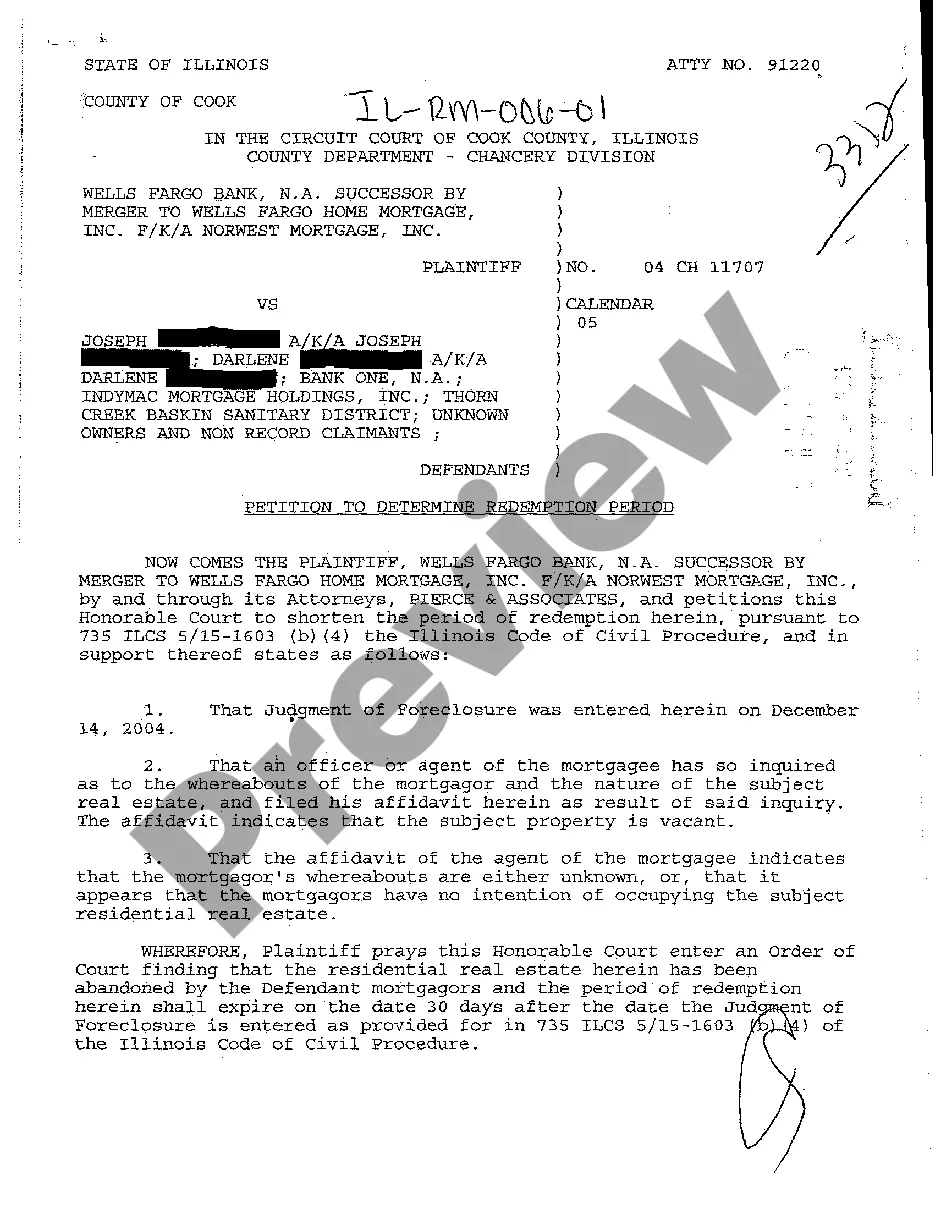

The Elgin Illinois Petition to Determine Redemption Period refers to a legal document filed in the city of Elgin, Illinois, which aims to establish the timeframe for property redemption in cases of foreclosure or tax delinquency. This petition is crucial in determining the rights and responsibilities of property owners to reclaim their assets following the completion of the foreclosure process. In the state of Illinois, there are various types of Elgin Illinois Petitions to Determine Redemption Period, tailored to specific circumstances. These include: 1. Mortgage foreclosure petition: This type of petition is commonly filed by lenders or financial institutions when a property owner fails to meet mortgage payment obligations, resulting in foreclosure proceedings. The petition aims to determine the redemption period during which the property owner has the opportunity to redeem their property by paying the outstanding mortgage amount, as well as any associated fees and penalties. 2. Tax sale petition: When property owners fail to pay their property tax, the local government has the authority to initiate tax sale proceedings to recover the unpaid taxes. The Elgin Illinois Petition to Determine Redemption Period is filed in these cases to establish the timeframe in which the property owner can redeem their property by paying the delinquent taxes, interest, and additional costs. 3. Judicial sale petition: In certain situations, such as when there are conflicting claims or disputes over the ownership or liens on a property, a judicial sale may be ordered by the court. The Elgin Illinois Petition to Determine Redemption Period, in this case, determines the timeframe for redemption after the completion of the judicial sale, allowing interested parties to exercise their right to redeem the property. It is important to note that each type of petition has its own unique rules and regulations that must be followed. Seeking legal advice or consulting with a knowledgeable attorney is highly recommended ensuring proper compliance with the requirements set forth by the Elgin Illinois Petition to Determine Redemption Period.

Elgin Illinois Petition To Determine Redemption Period

Description

How to fill out Elgin Illinois Petition To Determine Redemption Period?

If you are looking for a relevant form, it’s impossible to choose a more convenient place than the US Legal Forms site – probably the most comprehensive libraries on the internet. Here you can get thousands of form samples for organization and individual purposes by types and states, or keywords. With the high-quality search feature, finding the newest Elgin Illinois Petition To Determine Redemption Period is as elementary as 1-2-3. Moreover, the relevance of every file is verified by a team of expert lawyers that on a regular basis check the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our platform and have an account, all you should do to get the Elgin Illinois Petition To Determine Redemption Period is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the sample you need. Check its description and make use of the Preview option (if available) to explore its content. If it doesn’t suit your needs, use the Search field near the top of the screen to find the proper file.

- Confirm your choice. Choose the Buy now option. After that, choose the preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Receive the template. Choose the format and download it to your system.

- Make changes. Fill out, modify, print, and sign the received Elgin Illinois Petition To Determine Redemption Period.

Each and every template you save in your account does not have an expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you want to get an additional copy for editing or printing, you can return and save it once again at any time.

Make use of the US Legal Forms extensive catalogue to gain access to the Elgin Illinois Petition To Determine Redemption Period you were looking for and thousands of other professional and state-specific samples in one place!