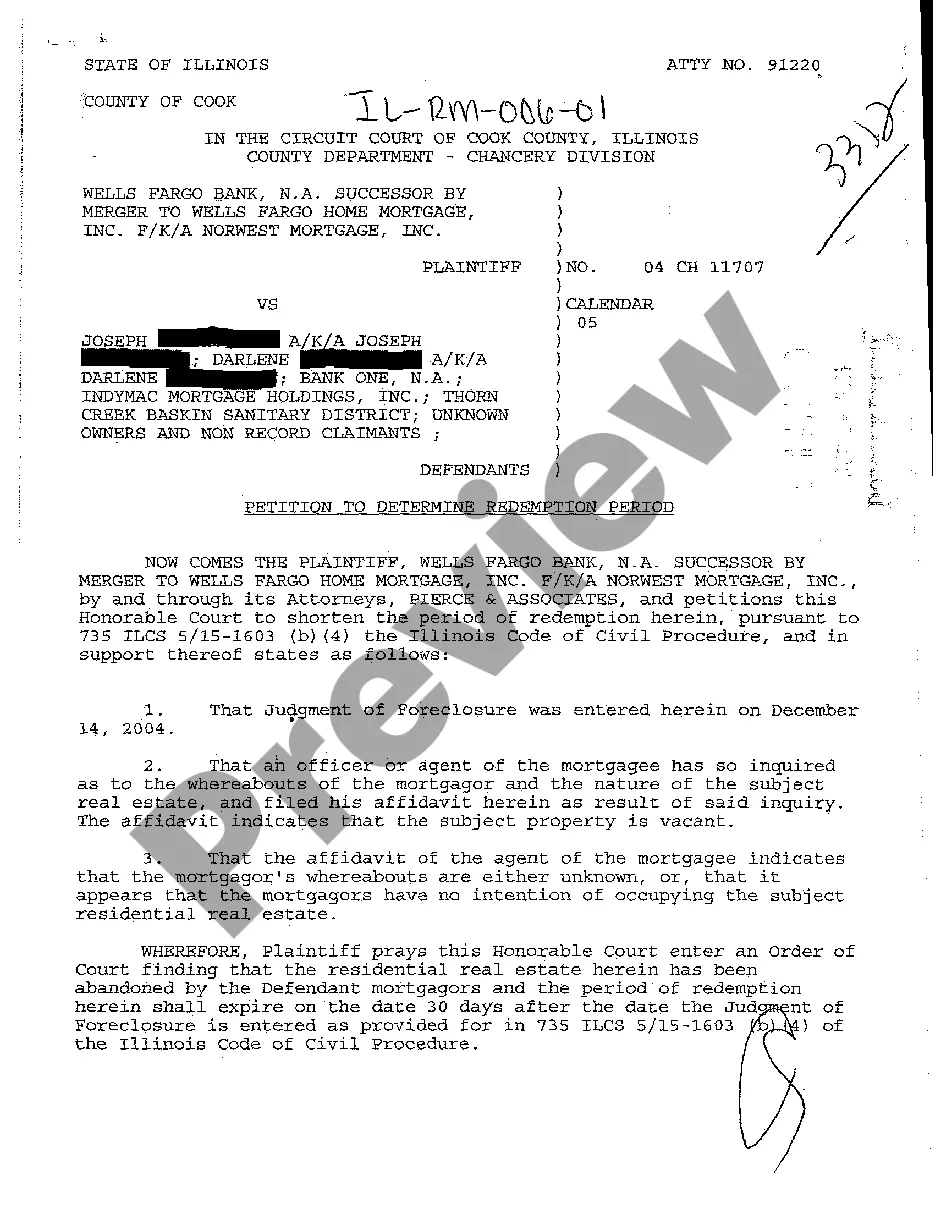

The Rockford Illinois Petition to Determine Redemption Period is a legal process that allows property owners in Rockford, Illinois, to request a determination of the redemption period for their property. This petition is particularly important for property owners who are facing foreclosure or delinquency on their property taxes. The redemption period refers to the time frame during which a property owner has the opportunity to redeem or reclaim their property after it has been sold at a tax sale or foreclosure auction. The length of the redemption period can vary depending on the circumstances and the type of property involved. There are different types of Rockford Illinois Petition to Determine Redemption Period, including: 1. Residential Property Redemption Petition: This is the most common type of petition filed by homeowners of residential properties in Rockford. It allows them to determine the redemption period for their property to avoid losing ownership rights. 2. Commercial Property Redemption Petition: Business owners who own commercial properties in Rockford can file this petition to determine the redemption period for their property. It gives them the opportunity to save their businesses from foreclosure or tax sale. 3. Vacant Land Redemption Petition: Individuals or companies who own vacant land in Rockford can file this petition to establish the redemption period for their property. It is crucial for those seeking to retain ownership or sell the land without the risk of foreclosure. 4. Mixed-Use Property Redemption Petition: This type of petition applies to properties in Rockford that serve a combination of residential and commercial purposes. Property owners can use this petition to determine the redemption period and protect their investment. The Rockford Illinois Petition to Determine Redemption Period provides property owners with a legal avenue to gain clarity on the timeframe they have to redeem their property. It allows individuals to understand their rights and make informed decisions to either redeem their property or explore alternative options to resolve their financial difficulties. It is important for property owners in Rockford to consult with a qualified attorney or seek advice from the county treasurer's office to understand the specific requirements and procedures associated with filing the petition. Failure to adhere to the correct process may result in delays or the loss of redemption rights.

Rockford Illinois Petition To Determine Redemption Period

Description

How to fill out Rockford Illinois Petition To Determine Redemption Period?

Are you looking for a trustworthy and affordable legal forms provider to get the Rockford Illinois Petition To Determine Redemption Period? US Legal Forms is your go-to choice.

Whether you require a simple agreement to set regulations for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and frameworked based on the requirements of separate state and area.

To download the document, you need to log in account, find the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Rockford Illinois Petition To Determine Redemption Period conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to find out who and what the document is intended for.

- Start the search over if the form isn’t good for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is completed, download the Rockford Illinois Petition To Determine Redemption Period in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time learning about legal paperwork online once and for all.