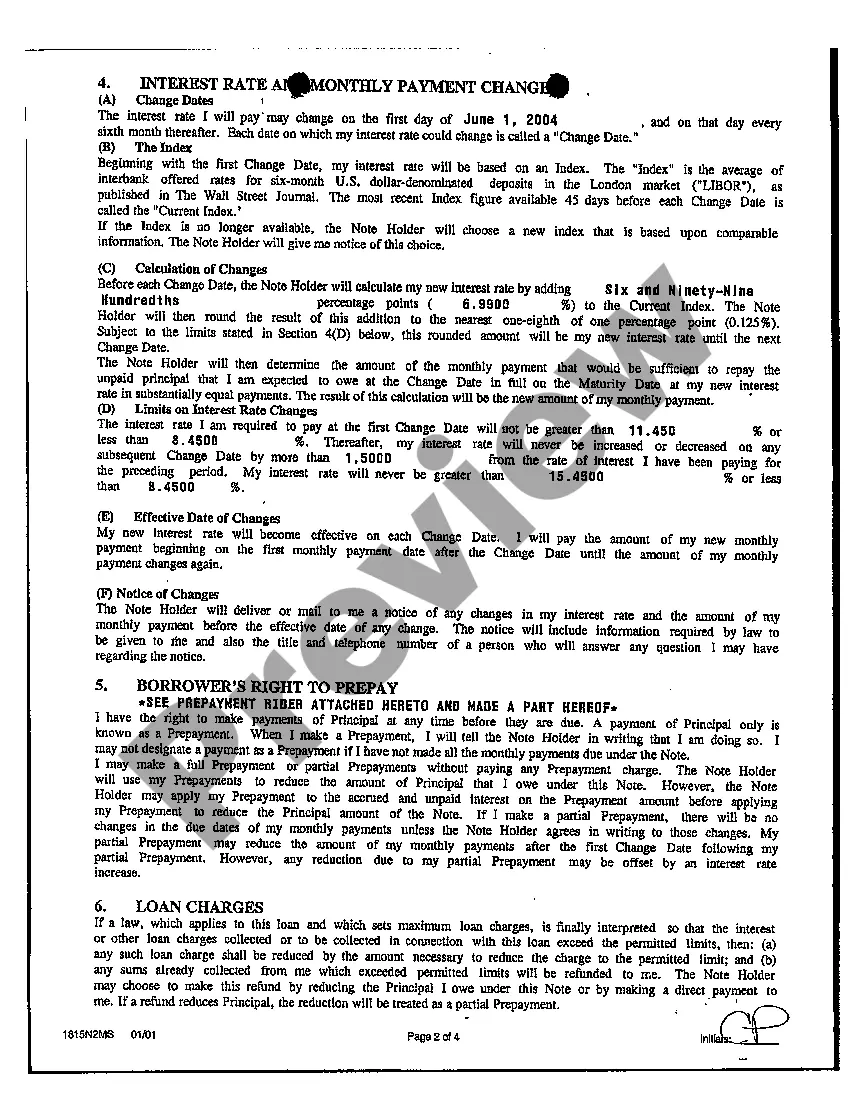

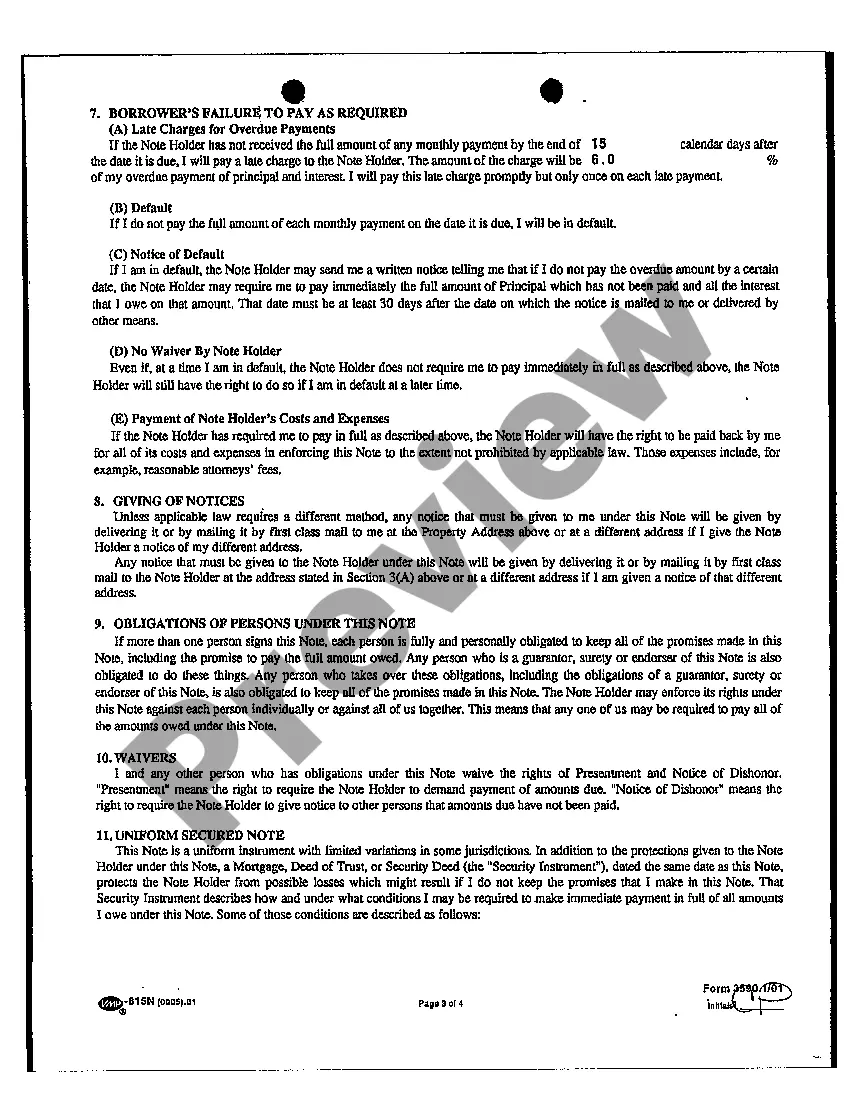

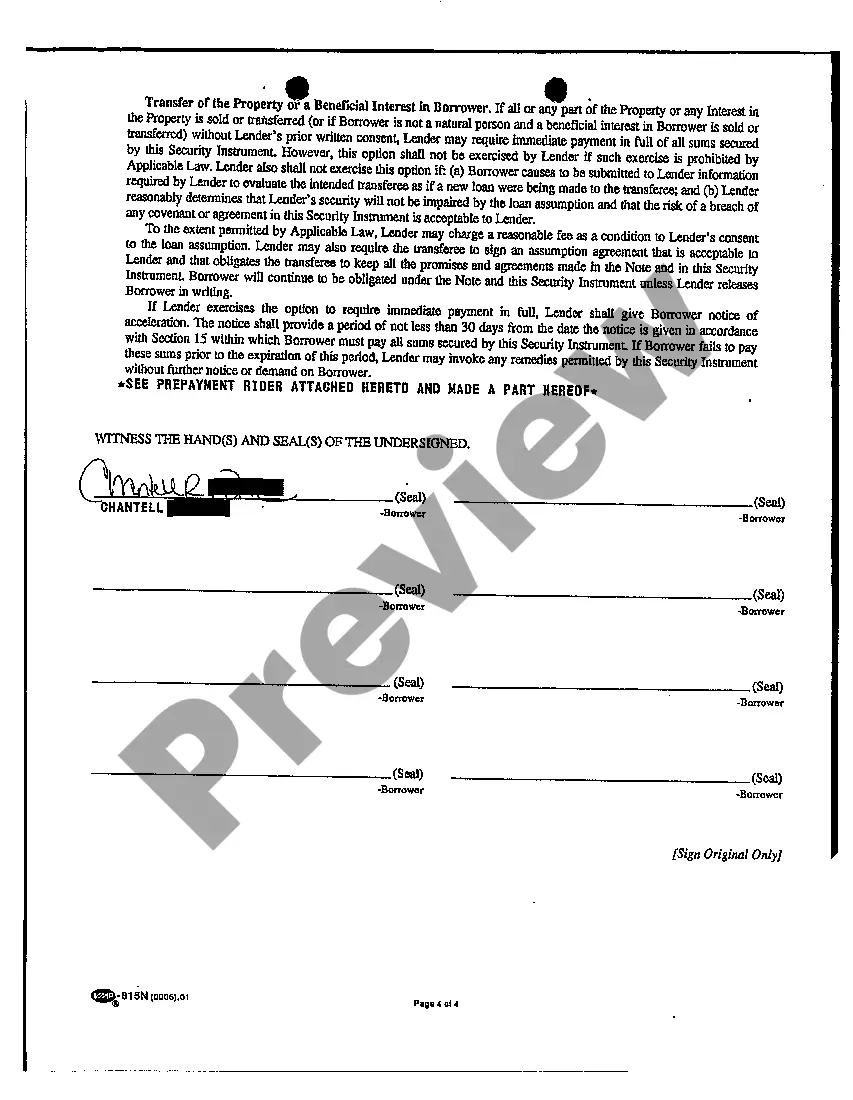

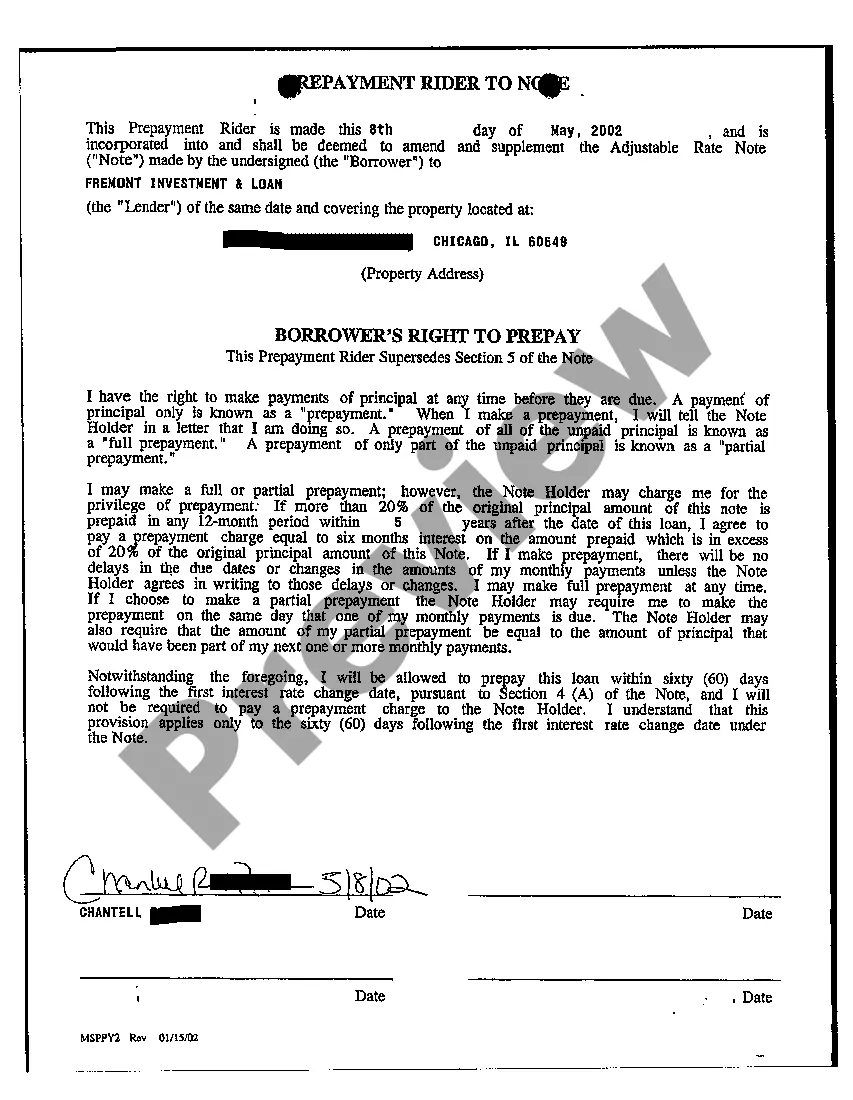

The Cook Illinois Exhibit A Adjustable Rate Note is a financial instrument commonly used in the real estate industry. It is a type of promissory note that outlines the terms and conditions of a loan which has an adjustable interest rate. The adjustable rate note (ARN) is designed to allow the interest rate to fluctuate over time, based on an underlying index such as the London Interbank Offered Rate (LIBOR) or the Cost of Funds Index (CFI). This means that the interest rate can go up or down during the life of the loan, which can lead to changes in the monthly payment amount for the borrower. The Cook Illinois Exhibit A Adjustable Rate Note is specifically used within the Cook County, Illinois region. It is tailored to adhere to local laws and regulations, ensuring compliance with the specific requirements of this jurisdiction. There are different types of Cook Illinois Exhibit A Adjustable Rate Notes available, depending on the specific needs and circumstances of the borrower. Some of these may include: 1. 