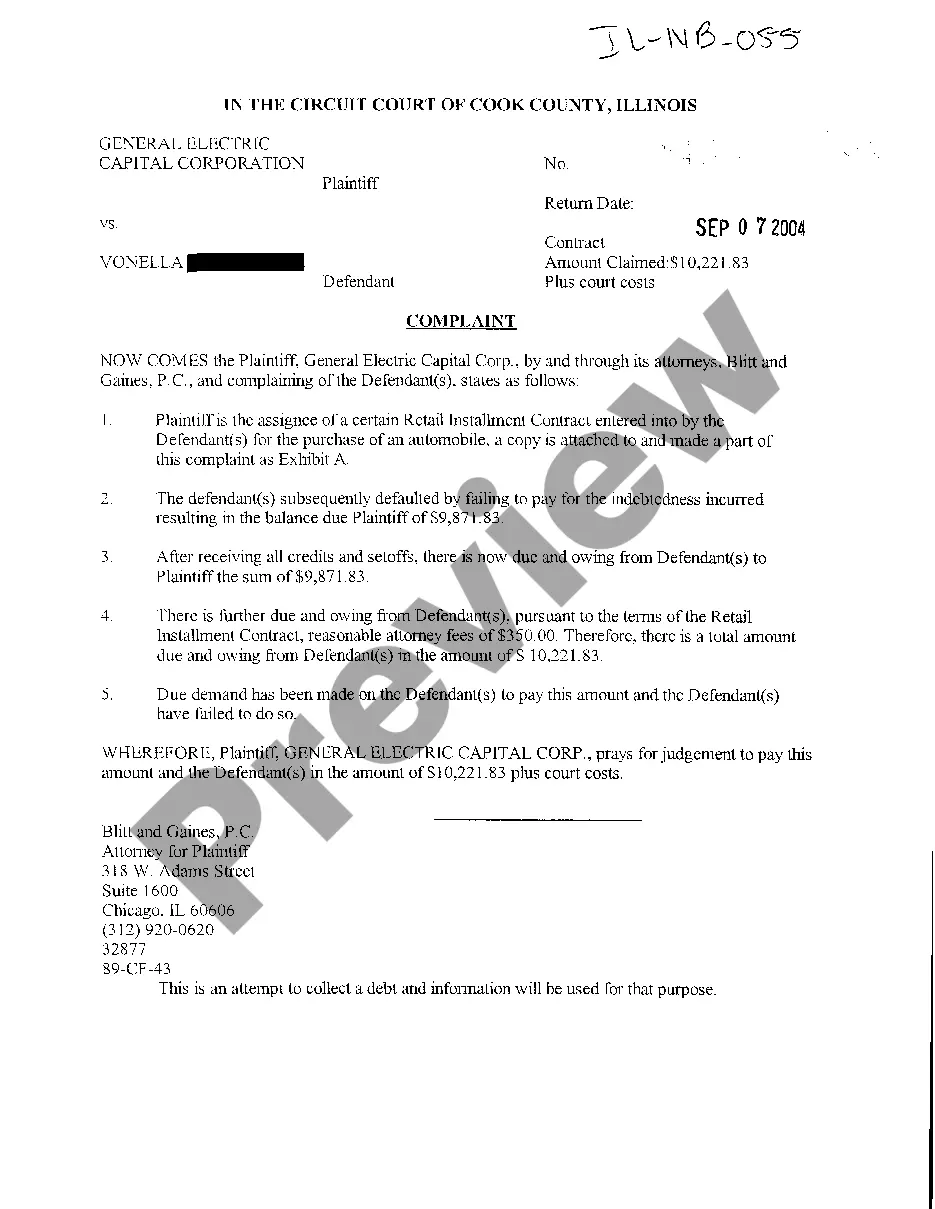

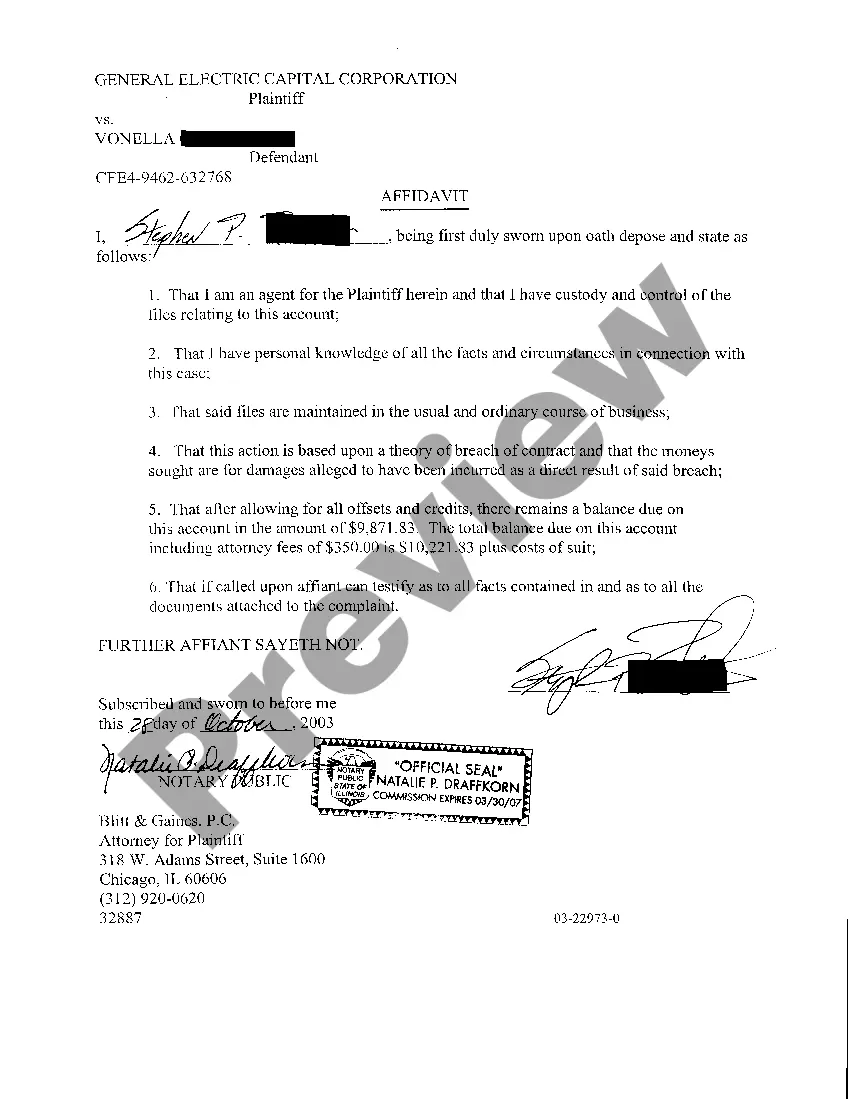

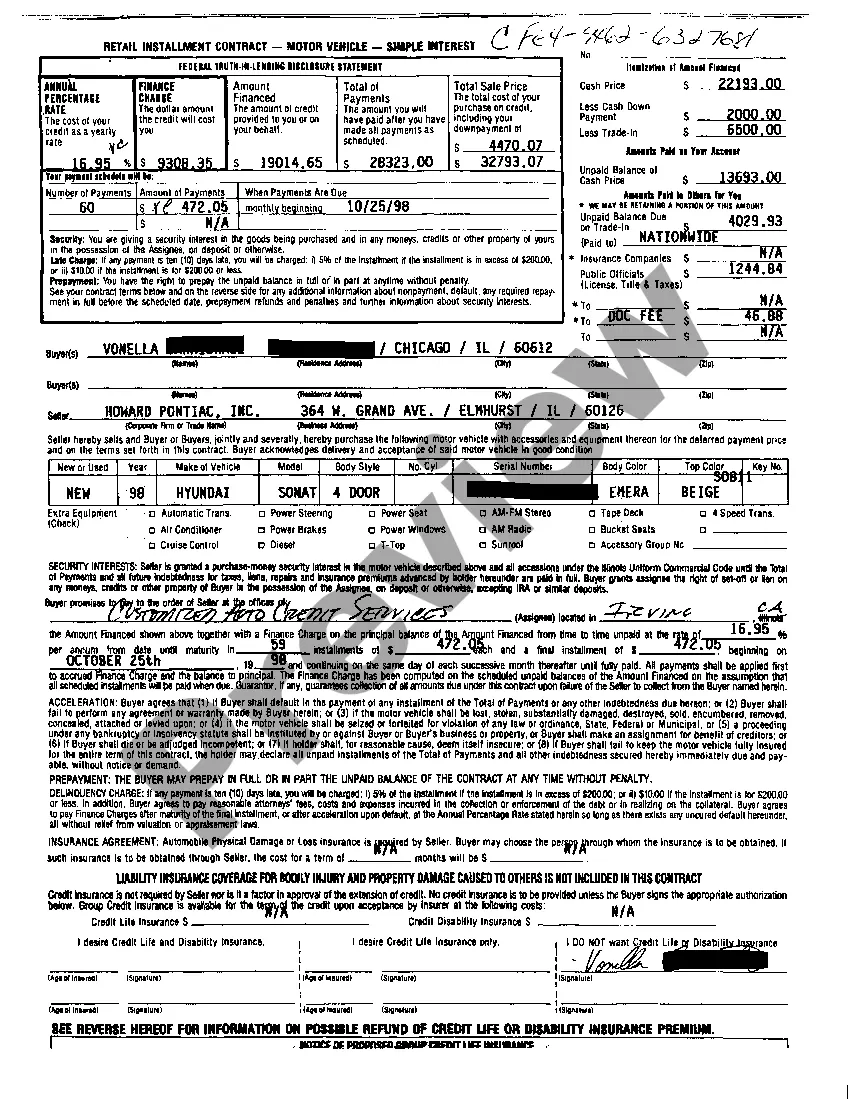

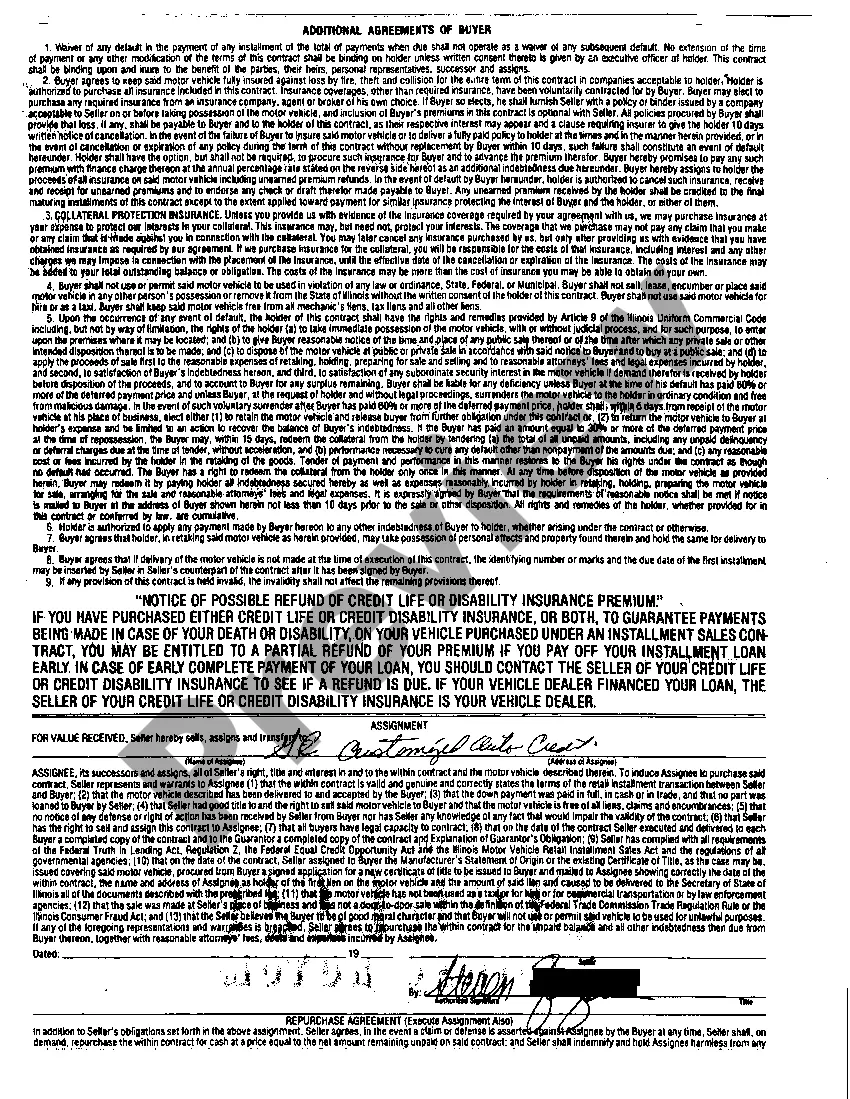

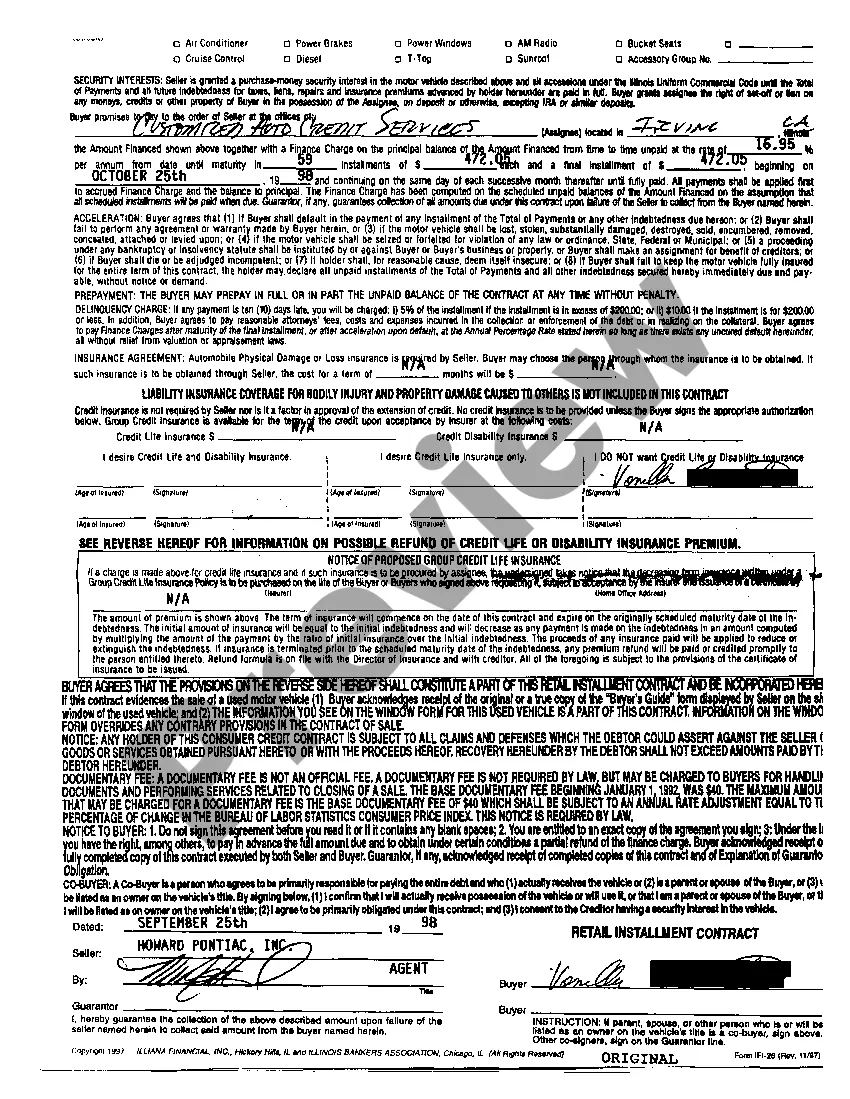

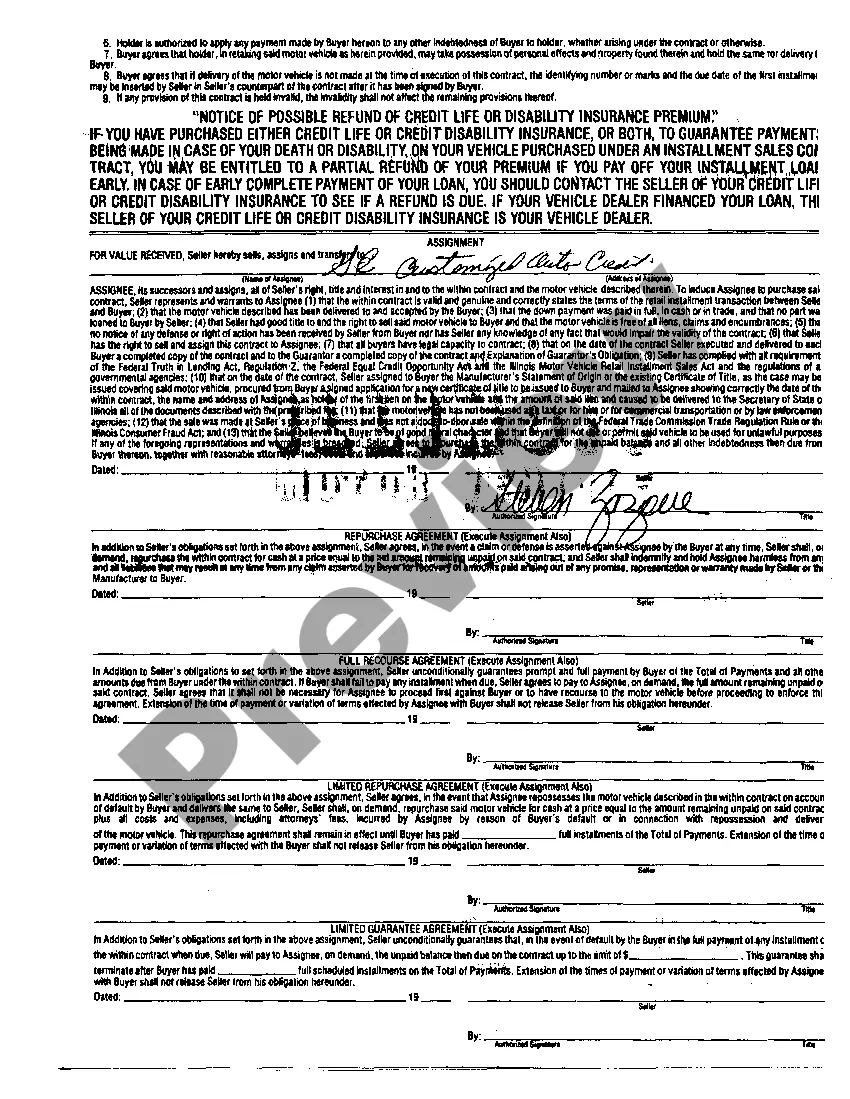

Naperville is a bustling city in Illinois, known for its vibrant community and thriving businesses. However, like any other place, there may be instances where issues arise, such as a complaint to collect a balance due on a retail installment contract. Such complaints typically involve an agreement between a consumer and a seller, where the consumer purchases goods or services and repays the amount owed in installments. In Naperville, Illinois, complaints to collect balances due on retail installment contracts are a type of legal action taken by sellers or creditors when consumers fail to fulfill their payment obligations. These complaints aim to recover the outstanding balance owed by the consumer, typically with the involvement of the court system if necessary. There are several types of complaints