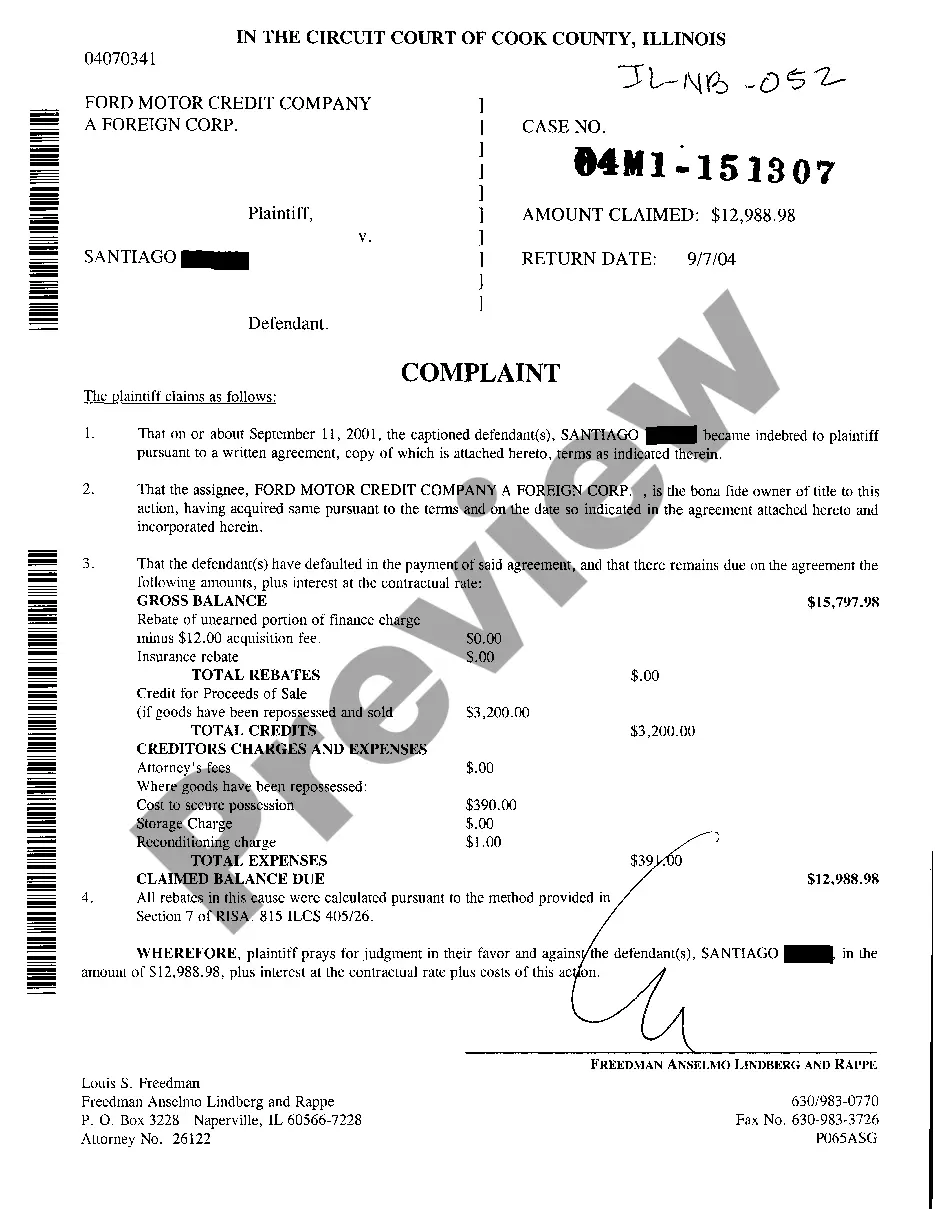

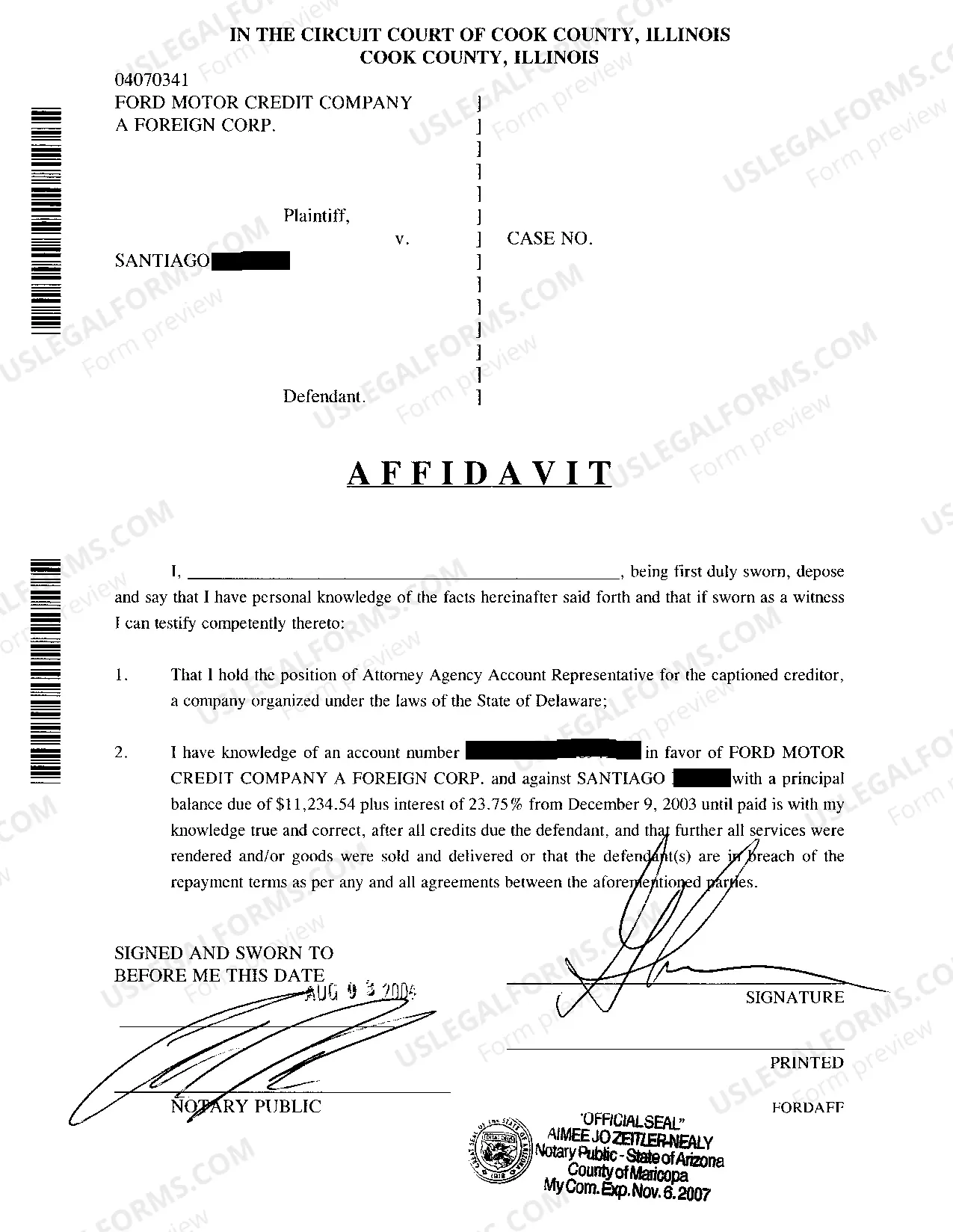

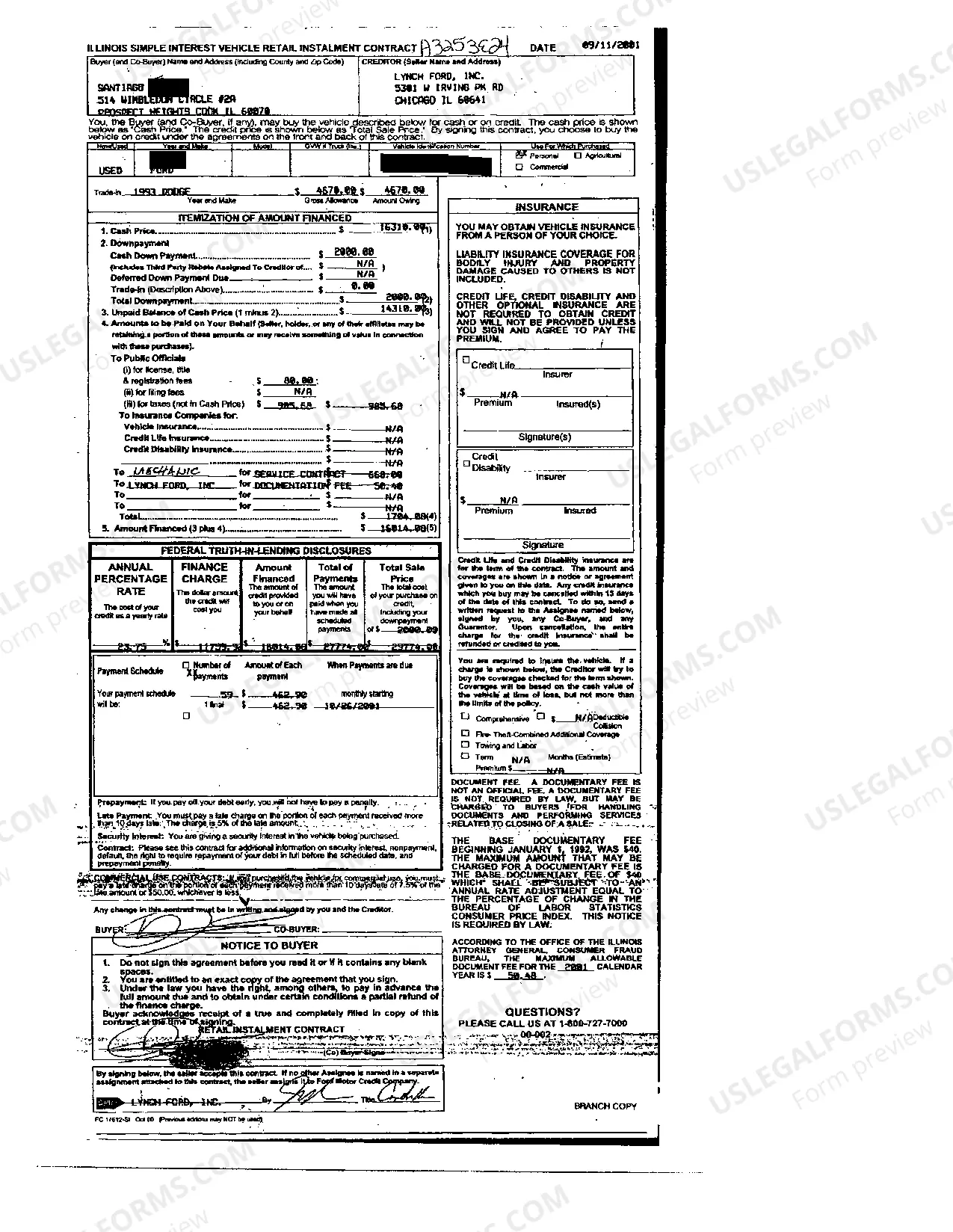

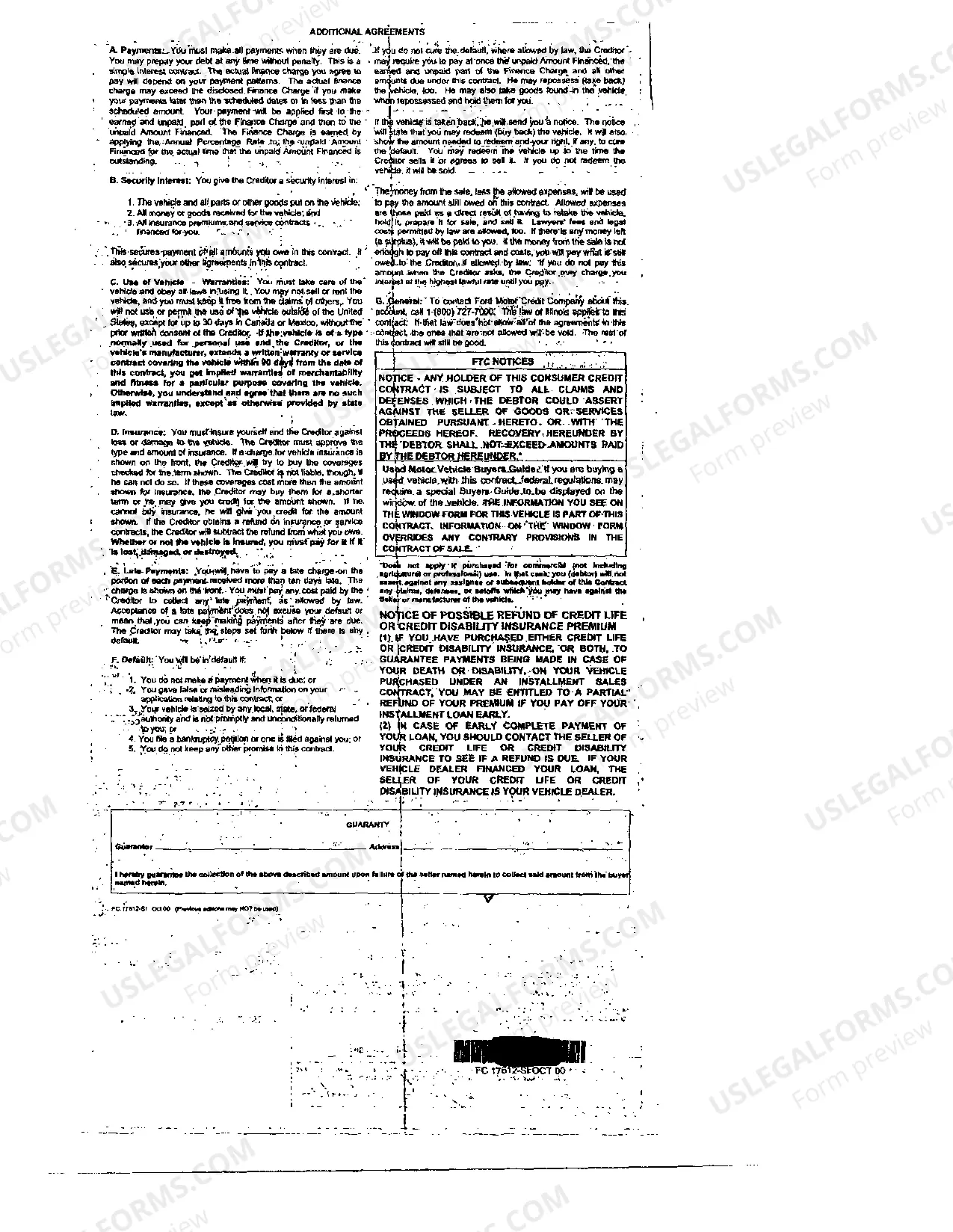

Title: Rockford Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile: A Detailed Overview Introduction: In the event of a vehicle repossession sale resulting in a deficiency balance, individuals in Rockford, Illinois may have specific rights and options. This article aims to provide a comprehensive description of the process, potential complaints, and relevant keywords associated with this legal issue. 1. Understanding Repossession Sales: A vehicle repossession occurs when a borrower fails to make required loan payments, resulting in the lender reclaiming the vehicle. Following repossession, the lender typically sells the vehicle to recoup the outstanding debt. If the sales proceeds do not cover the full balance owed, a deficiency balance may arise. 