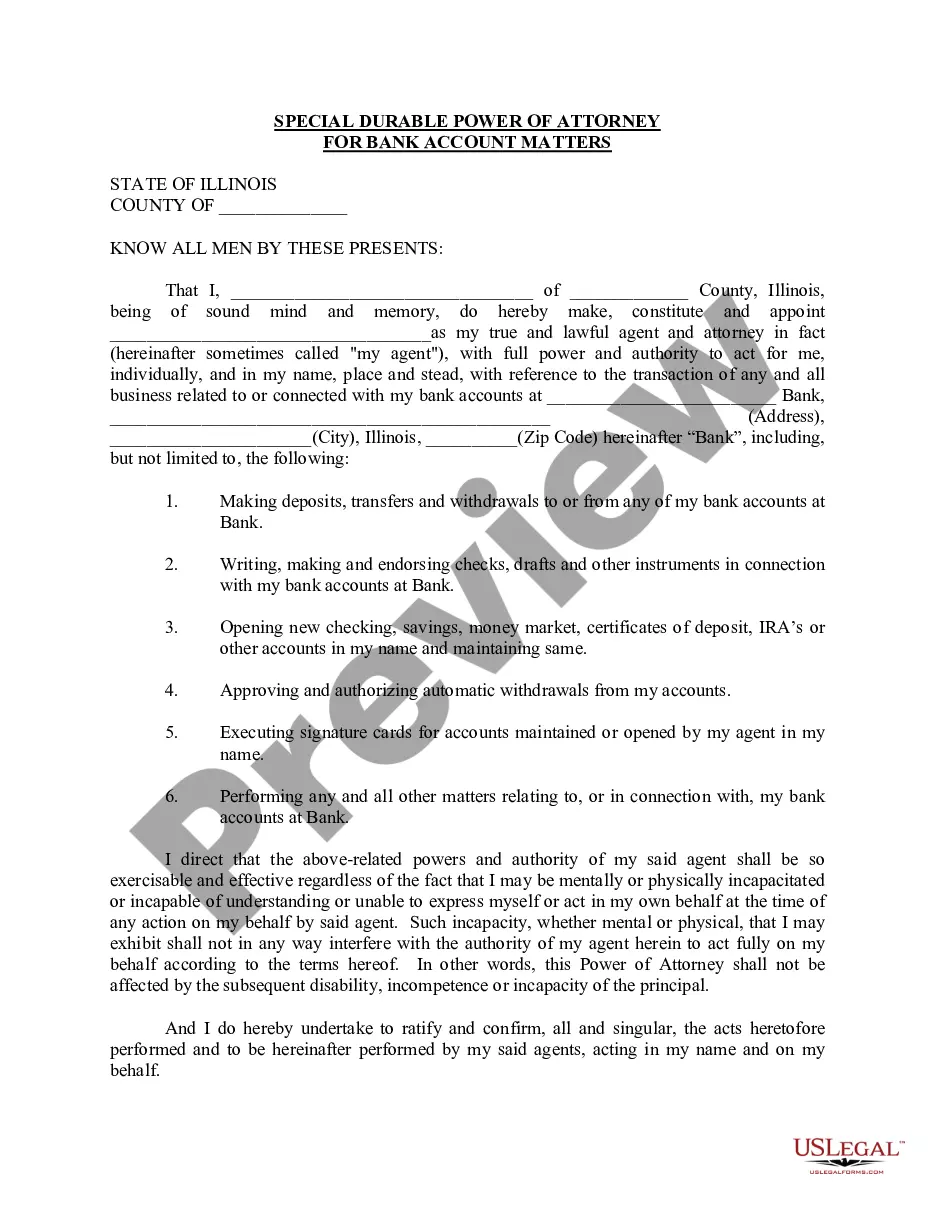

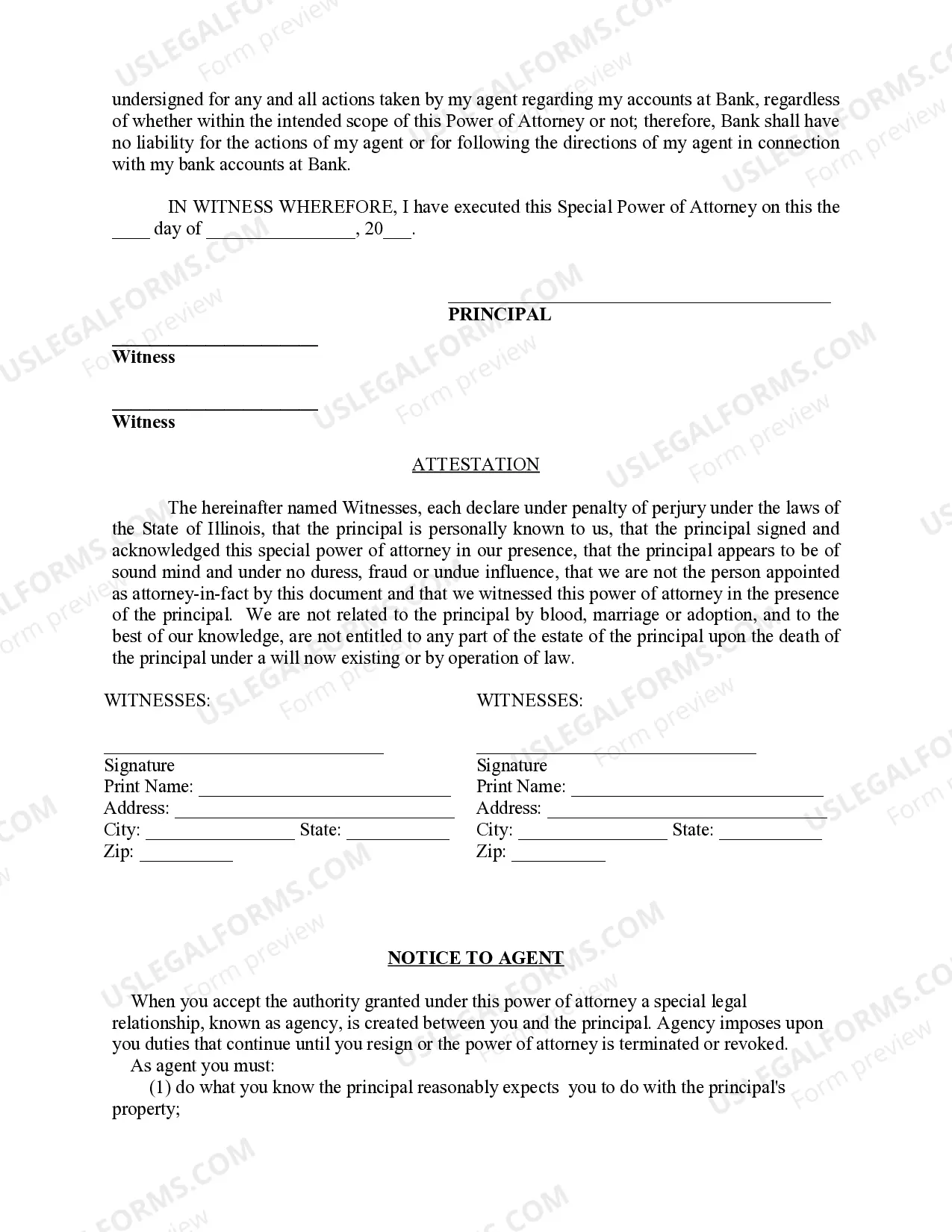

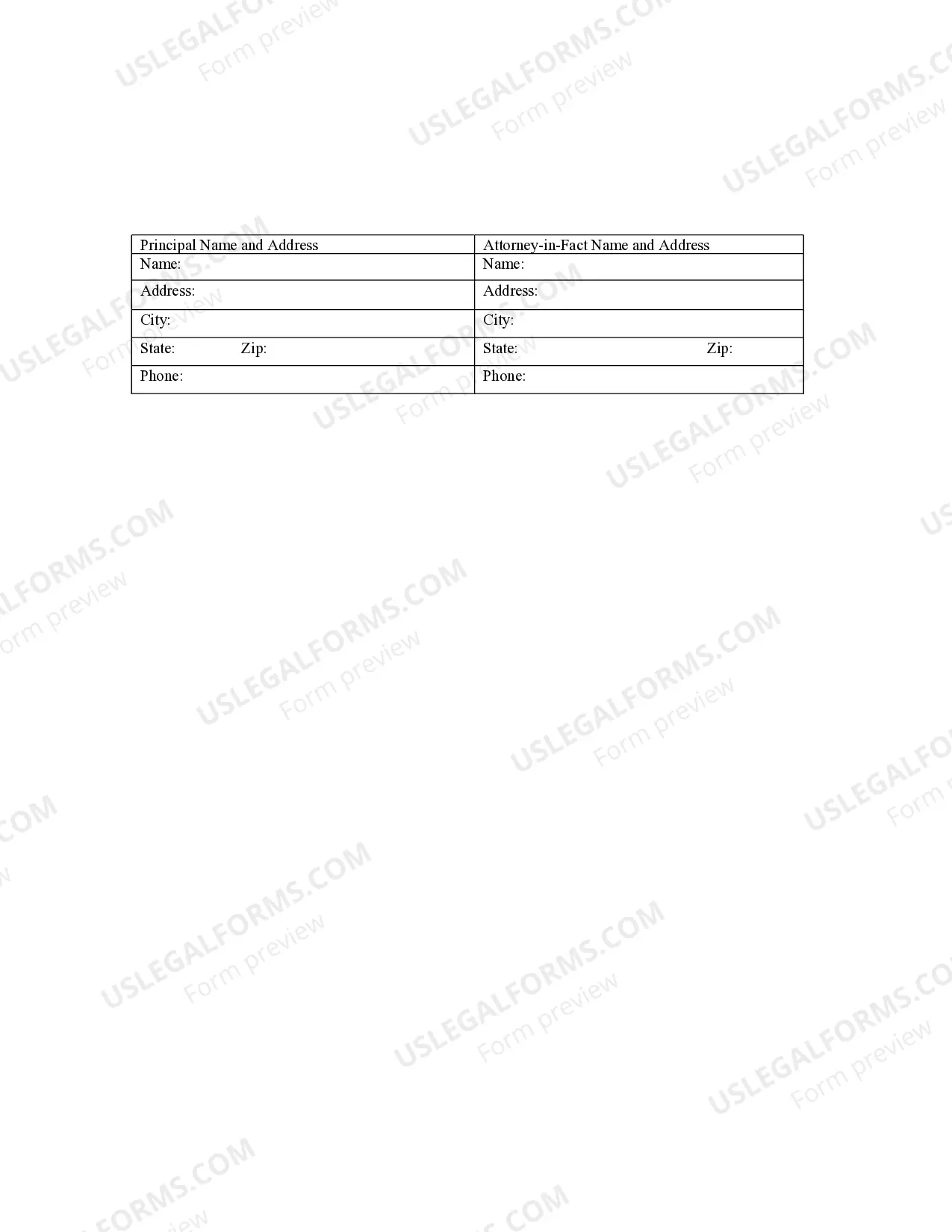

A Joliet Illinois Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual, referred to as the agent or attorney-in-fact, the authority to make financial decisions on behalf of another person, known as the principal. This specific type of power of attorney is designed to specifically address bank account matters. The Joliet Illinois Special Durable Power of Attorney for Bank Account Matters allows the agent to manage the principal's bank accounts, including making deposits, withdrawals, transfers, and any other transactions related to their financial accounts. This document gives the agent the power to access and manage funds, pay bills, and handle other financial responsibilities on behalf of the principal. Joliet Illinois offers several types of Special Durable Power of Attorney for Bank Account Matters to cater to different situations and preferences. These may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This grants the agent limited authority