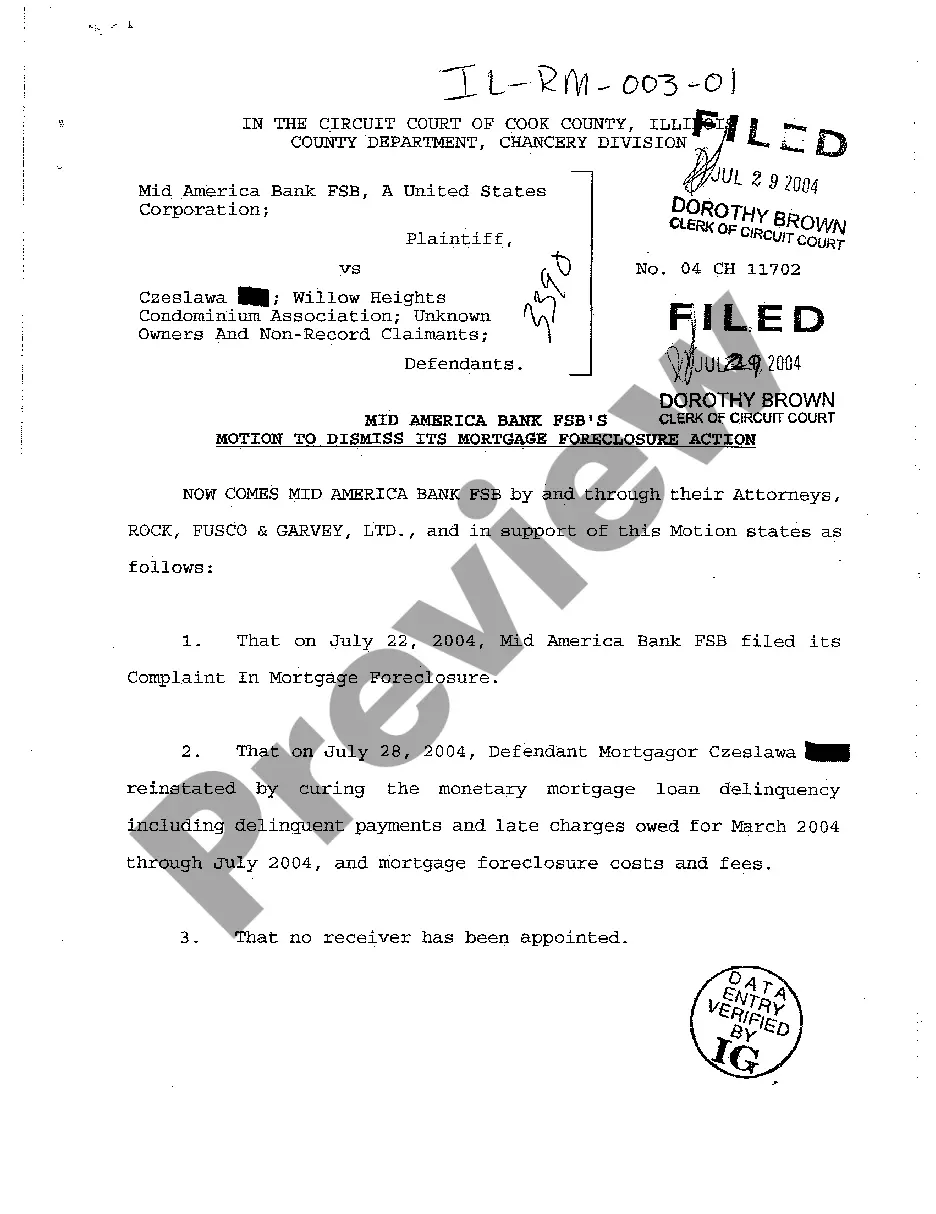

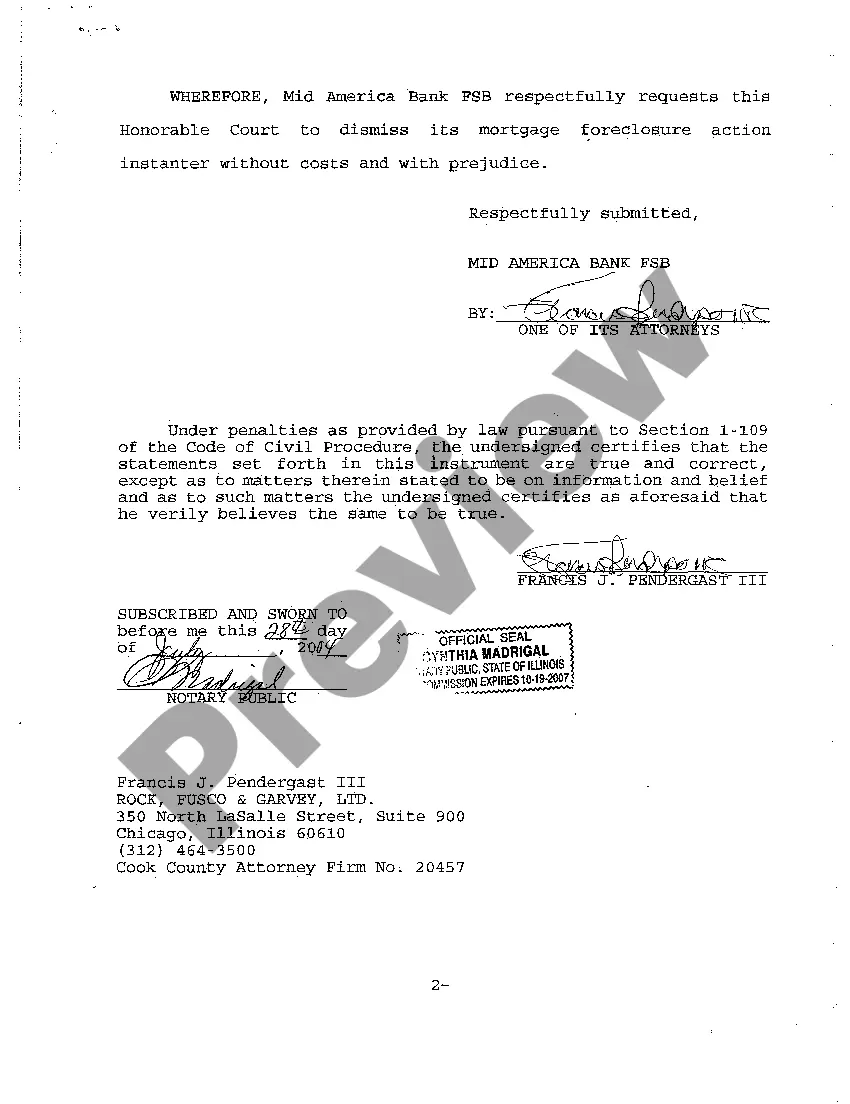

Elgin, Illinois, has its own specific guidelines and legal procedures when it comes to mortgage foreclosure actions. One crucial step that homeowners can take is filing a motion to dismiss to potentially halt or dismiss their foreclosure case. This motion serves as a formal request to the court asking for the foreclosure lawsuit to be dismissed due to various valid reasons. There are different types of Elgin, Illinois Motion to Dismiss its Mortgage Foreclosure Action, each catering to specific circumstances. Some common types include: 1. Lack of Standing: Homeowners can file a motion to dismiss if they believe the plaintiff does not have the legal right or "standing" to bring the foreclosure lawsuit. Lack of standing may occur if the plaintiff is unable to prove that they are the rightful mortgage holder or if they have not followed proper legal procedures in transferring the mortgage. 2. Defective Complaint: Homeowners may file a motion to dismiss if they identify significant defects in the foreclosure complaint. This can include incorrect or incomplete information, improper service of process, or failure to comply with statutory requirements. 3. Violation of Consumer Protection Laws: If lenders or creditors engaged in predatory lending practices or violated consumer protection laws during the mortgage process, homeowners can file a motion to dismiss based on these grounds. This may include unfair or deceptive practices, fraudulent misrepresentations, or violation of state and federal lending regulations. 4. Lack of Default: If homeowners can demonstrate that they are not actually in default on their mortgage payments, they can file a motion to dismiss. This may occur if the lender miscalculated the amount owed or failed to credit payments made by the homeowner. 5. Unresolved Loan Modification or Loss Mitigation Applications: If the homeowner applied for a loan modification or loss mitigation program to avoid foreclosure, but the lender improperly denied or failed to review the application, a motion to dismiss may be filed. It is crucial for homeowners in Elgin, Illinois, to consult with a qualified foreclosure attorney who can evaluate their specific circumstances and determine the most appropriate type of motion to file. Successfully filing a motion to dismiss may help homeowners protect their rights and potentially save their homes from foreclosure.

Foreclosure Elgin Il

Description

How to fill out Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

You can file an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action at various stages of the legal process. Typically, this motion is submitted when you believe the complaint lacks sufficient legal grounds or when critical legal procedures were not followed. It's essential to file this motion early, as waiting too long may limit your options. Utilizing resources like UsLegalForms can help you navigate this process and ensure you meet all necessary requirements.

In Illinois, the redemption period typically allows homeowners to reclaim their property after a foreclosure. This period can last from six months to three years, depending on the case. If you are exploring options to challenge your situation, you may want to consider an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action to take advantage of this time frame.

