This package contains the following forms:

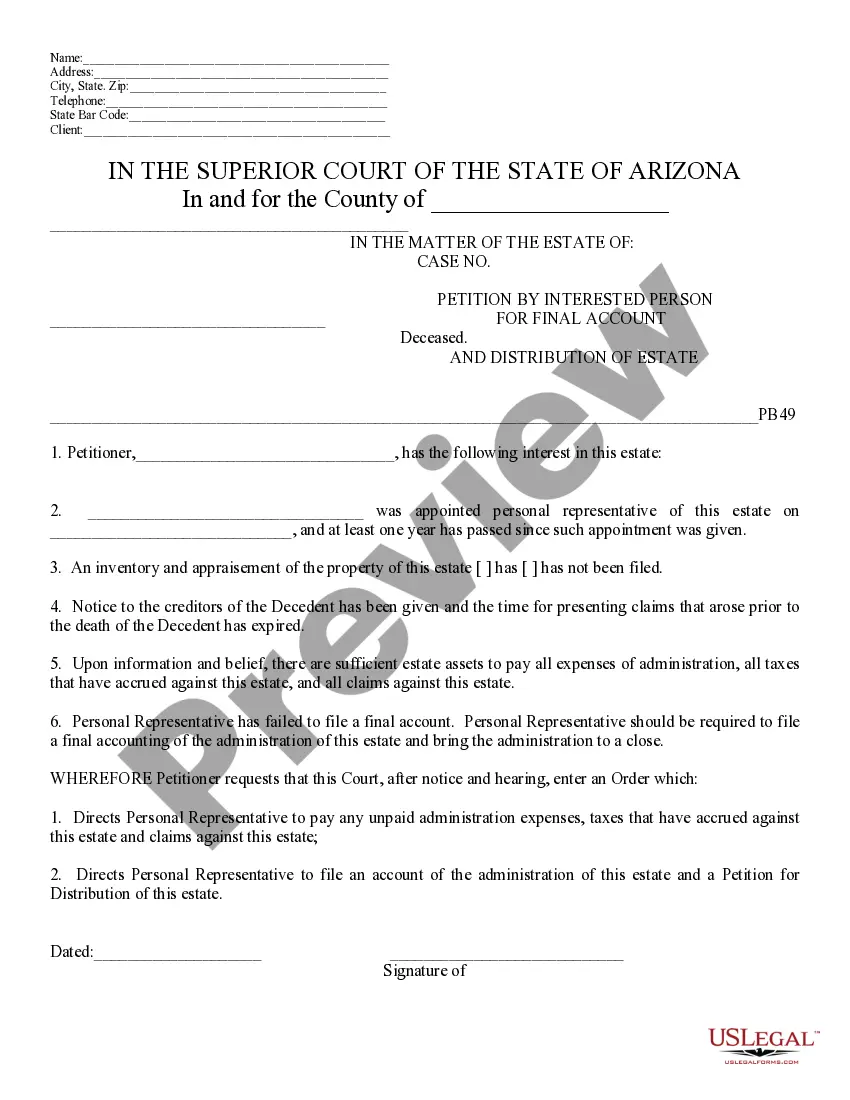

1) Agreement for Sale of Business- Sole Proprietorship

2) Asset Purchase Agreement

3) Bill of Sale for Personal Assets

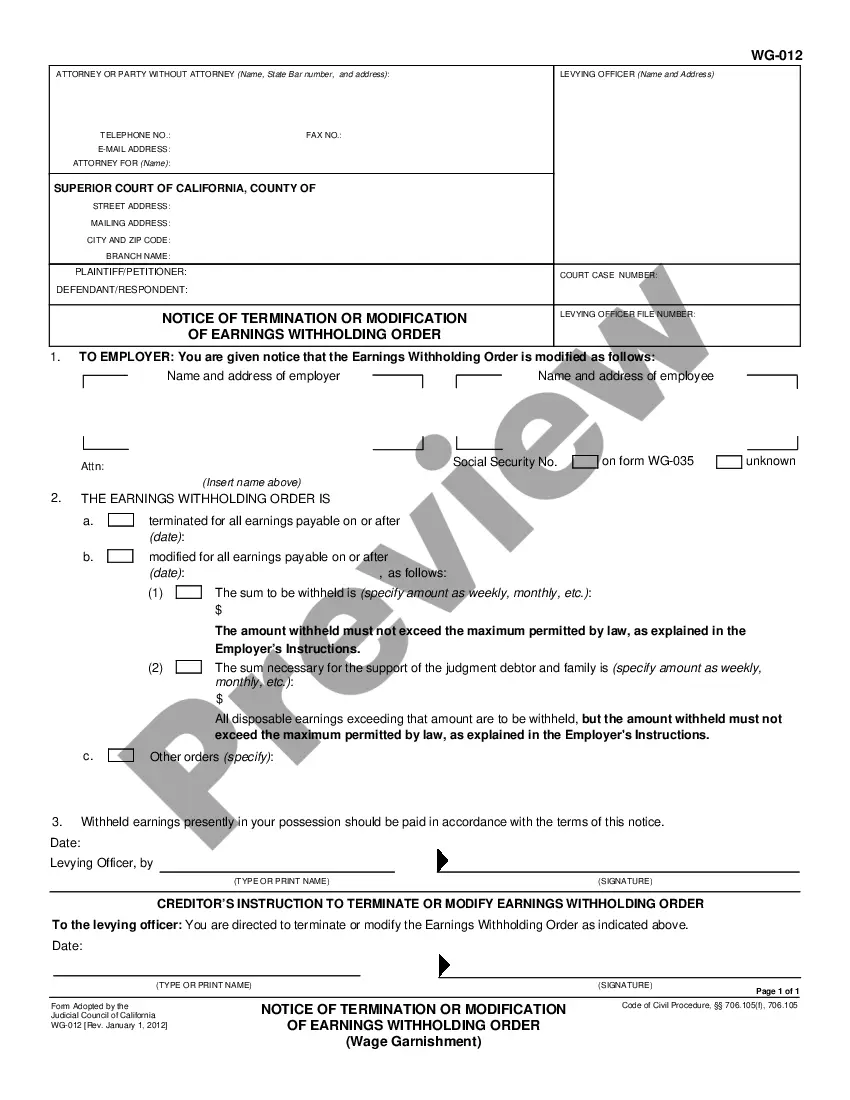

4) Promissory Note

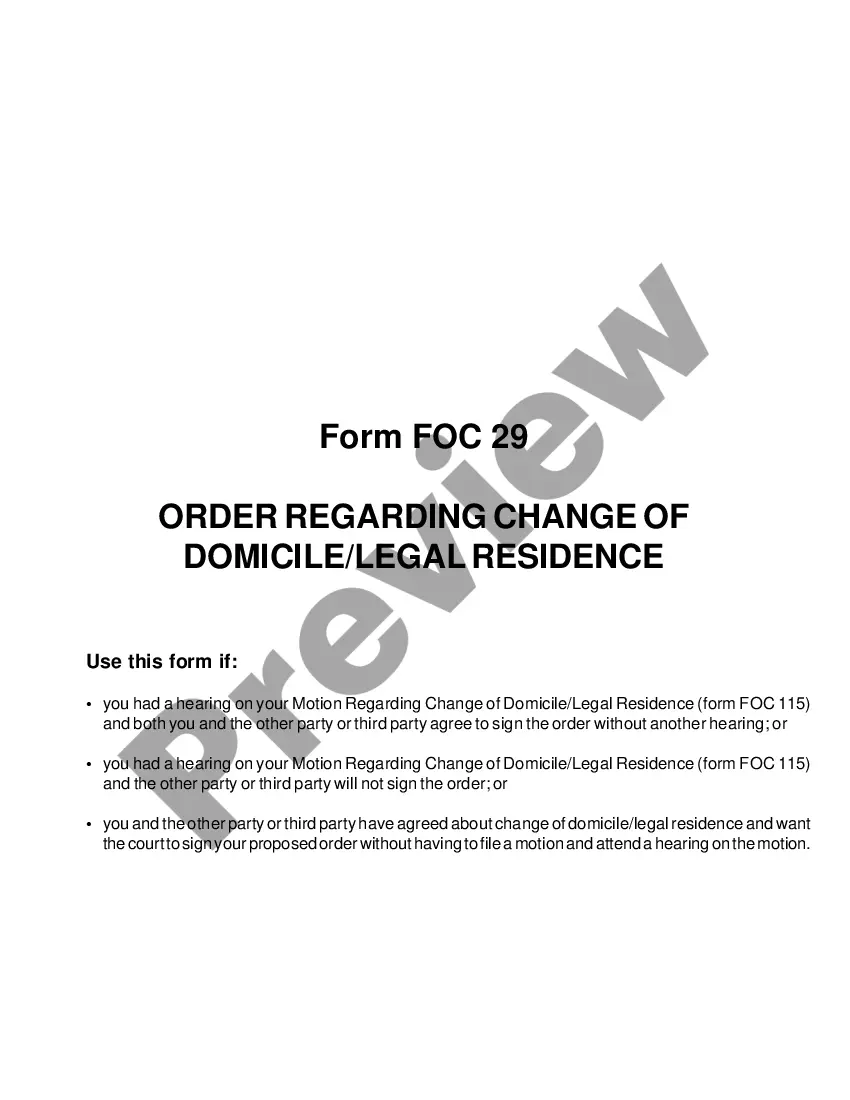

5) Landlord's Consent to Assignment of Lease

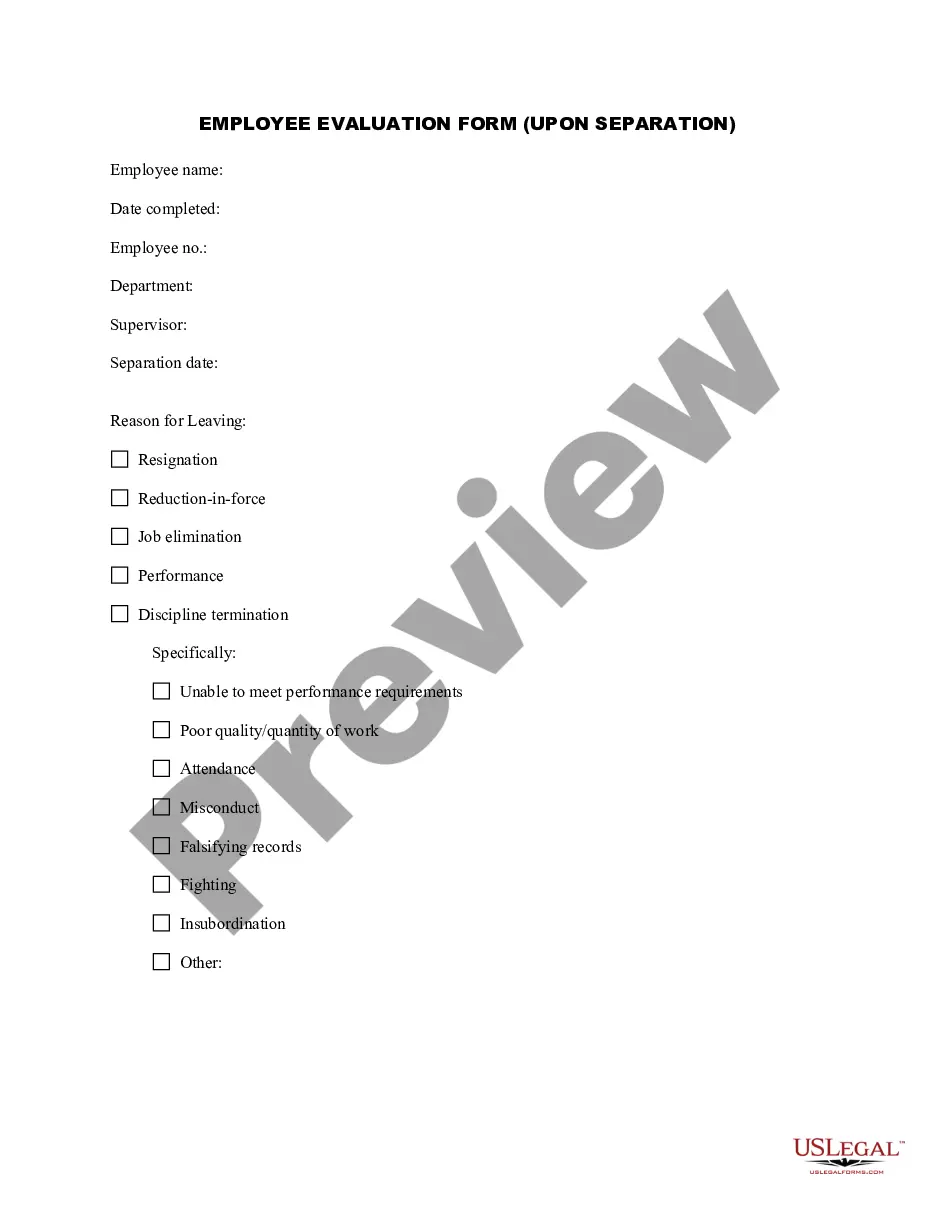

6) Retained Employees Agreement

7) Noncompetition Covenant by Seller

8) Profit and Loss Statement

9) Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Purchase this package and save up to 40% over purchasing the forms separately!

The Chicago Illinois Sale of a Business Package is a comprehensive set of legal documents and forms specifically tailored for individuals or entities looking to buy or sell a business in the state of Illinois, particularly in the city of Chicago. These packages provide