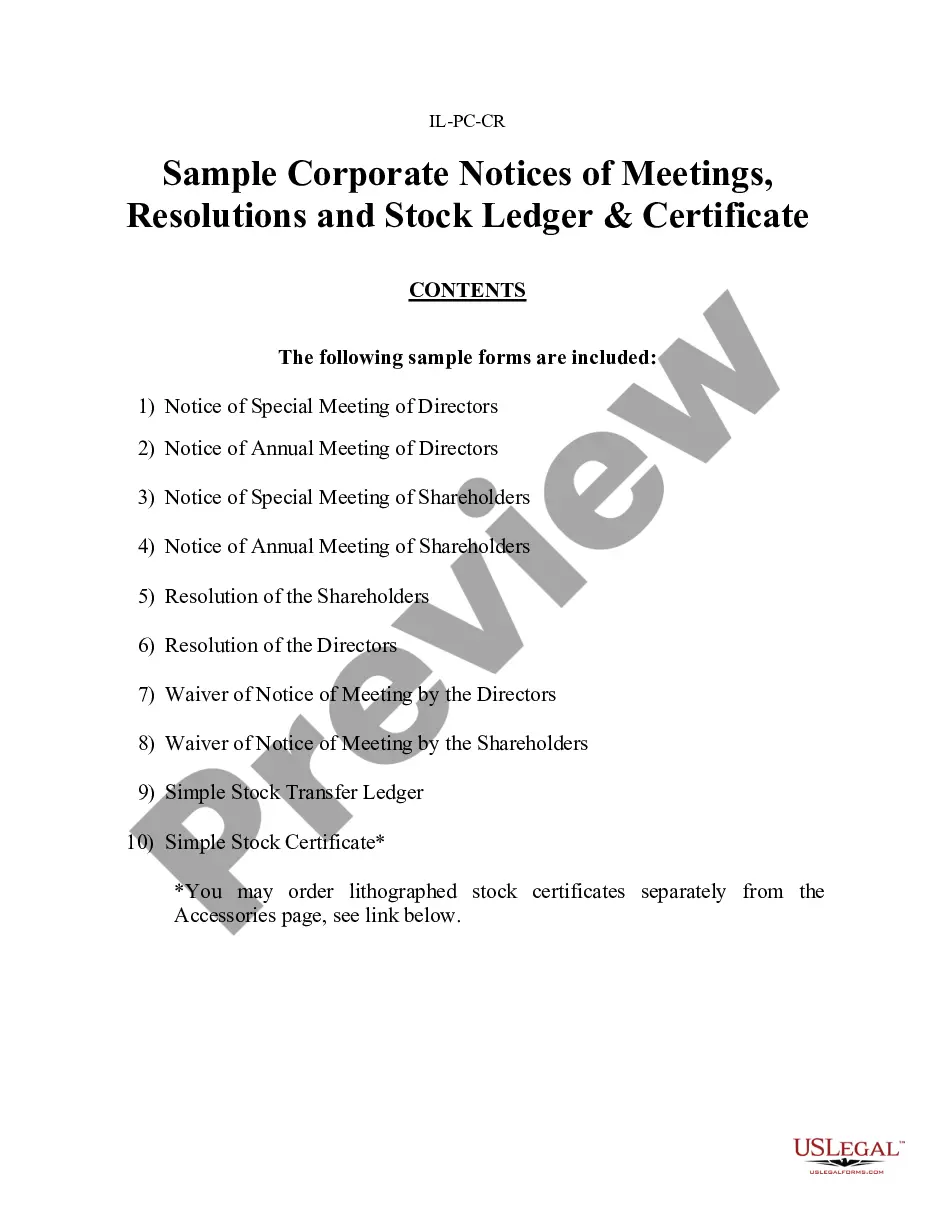

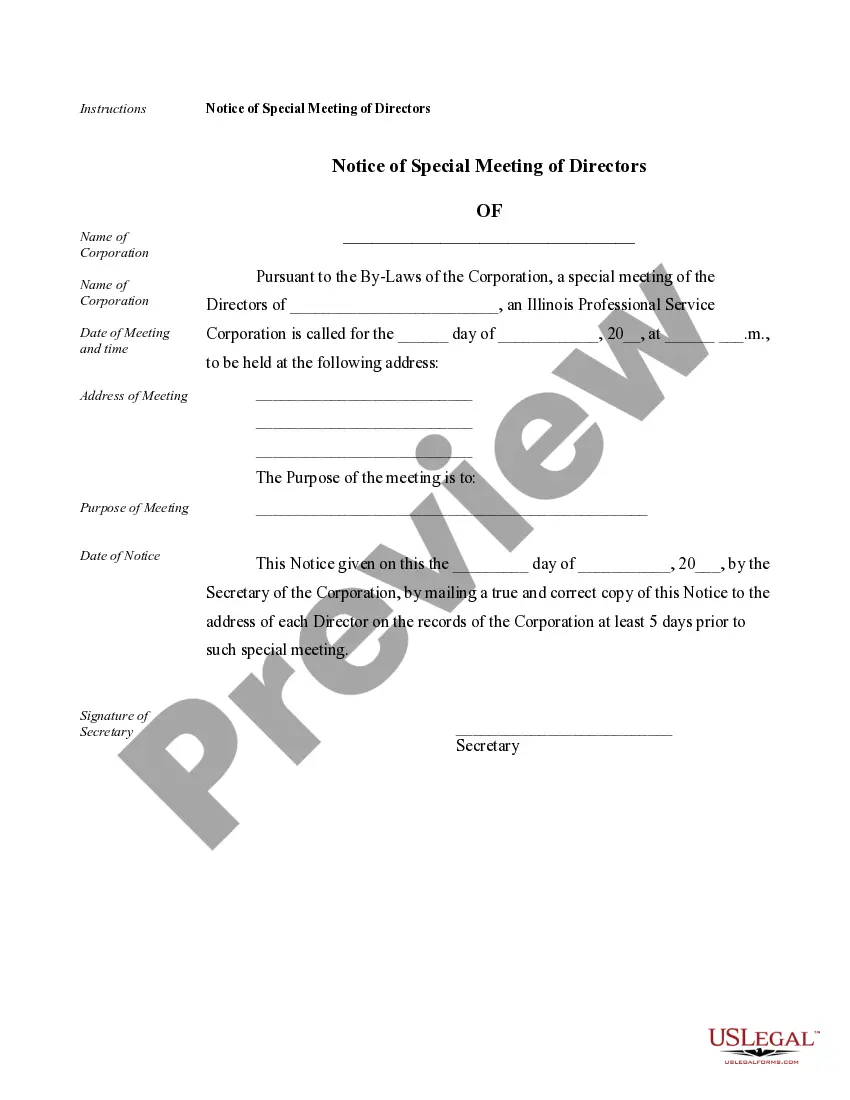

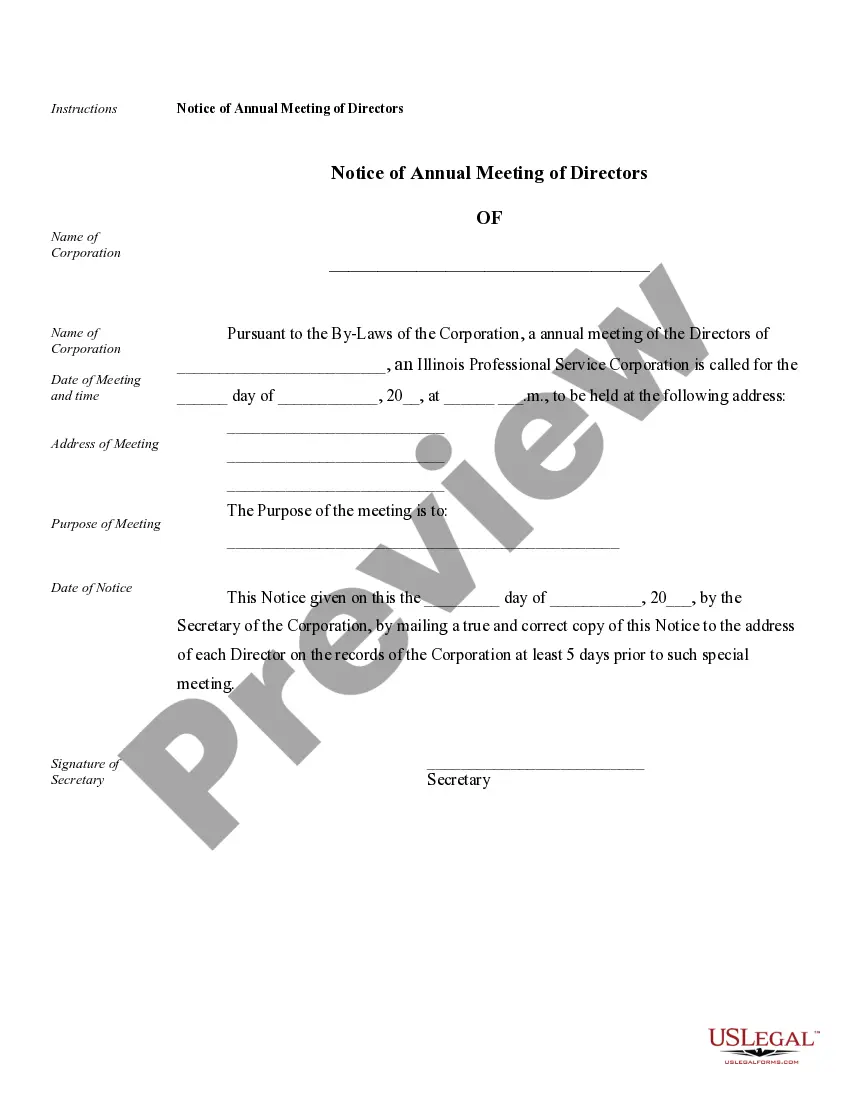

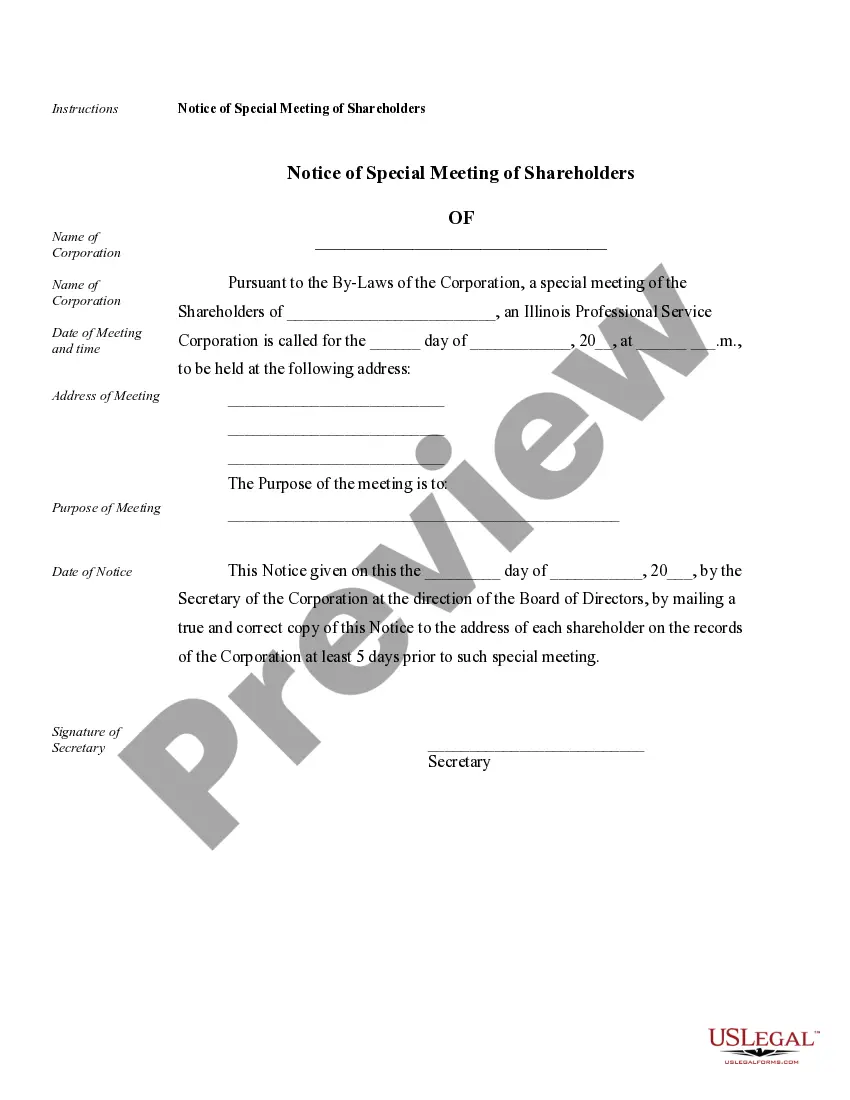

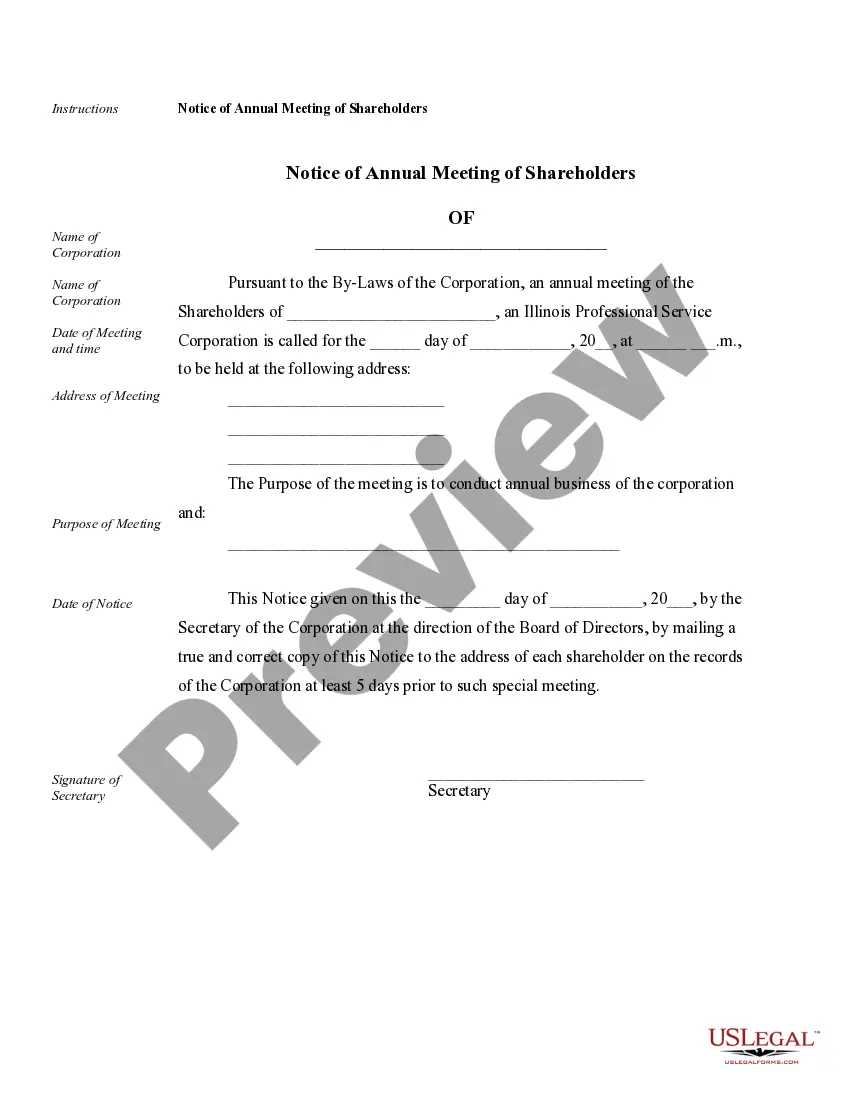

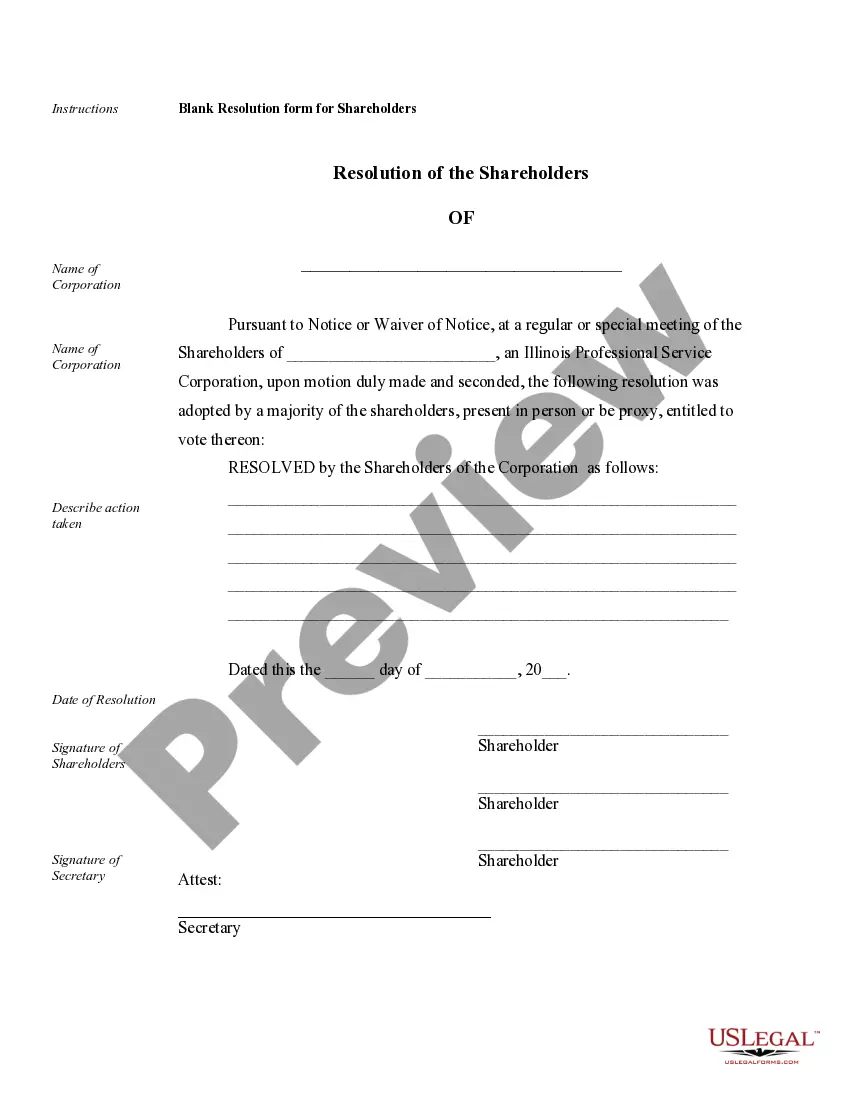

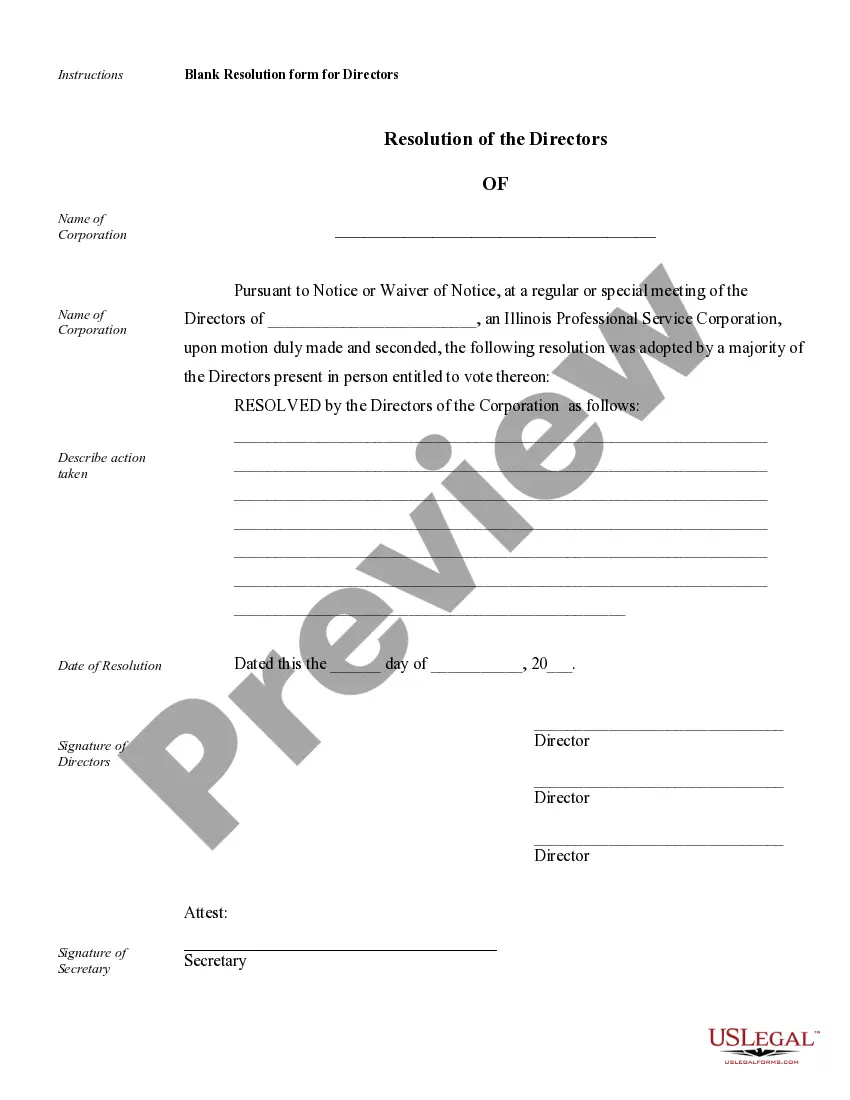

Rockford Annual Minutes for an Illinois Professional Corporation: A comprehensive overview In the state of Illinois, a professional corporation is a recognized business entity that allows professionals to provide specific licensed services, such as legal, medical, or