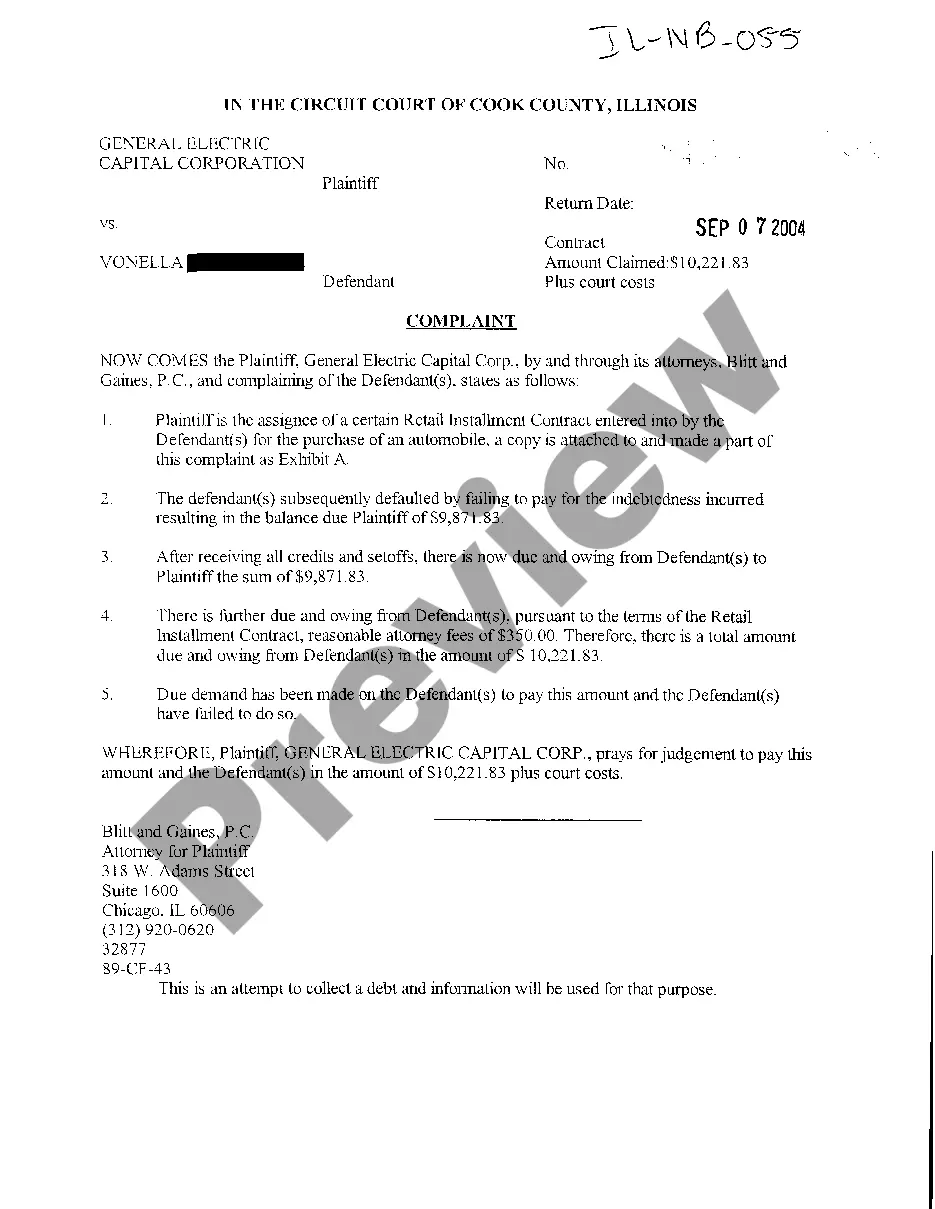

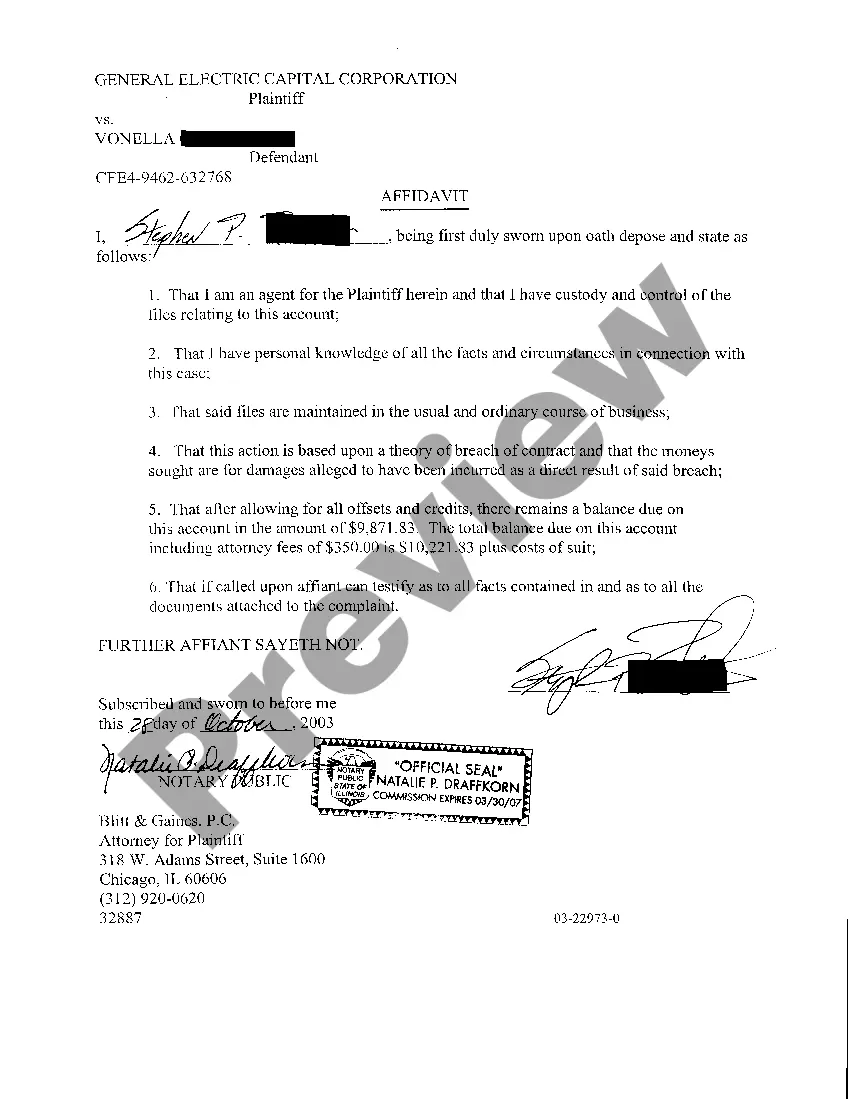

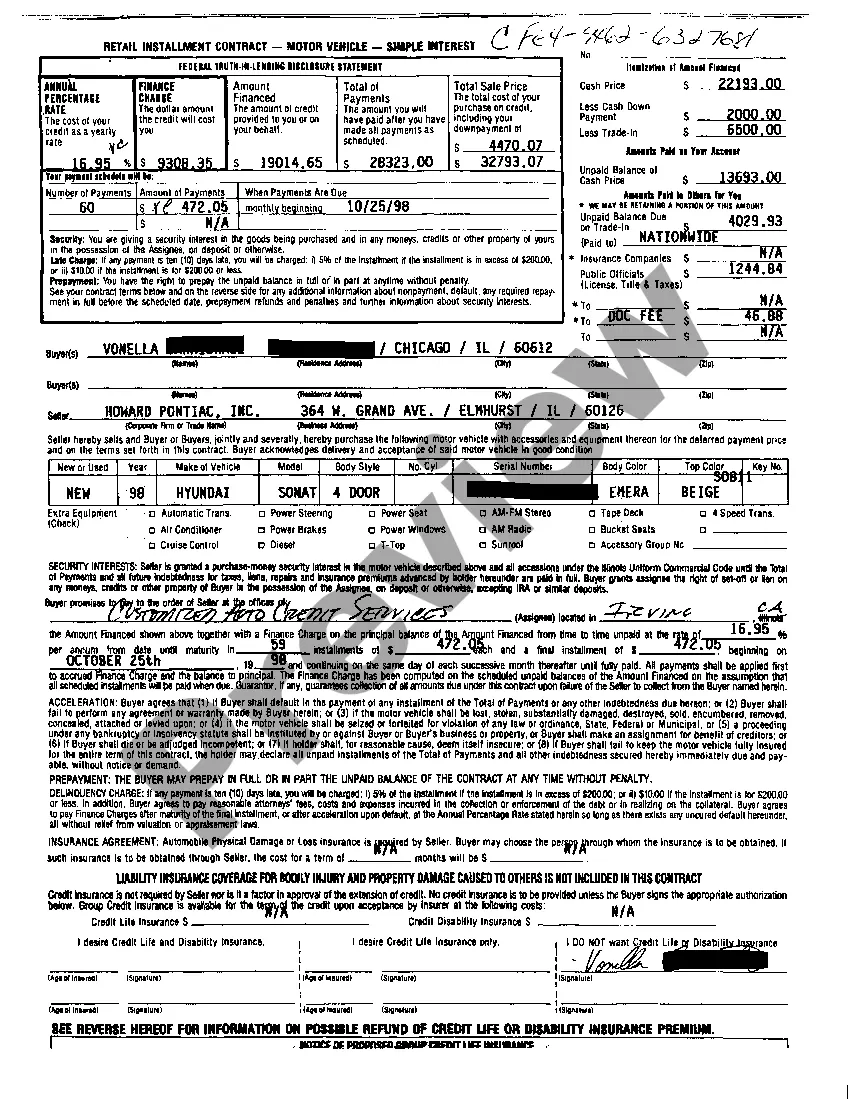

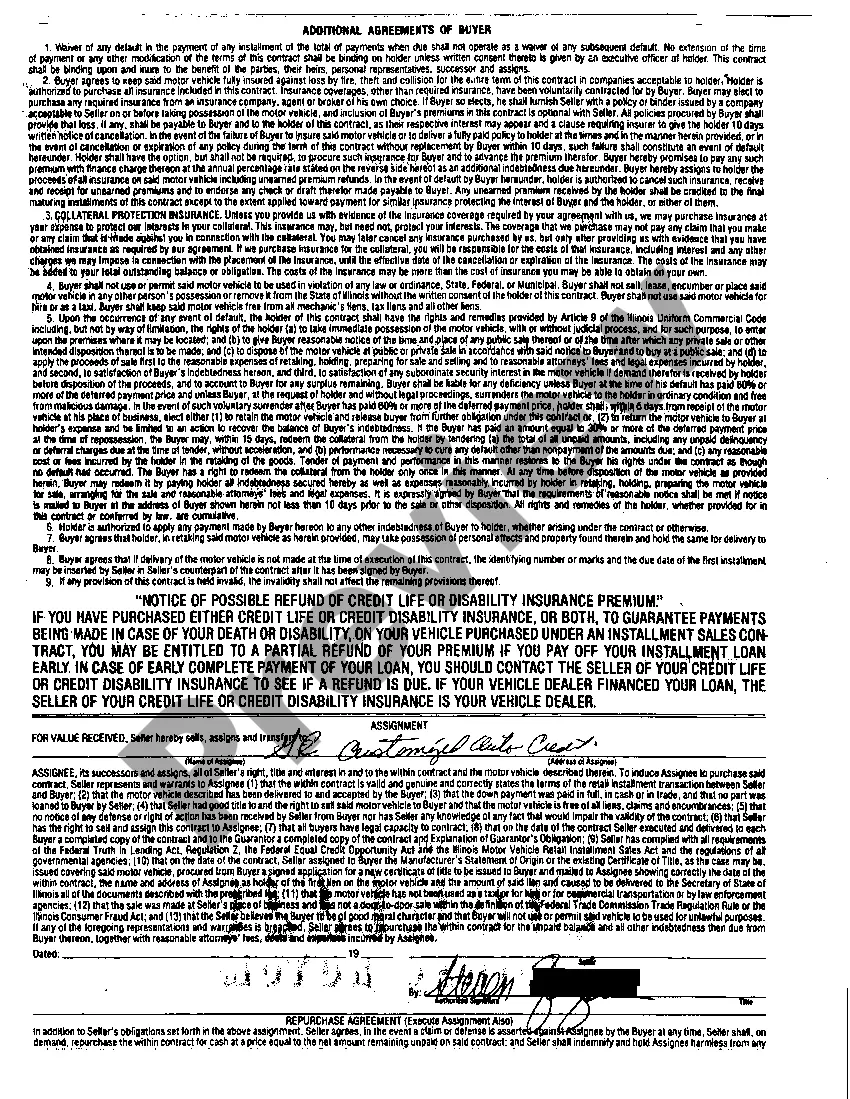

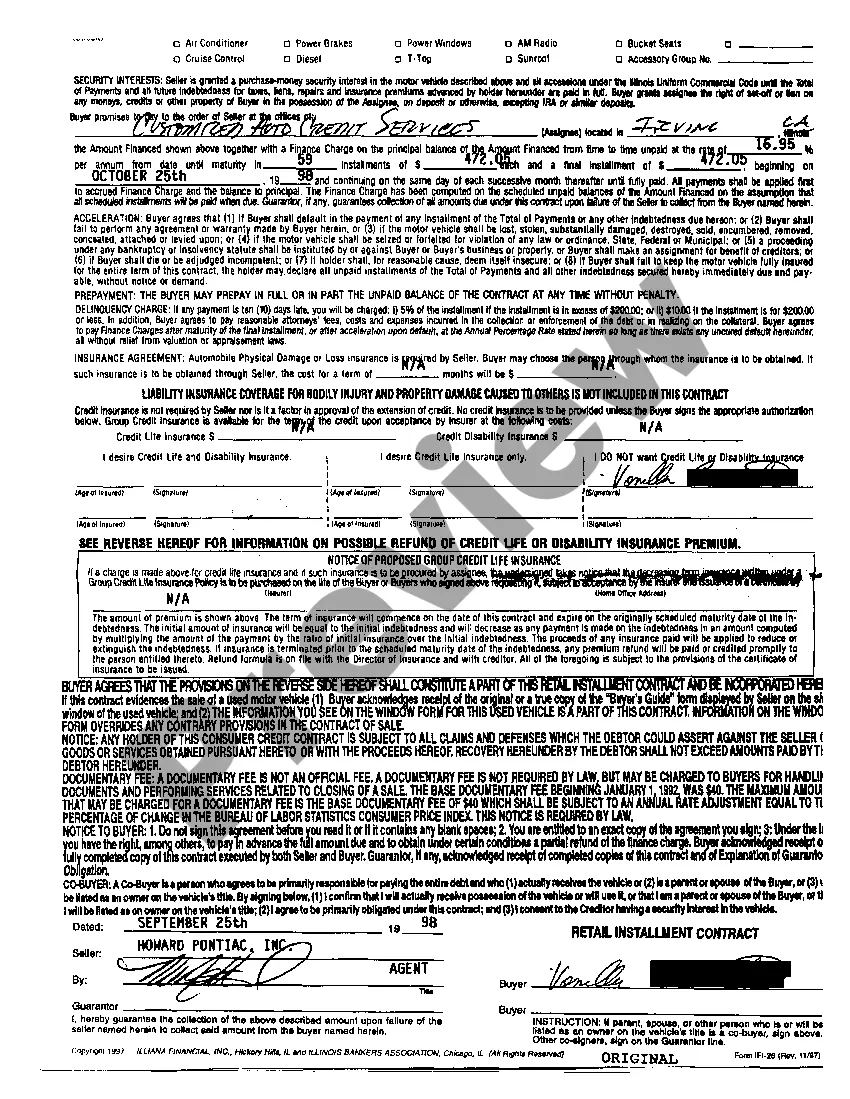

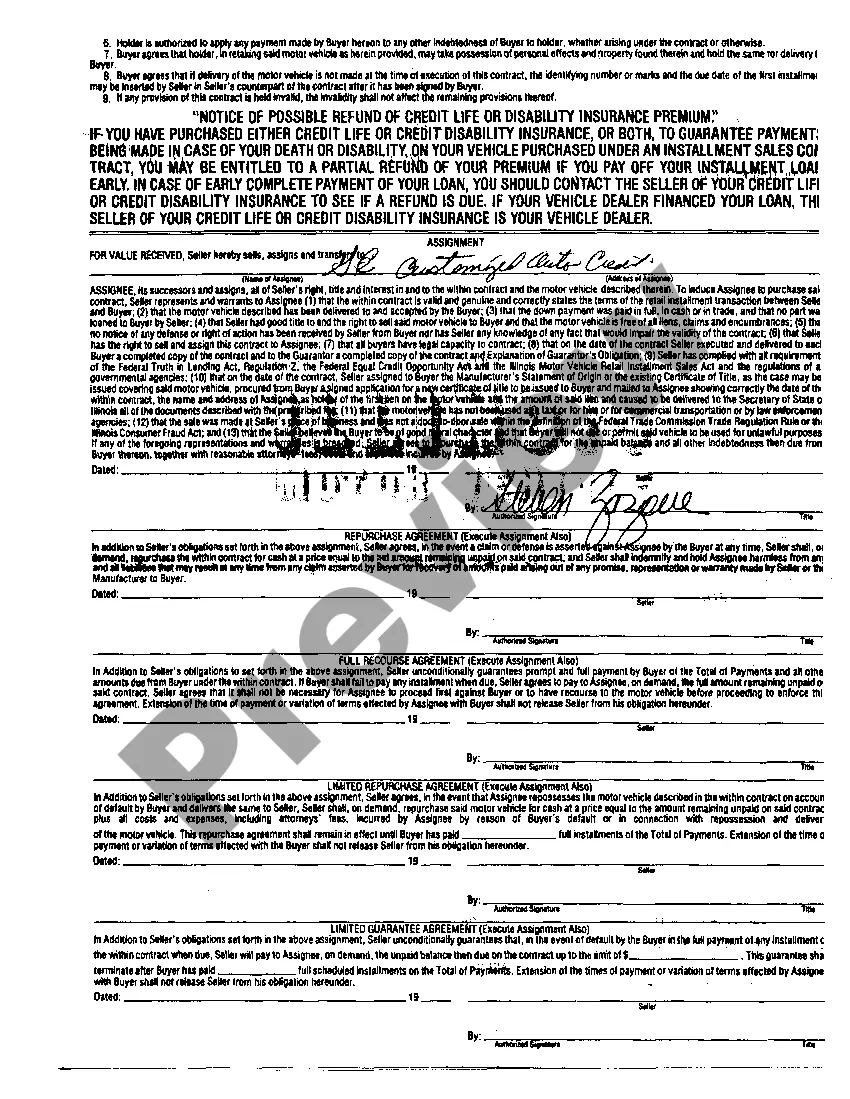

A Chicago Illinois Complaint to Collect Balance Due on Retail Installment Contract is a legal document that outlines a grievance filed against a party by a creditor to recover an outstanding amount owed on a retail installment contract. This complaint is typically used when the debtor fails to make payment for goods or services purchased through an installment plan in the city of Chicago, Illinois. The complaint begins with the