that fall under the category of collecting balances due on retail installment contracts: 1. Standard Collection Complaint: This is the most common type of complaint where a seller files a legal action against a consumer who has failed to make the agreed-upon payments on time. The rights and remedies available to the seller will depend on the terms outlined in the original contract and applicable state laws. 2. Breach of Contract Complaint: In some cases, the consumer may not only have missed payments but may have violated other terms of the contract as well. This type of complaint highlights the consumer's failure to adhere to the agreement in its entirety, allowing the seller to seek a legal resolution to collect the outstanding balance. 3. Unconscionable Contract Complaint: In certain situations, the consumer may argue that the terms of the retail installment contract are unfair or unconscionable. They may claim that the contract was presented in a deceptive or misleading manner, or that the terms placed an excessive burden on them. This complaint challenges the validity of the contract itself. 4. Fraudulent Activity Complaint: If the consumer believes that fraudulent activity or misrepresentation has occurred during the formation of the retail installment contract, they can file a complaint asserting such claims. This might involve deceptive sales practices, false promises, or intentional misinformation regarding the goods or services provided. It is important to note that handling complaints to collect balances due on retail installment contracts requires thorough knowledge of consumer protection laws, contract regulations, and local legal procedures. Both parties involved, the consumer and the seller, should seek legal advice to understand their rights and obligations during the dispute resolution process. In conclusion, Naperville, Illinois complaints to collect balances due on retail installment contracts involve legal actions taken by sellers or creditors to recover outstanding payments from consumers who have not fulfilled their contractual obligations. The specific type of