to only manage specific bank accounts or perform certain financial transactions specified in the document. It restricts the agent's power to a specific scope outlined by the principal. 2. Full Special Durable Power of Attorney for Bank Account Matters: This provides the agent with comprehensive authority over all the principal's bank accounts and financial matters. The agent has unrestricted power to act on behalf of the principal in all bank account-related transactions. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only under specific circumstances stated in the document, usually when the principal becomes incapacitated or unable to manage their bank accounts independently. Until the triggering event occurs, the agent does not possess any powers or authority. When creating a Joliet Illinois Special Durable Power of Attorney for Bank Account Matters, it is essential to define the agent's powers and responsibilities explicitly. This should include clear instructions on how the agent should manage the bank accounts, any limitations or restrictions on their authority, and the duration of the power granted. It is crucial to consult with a qualified attorney to properly draft and execute this legal document to ensure compliance with applicable laws and regulations.

Joliet Illinois Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Joliet Illinois Special Durable Power Of Attorney For Bank Account Matters?

Do you need a reliable and inexpensive legal forms provider to buy the Joliet Illinois Special Durable Power of Attorney for Bank Account Matters? US Legal Forms is your go-to choice.

No matter if you need a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Joliet Illinois Special Durable Power of Attorney for Bank Account Matters conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is good for.

- Start the search over in case the template isn’t suitable for your specific situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Joliet Illinois Special Durable Power of Attorney for Bank Account Matters in any available file format. You can return to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal papers online once and for all.