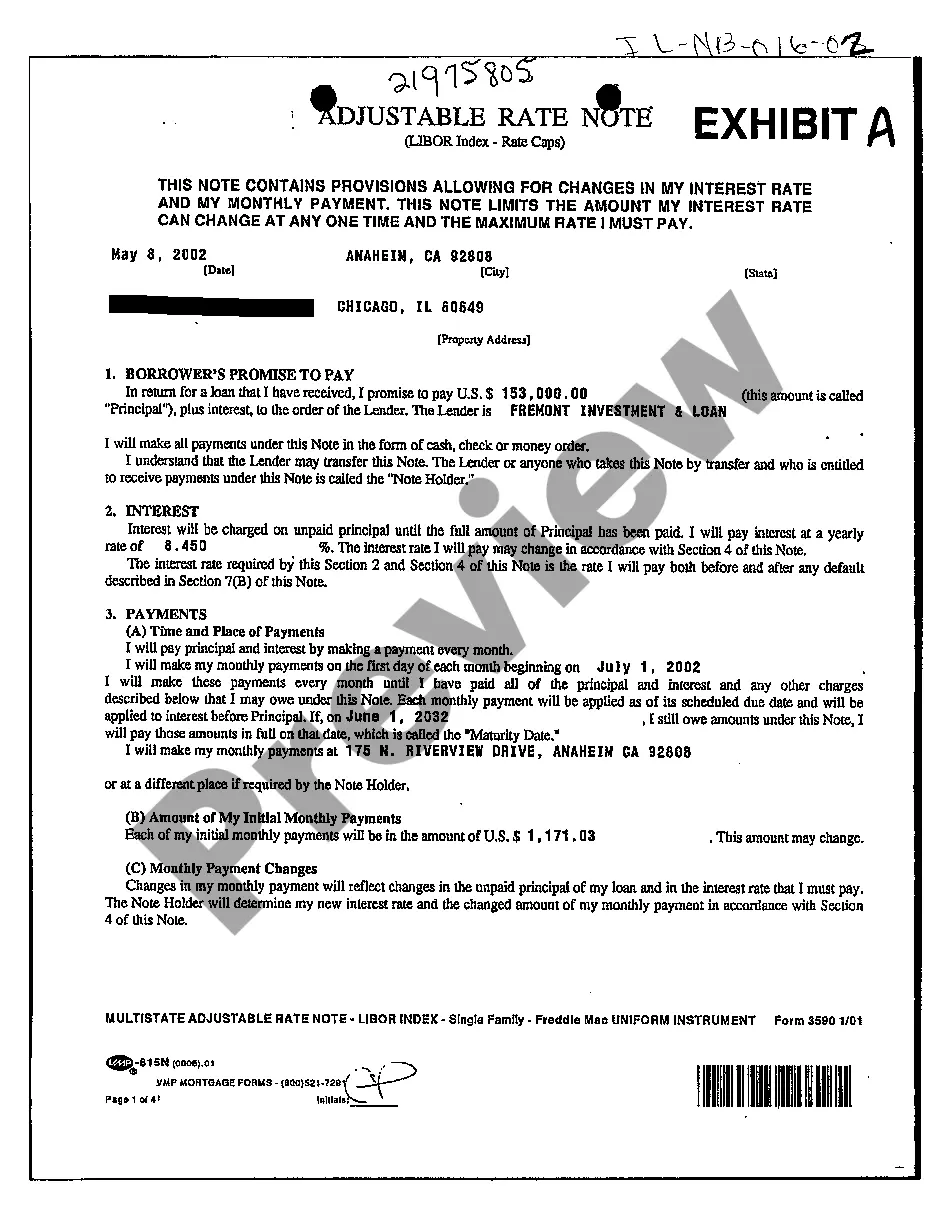

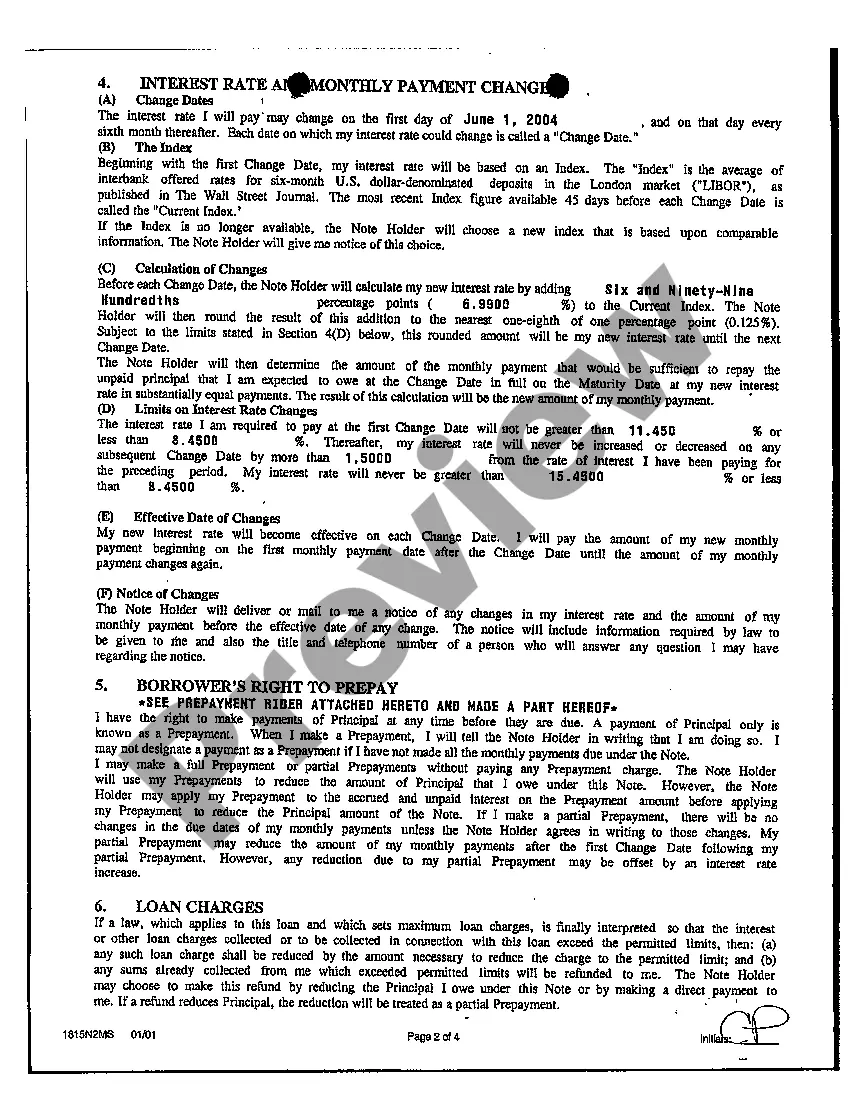

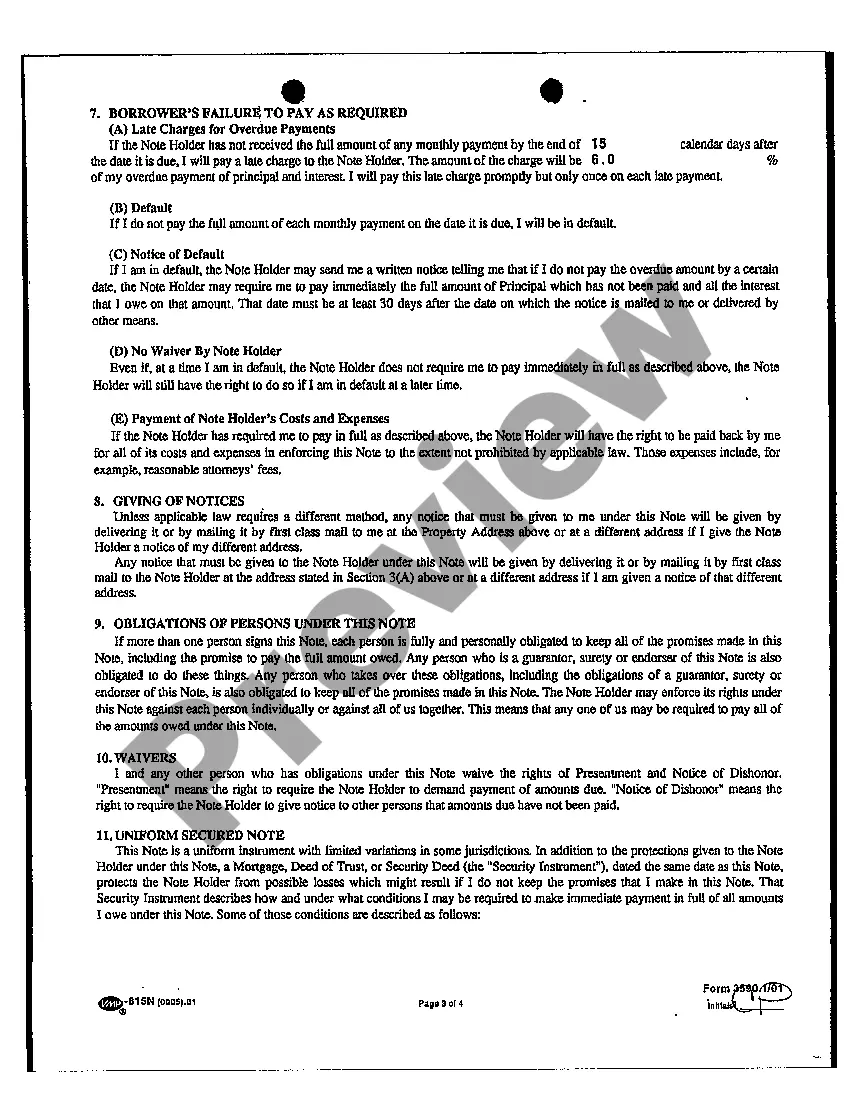

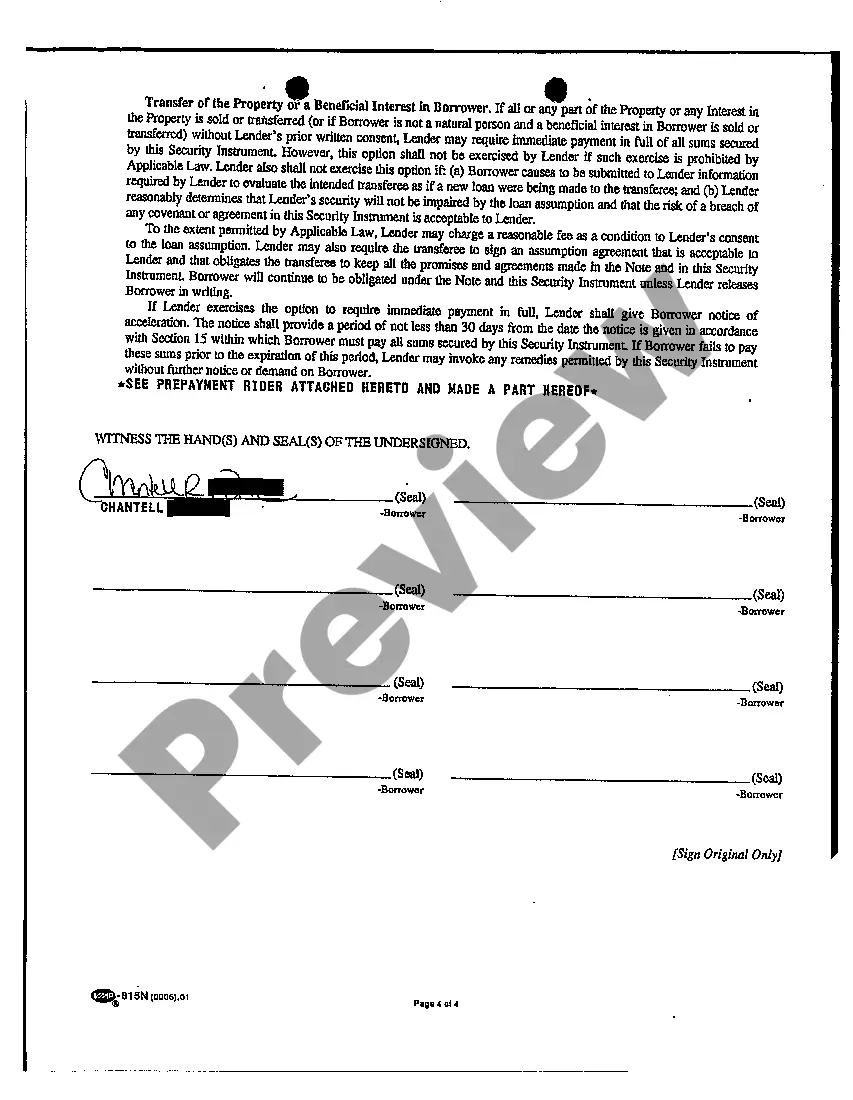

The Naperville Illinois Exhibit A Adjustable Rate Note is a legal document used in real estate transactions in the city of Naperville, Illinois. This note outlines the terms and conditions of an adjustable rate mortgage (ARM) loan offered by a lender to a borrower in Naperville. The Naperville Illinois Exhibit A Adjustable Rate Note contains several key details that are essential for both the lender and borrower. It specifies the initial interest rate, which is typically lower than that of a fixed-rate mortgage, making it an attractive option for borrowers in Naperville seeking lower starting interest payments. Keywords: Naperville Illinois Exhibit A Adjustable Rate Note, adjustable rate mortgage, ARM loan, real estate transactions, initial interest rate, fixed-rate