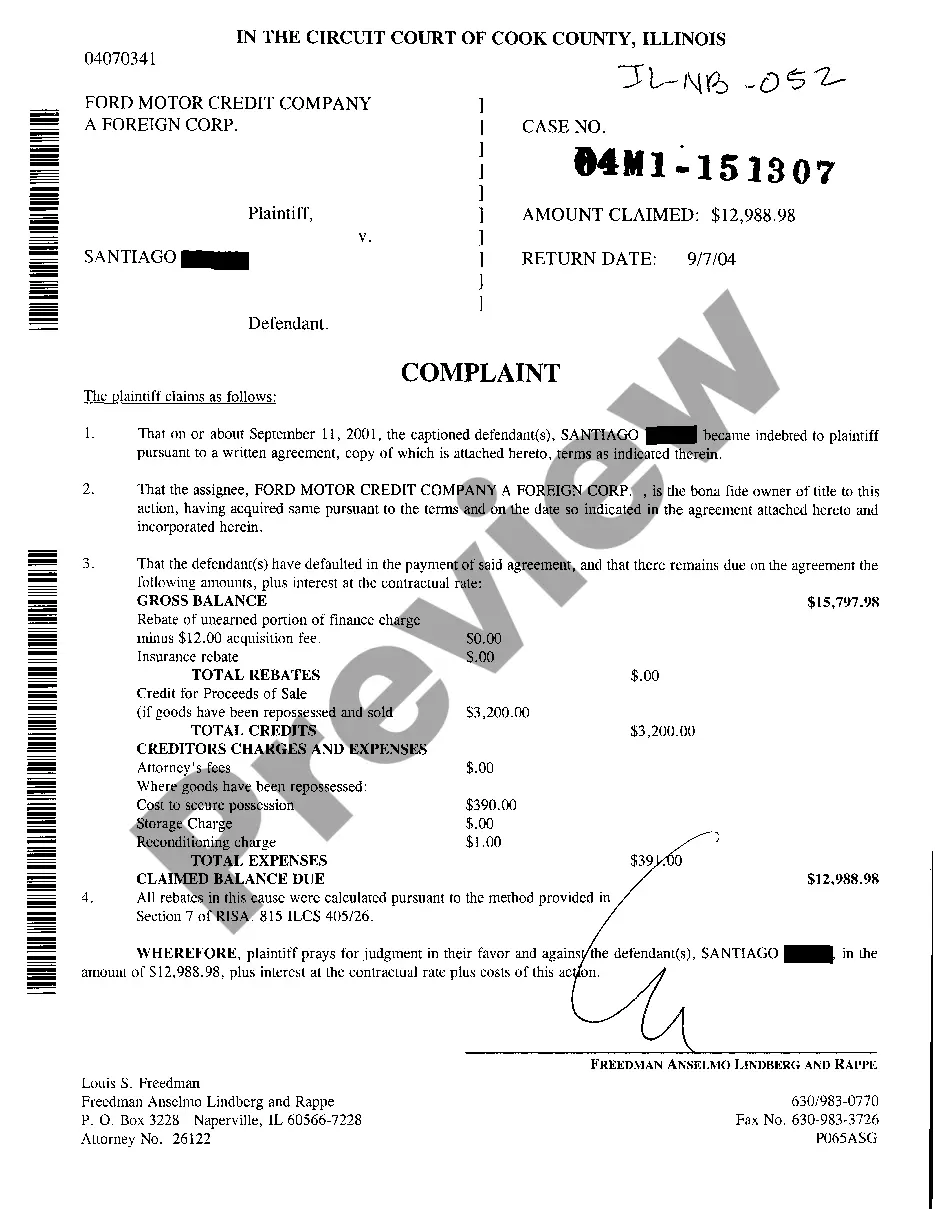

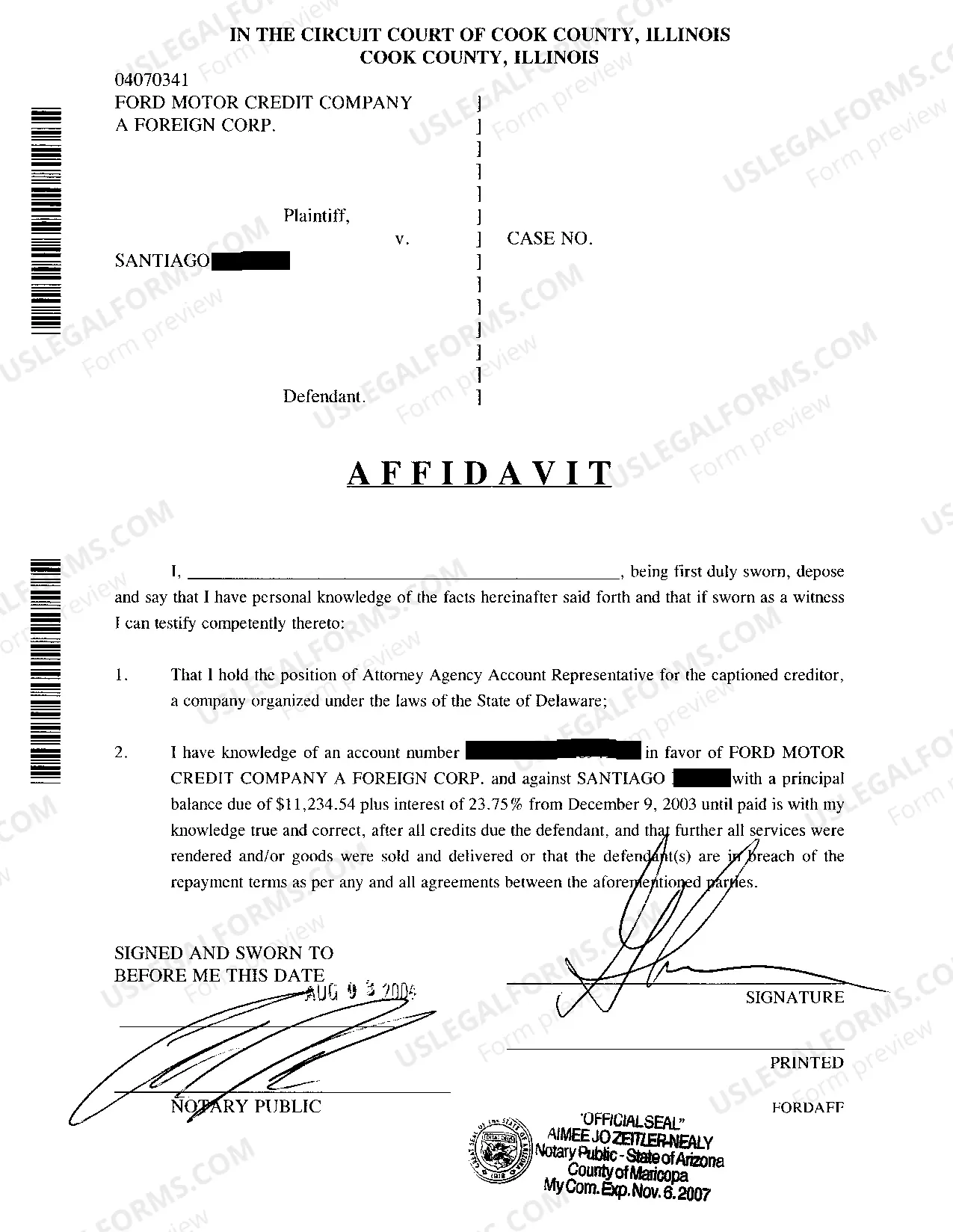

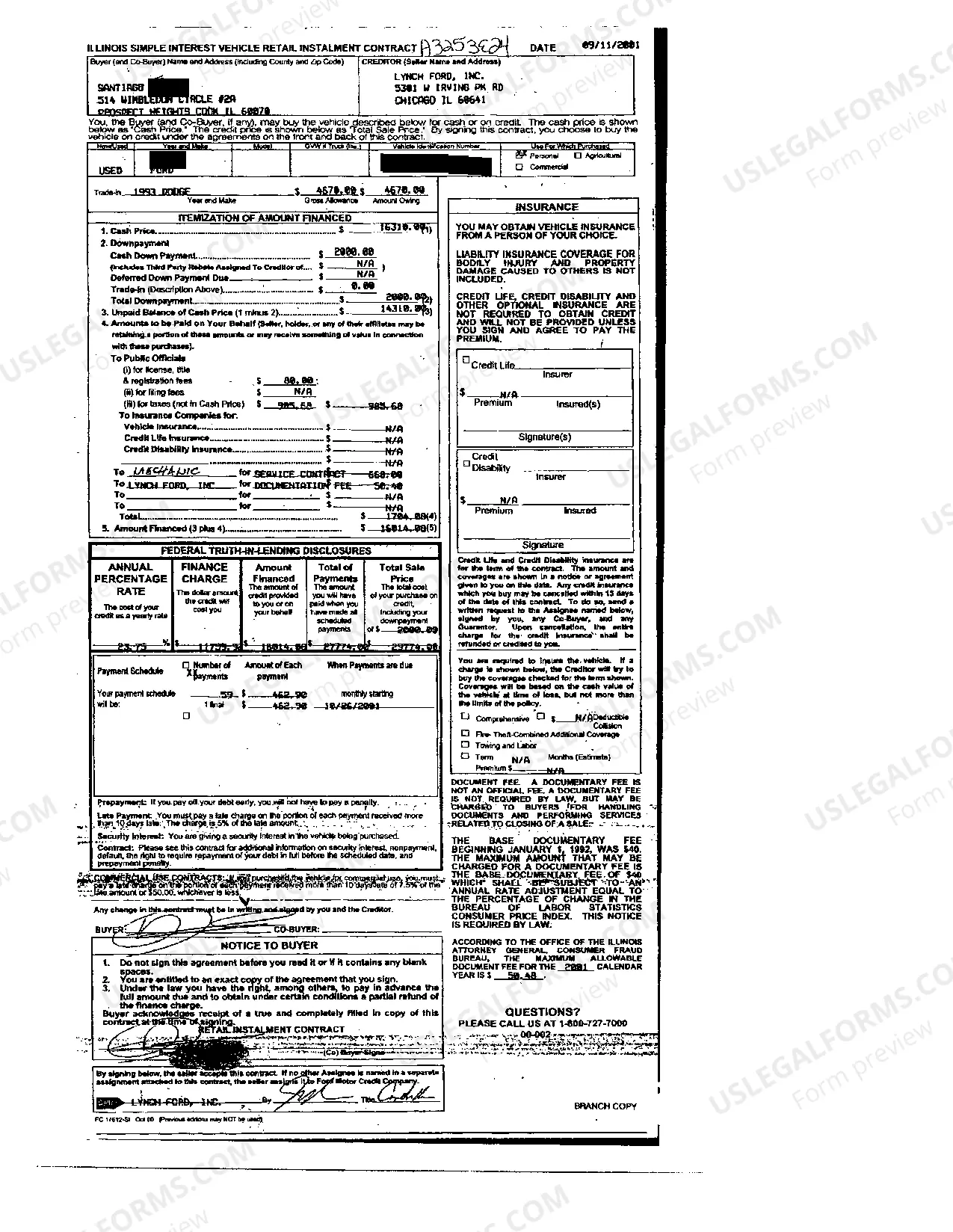

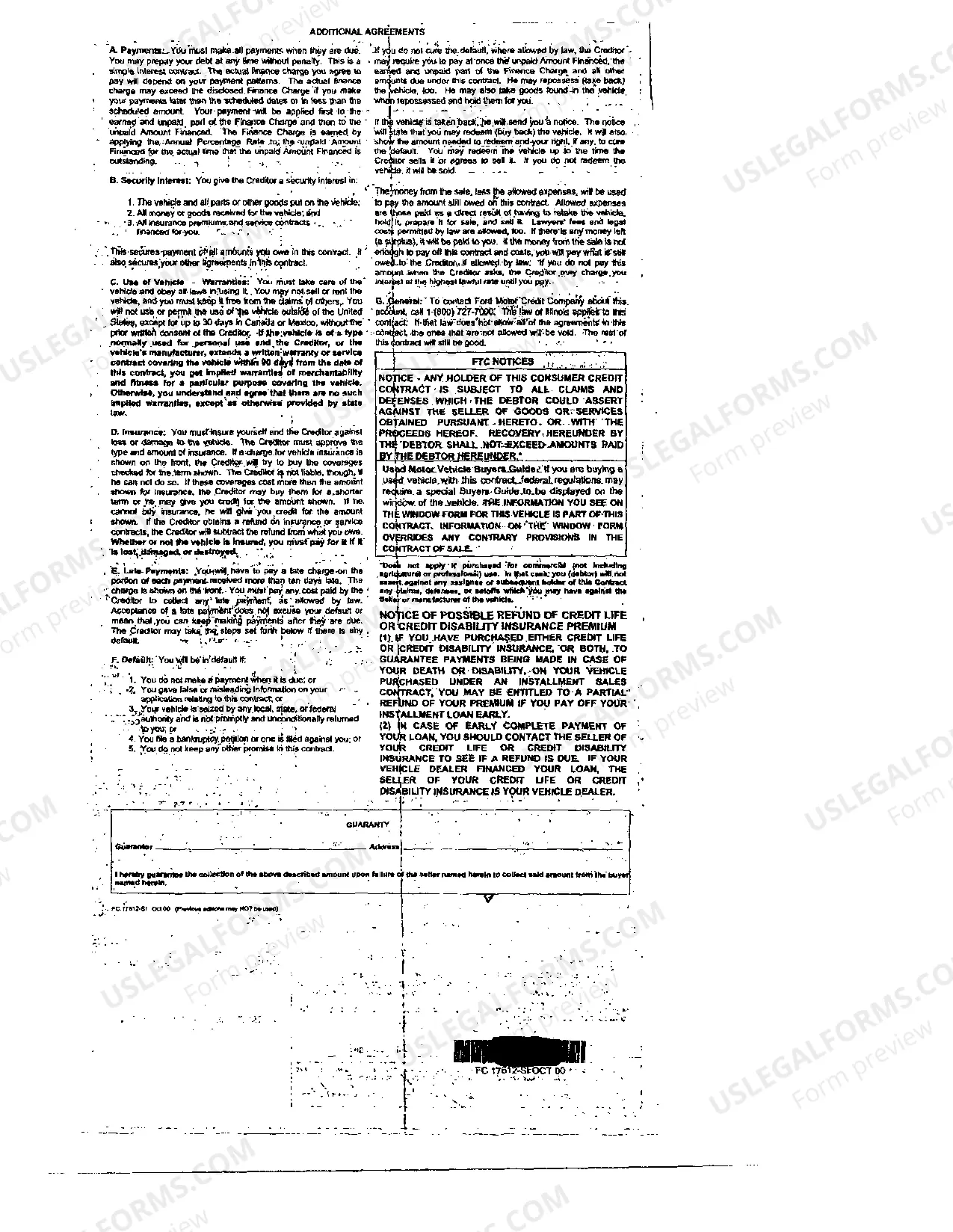

Elgin Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile When an individual falls behind on their car loan payments and their vehicle gets repossessed in Elgin, Illinois, the lender often auctions off the car to recover the outstanding balance. However, in some cases, the sale proceeds might not cover the full loan amount, leaving a deficiency balance — the remaining debt that the borrower is responsible for. There are several types of complaints related to collecting deficiency balances after the repossession sale of an automobile in Elgin, Illinois. These may include: 1. Inadequate Sale Proceeds Complaints: If the lender fails to obtain a reasonable price for the repossessed vehicle at auction, the borrower may file a complaint, arguing that the sale price was unfairly low. They might claim that the lender didn't make enough effort to secure a higher bid, resulting in a larger deficiency balance. 