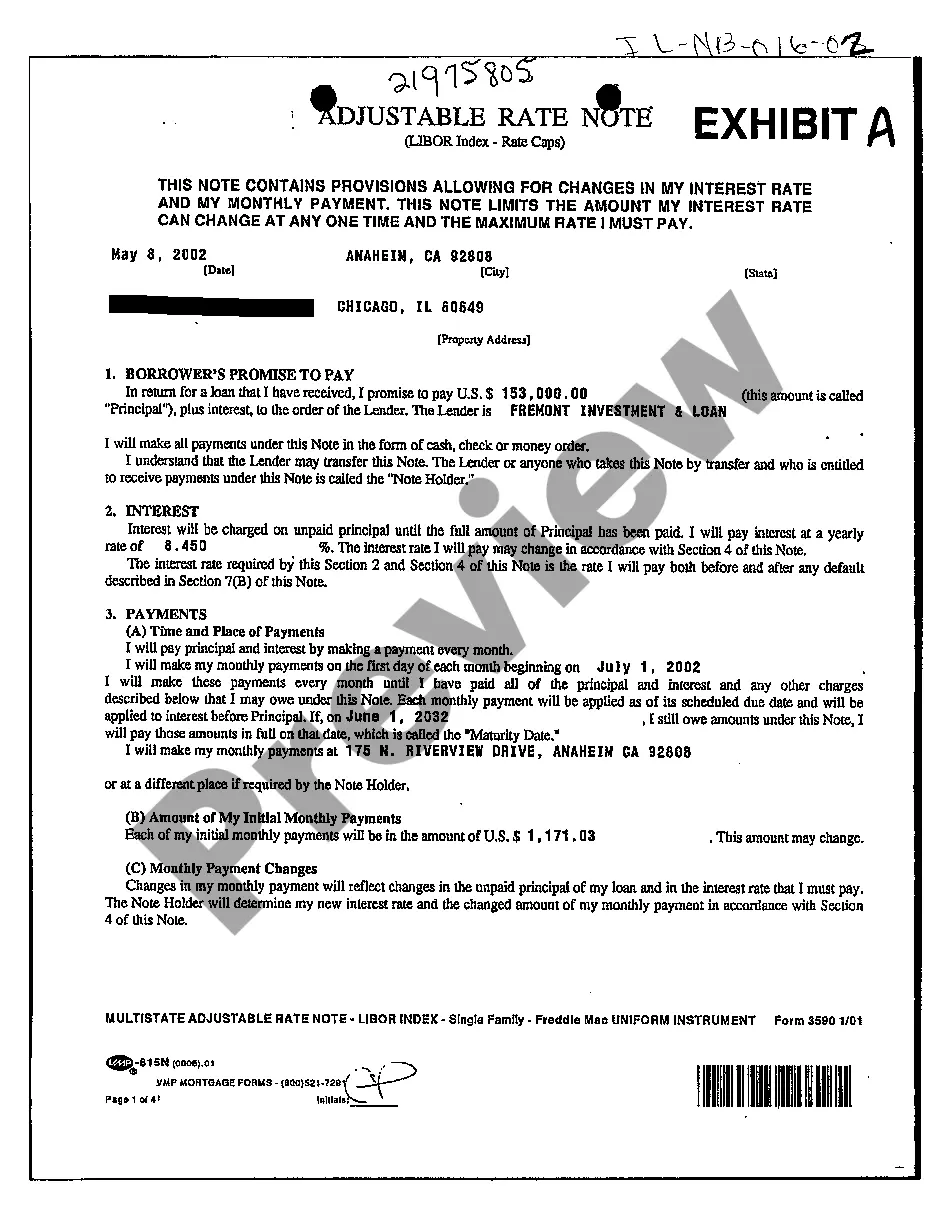

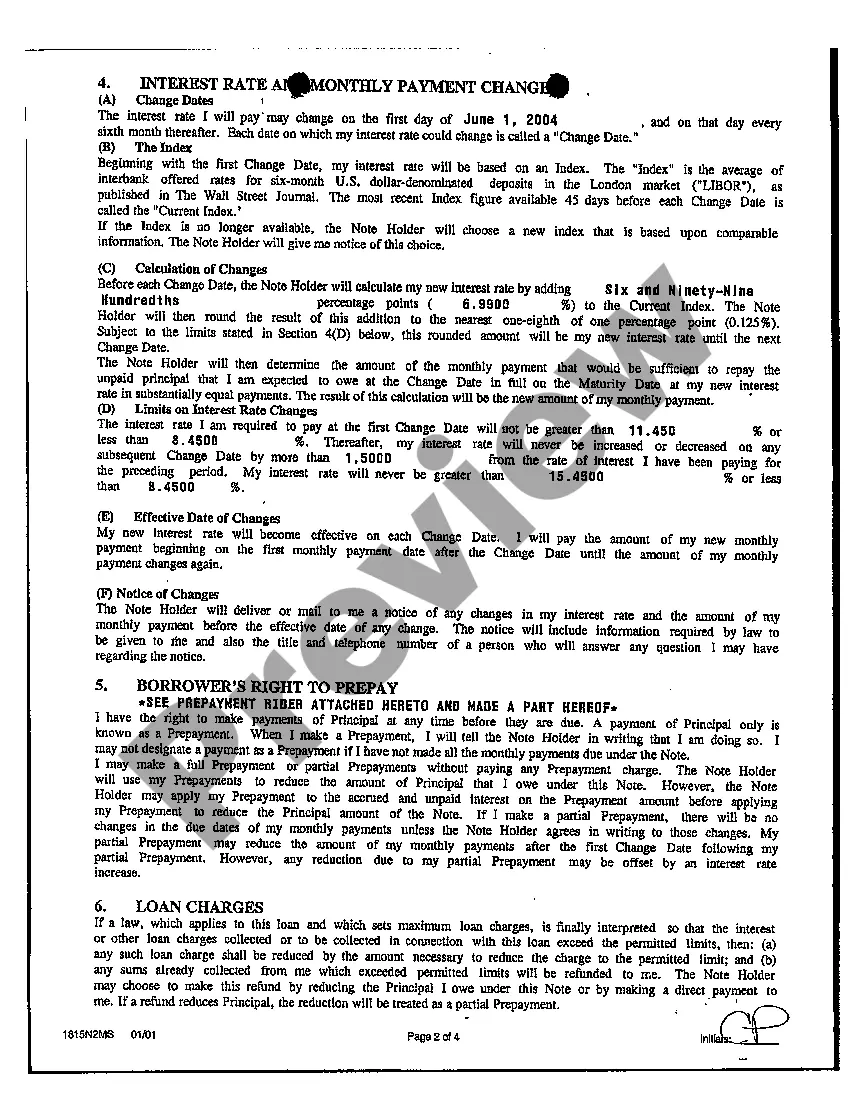

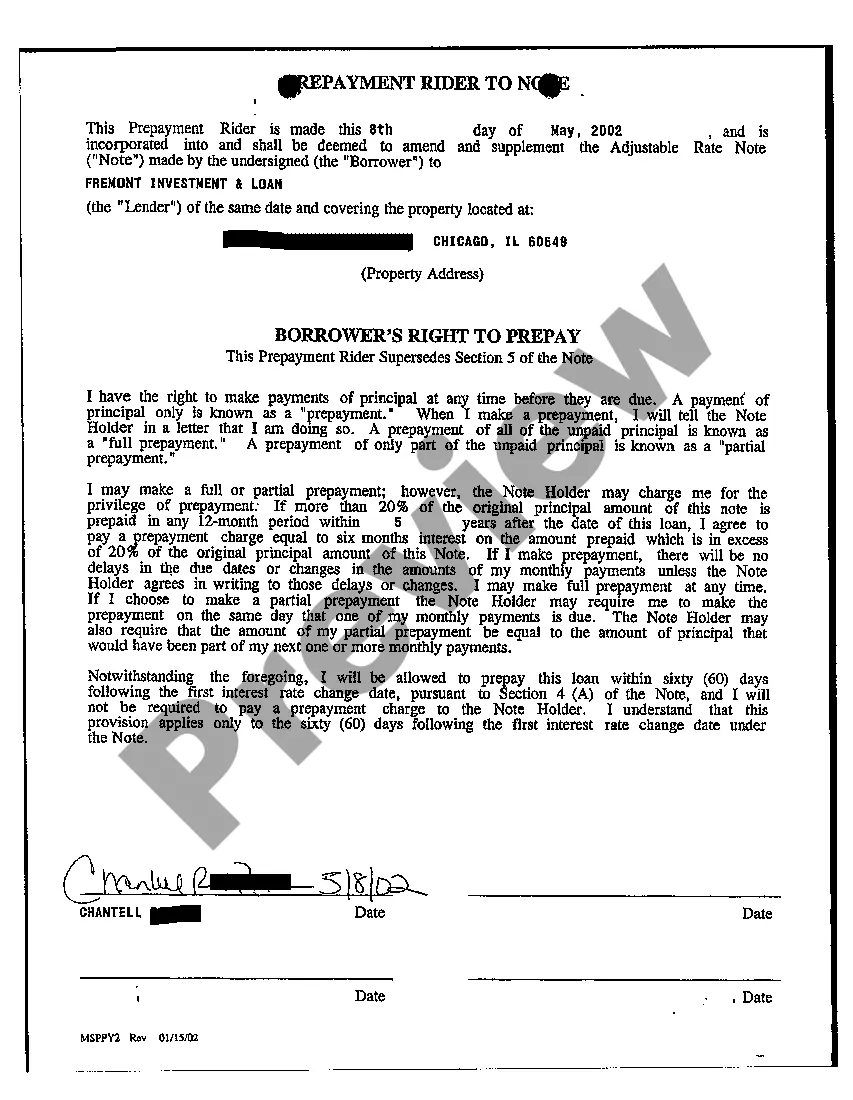

Rockford Illinois Exhibit A Adjustable Rate Note refers to a specific legal document used in the city of Rockford, Illinois, which outlines the terms and conditions of an adjustable rate loan agreement. This note is an essential part of any mortgage or loan agreement, providing crucial details about the loan itself. The Rockford Illinois Exhibit A Adjustable Rate Note is a legal contract that determines the repayment schedule, interest rates, and other adjustable terms of a loan. It is specifically tailored to the laws and regulations of Rockford, Illinois, ensuring compliance with local ordinances. There are no specific types of Rockford Illinois Exhibit A Adjustable Rate Note as it represents a standardized form provided by financial institutions or lenders. However, it is important to note that the terms and conditions within the Exhibit A Adjustable Rate Note may vary depending on numerous factors, including the type of loan (i.e., mortgage, personal