A Qualified Domestic Relations Order (QDR) in the state of Illinois is a legal document that outlines how retirement benefits will be divided between divorcing spouses or former partners in a domestic partnership. It is crucial to understand that a QDR is specific to retirement benefits and does not address other aspects of property division or spousal support. In Chicago, Illinois, there are no specific types of QDR Os that differ from those in other parts of the state. A QDR is a standard document implemented to ensure the fair distribution of retirement assets. However, it is essential to consult a qualified attorney or financial advisor to navigate the specific requirements and procedures of Chicago's court system when obtaining a QDR. A QDR typically includes important details such as the names of the parties involved, the retirement plan(s) in question, and the specific percentage or dollar amount to be allocated to the non-employee spouse or partner. It is crucial for the QDR to meet the requirements set forth in the Internal Revenue Code Section 414(p) and the Employee Retirement Income Security Act (ERICA) to maintain the tax-deferred status of the retirement funds involved. A QDR in Chicago, Illinois, can apply to various retirement plans, including 401(k) plans, pension plans, profit-sharing plans, and deferred compensation plans. It is essential to note that individual retirement accounts (IRAs) do not require a QDR for division, as they can be transferred without a court order. However, it is still advisable to consult an attorney to ensure compliance with federal and state laws. To obtain a QDR in Chicago, Illinois, the involved parties must initiate the process during the divorce or legal separation proceedings. This typically involves drafting the QDR, obtaining court approval, and then submitting the order to the plan administrator for implementation. The court's approval is crucial to ensure that the QDR is fair and complies with the relevant laws. Moreover, it is also important to work closely with the plan administrator to ensure that the order is properly administered and executed. In summary, a Qualified Domestic Relations Order (QDR) in Chicago, Illinois, is a legal document that outlines the division of retirement benefits between divorcing spouses or former domestic partners. While there are no distinct types of QDR Os specific to Chicago, it is crucial to adhere to state and federal laws, consult professional guidance, and ensure court approval for a fair and valid document that protects the rights and interests of both parties involved.

Chicago Illinois Qualified Domestic Relations Order

Description

How to fill out Illinois Qualified Domestic Relations Order?

Take advantage of the US Legal Forms and gain instant access to any form template you desire.

Our user-friendly website with a vast array of document templates streamlines the process of locating and acquiring nearly any document sample you may require.

You can export, fill out, and validate the Chicago Illinois Qualified Domestic Relations Order in just a few moments rather than spending hours online searching for the correct template.

Utilizing our catalog is an excellent way to enhance the security of your record submissions.

If you haven’t established an account yet, follow the instructions listed below.

Open the page with the template you need. Ensure that it is the template you expected to find: confirm its title and description, and use the Preview feature if it is available. Otherwise, use the Search field to seek the correct one.

- Our expert legal professionals continuously examine all documents to confirm that the forms are applicable for a specific state and adhere to the latest acts and regulations.

- How can you acquire the Chicago Illinois Qualified Domestic Relations Order? If you already have an account, simply Log In to your profile.

- The Download option will show up on all samples you consult.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

A QILDRO (Qualified Illinois Domestic Relations Order) is an Illinois court order that directs SERS to pay a designated portion of a SERS member's retirement benefit or certain refunds to an alternate payee.

Also, while a QDRO can assign survivor benefits, QILDROs do not apply to death or survivor benefits; with the exception that a former spouse may be assigned part of the ?death benefit.? The death benefit, however, is not the same as a periodic survivor benefit. It generally is a small, one-time payment.

Simply walk into court or email the agreed QDRO to the judge's clerk for entry. Most tax-deferred plan administrators require a signed copy of the QDRO. Typically, the judge only signs one copy of an order so you'll need to remind the judge to sign two copies. One for the file and one for the plan administrator.

One huge benefit of a QDRO is that it allows for early withdrawals from a 401(k) or other qualified retirement plans without incurring a penalty. As a result, if the plan allows it, an alternate payee can receive a lump sum or payments before they reach age 59.5 without a 10% IRS penalty.

A QDRO allows a former spouse to receive a predefined amount of their spouse's retirement plan assets. For example, a QDRO might pay out 50% of the account's value that has grown during the marriage. The funds, as a result of the QDRO, could then be transferred or rolled over into an IRA for the beneficiary spouse.

QDROs can be filed at any time. Whether you are in the middle of the divorce process or have been divorced for a decade, QDROs do not have a time limit. This is done in part because financial situations can change over time.

A QDRO is a judgment, decree or order for a retirement plan to pay child support, alimony or marital property rights to a spouse, former spouse, child or other dependent of a participant.