accounting services under a corporate structure. To ensure compliance with state regulations, professional corporations are required to hold annual meetings and maintain a record of these proceedings, known as Rockford Annual Minutes. Rockford Annual Minutes for an Illinois Professional Corporation serve as a formal documentation of the discussions, decisions, and actions taken during the corporation's annual meeting. These minutes hold significant importance as they help establish the corporation's adherence to corporate governance, legal compliance, and regulatory requirements. Typically, the Rockford Annual Minutes cover various aspects and facilitate a transparent record-keeping system. Mentioned below are key points that may be included: 1. Meeting Details: The Rockford Annual Minutes begin with essential meeting information, such as the date, time, location, and participants present at the meeting. This ensures a clear understanding of who attended and who had voting rights during the proceedings. 2. Approval of Prior Meeting Minutes: The minutes provide an opportunity to review and approve the minutes from the previous annual meeting. This step ensures that the corporation maintains an accurate historical record of its activities and decisions. 3. Reports and Discussions: The minutes will outline reports presented during the meeting. These reports may include financial reports, operational updates, and projections for the upcoming year. Discussions related to business strategies, policies, and any significant changes in operations may also be captured. 4. Election of Directors/Officers: If applicable, the minutes will cover the process of electing directors or officers for the upcoming year. Details such as the names of candidates, voting results, and terms served are typically included to ensure transparency. 5. Approval of Corporate Actions: Any resolutions or actions taken at the annual meeting, such as amending bylaws, approving budgets, or authorizing business contracts, should be explicitly documented in the Rockford Annual Minutes. This helps ensure legal compliance and protects the interests of shareholders and stakeholders. 6. Compliance Requirements: Professional corporations often have specific compliance