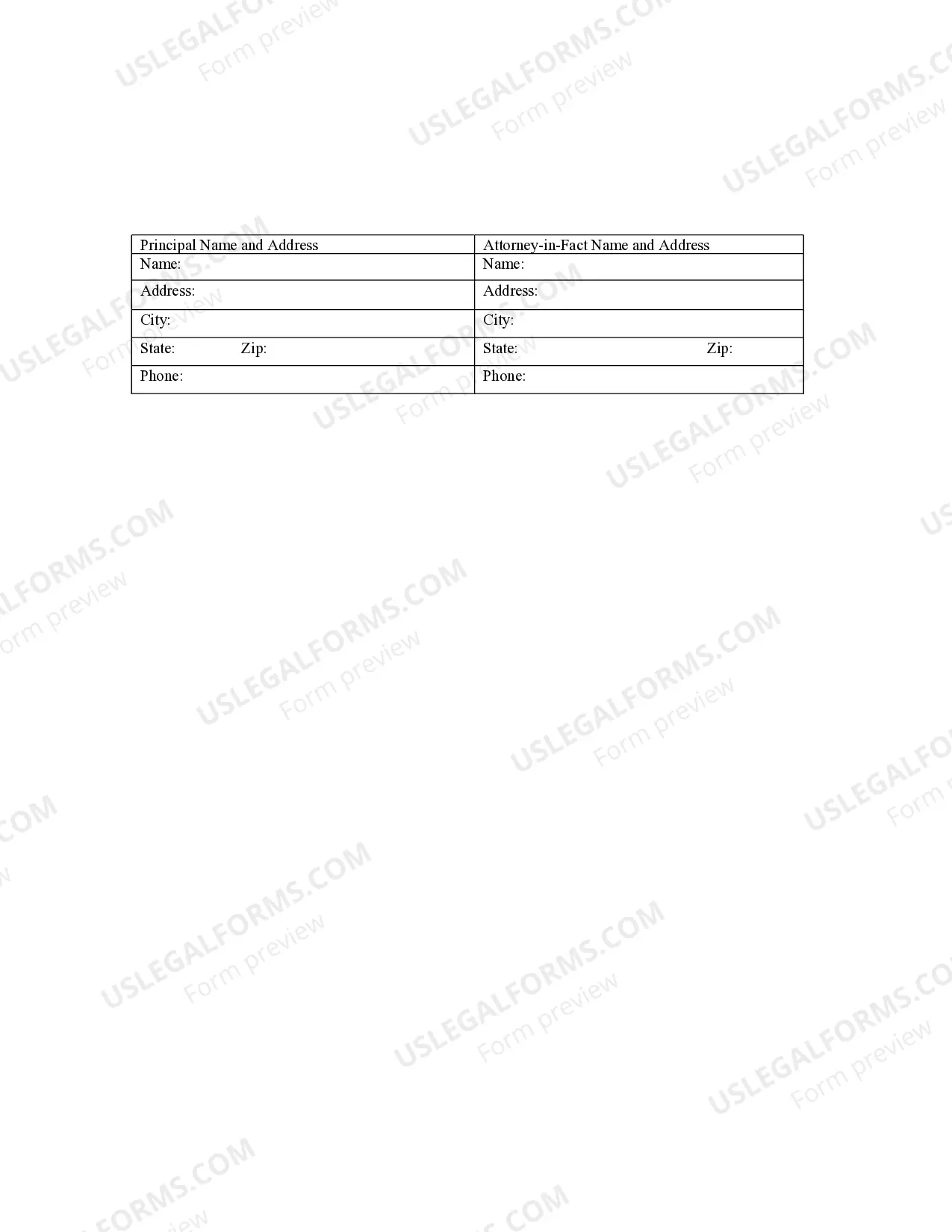

A Chicago Illinois Special Durable Power of Attorney for Bank Account Matters is a legal document that grants authority to an appointed individual, known as the attorney-in-fact, to handle specific bank account matters on behalf of the principal, who is the person creating the power of attorney. This type of power of attorney is specifically designed to address various financial transactions related to bank accounts. It allows the attorney-in-fact to make decisions and take actions regarding the principal's bank accounts, including but not limited to accessing funds, depositing or withdrawing money, transferring funds between accounts or banks, signing checks, managing investments, and dealing with any other matters related to the principal's banking activities. The term "special" in the document refers to the fact that the powers granted are limited to bank account matters only and do not extend to other areas of the principal's finances or personal affairs. The term "durable" indicates that the power of attorney remains in effect even if the principal becomes incapacitated or unable to make decisions on their own. This can be particularly essential in cases where the principal becomes physically or mentally incapable of managing their own bank accounts, ensuring that someone they trust can handle these matters on their behalf. Different types of Chicago Illinois Special Durable Power of Attorney for Bank Account Matters may exist to cater to specific situations or preferences of the principal. For example, there may be options for the power of attorney to be effective immediately upon signing, or it could only come into effect upon the occurrence of a specific event, such as the principal's incapacitation. It is important for the principal to carefully consider the powers they wish to grant to the attorney-in-fact and clearly specify those powers in the document. They should also select a trustworthy and responsible individual to act as their attorney-in-fact, as this person will have access to their bank accounts and be responsible for managing their financial affairs. Additionally, it is recommended that the principal consult with an attorney specializing in estate planning or elder law to ensure that the power of attorney document complies with all Chicago and Illinois laws and is tailored to their specific needs and circumstances.

Chicago Attorney Bank

Description chicago attorney poa

How to fill out Chicago Illinois Special Durable Power Of Attorney For Bank Account Matters?

If you are searching for a relevant form, it’s extremely hard to find a better place than the US Legal Forms website – probably the most extensive libraries on the internet. With this library, you can find a large number of form samples for business and personal purposes by categories and regions, or keywords. With our advanced search option, finding the newest Chicago Illinois Special Durable Power of Attorney for Bank Account Matters is as easy as 1-2-3. Furthermore, the relevance of each and every record is confirmed by a group of expert attorneys that regularly review the templates on our website and update them based on the latest state and county laws.

If you already know about our platform and have an account, all you should do to receive the Chicago Illinois Special Durable Power of Attorney for Bank Account Matters is to log in to your user profile and click the Download button.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have chosen the sample you want. Look at its description and use the Preview feature (if available) to see its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to discover the needed document.

- Confirm your decision. Click the Buy now button. After that, choose your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Chicago Illinois Special Durable Power of Attorney for Bank Account Matters.

Each form you save in your user profile has no expiration date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you want to have an additional duplicate for enhancing or creating a hard copy, feel free to come back and download it once again whenever you want.

Make use of the US Legal Forms professional library to gain access to the Chicago Illinois Special Durable Power of Attorney for Bank Account Matters you were looking for and a large number of other professional and state-specific templates in one place!