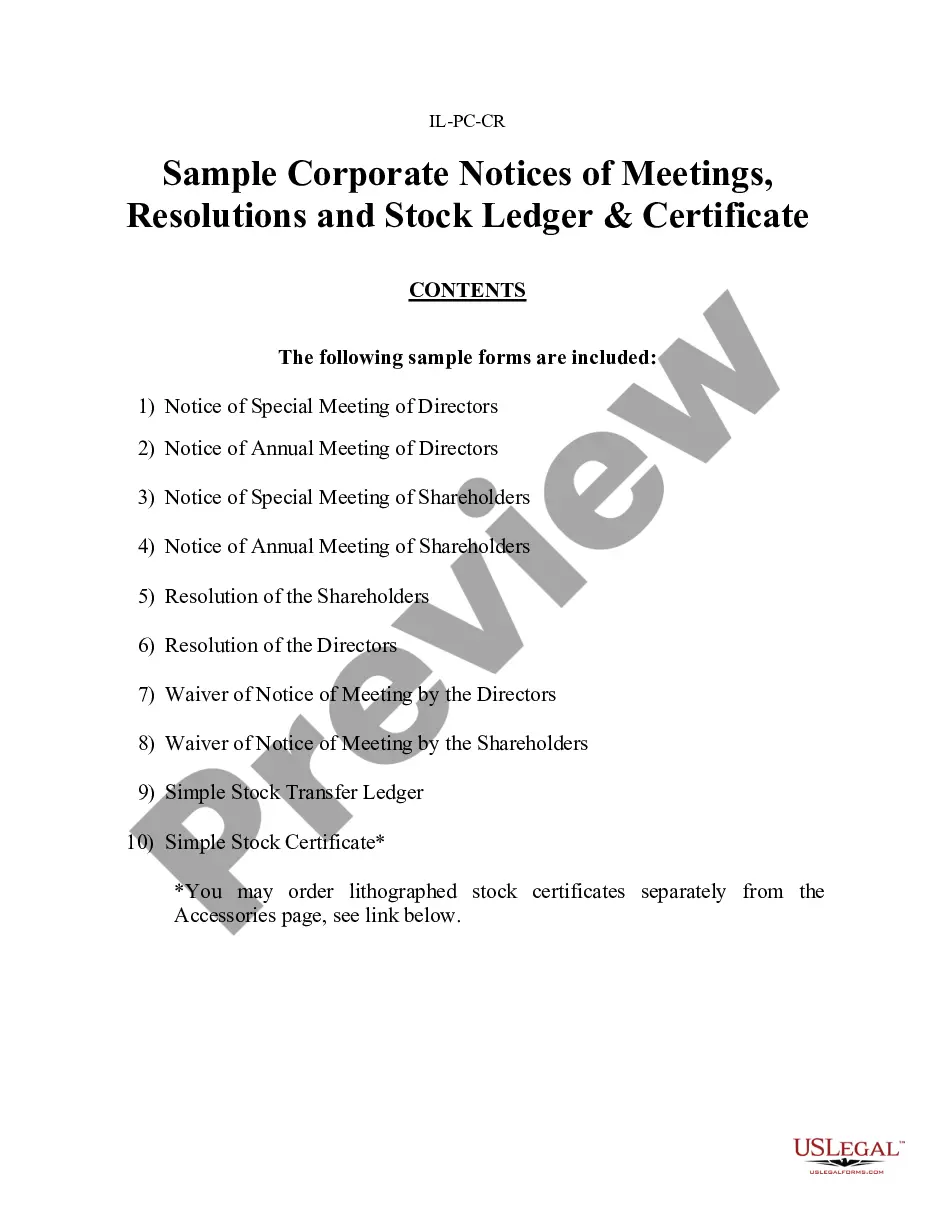

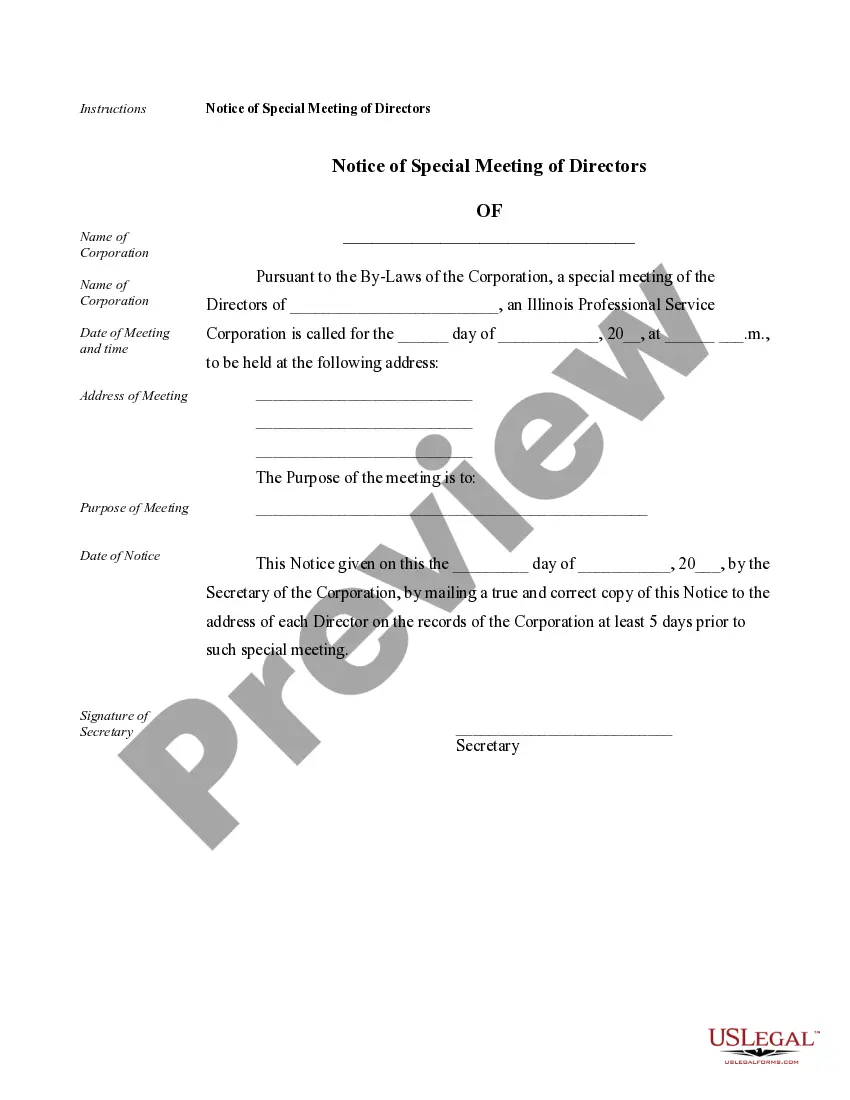

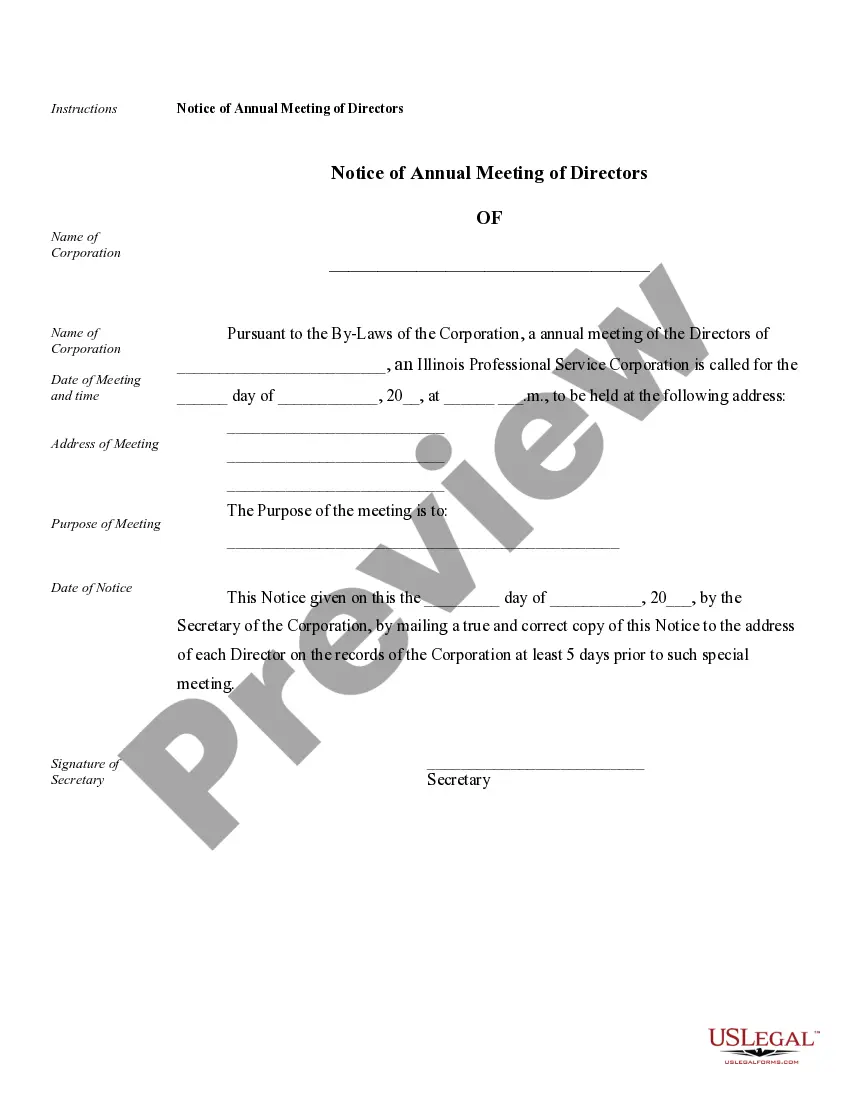

Chicago Annual Minutes for an Illinois Professional Corporation

Description

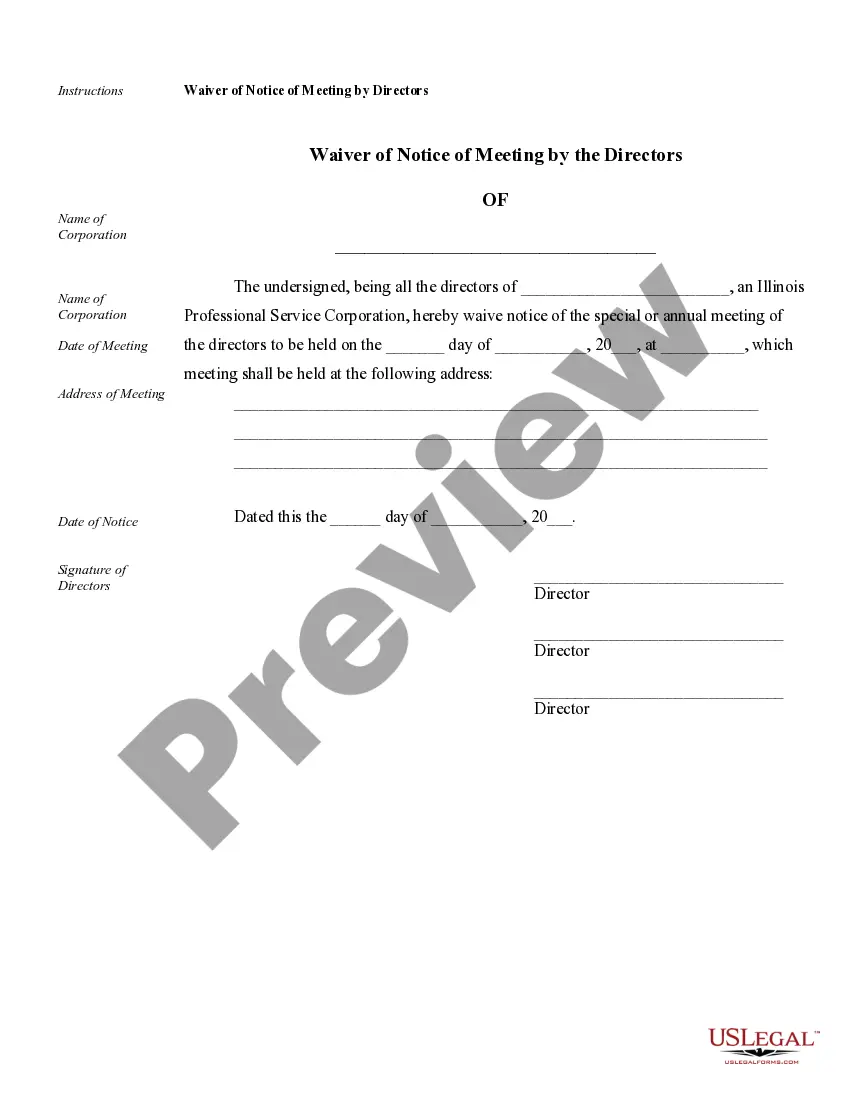