2. Deficiency Balance Collection: The deficiency balance refers to the remaining amount owed by the borrower after the sale of the repossessed vehicle. In Rockford, Illinois, lenders have the right to pursue collection efforts to recover this balance. 3. Rockford Illinois Complaints: a. Complaints against Repossession Practices: — Unauthorized repossession: Addressing instances where the vehicle was repossessed without legal grounds or proper notice. — Breach of peace during repossession: Exploring complaints relating to aggressive or unlawful repo tactics. — Failure to comply with repossession requirements: Examining issues regarding the lender's failure to adhere to legal procedures during repossession. b. Complaints against Deficiency Balance Collection: — Unlawful debt collection practices: Addressing violations of the Fair Debt Collection Practices Act (FD CPA), such as harassment or false representation. — Failure to provide proper notification: Discussing concerns regarding inadequate or incomplete disclosure of the deficiency balance. — Disputing the amount of the deficiency balance: Exploring situations where borrowers contest the accuracy of the balance claimed by the lender. 4. Protecting Consumer Rights: Rockford, Illinois residents can take various steps to protect their rights and challenge the collection of deficiency balances effectively. These include: — Reviewing loan and repossession agreements to ensure legal compliance. — Keeping records and documentation of all communications and transactions. — Seeking legal assistance or guidance to understand rights and options. 5. Relevant Keywords: — Rockford Illinois auto repossession laws — Repossession sale deficiency balance in Rockford — Complaints against auto repossessions in Illinois — Rockford auto repossession right— - Deficiency balance collection in Rockford Illinois — Rockford consumer protections for auto repossession — Legal recourse after vehicle repossession in Rockford Conclusion: Understanding the Rockford, Illinois complaint process for collecting deficiency balances after an automobile repossession sale is vital for safeguarding consumer rights. By being aware of relevant keywords and the different types of complaints that can arise, individuals can navigate this complex territory more effectively and protect themselves from unfair practices. Seeking legal counsel is recommended for personalized advice regarding specific situations.

Rockford Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile

Description

How to fill out Rockford Illinois Complaint To Collect Deficiency Balance After Repossession Sale Of Automobile?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal solutions that, usually, are very costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Rockford Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Rockford Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Rockford Illinois Complaint to Collect Deficiency Balance after Repossession Sale of Automobile is suitable for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!