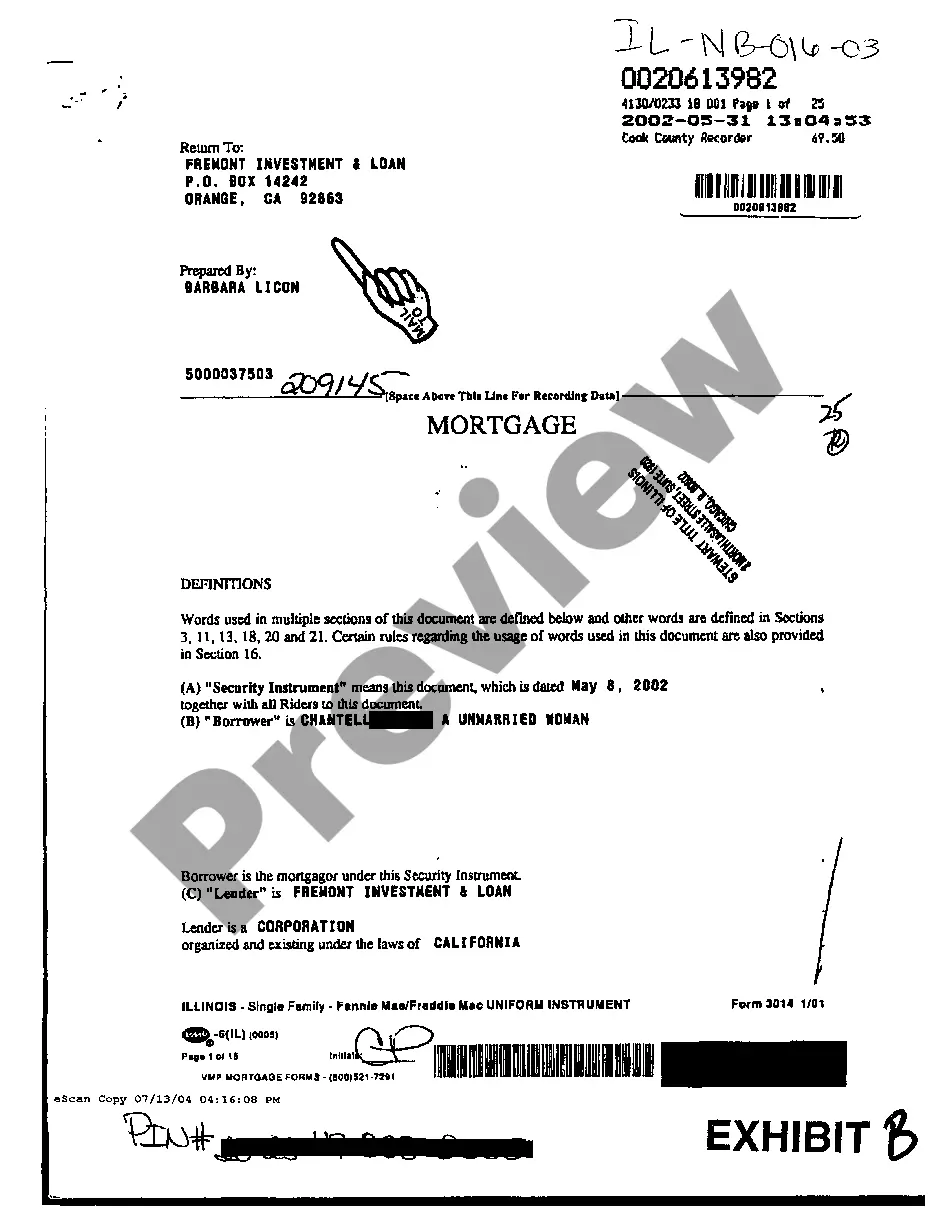

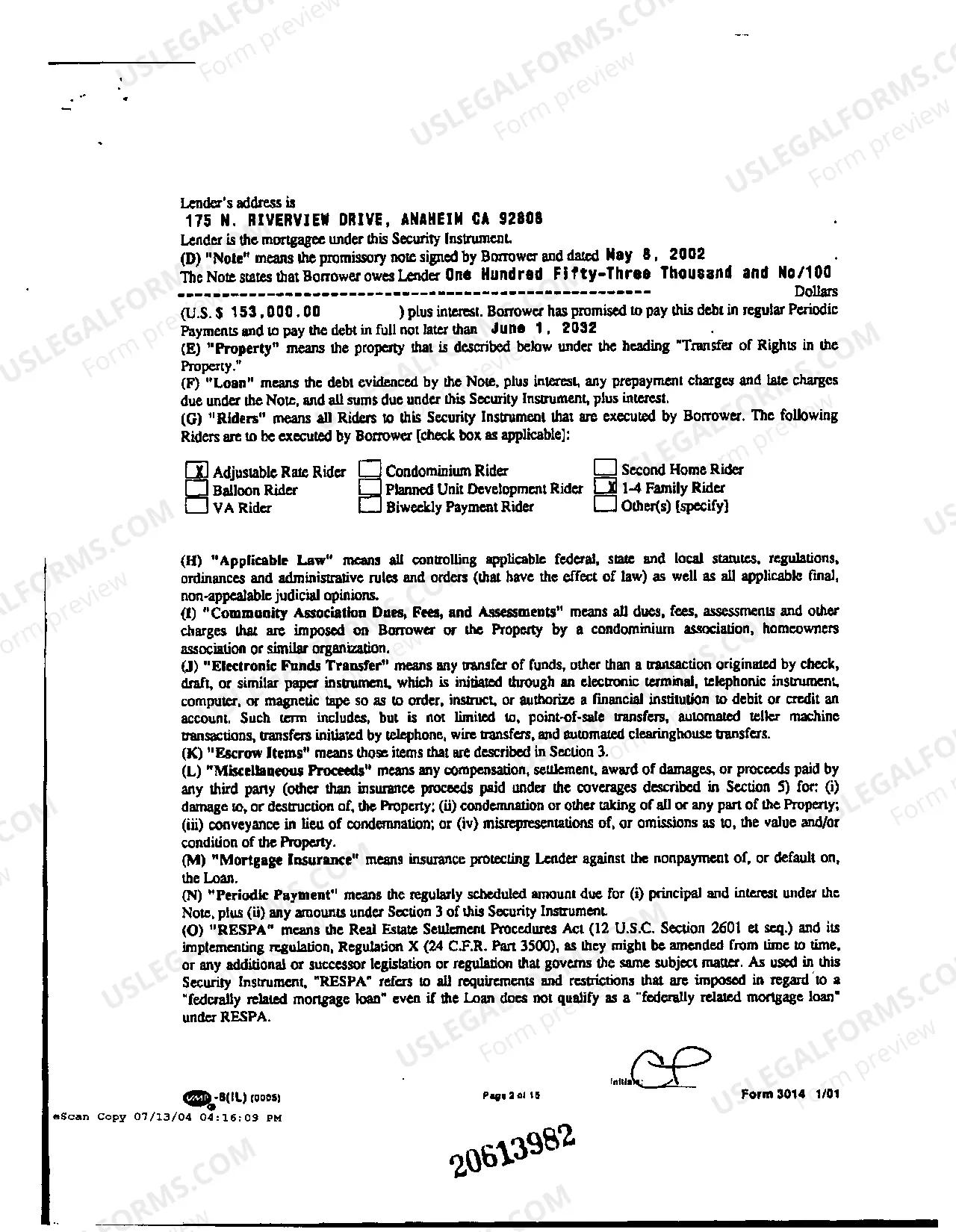

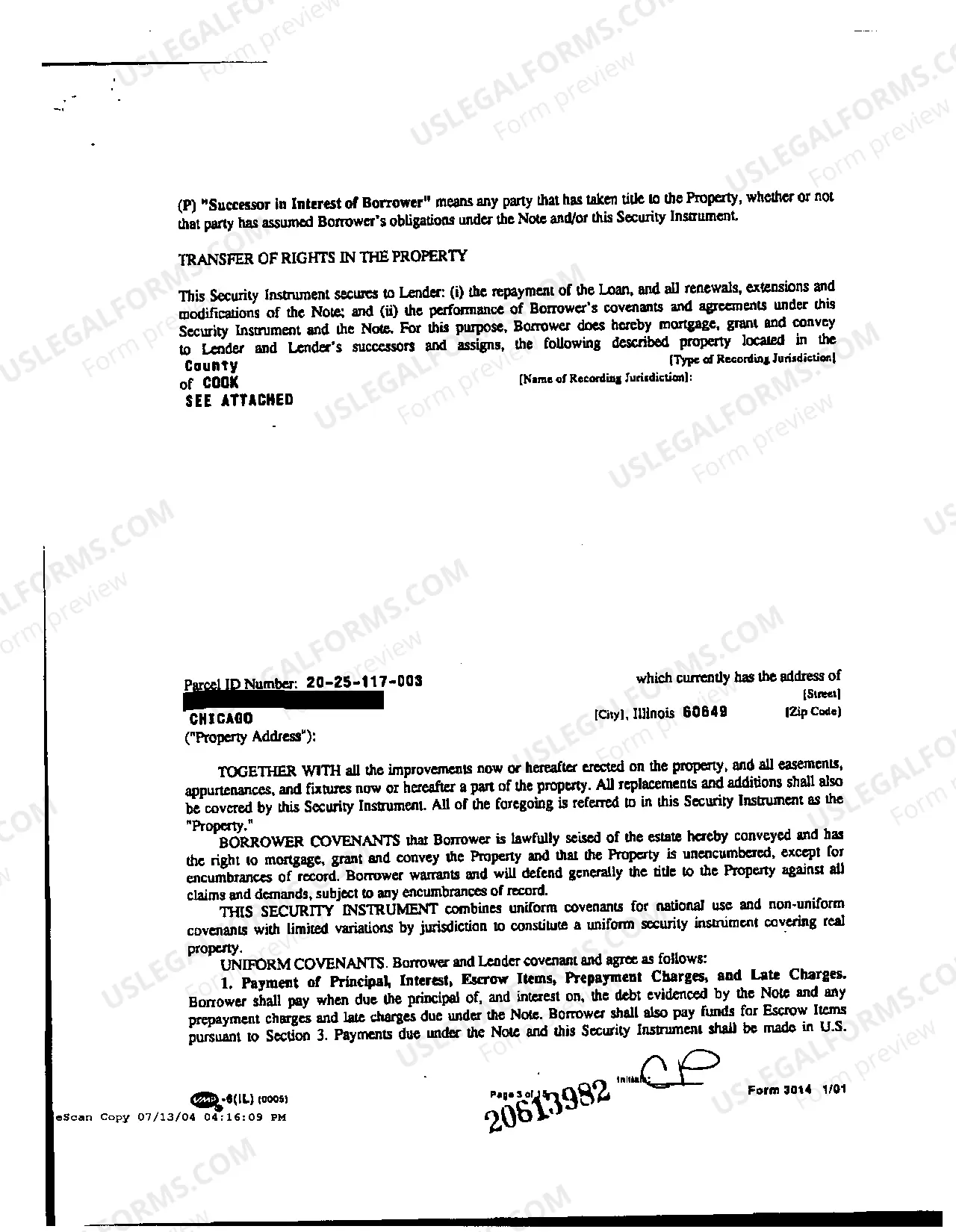

Rockford Illinois Exhibit B Mortgage is a mortgage agreement specific to Rockford, Illinois that outlines the terms and conditions of a loan between a lender and a borrower. This type of mortgage is commonly used in real estate transactions in Rockford, allowing individuals to purchase properties by borrowing money from a financial institution. The Exhibit B Mortgage document serves as a legal agreement between the lender and borrower, detailing the obligations, rights, and responsibilities of each party. The Rockford Illinois Exhibit B Mortgage usually includes key information such as the loan amount, interest rate, repayment terms, and loan duration. It also states the specific property that is serving as collateral for the loan and may include information about any additional terms or conditions that both parties have agreed upon, such as potential fees, prepayment penalties, or insurance requirements. Different types of Rockford Illinois Exhibit B Mortgages can include: 1. Fixed-rate Exhibit B Mortgage: This type of mortgage offers a fixed interest rate for the entire loan term, providing borrowers with consistent monthly payments for the duration of the loan. 2. Adjustable-rate Exhibit B Mortgage: With this type of mortgage, the interest rate is variable and may fluctuate over the loan term, usually based on a specific financial index such as the prime rate. Borrowers may experience changes in their monthly payments as the interest rate adjusts periodically. 