mortgage, lower interest payments. There are various types of Naperville Illinois Exhibit A Adjustable Rate Notes, depending on factors such as the length of the loan term and the adjustment period intervals. Some common types include: 1. Naperville Illinois Exhibit A 5/1 Adjustable Rate Note: This type of note offers a fixed interest rate for the first 5 years, after which it adjusts annually based on prevailing market rates. 2. Naperville Illinois Exhibit A 7/1 Adjustable Rate Note: With this note, the initial fixed-rate period extends to 7 years before the interest rate adjusts annually. 3. Naperville Illinois Exhibit A 10/1 Adjustable Rate Note: This type provides a fixed rate for the first 10 years, after which the interest rate adjusts annually. Keywords: Naperville Illinois Exhibit A 5/1 Adjustable Rate Note, Naperville Illinois Exhibit A 7/1 Adjustable Rate Note, Naperville Illinois Exhibit A 10/1 Adjustable Rate Note, fixed interest rate, adjustment period intervals, prevailing market rates. Regardless of the specific type of Naperville Illinois Exhibit A Adjustable Rate Note, it is vital for borrowers to carefully review and understand the terms outlined in the document before proceeding with the loan. This includes assessing the potential for interest rate increases and analyzing how these adjustments may impact future payments. Furthermore, borrowers in Naperville should consider their long-term financial goals and plans to determine if an adjustable rate mortgage aligns with their needs. Consulting with a qualified mortgage professional and seeking legal advice is highly recommended ensuring a thorough understanding of the Naperville Illinois Exhibit A Adjustable Rate Note. Keywords: adjustable rate mortgage, interest rate increases, financial goals, mortgage professional, legal advice. In conclusion, the Naperville Illinois Exhibit A Adjustable Rate Note is a crucial component of real estate transactions involving an adjustable rate mortgage in Naperville, Illinois. It defines the terms of the loan, including the initial interest rate and adjustment intervals. It is essential for borrowers to carefully review the note and seek professional guidance to make informed decisions about their mortgage.

Naperville Illinois Exhibit A Adjustable Rate Note

Description

How to fill out Naperville Illinois Exhibit A Adjustable Rate Note?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we apply for attorney solutions that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Naperville Illinois Exhibit A Adjustable Rate Note or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Naperville Illinois Exhibit A Adjustable Rate Note adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Naperville Illinois Exhibit A Adjustable Rate Note is proper for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!