2. Notice and Disposal Procedure Complaints: Lenders in Elgin, Illinois must adhere to strict notice and disposal procedures when repossessing and selling a vehicle. If the borrower believes that the lender didn't follow these guidelines, they may file a complaint. This could involve inadequate notice before repossession, improper conduct during repossession, or failure to provide a proper notice of intent to sell the vehicle. 3. Unfair Collection Practices Complaints: If a borrower feels harassed, threatened, or subjected to abusive tactics during the collection process of a deficiency balance, they can file a complaint against the lender for unfair collection practices. This may include constant phone calls, aggressive communication, or misrepresentation of legal rights. 4. Calculation of Deficiency Balance Complaints: Disputes can arise over the calculation of the deficiency balance itself. Borrowers might claim that the lender included additional fees or charges that are not allowed under Illinois law. They can dispute the accuracy of the remaining balance and request a detailed breakdown of how it was calculated. Complaints regarding the collection of deficiency balances after the repossession sale of an automobile in Elgin, Illinois can be filed with various authorities or agencies, such as the Illinois Attorney General's Office, the Better Business Bureau, or through small claims court. If facing the situation described above, it is crucial for borrowers to consult with legal professionals who specialize in consumer law or seek assistance from reputable agencies that can provide guidance on how to address these complaints effectively. Remember, understanding your rights and diligently pursuing a fair resolution is vital when dealing with a complaint to collect a deficiency balance after the repossession sale of an automobile in Elgin, Illinois.

Elgin Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile

State:

Illinois

City:

Elgin

Control #:

IL-NB-052

Format:

PDF

Instant download

This form is available by subscription

Description

Complaint to Collect Deficiency Balance after Repossession Sale of Automobile

Elgin Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile When an individual falls behind on their car loan payments and their vehicle gets repossessed in Elgin, Illinois, the lender often auctions off the car to recover the outstanding balance. However, in some cases, the sale proceeds might not cover the full loan amount, leaving a deficiency balance — the remaining debt that the borrower is responsible for. There are several types of complaints related to collecting deficiency balances after the repossession sale of an automobile in Elgin, Illinois. These may