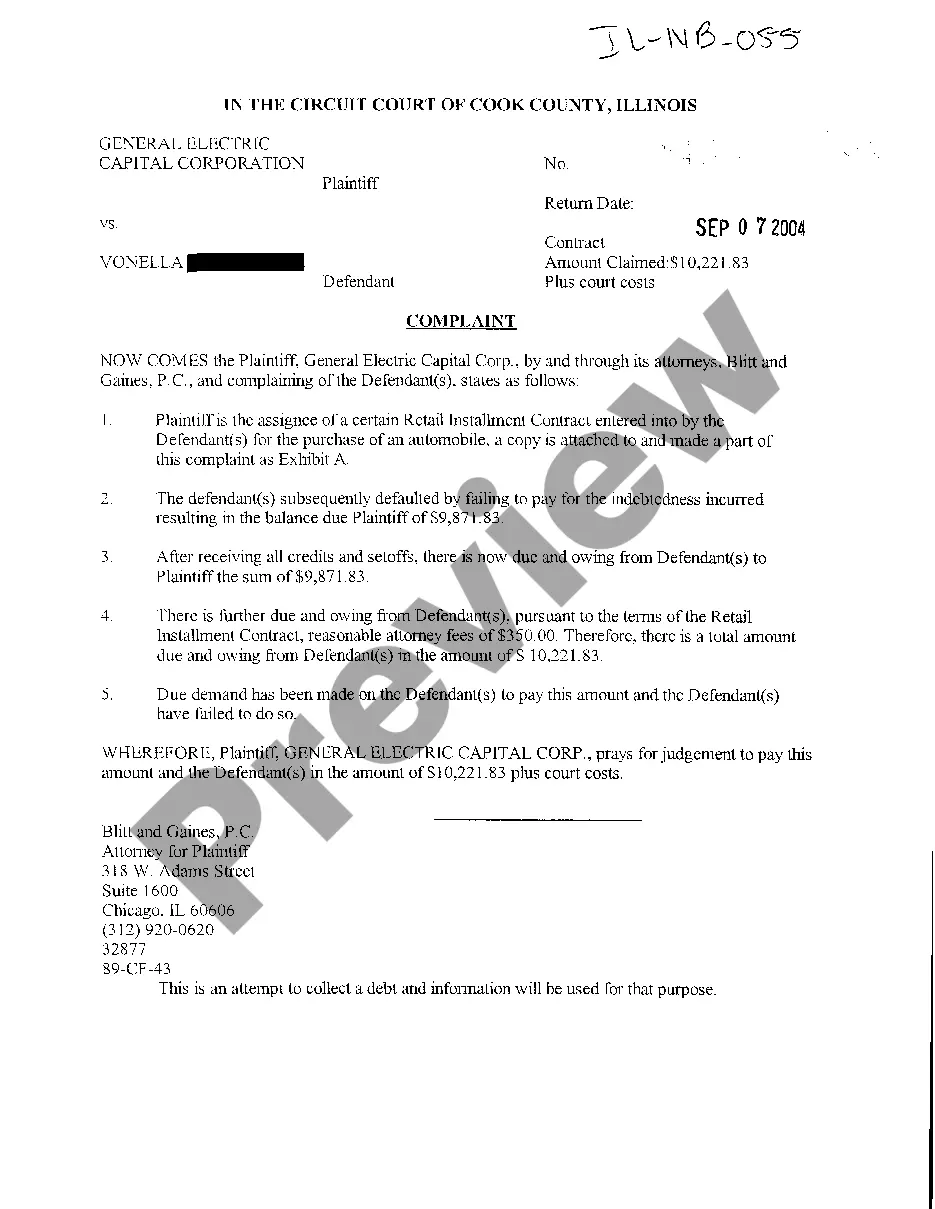

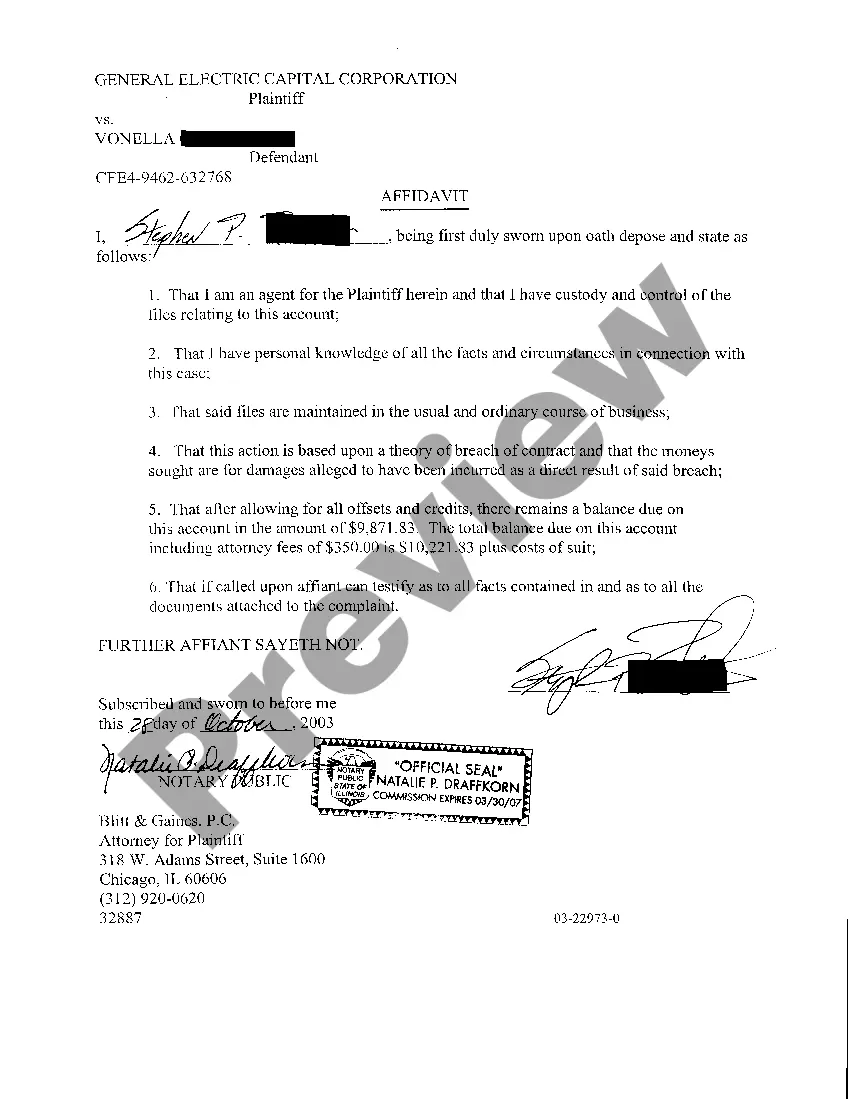

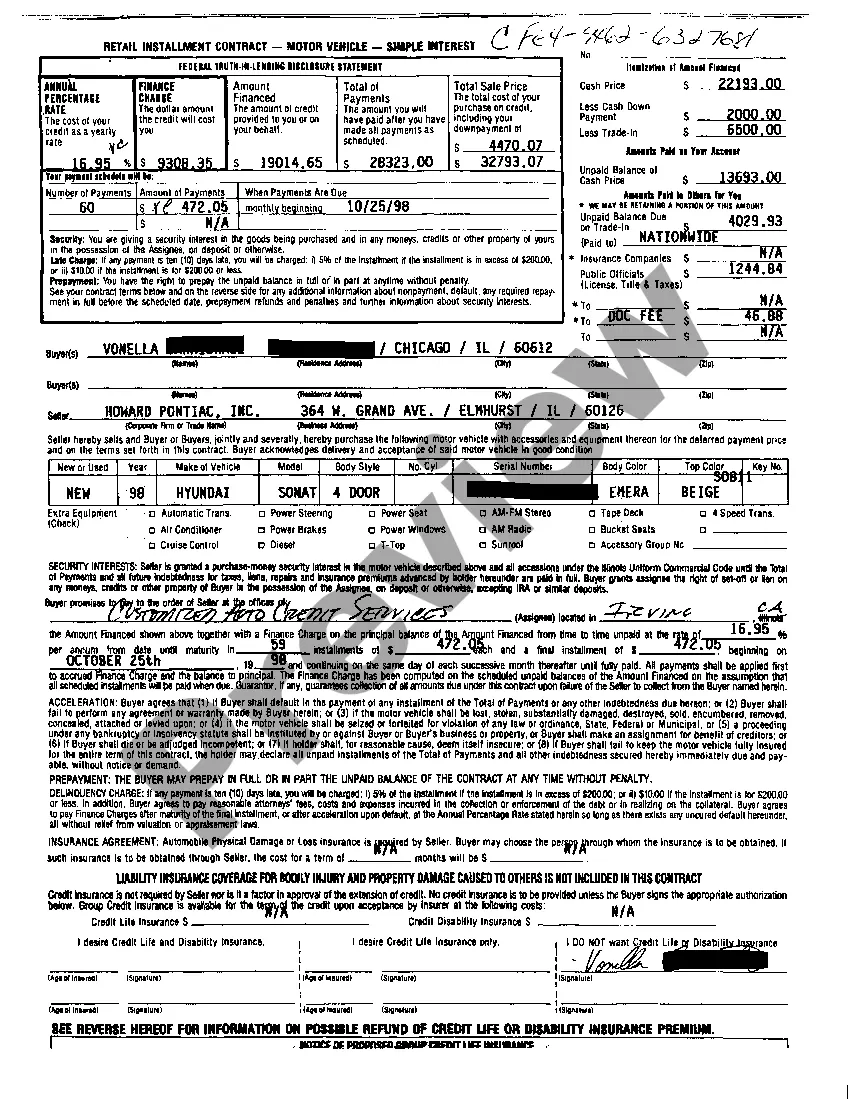

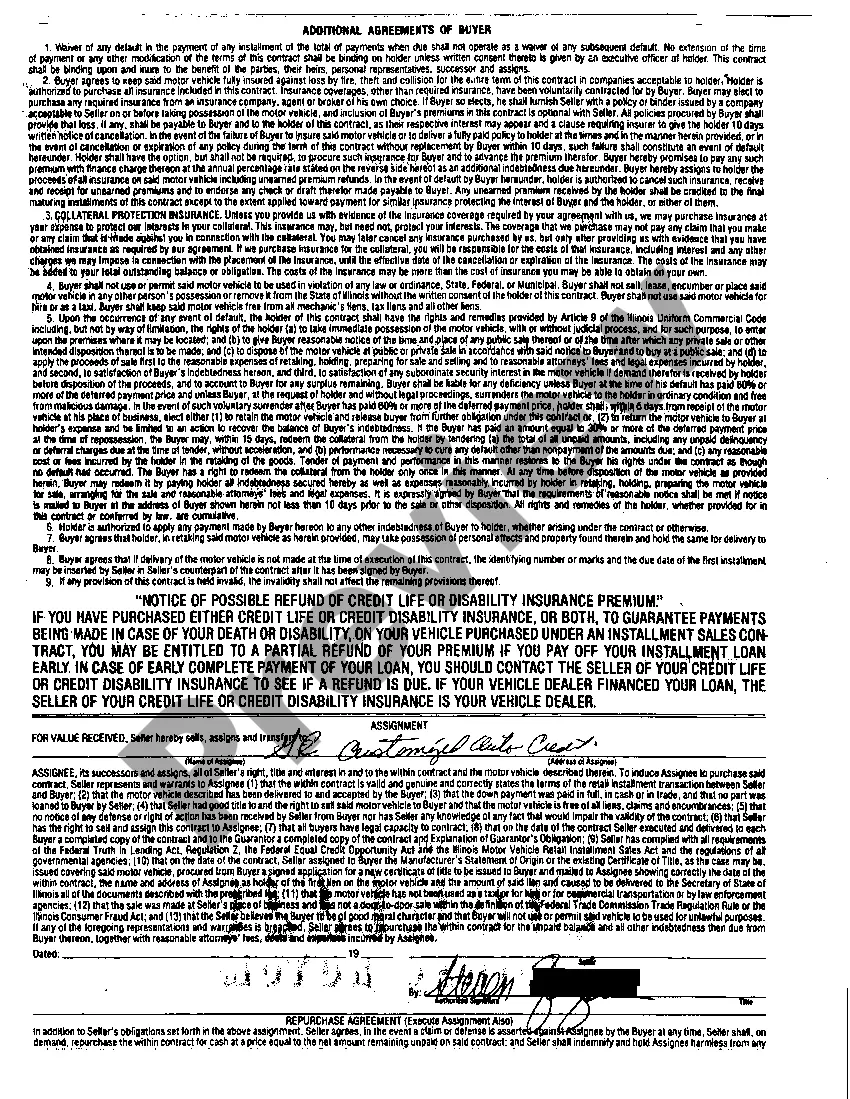

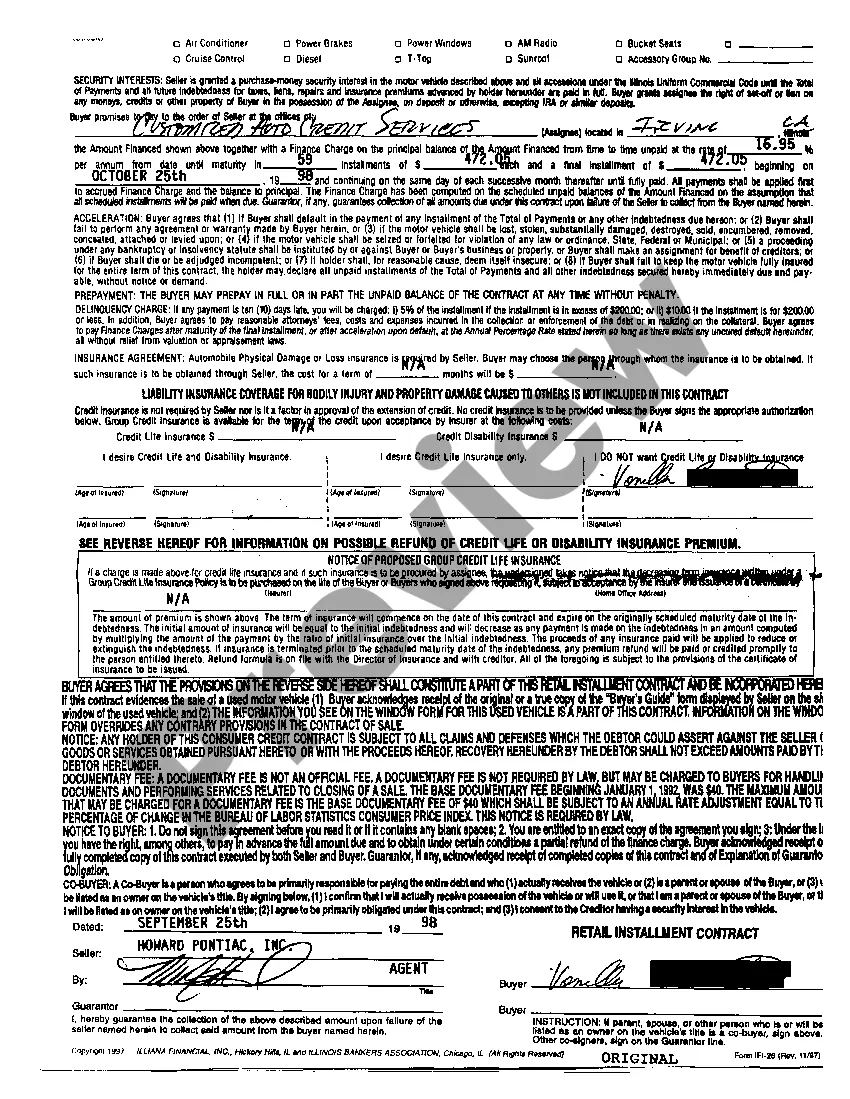

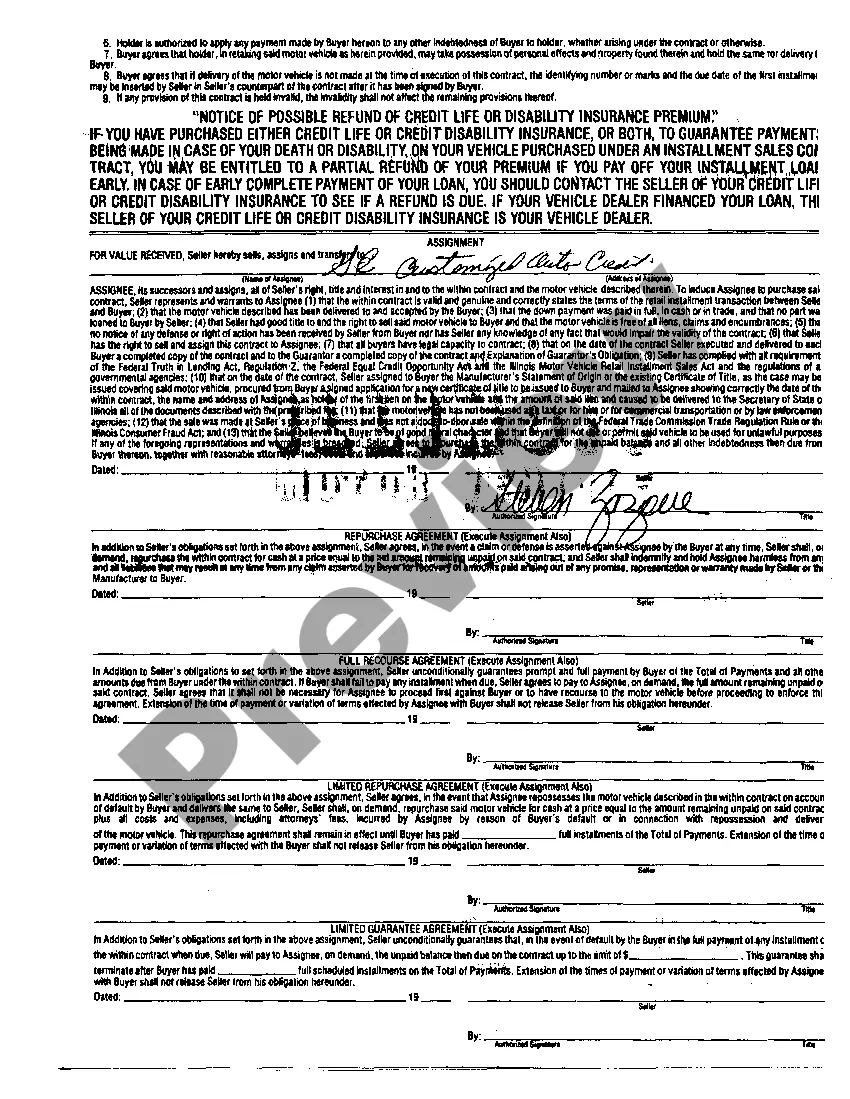

Title: Joliet, Illinois Complaint to Collect Balance Due on Retail Installment Contract: A Comprehensive Overview Keywords: Joliet, Illinois, complaint, collect, balance due, retail installment contract Introduction: In Joliet, Illinois, individuals or businesses who are owed money through a retail installment contract may choose to file a complaint to collect the balance due. This legal process enables them to seek resolution and recover the outstanding payment owed to them. In this article, we will delve into the details of what a Joliet, Illinois Complaint to Collect Balance Due on a Retail Installment Contract entails, its significance, and the