A QILDRO (Qualified Illinois Domestic Relations Order) is an Illinois court order that directs SERS to pay a designated portion of a SERS member's retirement benefit or certain refunds to an alternate payee.

More info

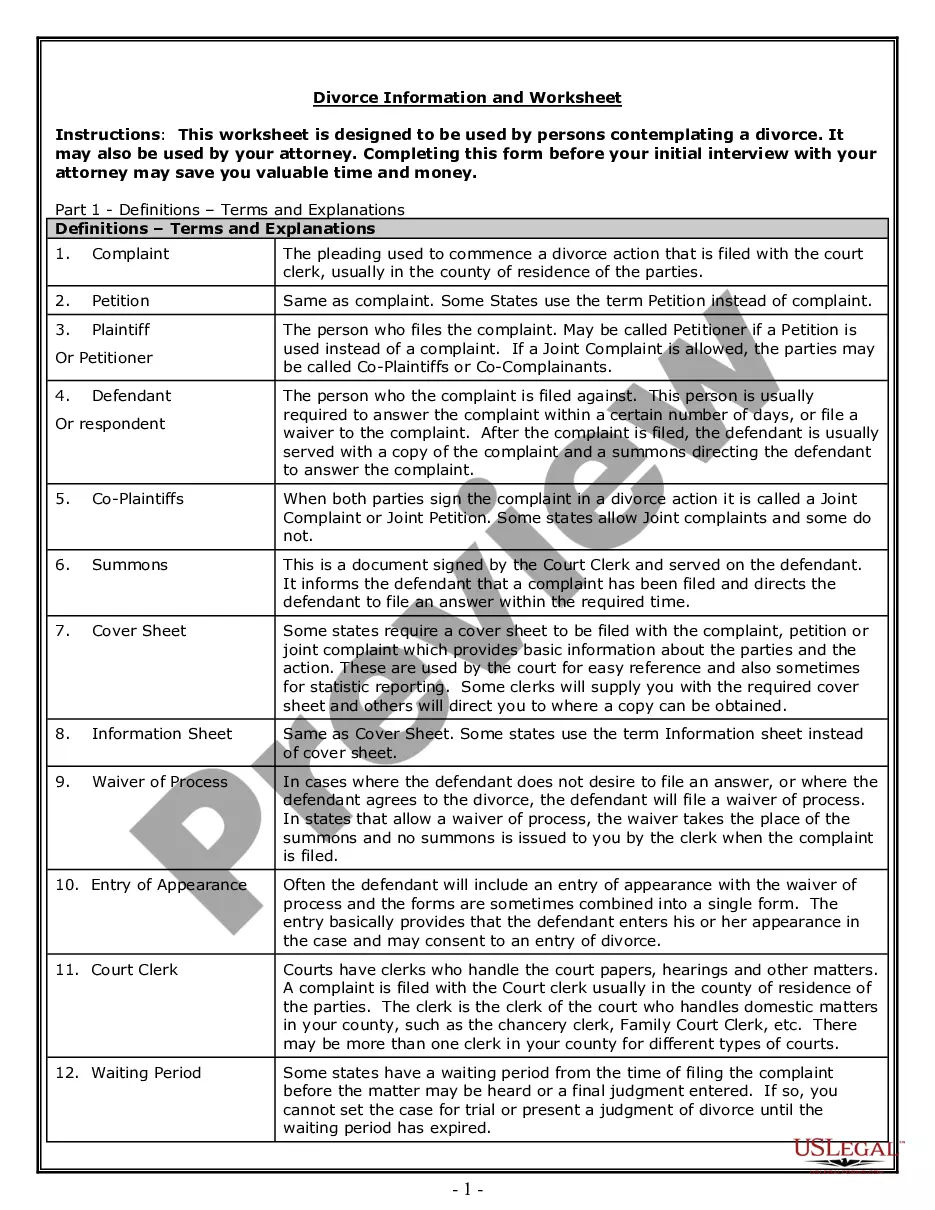

How do the different divorce forms differ? What is the difference between the qualified domestic relations order and a QDR? What is the time limit for a legal separation? What is the time limit for divorce? Does a spouse lose the right to file for divorce or to seek division of property in a QDR? How is divorce accomplished? Does a party lose their right to file for divorce after filing the QDR? When do I have to file for divorce in Illinois? When does the Court begin to give notice of a proposed divorce? What happens if the parties cannot agree on a settlement within the time period? What is the process for a mutual agreement? How can I file a joint petition in Illinois for a divorce? When does the Court begin the process of accepting written requests for mediation, and when do the parties have to agree on the mediator? How do I stop a motion to set aside my case? Who are my witnesses? How do I prepare my case for Trial? Who will represent me at trial, on either end?

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.