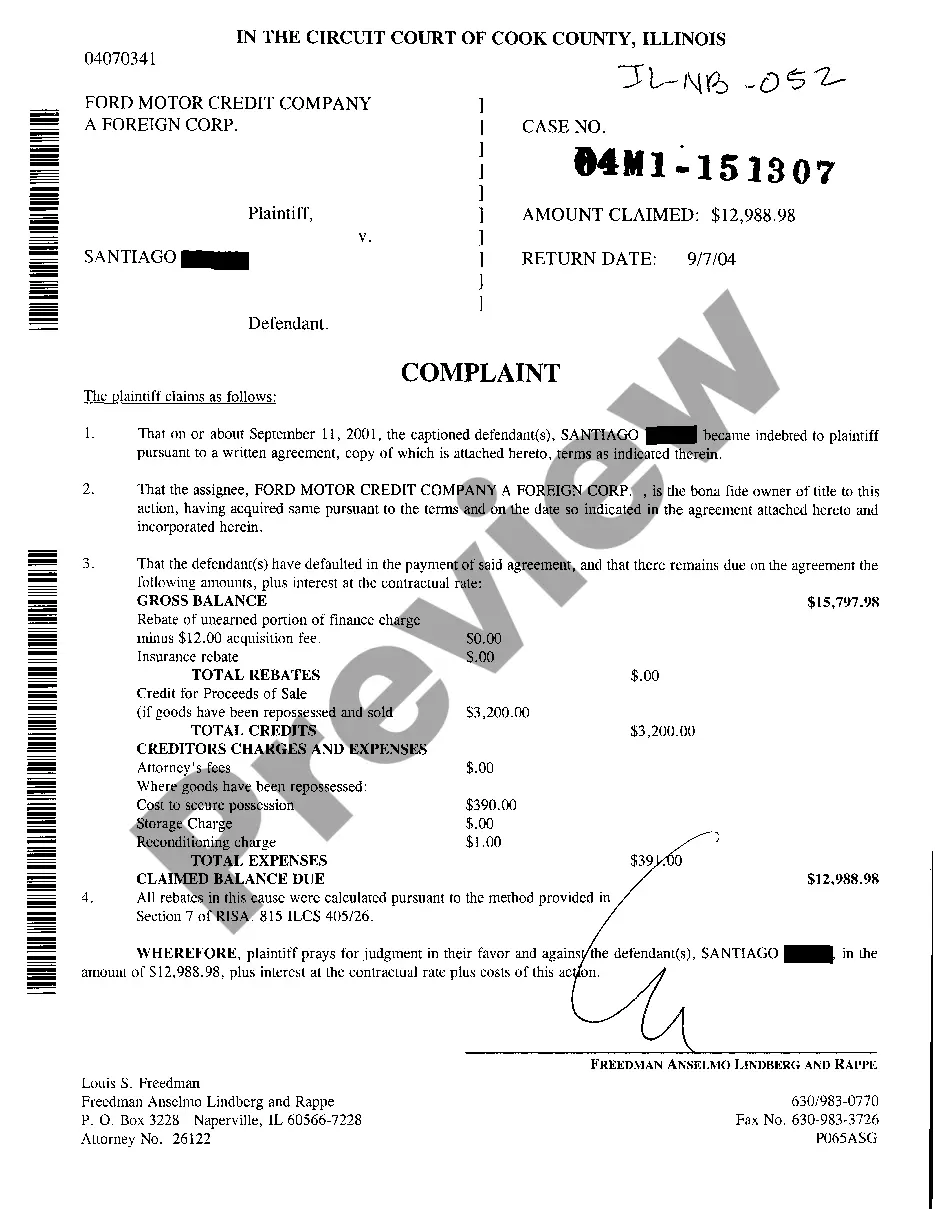

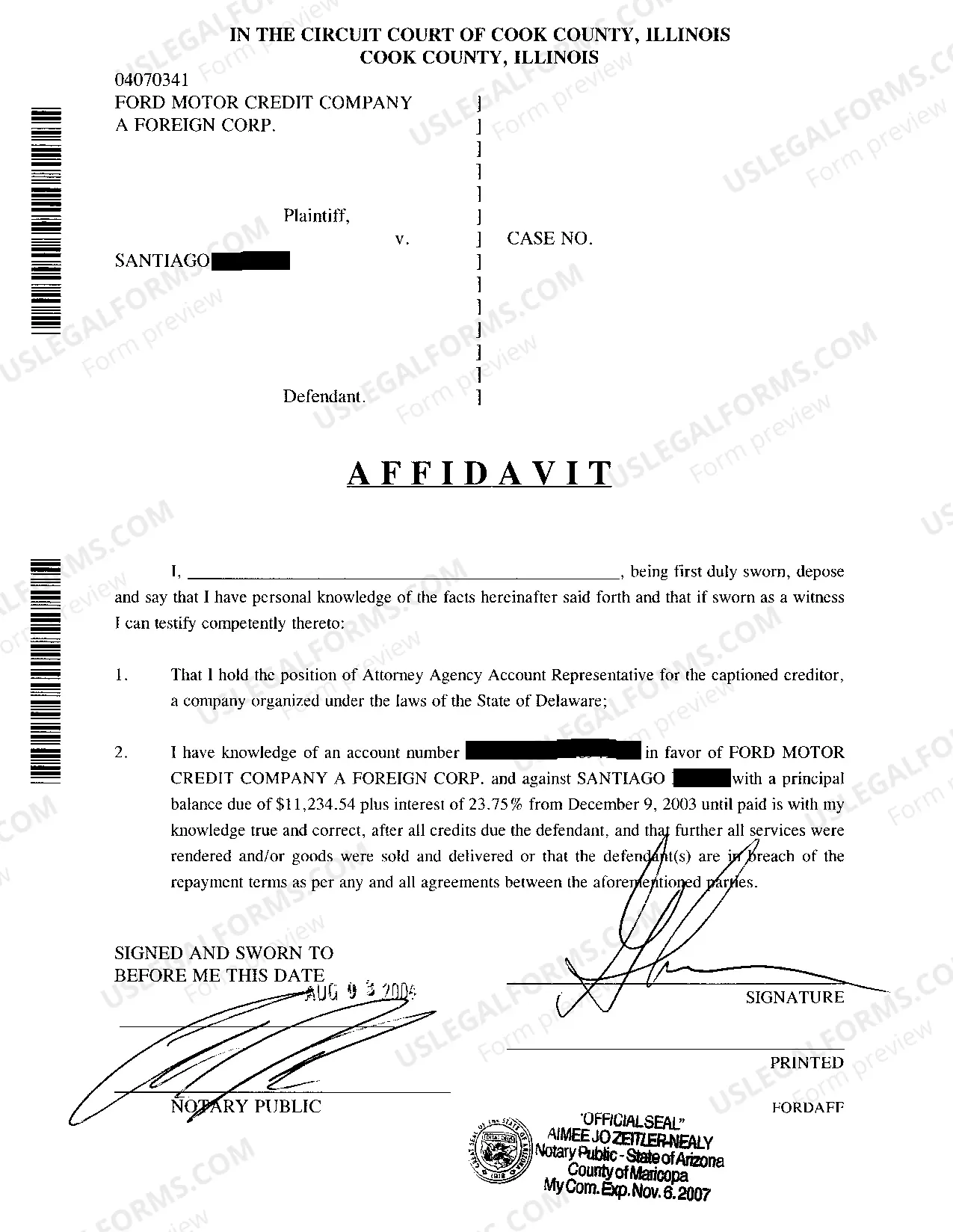

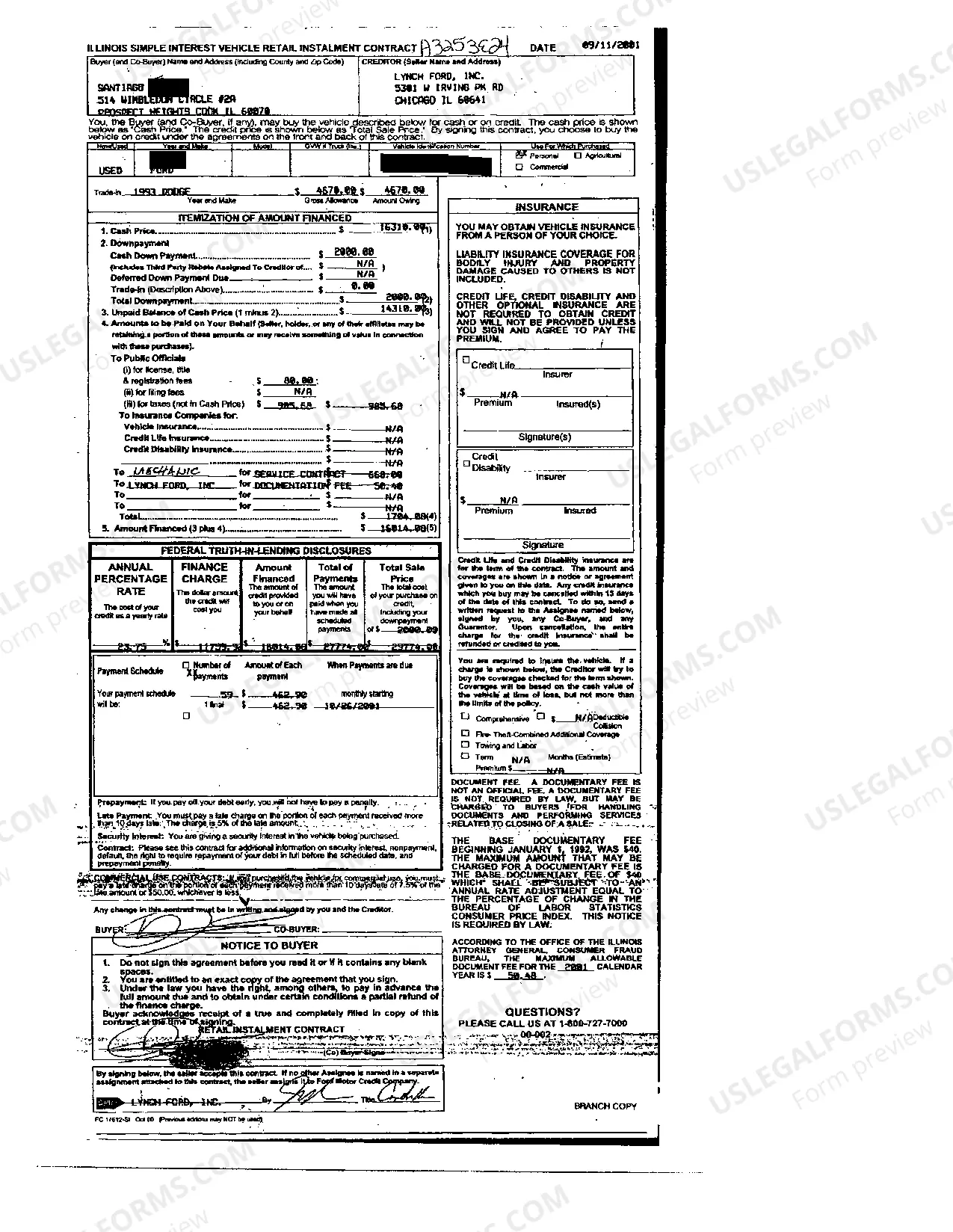

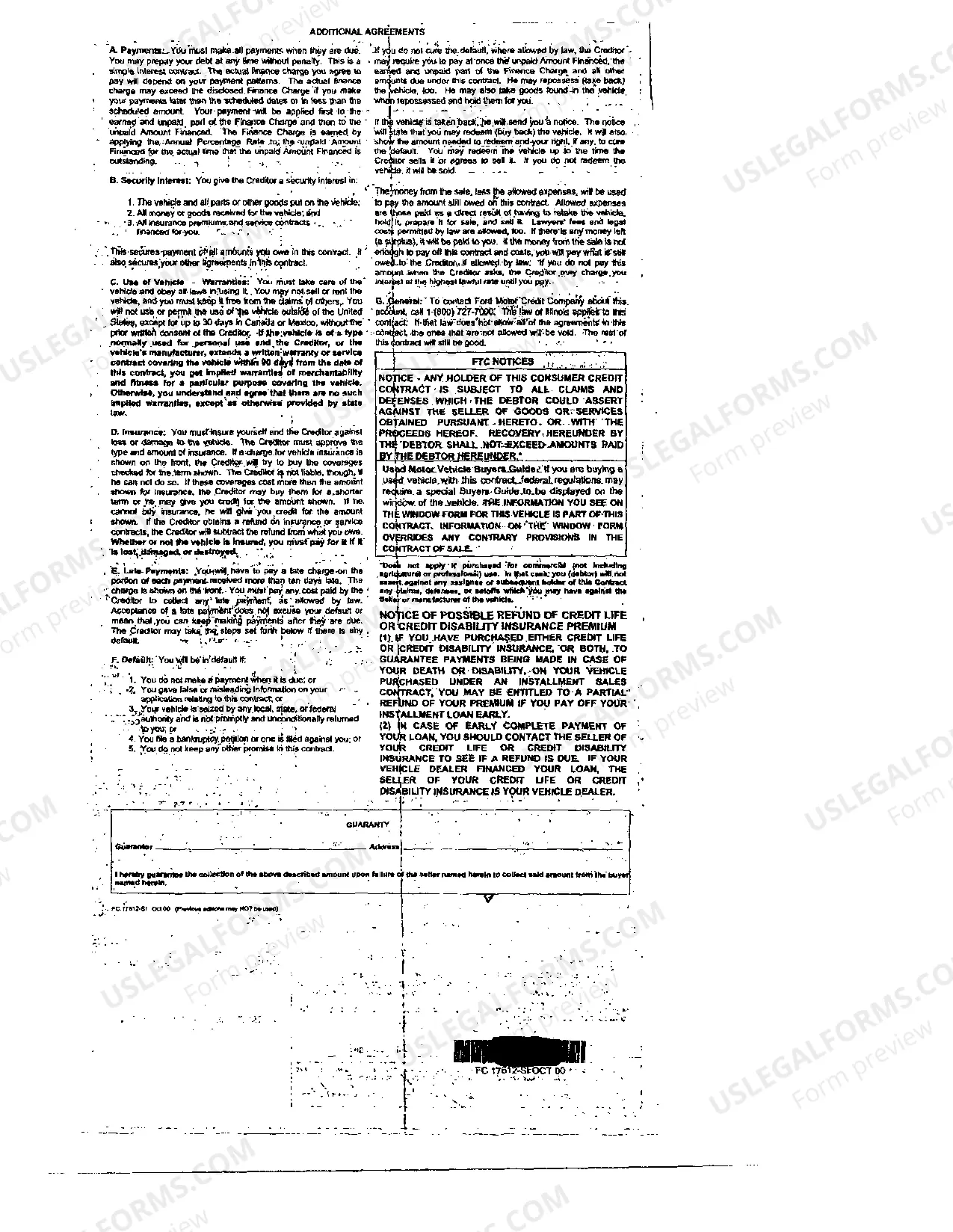

Naperville is a city located in the state of Illinois, known for its beautiful suburbs and thriving community. In recent years, however, there have been cases of complaints regarding the collection of deficiency balances after the sale of repossessed automobiles. This type of complaint typically arises when a borrower fails to make timely payments on their car loan, resulting in repossession by the lender. One type of Naperville Illinois complaint to collect deficiency balance after repossession sale of an automobile relates to alleged unfair practices by the lenders. Some borrowers claim that they have been charged