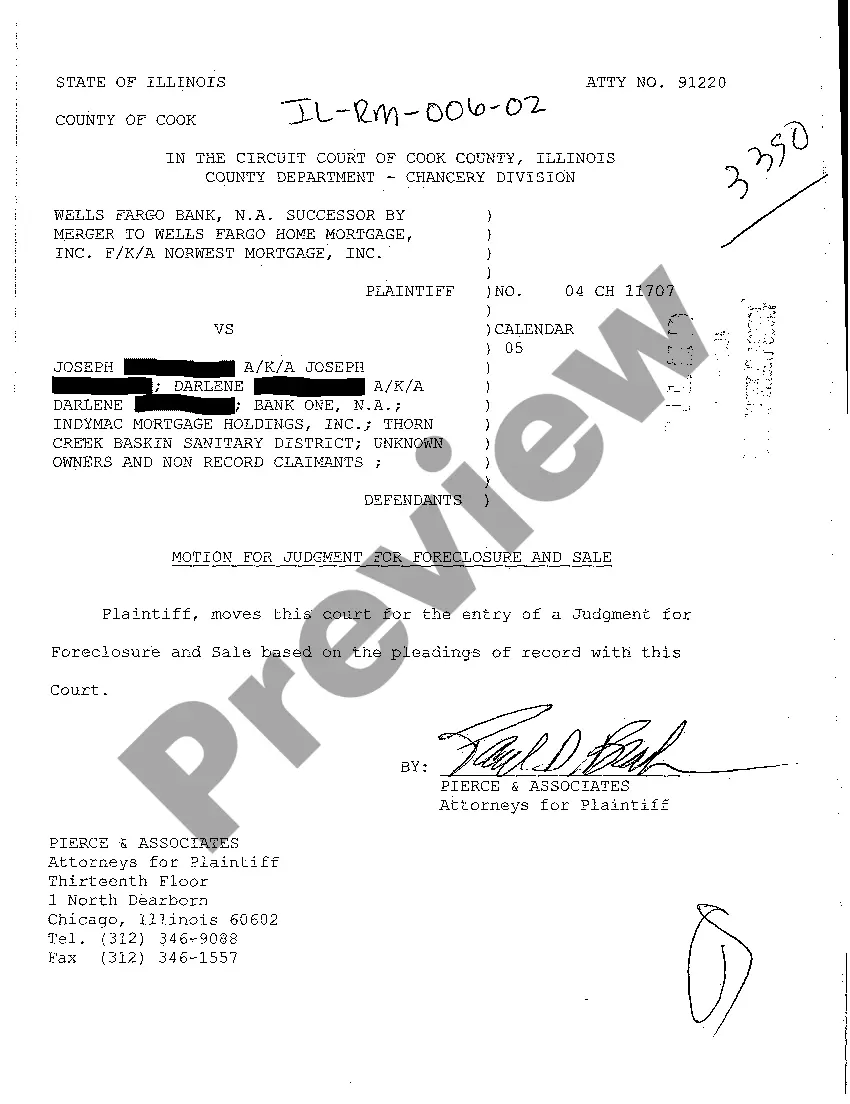

Chicago Illinois Motion for Judgment for Foreclosure and Sale is a legal process initiated by a lender or mortgage holder in an effort to secure repayment from a borrower who has defaulted on their mortgage payments. This motion involves seeking a court order to proceed with the foreclosure of the property and subsequently sell it in a public auction to recoup the outstanding debt. Keywords: Chicago, Illinois, motion, judgment, foreclosure, sale, lender, mortgage holder, borrower, defaulted, mortgage payments, court order, property, public auction, outstanding debt. There are two main types of Chicago Illinois Motion for Judgment for Foreclosure and Sale: 1. Strict Foreclosure: This type of foreclosure allows the lender to take ownership of the property without the need for a public auction. Once the court grants the motion for strict foreclosure, the borrower usually has a specific period within which they can redeem the property by repaying the outstanding debt in full. If the borrower fails to redeem the property within the given timeframe, ownership transfers to the lender. 2. Judicial Foreclosure: In this type of foreclosure, the lender seeks permission from the court to sell the property through a public auction. The motion for judgment for foreclosure and sale outlines the lender's intent to sell the property to recover the outstanding debt. The auction is typically conducted by a county sheriff or trustee appointed by the court. The highest bidder at the auction becomes the new owner of the property. Chicago Illinois Motion for Judgment for Foreclosure and Sale must satisfy specific legal requirements, including: — Providing notice to the borrower of the intent to initiate foreclosure proceedings. — Demonstrating that the borrower has defaulted on their mortgage payments. — Proving that the lender has the legal right to foreclose on the property. — Outlining the outstanding debt and any additional costs incurred during the foreclosure process. It is important to note that each case may have unique circumstances and requirements, and the specific details may vary. Therefore, it is advisable to consult with an attorney familiar with Chicago and Illinois foreclosure laws to ensure compliance with all legal requirements and procedures.

Chicago Illinois Motion For Judgment For Foreclosure And Sale

Description

How to fill out Chicago Illinois Motion For Judgment For Foreclosure And Sale?

Are you looking for a trustworthy and affordable legal forms provider to get the Chicago Illinois Motion For Judgment For Foreclosure And Sale? US Legal Forms is your go-to choice.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Chicago Illinois Motion For Judgment For Foreclosure And Sale conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the form is intended for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Chicago Illinois Motion For Judgment For Foreclosure And Sale in any provided format. You can get back to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online for good.