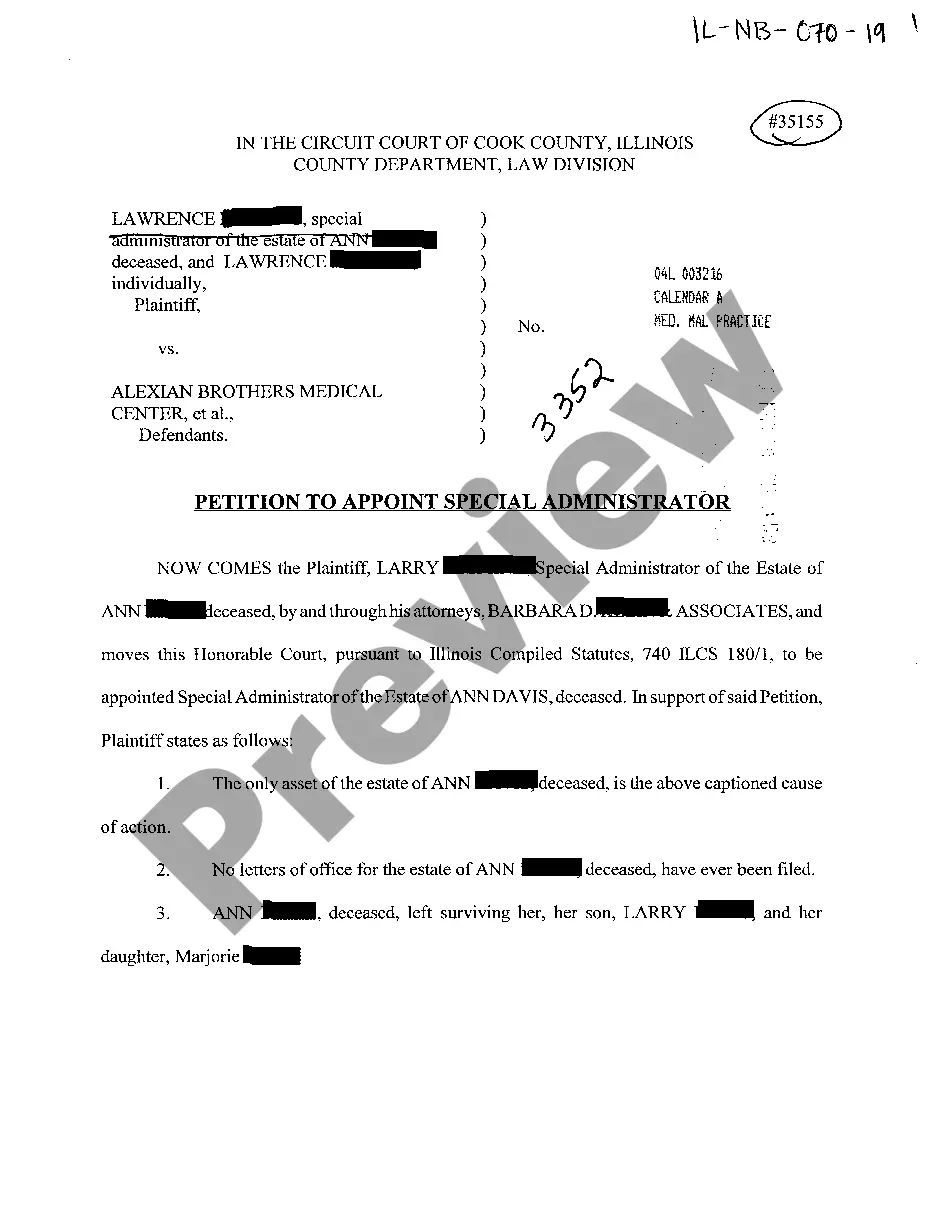

The Joliet Illinois Petition to Appoint Special Administrator is a legal document that individuals in Joliet, Illinois can file in probate court when there is a need to appoint a special administrator for a deceased person's estate. This petition is crucial and necessary in cases where there is no appointed executor or when the appointed executor is unable or unwilling to fulfill their duties. Filing a Joliet Illinois Petition to Appoint Special Administrator involves various steps and requires gathering specific information. The petitioner, usually a family member or interested party, must include the deceased individual's full name, date of death, and last known address. Additionally, the petition should outline the reasons why a special administrator is needed and provide any evidence supporting this request. There are several types of Joliet Illinois Petition to Appoint Special Administrator, categorized based on the circumstances of the need for the special administrator: 1. Lack of Executor: This type of petition is filed when the deceased person did not appoint an executor in their will or failed to leave behind a valid will. Without an executor, a special administrator is required to manage the estate's affairs. 2. Incapacitated Executor: In cases where the appointed executor is physically or mentally incapacitated, unable to fulfill their duties, or has passed away before fully administrating the estate, a petition can be filed to appoint a special administrator to handle the remaining tasks. 3. Conflicting Interests: When conflicts arise between potential executors or interested parties regarding the administration of the estate, a petition may be submitted to appoint a neutral and unbiased special administrator. This can help ensure fairness and prevent potential disputes. Overall, the Joliet Illinois Petition to Appoint Special Administrator is an important legal instrument used to ensure the efficient, fair, and lawful administration of a deceased individual's estate when a regular executor cannot fulfill their obligations. It provides a viable solution to estate administration difficulties and guarantees the proper distribution of assets according to the applicable laws and the decedent's intentions.

Joliet Illinois Petition to Appoint Special Administrator

Description

How to fill out Joliet Illinois Petition To Appoint Special Administrator?

Benefit from the US Legal Forms and get instant access to any form sample you want. Our helpful platform with thousands of document templates makes it easy to find and get almost any document sample you want. It is possible to export, complete, and certify the Joliet Illinois Petition to Appoint Special Administrator in just a couple of minutes instead of browsing the web for several hours searching for a proper template.

Using our collection is a wonderful way to raise the safety of your form submissions. Our professional attorneys on a regular basis review all the records to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you obtain the Joliet Illinois Petition to Appoint Special Administrator? If you have a profile, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can find all the earlier saved documents in the My Forms menu.

If you haven’t registered a profile yet, stick to the instructions listed below:

- Find the template you need. Make certain that it is the template you were seeking: verify its name and description, and utilize the Preview option when it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Save the document. Pick the format to obtain the Joliet Illinois Petition to Appoint Special Administrator and revise and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy template libraries on the web. We are always happy to assist you in any legal process, even if it is just downloading the Joliet Illinois Petition to Appoint Special Administrator.

Feel free to benefit from our service and make your document experience as convenient as possible!