include: 1. Inadequate Sale Proceeds Complaints: If the lender fails to obtain a reasonable price for the repossessed vehicle at auction, the borrower may file a complaint, arguing that the sale price was unfairly low. They might claim that the lender didn't make enough effort to secure a higher bid, resulting in a larger deficiency balance. 2. Notice and Disposal Procedure Complaints: Lenders in Elgin, Illinois must adhere to strict notice and disposal procedures when repossessing and selling a vehicle. If the borrower believes that the lender didn't follow these guidelines, they may file a complaint. This could involve inadequate notice before repossession, improper conduct during repossession, or failure to provide a proper notice of intent to sell the vehicle. 3. Unfair Collection Practices Complaints: If a borrower feels harassed, threatened, or subjected to abusive tactics during the collection process of a deficiency balance, they can file a complaint against the lender for unfair collection practices. This may include constant phone calls, aggressive communication, or misrepresentation of legal rights. 4. Calculation of Deficiency Balance Complaints: Disputes can arise over the calculation of the deficiency balance itself. Borrowers might claim that the lender included additional fees or charges that are not allowed under Illinois law. They can dispute the accuracy of the remaining balance and request a detailed breakdown of how it was calculated. Complaints regarding the collection of deficiency balances after the repossession sale of an automobile in Elgin, Illinois can be filed with various authorities or agencies, such as the Illinois Attorney General's Office, the Better Business Bureau, or through small claims court. If facing the situation described above, it is crucial for borrowers to consult with legal professionals who specialize in consumer law or seek assistance from reputable agencies that can provide guidance on how to address these complaints effectively. Remember, understanding your rights and diligently pursuing a fair resolution is vital when dealing with a complaint to collect a deficiency balance after the repossession sale of an automobile in Elgin, Illinois.

Free preview

How to fill out Elgin Illinois Complaint To Collect Deficiency Balance After Repossession Sale Of Automobile?

If you’ve already used our service before, log in to your account and save the Elgin Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Elgin Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!