loan, auto loan), loan amount, borrower's credit history, and lender's policies. Typically, the Rockford Illinois Exhibit A Adjustable Rate Note will include the following key components: 1. Loan Terms: This section outlines the primary characteristics of the loan, including the loan amount, the purpose of the loan, and any collateral provided by the borrower. 2. Interest Rate: The adjustable nature of the loan means that the interest rate may change over time based on specified factors outlined in the note. It identifies the initial interest rate, how often adjustments occur, and any limits or caps on rate changes. 3. Payment Terms: This section details the repayment structure, including the frequency of payments (monthly, bi-weekly, etc.), the due date, and any late payment penalties or grace periods. 4. Prepayment and Default: It includes provisions for prepayment, specifying if there are any penalties or fees for paying off the loan early. Additionally, this section outlines the potential consequences of defaulting on the loan, such as foreclosure or legal action. 5. Miscellaneous Provisions: This part covers additional clauses that may affect the loan, such as insurance requirements, transferability of the loan, and any special conditions agreed upon by both parties. It is important to thoroughly review and understand the Rockford Illinois Exhibit A Adjustable Rate Note before signing it, as it legally binds both the borrower and lender to specific terms and obligations. Consulting with a legal professional is highly recommended ensuring full comprehension of the document and to address any concerns before committing to the loan.

Rockford Illinois Exhibit A Adjustable Rate Note

Description

How to fill out Rockford Illinois Exhibit A Adjustable Rate Note?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Rockford Illinois Exhibit A Adjustable Rate Note gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Rockford Illinois Exhibit A Adjustable Rate Note takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Rockford Illinois Exhibit A Adjustable Rate Note. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!