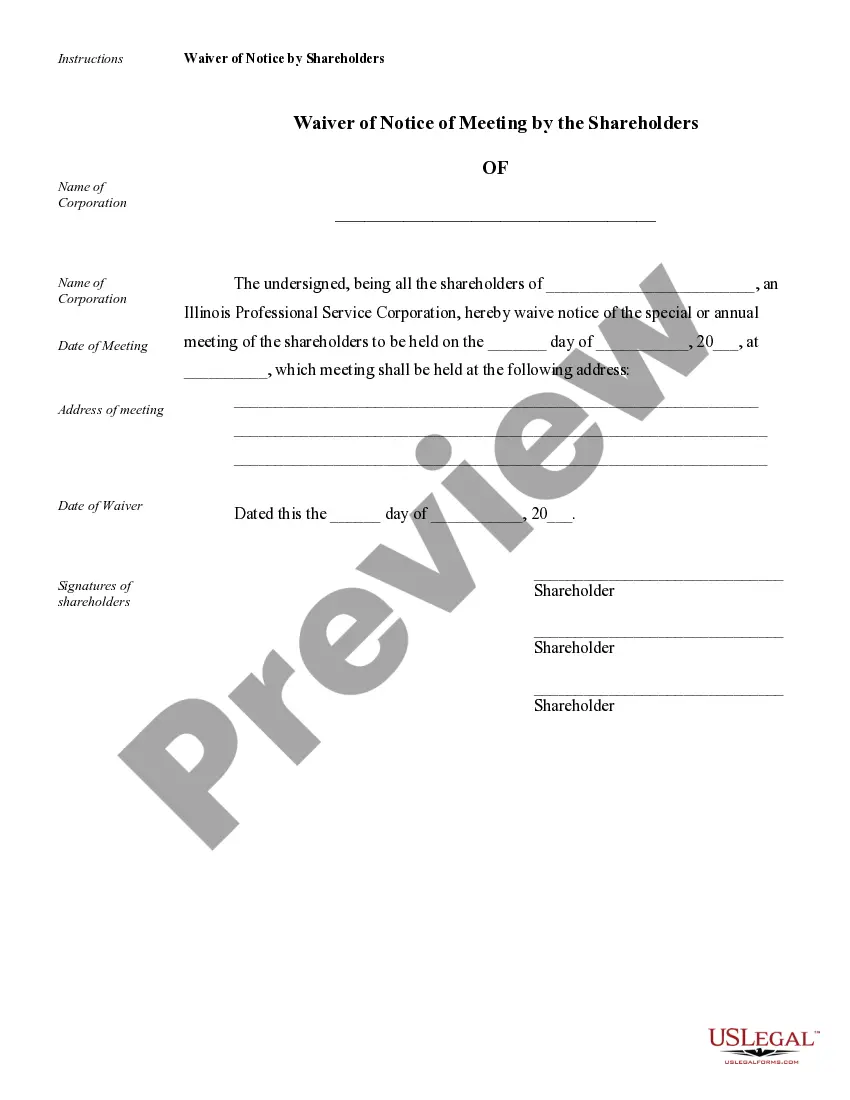

How to fill out Annual Minutes For An Illinois Professional Corporation?

If you have previously engaged our service, Log In to your account and download the Chicago Annual Minutes for an Illinois Professional Corporation onto your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it based on your payment arrangement.

If this is your initial experience with our service, follow these straightforward steps to acquire your file.

You have continuous access to all documents purchased: you can find them in your profile under the My documents section whenever you need to access them again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

