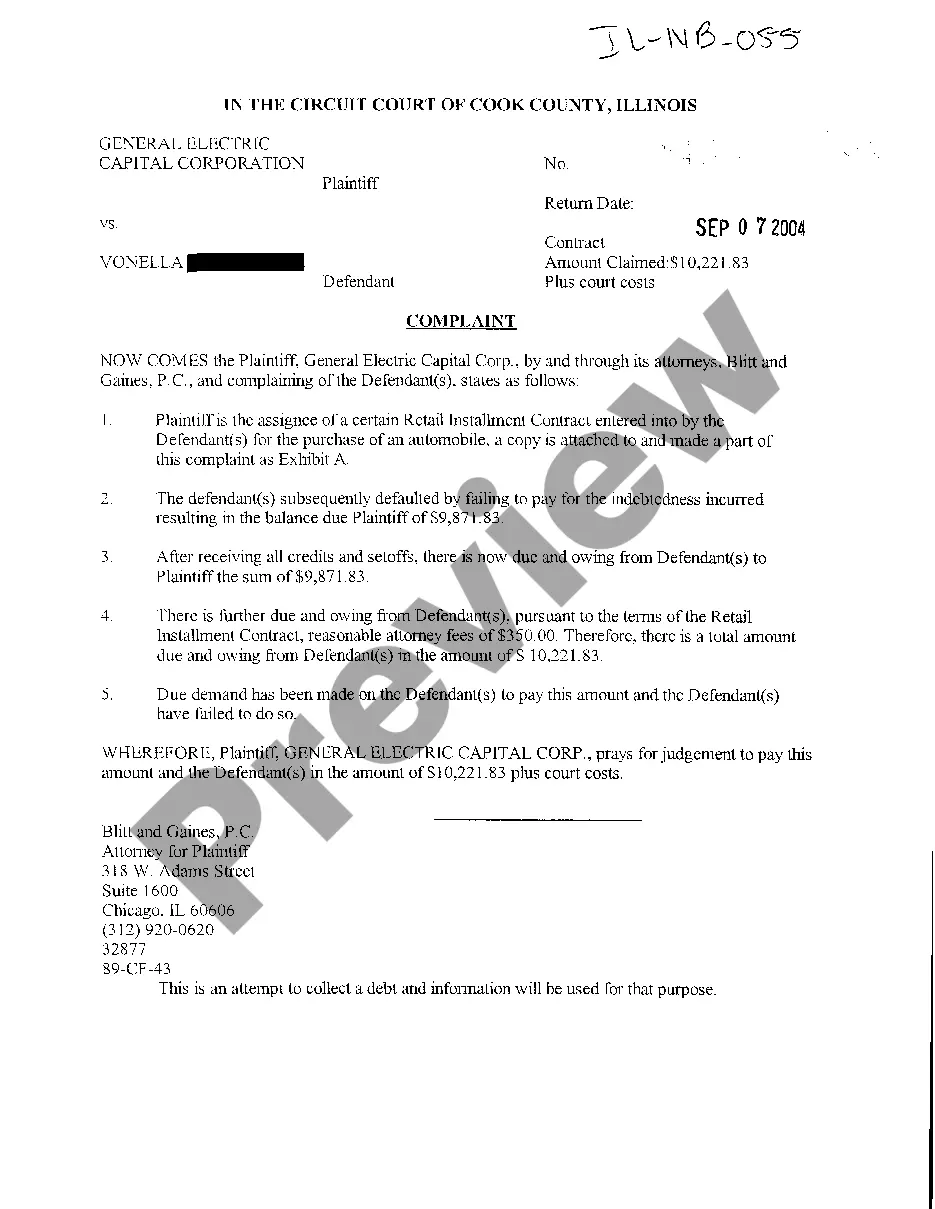

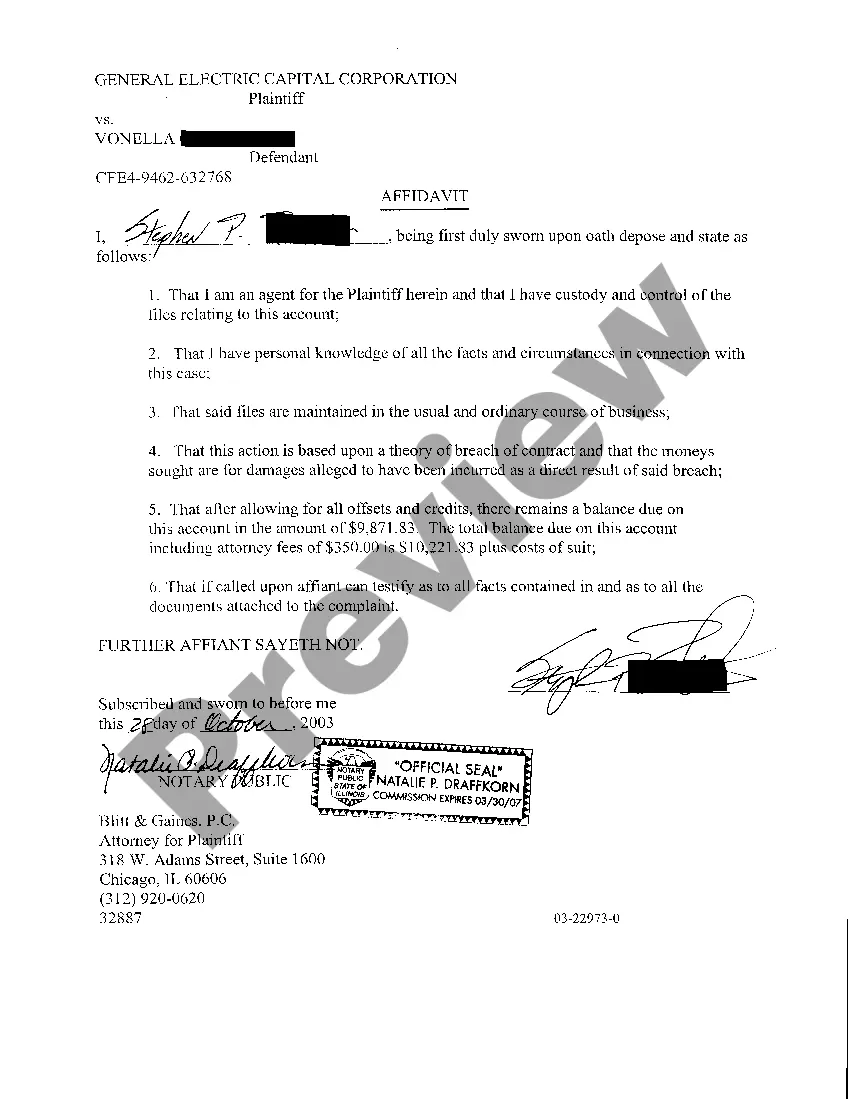

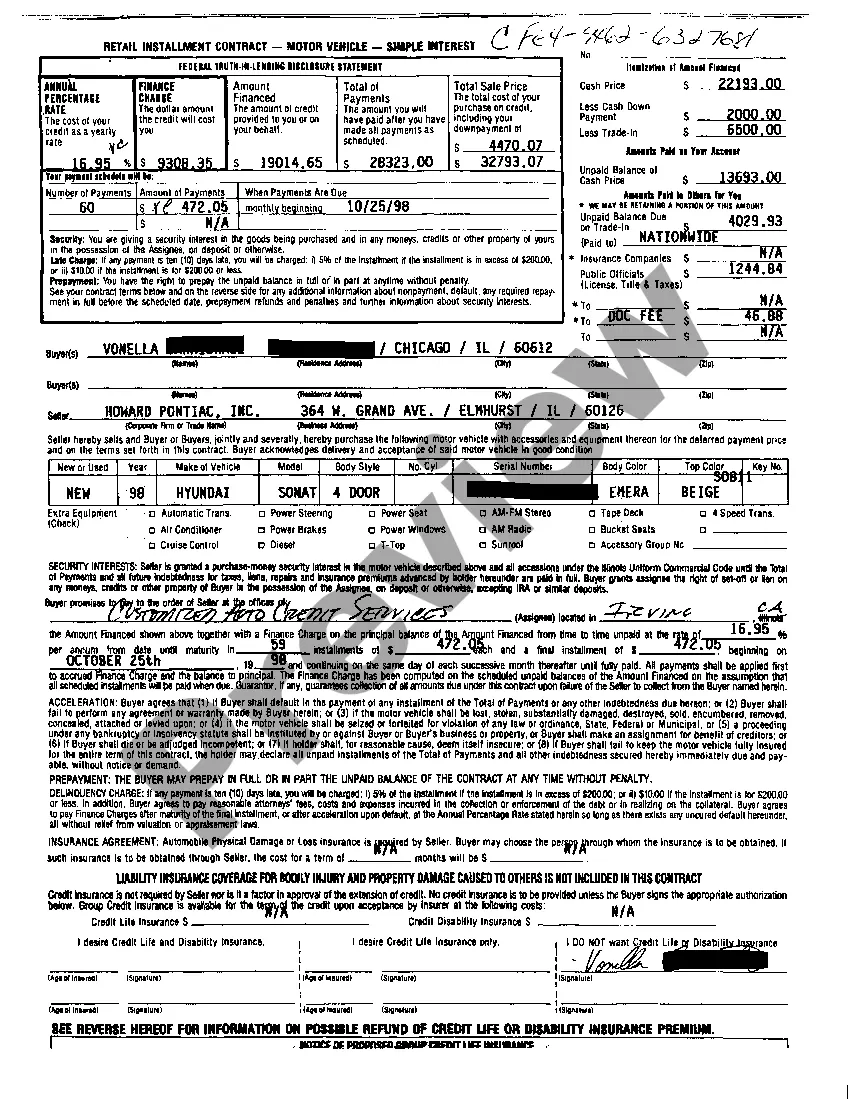

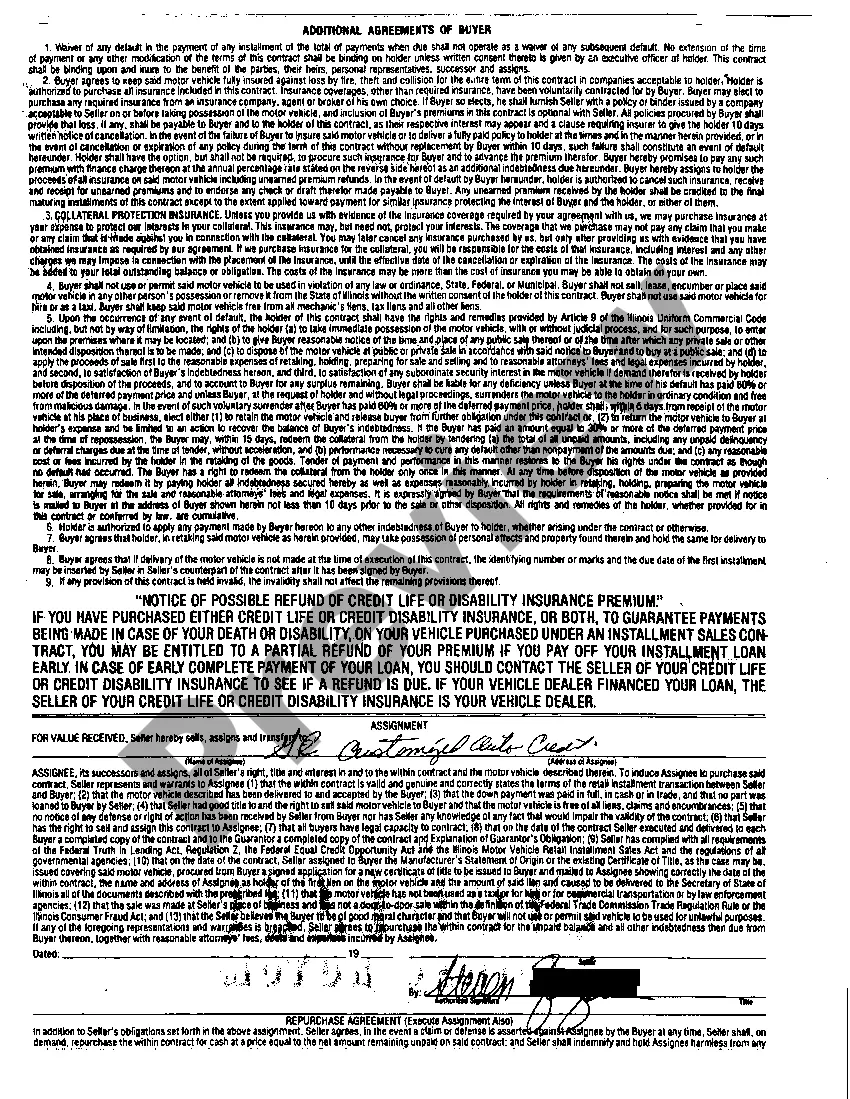

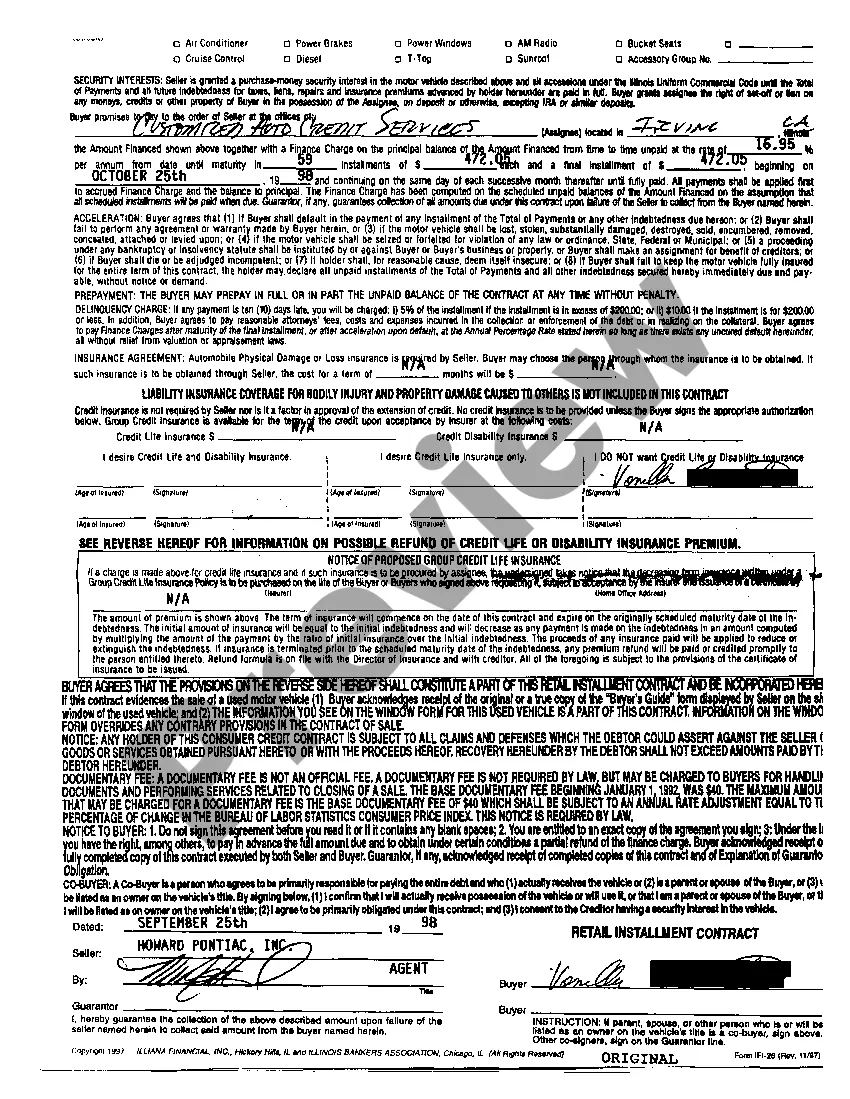

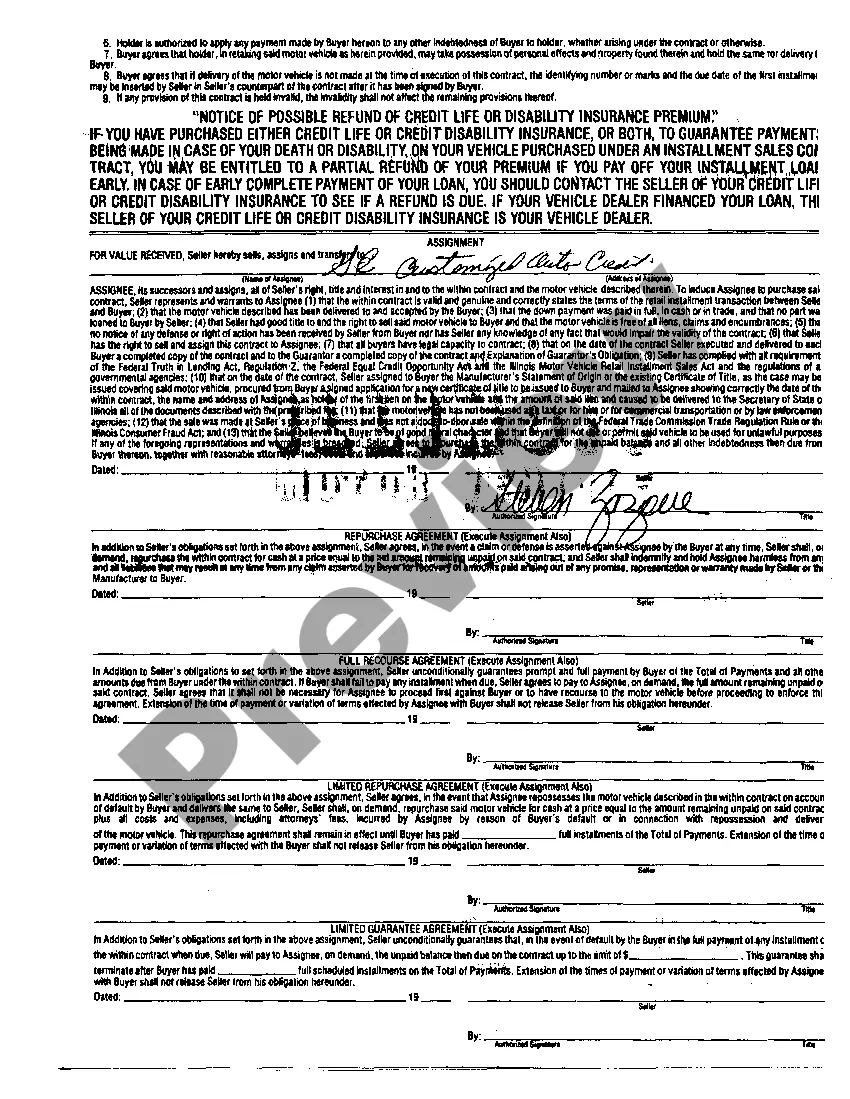

Title: Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract: A Comprehensive Guide Introduction: The Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract is a legal process in which a creditor files a complaint against a debtor for outstanding payments in relation to a retail installment contract. This detailed description will provide an in-depth understanding of this type of complaint, including its process and key considerations involved. Keywords: Rockford Illinois, Complaint, Collect, Balance Due, Retail Installment Contract, creditor, debtor, legal process, outstanding payments, process, key considerations. Types of Rockford Illinois Complaints to Collect Balance Due on Retail Installment Contract: 1. Individual Consumer Complaint: This type of complaint is filed by individual consumers, typically involving agreements made between a consumer and a retailer for the purchase of goods or services on installment payment terms. 2. Business-to-Business Complaint: Businesses may also file complaints against other businesses for outstanding payments on a retail installment contract. This type of complaint involves agreements made between two commercial entities or companies. Key Components of a Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract: 1. Identifying Information: The complaint will include details about both the creditor and the debtor. This typically includes their names, contact information, and any relevant account or contract numbers. 2. Details of the Retail Installment Contract: The complaint should outline the key terms and conditions of the retail installment contract. This may include information about the purchase, payment schedule, interest rates, and any penalties or fees associated with non-payment. 3. Description of the Balance Due: The complaint will specify the outstanding balance owed by the debtor. It should provide a comprehensive breakdown of the principal amount, any accrued interest, late fees, or other charges if applicable. 4. Documentation of Non-Payment Attempts: The creditor will need to provide evidence of their attempts to collect the balance due. This may include copies of invoices, billing statements, correspondence, and records of communication between the creditor and debtor. 5. Revised Payment Plan Proposal: In some cases, the creditor may propose a revised payment plan in the complaint. This could include adjusting the payment schedule or offering a settlement amount to resolve the debt. 6. Legal Action Request: Lastly, the complaint will request that the court takes legal action to enforce the debt collection. This may involve obtaining a judgment, garnishing wages, or placing liens on the debtor's assets. Conclusion: The Rockford Illinois Complaint to Collect Balance Due on a Retail Installment Contract is a critical legal tool for creditors seeking to recover outstanding debts. Understanding the key components and considerations involved in this process is vital for both creditors and debtors. By following the appropriate legal procedures, resolution can be achieved and a fair resolution for all parties involved can be reached.

Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract

Description

How to fill out Rockford Illinois Complaint To Collect Balance Due On Retail Installment Contract?

Make use of the US Legal Forms and get immediate access to any form template you want. Our useful platform with a large number of documents makes it easy to find and get almost any document sample you need. It is possible to download, fill, and sign the Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract in a matter of minutes instead of browsing the web for hours seeking the right template.

Using our collection is a superb way to increase the safety of your document submissions. Our experienced attorneys on a regular basis review all the records to make sure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you view. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Open the page with the form you need. Make certain that it is the template you were looking for: examine its headline and description, and utilize the Preview option when it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading procedure. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Indicate the format to get the Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract and change and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy document libraries on the internet. Our company is always ready to assist you in virtually any legal process, even if it is just downloading the Rockford Illinois Complaint to Collect Balance Due on Retail Installment Contract.

Feel free to take advantage of our service and make your document experience as efficient as possible!