requirements, such as maintaining adequate professional liability insurance coverage and following ethical guidelines specific to their profession. The minutes might include discussions or decisions related to such compliance matters. In terms of different types of Rockford Annual Minutes for an Illinois Professional Corporation, variations may arise based on the specific nature of the corporation's business. For instance, a medical professional corporation might have additional discussions related to patient care, medical staff appointments, or research activities. Similarly, legal professional corporations could cover discussions related to case load, client management, or legal ethics. In conclusion, Rockford Annual Minutes for an Illinois Professional Corporation provide a legal record of the corporation's annual meeting proceedings and decisions. These minutes ensure transparency, corporate governance, and compliance with relevant professional regulations.

Rockford Annual Minutes for an Illinois Professional Corporation

Description

How to fill out Rockford Annual Minutes For An Illinois Professional Corporation?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Rockford Annual Minutes for an Illinois Professional Corporation gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Rockford Annual Minutes for an Illinois Professional Corporation takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

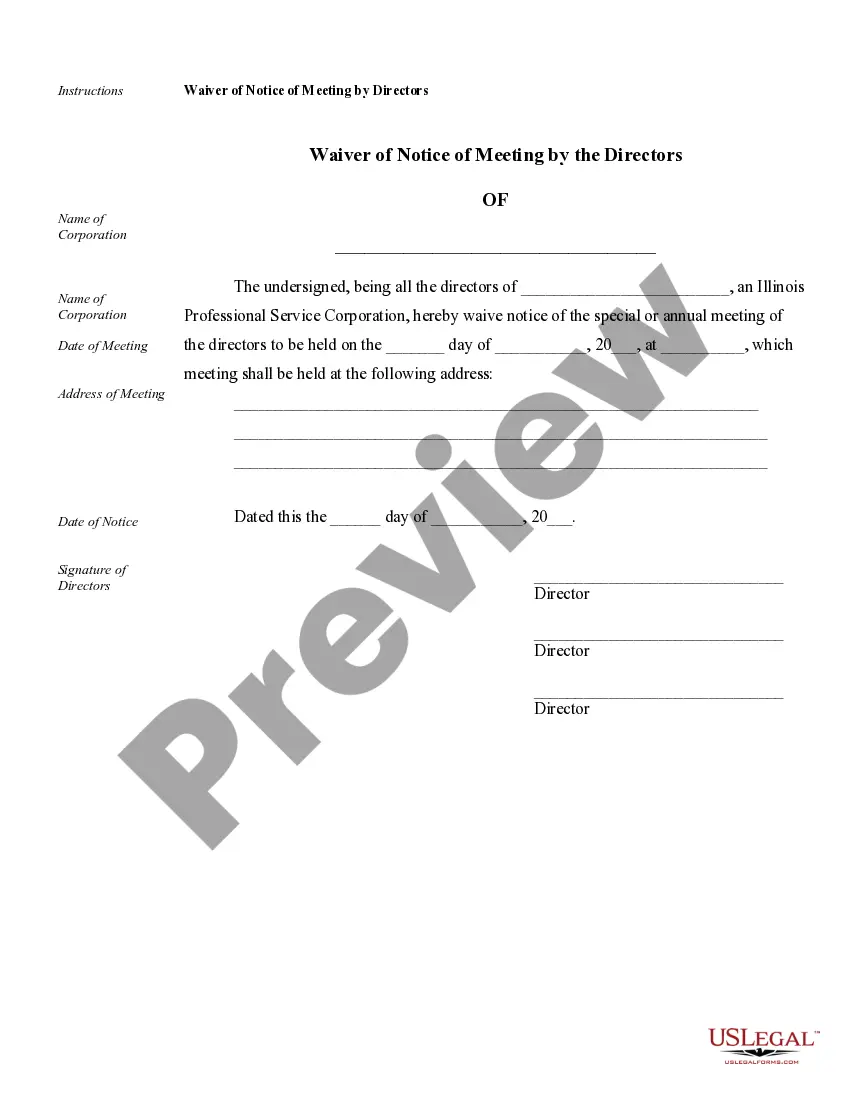

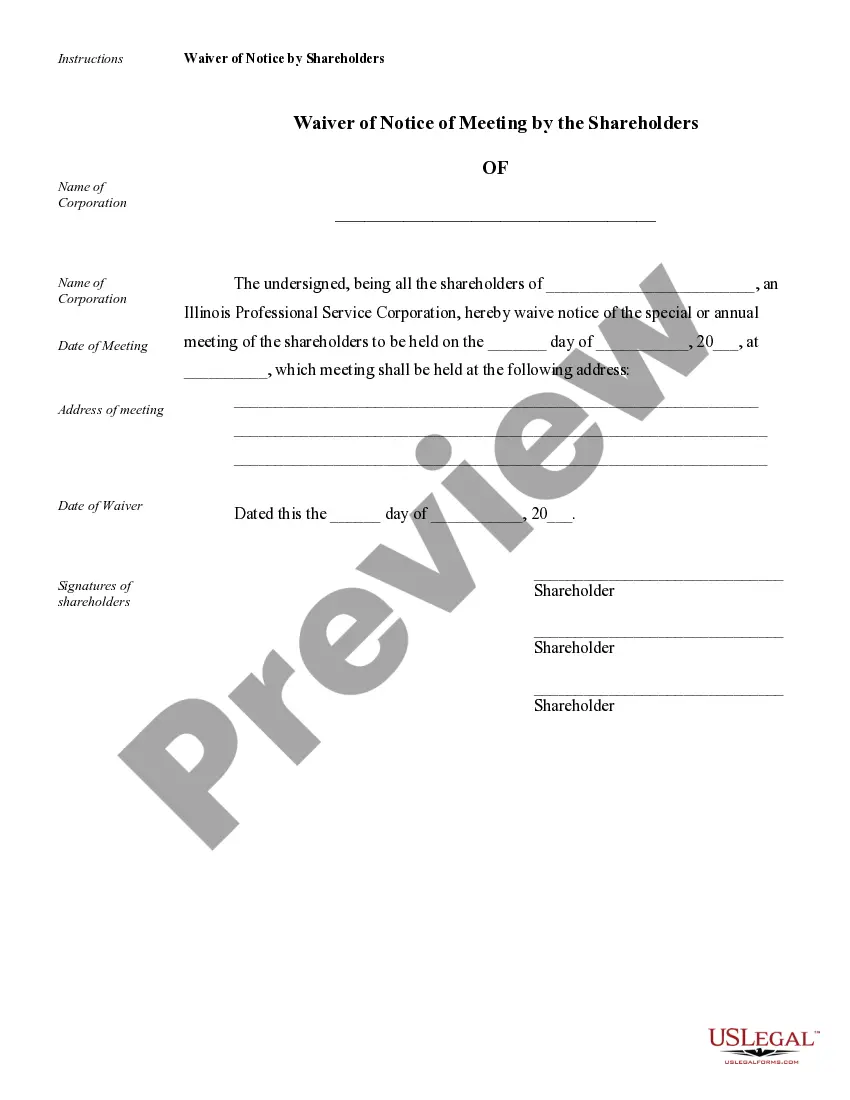

- Look at the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Rockford Annual Minutes for an Illinois Professional Corporation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!