all the necessary paperwork and guidelines to ensure a smooth and legally compliant transaction. Key features of the Chicago Illinois Sale of a Business Package include: 1. Purchase and Sale Agreement: This document serves as the backbone of the transaction, outlining the terms and conditions of the sale, including the purchase price, payment terms, warranties, and representations of both parties, and any contingencies. 2. Bill of Sale: This legally transfers the ownership of the business from the seller to the buyer. It includes detailed descriptions of the assets being sold, such as inventory, equipment, intellectual property, and customer lists. 3. Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), it protects the sensitive information shared during the negotiation process from being disclosed to third parties or competitors. 4. Promissory Note: If the buyer agrees to pay the purchase price in installments or through financing, a promissory note is used. It specifies the terms of the loan, including interest rate, repayment schedule, and other conditions. 5. Employment Agreement: If the buyer intends to retain some current employees after the sale, an employment agreement can be included in the package. This outlines the terms of employment, including compensation, benefits, duties, and duration. 6. Closing Statement: This document summarizes the financial aspects of the transaction, including the final purchase price, adjustments for inventory and working capital, prorations, and closing costs. It ensures transparency and accuracy in the financial settlement. Other optional documents that can be included in the Chicago Illinois Sale of a Business Package may vary depending on the specifics of the transaction, such as: — Lease Agreement Assignment: If the business operates from a leased property, an assignment agreement may be necessary to transfer the lease to the buyer, subject to the landlord's approval. — Non-Compete Agreement: This document restricts the seller from engaging in a similar business that could compete with the purchased business within a specified geographic area and timeframe. — Due Diligence Checklist: A list of documents and information that the buyer should review and verify before finalizing the purchase, including financial statements, tax returns, licenses, contracts, permits, and other relevant records. Overall, the Chicago Illinois Sale of a Business Package provides a comprehensive and customizable set of legal documents to effectively facilitate the purchase or sale of a business in the city of Chicago, ensuring compliance with relevant laws and protecting the rights and interests of both parties involved in the transaction.