excessive fees and interest rates, which they believe are unfair and unjust. These complaints often focus on the lack of transparency in the loan agreement and the lender's failure to provide clear explanations of the charges associated with repossessing and selling the vehicle. Another type of complaint involves issues with the repossession process itself. Borrowers have made allegations that their vehicles were improperly repossessed or that they were not given proper notice prior to the repossession. These complaints may also address the conduct of the repo agents, such as unauthorized entry or damage to personal property during the repossession. In some instances, borrowers may dispute the sale price of the repossessed vehicle, which directly impacts the deficiency balance. Allegations of inflated sale prices or improper valuation of the vehicle can lead to a complaint against the lender or the auto auction house involved in the sale. It is essential for individuals facing this type of complaint to be aware of their rights and options. Seeking legal advice from knowledgeable attorneys who specialize in consumer rights and automobile law is often recommended. These professionals can analyze the specific circumstances of the case and guide borrowers on how to navigate the legal process effectively. Overall, while Naperville is generally a harmonious community, complaints regarding the collection of deficiency balances after the repossession sale of automobiles do occur. By understanding the various types of complaints that can arise, borrowers can be better prepared to address any potential issues and protect their rights during the process.

Naperville Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile

Description

How to fill out Naperville Illinois Complaint To Collect Deficiency Balance After Repossession Sale Of Automobile?

We always want to reduce or avoid legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for attorney services that, as a rule, are very costly. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Naperville Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Naperville Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Naperville Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile is proper for you, you can choose the subscription option and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!