The pre-foreclosure period in Illinois starts the moment the lender issues a default notice and lasts until the actual foreclosure process begins. This period can last for several months, allowing you time to resolve the situation. Utilizing resources like an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action may provide you with alternative solutions during this critical period.

After a foreclosure auction in Illinois, the new owner will typically provide you with a notice to vacate. You generally have 30 days to move out after receiving this notice. If you are considering your options, filing an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action could potentially give you more time to secure your next steps.

In Illinois, missing just one payment can lead to a notice of default. Typically, lenders may start the foreclosure process after you miss three to six payments, but this can vary by lender. To effectively address this, you might explore filing an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action if you find yourself in such a situation.

When your home goes into foreclosure in Illinois, you face the possibility of losing ownership. The lender will initiate legal proceedings to reclaim the property if mortgage payments are significantly overdue. Understanding your rights can help you consider an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action to contest the proceedings and possibly keep your home.

In Illinois, the statute of limitations on mortgage foreclosure is generally 10 years. This means that lenders have a decade to initiate foreclosure proceedings after the last payment is due. If you believe you have a case for an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action based on this limitation, consider consulting with legal professionals who can guide you through your options.

Writing a reply to a motion to dismiss involves addressing the arguments made in the motion while presenting your counterarguments clearly and effectively. It’s essential to cite relevant laws and precedents that support your position. In the context of an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action, utilizing templates and resources available through uslegalforms can streamline this process and ensure a solid response.

answer motion to dismiss is filed before the defendant submits an answer to the complaint. This type of motion typically challenges the legal validity of the claims before the case proceeds. When involved in an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action, recognizing the significance of preanswer motions can be a vital strategy in protecting one’s rights.

A motion for final judgment of foreclosure is a request made to the court to conclude the foreclosure process after the necessary legal steps have been followed. This motion seeks the court’s approval to finalize the foreclosure and transfer property ownership. For anyone involved in an Elgin Illinois Motion To Dismiss Its Mortgage Foreclosure Action, understanding this aspect helps clarify the potential next steps in the foreclosure process.