complaint can vary, ranging from standard collection complaints to breach of contract, unconscionable contract, or fraudulent activity complaints. Seeking legal assistance is crucial for both parties involved in order to navigate the complexities of these disputes effectively.

Naperville Illinois Complaint to Collect Balance Due on Retail Installment Contract

Description

How to fill out Naperville Illinois Complaint To Collect Balance Due On Retail Installment Contract?

Make use of the US Legal Forms and obtain instant access to any form you need. Our useful platform with a large number of templates simplifies the way to find and obtain almost any document sample you want. You are able to download, complete, and certify the Naperville Illinois Complaint to Collect Balance Due on Retail Installment Contract in a matter of minutes instead of surfing the Net for several hours attempting to find an appropriate template.

Utilizing our catalog is a wonderful way to improve the safety of your record filing. Our professional attorneys regularly review all the documents to make certain that the templates are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Naperville Illinois Complaint to Collect Balance Due on Retail Installment Contract? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Moreover, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the tips listed below:

- Find the form you require. Make certain that it is the template you were looking for: examine its headline and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the file. Choose the format to get the Naperville Illinois Complaint to Collect Balance Due on Retail Installment Contract and change and complete, or sign it for your needs.

US Legal Forms is among the most significant and trustworthy document libraries on the internet. Our company is always happy to assist you in any legal process, even if it is just downloading the Naperville Illinois Complaint to Collect Balance Due on Retail Installment Contract.

Feel free to make the most of our service and make your document experience as efficient as possible!