identification and contact details of both the creditor (plaintiff) and the debtor (defendant). It states the nature of the complaint, emphasizing the outstanding balance due on the retail installment contract. It includes specific information regarding the contract, such as the date of execution, the total amount financed, the number of installments, and the terms and conditions agreed upon. The complaint outlines the reasons for initiating legal action, which could include breach of contract, failure to make payments as agreed, or late payment. The creditor may list any attempts made to resolve the issue amicably, such as reminders, demand letters, or negotiation attempts, to demonstrate good faith in pursuing collection. Key elements of the complaint include a detailed account of the payment history, highlighting the specific missed or late payments, and the corresponding amount owed for each installment. It may also reference any applicable interest charges, penalties, or fees as stated in the original contract or subsequent collection attempts. Additionally, the complaint must adhere to the relevant laws and regulations governing retail installment contracts in Chicago, Illinois. It may cite specific provisions from the Retail Installment Sales Act or other applicable consumer protection laws to support the creditor's claim. Different types of Chicago Illinois Complaints to Collect Balance Due on Retail Installment Contracts may arise based on the particular circumstances of the case. Some examples could be: 1. Simple Complaint: This type of complaint is filed when the debtor has failed to make any payments on the retail installment contract, resulting in a total balance due. 2. Partial Payment Complaint: This complaint is lodged when the debtor has made some payments, but the remaining balance is still outstanding, either in part or in full. 3. Late Payment Complaint: This type of complaint is filed when the debtor consistently makes payments but fails to do so within the agreed-upon timeframe, resulting in penalties or fees owed. 4. Breach of Contract Complaint: This complaint is initiated when the debtor violates other terms and conditions of the retail installment contract, such as using the financed goods or services for unauthorized purposes. In conclusion, a Chicago Illinois Complaint to Collect Balance Due on Retail Installment Contract is a legal document that allows a creditor to pursue legal action to recover outstanding balances on a retail installment contract. It contains detailed information regarding the contract, payment history, attempts to resolve the issue, and applicable laws and regulations. Different types of complaints may arise based on the specific circumstances of the case.