1-Year Adjustable Rate Note: This type of note offers an adjustable interest rate that is revised annually, meaning the interest rate and monthly payment may change each year. 2. 3-Year Adjustable Rate Note: With this note, the interest rate remains fixed for the initial 3 years, after which it becomes adjustable on a predetermined schedule. 3. 5/1 Adjustable Rate Note: This note features a fixed interest rate for the first 5 years, and thereafter, the rate adjusts annually. 4. 7/1 Adjustable Rate Note: Similarly, this note has a fixed interest rate for the initial 7 years, after which the rate adjusts annually. 5. 10/1 Adjustable Rate Note: This type of note provides a fixed interest rate for the first 10 years, and then transitions to an adjustable rate for the remaining term. These different variations of the Cook Illinois Exhibit A Adjustable Rate Note provide borrowers with flexibility in choosing a loan product that best suits their financial goals and risk tolerance. It should be noted that the interest rate changes are typically subject to certain limitations, often referred to as rate caps, to prevent extreme fluctuations and protect borrowers. In conclusion, the Cook Illinois Exhibit A Adjustable Rate Note is a customizable loan instrument commonly used within Cook County, Illinois. It offers the flexibility of adjustable interest rates, which can be advantageous for borrowers seeking potential cost savings or shorter-term financing solutions. However, it is crucial for borrowers to carefully evaluate the terms and educate themselves about the potential risks associated with adjustable rate notes before entering into any financial agreement.

Cook Illinois Exhibit A Adjustable Rate Note

Description

How to fill out Cook Illinois Exhibit A Adjustable Rate Note?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Cook Illinois Exhibit A Adjustable Rate Note gets as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Cook Illinois Exhibit A Adjustable Rate Note takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Cook Illinois Exhibit A Adjustable Rate Note. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!