potential types of such complaints. What is a Joliet, Illinois Complaint to Collect Balance Due on Retail Installment Contract? A Joliet, Illinois Complaint to Collect Balance Due on a Retail Installment Contract is a legal document that allows creditors to initiate a formal lawsuit when a debtor fails to fulfill their financial obligations outlined in a retail installment contract. It serves as a means to recover the outstanding balance owed by the debtor. Key Components of a Joliet, Illinois Complaint to Collect Balance Due on Retail Installment Contract: 1. Plaintiff's Information: The complaint starts by identifying the party filing the complaint, often referred to as the plaintiff. This includes their name, contact details, and their legal representative if applicable. 2. Defendant's Information: The defendant, also known as the debtor, is identified in this section. It includes their name, contact information, and any other relevant identification details. 3. Overview of Retail Installment Contract: A detailed description of the retail installment contract is provided. This includes information about the parties involved, the product or service being financed, terms of payment, interest rates, repayment schedule, and any other pertinent terms and conditions. 4. Documentation of Breach: The complaint must outline how the debtor has failed to comply with the terms and conditions of the retail installment contract. This may include missed payments, late payments, or failure to fulfill specific obligations outlined in the agreement. 5. Monetary Damages: The amount of money owed by the debtor, including any additional interest, penalties, or fees incurred due to the default on the retail installment contract, is stated in this section. Types of Joliet, Illinois Complaints to Collect