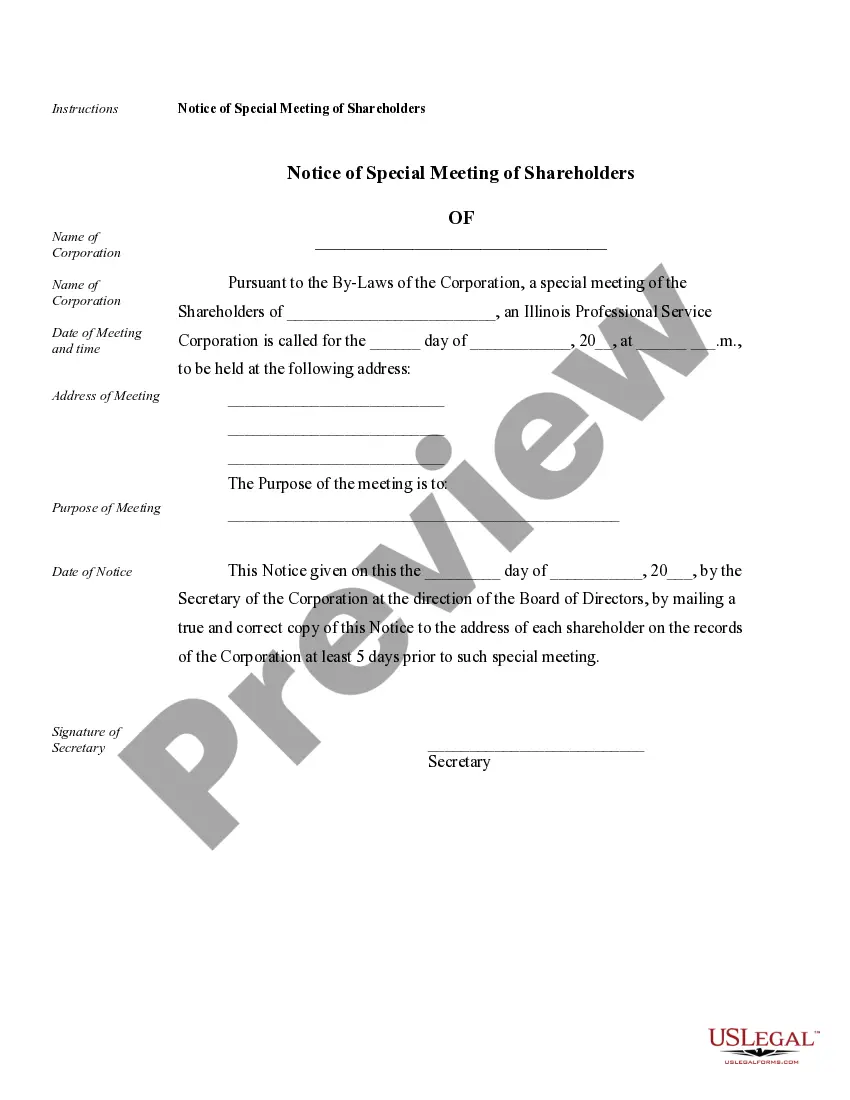

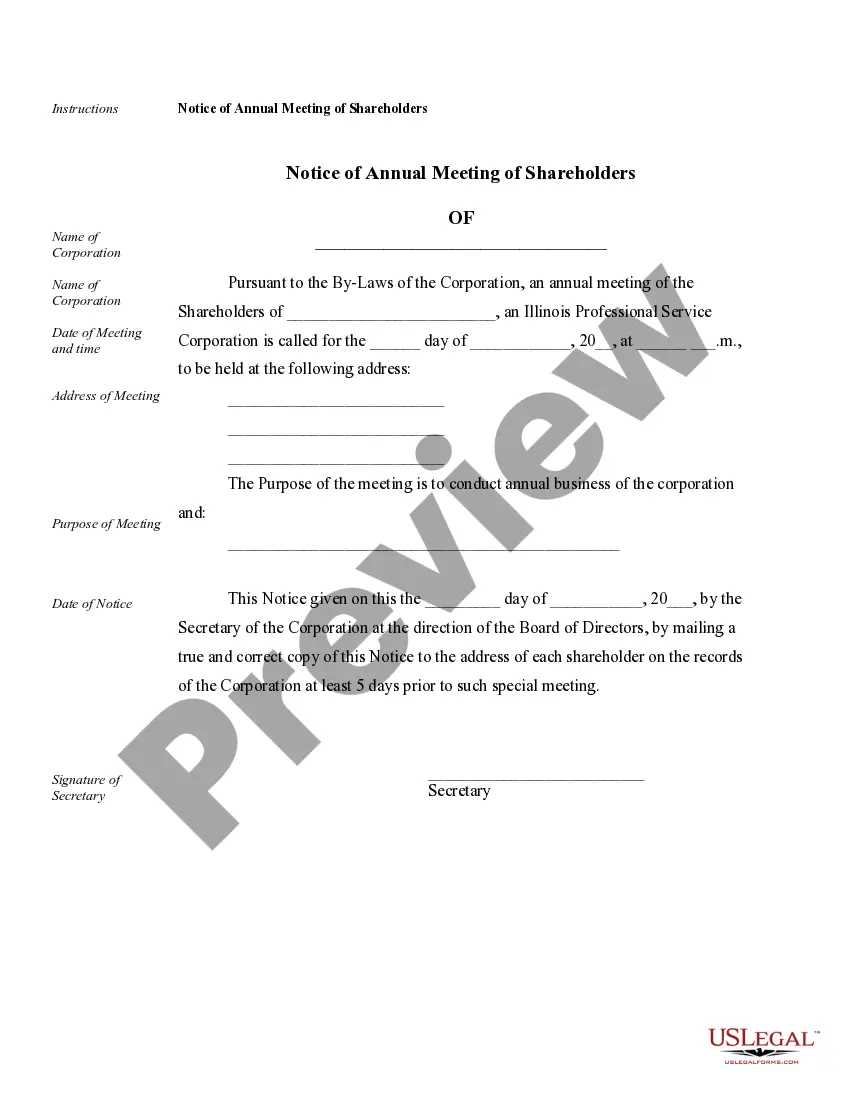

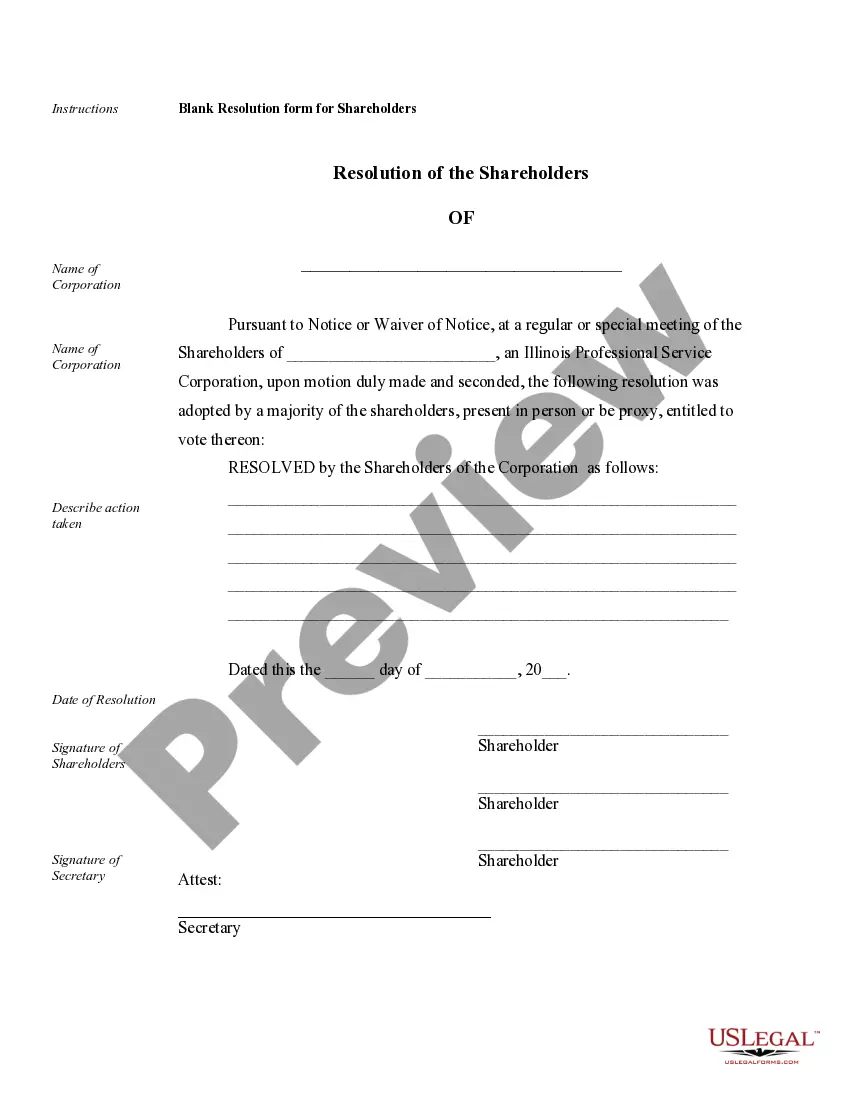

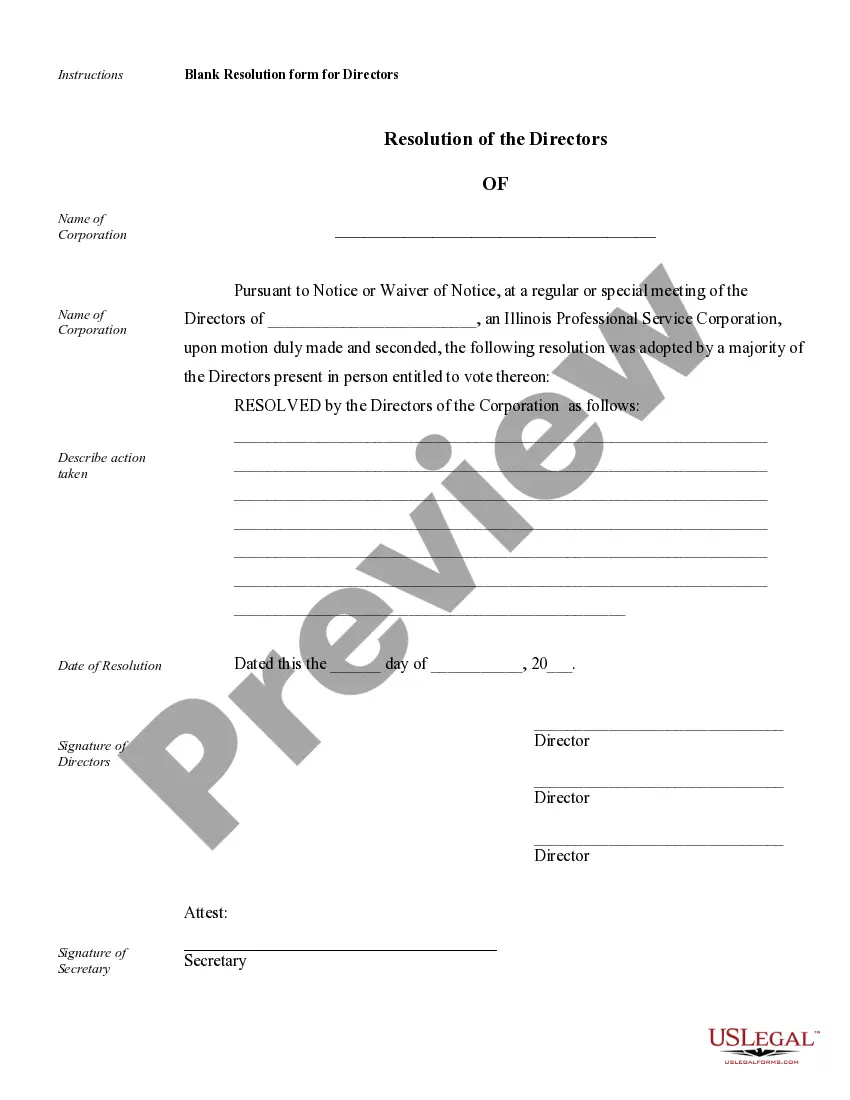

- Verify that you’ve found an appropriate document. Browse through the description and use the Preview feature, if available, to see if it satisfies your requirements. If it doesn't meet your expectations, utilize the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and choose either a monthly or annual subscription option.

- Create an account and process a payment. Use your credit card information or the PayPal option to finish the transaction.

- Retrieve your Chicago Annual Minutes for an Illinois Professional Corporation. Select the file format for your document and store it on your device.