3. FHA Exhibit B Mortgage: The Federal Housing Administration (FHA) insures this type of mortgage, making it an attractive option for borrowers who may have lower credit scores or a smaller down payment. FHA mortgages have specific requirements and guidelines to qualify for the loan. 4. VA Exhibit B Mortgage: Reserved for eligible veterans, active-duty service members, and surviving spouses, Veterans Affairs (VA) loans provide favorable terms and low or no down payment options. 5. Jumbo Exhibit B Mortgage: A jumbo mortgage is a loan that exceeds the conforming loan limits set by Fannie Mae and Freddie Mac. This type of loan is typically used for high-value properties and may have different qualification criteria and interest rates compared to standard mortgages. It is essential for borrowers in Rockford, Illinois, to carefully review and understand the terms and conditions specified in their Exhibit B Mortgage before signing it. Consulting with a qualified mortgage lender or financial advisor can provide valuable guidance throughout the mortgage process and ensure borrowers make informed decisions.

Rockford Illinois Exhibit B Mortgage

State:

Illinois

City:

Rockford

Control #:

IL-NB-016-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Exhibit B Mortgage

Rockford Illinois Exhibit B Mortgage is a mortgage agreement specific to Rockford, Illinois that outlines the terms and conditions of a loan between a lender and a borrower. This type of mortgage is commonly used in real estate transactions in Rockford, allowing individuals to purchase properties by borrowing money from a financial institution. The Exhibit B Mortgage document serves as a legal agreement between the lender and borrower, detailing the obligations, rights, and responsibilities of each party. The Rockford Illinois Exhibit B Mortgage usually includes key information such as the loan amount, interest rate, repayment terms, and loan duration. It also states the specific property that is serving as collateral for the loan and may include information about any additional terms or conditions that both parties have agreed upon, such as potential fees, prepayment penalties, or insurance requirements. Different types of Rockford Illinois Exhibit B Mortgages can include: 1. Fixed-rate Exhibit B Mortgage: This type of mortgage offers a fixed interest rate for the entire loan term, providing borrowers with consistent monthly payments for the duration of the loan. 2. Adjustable-rate Exhibit B Mortgage: With this type of mortgage, the interest rate is variable and may fluctuate over the loan term, usually based on a specific financial index such as the prime rate. Borrowers may experience changes in their monthly payments as the interest rate adjusts periodically. 3. FHA Exhibit B Mortgage: The Federal Housing Administration (FHA) insures this type of mortgage, making it an attractive option for borrowers who may have lower credit scores or a smaller down payment. FHA mortgages have specific requirements and guidelines to qualify for the loan. 4. VA Exhibit B Mortgage: Reserved for eligible veterans, active-duty service members, and surviving spouses, Veterans Affairs (VA) loans provide favorable terms and low or no down payment options. 5. Jumbo Exhibit B Mortgage: A jumbo mortgage is a loan that exceeds the conforming loan limits set by Fannie Mae and Freddie Mac. This type of loan is typically used for high-value properties and may have different qualification criteria and interest rates compared to standard mortgages. It is essential for borrowers in Rockford, Illinois, to carefully review and understand the terms and conditions specified in their Exhibit B Mortgage before signing it. Consulting with a qualified mortgage lender or financial advisor can provide valuable guidance throughout the mortgage process and ensure borrowers make informed decisions.

Free preview

How to fill out Rockford Illinois Exhibit B Mortgage?

If you’ve already utilized our service before, log in to your account and save the Rockford Illinois Exhibit B Mortgage on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Rockford Illinois Exhibit B Mortgage. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!