Balance Due on Retail Installment Contract: 1. Individual vs. Business Complaints: Depending on whether the creditor is an individual person or a business entity, the nature and requirements of the complaint may vary. It is essential to ensure that the correct legal procedures and documentation are followed according to the respective category. 2. Small Claims Complaints: In cases where the amount owed is within the jurisdictional limits of a small claims court, creditors may opt for a small claims complaint to collect the balance due on a retail installment contract. This provides a faster and simplified legal recourse for resolving the outstanding balance. Conclusion: A Joliet, Illinois Complaint to Collect Balance Due on a Retail Installment Contract allows creditors to seek legal redress and recover the outstanding debt owed to them by filing a complaint. By adhering to the appropriate legal procedures and providing substantial evidence of breach, creditors can pursue resolution through the court system. It is crucial for both parties to seek legal assistance and comply with the relevant laws and regulations to ensure a fair and just outcome.

Joliet Illinois Complaint to Collect Balance Due on Retail Installment Contract

Description

How to fill out Joliet Illinois Complaint To Collect Balance Due On Retail Installment Contract?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Joliet Illinois Complaint to Collect Balance Due on Retail Installment Contract gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Joliet Illinois Complaint to Collect Balance Due on Retail Installment Contract takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Joliet Illinois Complaint to Collect Balance Due on Retail Installment Contract. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!