Chicago Illinois Complaint to Collect Balance Due on Retail Installment Contract

Description

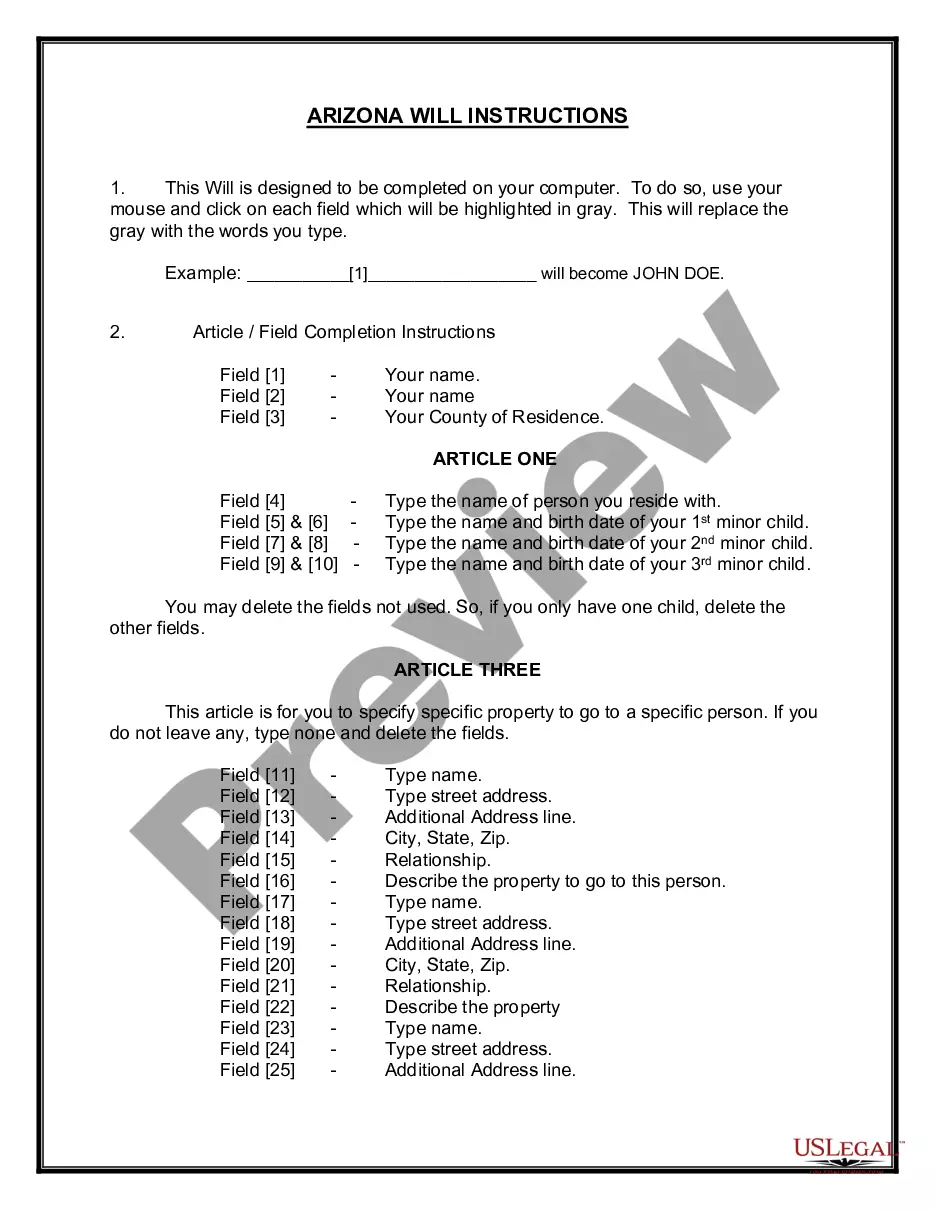

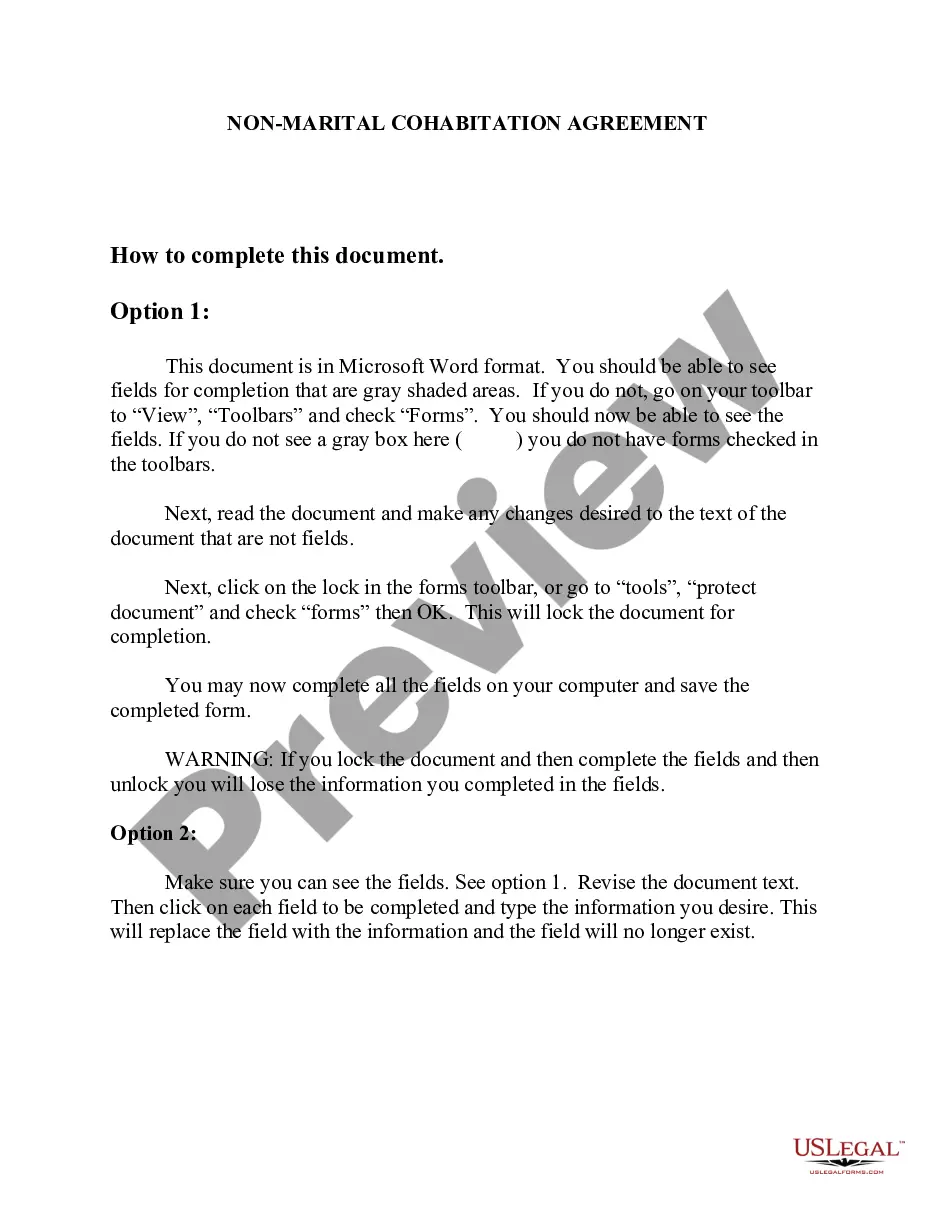

How to fill out Chicago Illinois Complaint To Collect Balance Due On Retail Installment Contract?

Take advantage of the US Legal Forms and have immediate access to any form sample you need. Our beneficial website with thousands of document templates makes it easy to find and obtain virtually any document sample you want. It is possible to export, fill, and sign the Chicago Illinois Complaint to Collect Balance Due on Retail Installment Contract in just a few minutes instead of browsing the web for several hours attempting to find an appropriate template.

Using our catalog is a superb way to improve the safety of your form filing. Our experienced lawyers regularly review all the records to make certain that the forms are relevant for a particular state and compliant with new acts and regulations.

How do you get the Chicago Illinois Complaint to Collect Balance Due on Retail Installment Contract? If you have a subscription, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the tips below:

- Find the template you need. Make sure that it is the template you were looking for: verify its headline and description, and utilize the Preview option if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving process. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Export the document. Indicate the format to obtain the Chicago Illinois Complaint to Collect Balance Due on Retail Installment Contract and revise and fill, or sign it for your needs.

US Legal Forms is one of the most considerable and reliable document libraries on the web. We are always ready to assist you in virtually any legal process, even if it is just downloading the Chicago Illinois Complaint to Collect Balance Due on Retail Installment Contract.

Feel free to benefit from our form catalog and make your document experience as straightforward as possible!