- Finalize your template. Print it out or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

(b) A Professional Corporation may, for purposes of dissolution, have as its shareholders, directors, officers, agents and employees individuals who are not licensed by this State, provided that the corporation does not render any professional services nor hold itself out as capable of or available to render any

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

Even if a company has all necessary business licenses, it still needs to file its annual reports. Annual report filing requirements continue even after forming your company. Just like tax returns and business licenses, formation and incorporation filings are different from annual report filings.

After you form an LLC in Illinois, you must file an Annual Report and pay a $75 fee every year. You need to file your Annual Report in order to keep your Illinois LLC in compliance and in good standing with the Illinois Secretary of State.

Professional corporations may exist as part of a larger, more complicated, legal entity; for example, a law firm or medical practice might be organized as a partnership of several or many professional corporations.

Penalty. An annual report not filed within 60 days of the due date requires payment of the late filing penalty mandated by Section 50-15 of the Limited Liability Company Act.

Illinois Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state.

What Is an Illinois Annual Report? An Illinois Annual Report must be filed every year to keep the LLC in good standing and compliance if you own an LLC in the state of Illinois. LLCs have the option of filing their Annual Report online or by mail.

The annual report must be filed by an officer of the corporation who is listed in the report's section for officers. A maximum six officers and six directors may be entered via the web form. The registered agent and/or registered office cannot be changed via an electronically filed annual report.

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.