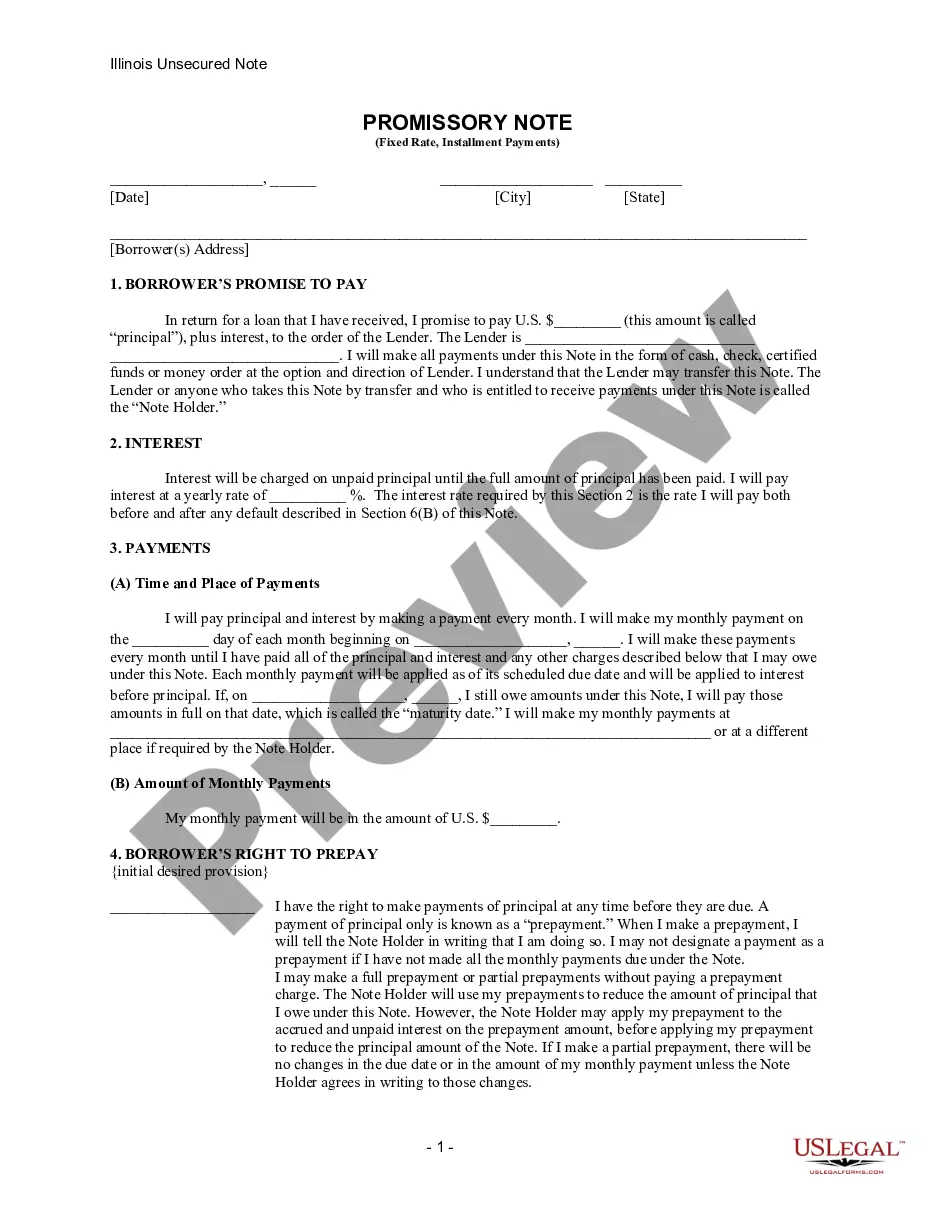

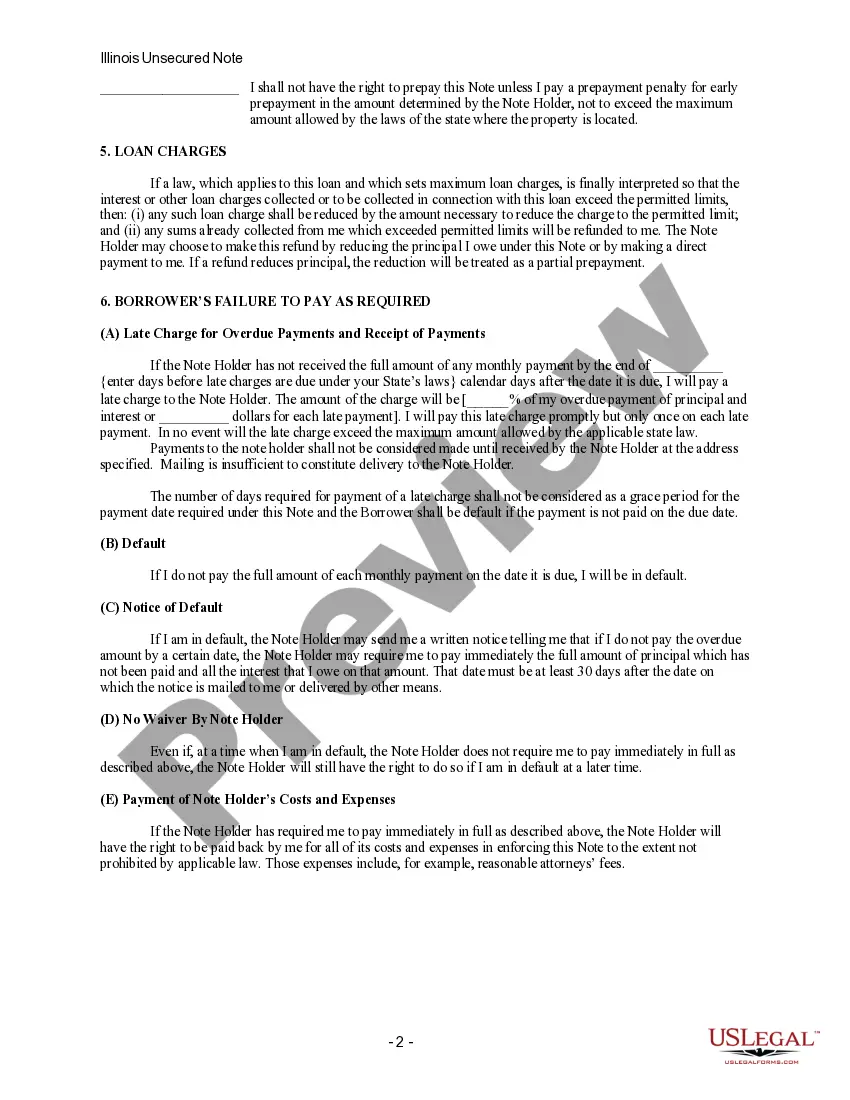

Keywords: Naperville Illinois, Unsecured Installment Payment Promissory Note, Fixed Rate, types Title: Understanding the Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate Introduction: In the city of Naperville, Illinois, individuals and businesses often utilize unsecured installment payment promissory notes to secure loans. These notes provide a formal agreement between a lender and a borrower, ensuring repayment over a specific period. This article will delve into the details of the Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate to provide a comprehensive understanding. Additionally, we will explore different types of these notes available to borrowers in the region. 1. What is a Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate? The Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate is a legal contract that establishes the terms and conditions for a loan. It is typically used when borrowers require funds without providing collateral. This note outlines the repayment schedule, interest rate, and other crucial details for both parties involved. 2. Key Components of the Note: — Principal Amount: The initial sum borrowed by the borrower, which is documented in the promissory note. — Interest Rate: The fixed rate that accrues on the outstanding balance throughout the loan duration. — Installment Payments: The agreed-upon periodic payments made by the borrower to repay the loan over a set period. — Due Dates: The specified dates on which installment payments are due. — Late Payments: Penalties or fees imposed by the lender in case of delayed or missed payments. — Maturity Date: The final date by which the borrower must repay the full outstanding balance. — Legal Provisions: Clauses outlining the dispute resolution process, governing law, and any additional terms to protect both parties' rights. 3. Types of Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate: a. Personal Loan Promissory Note: Used for personal loans between individuals, often for purposes such as financing educational expenses, home improvements, or debt consolidation. b. Business Loan Promissory Note: Employed for loans between businesses, encompassing funding for expansion, working capital, or equipment purchases. c. Student Loan Promissory Note: Specifically designed for educational expenses, often involving financial institutions, government agencies, or educational institutions. d. Medical Loan Promissory Note: Tailored to cover medical costs, including elective procedures, medical bills, or emergency expenses. e. Auto Loan Promissory Note: Pertaining to loans granted to finance the purchase of vehicles, including cars, motorcycles, or recreational vehicles. Conclusion: The Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate serves as a vital legal document for borrowers and lenders alike. Understanding its components and various types of promissory notes available can help borrowers make informed financial decisions. Whether seeking funds for personal, business, education, medical, or auto-related purposes, individuals in Naperville can benefit from familiarizing themselves with the specific terms and conditions of these promissory notes.

Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Naperville Illinois Unsecured Installment Payment Promissory Note For Fixed Rate?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for attorney solutions that, usually, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Naperville Illinois Unsecured Installment Payment Promissory Note for Fixed Rate is suitable for you, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!