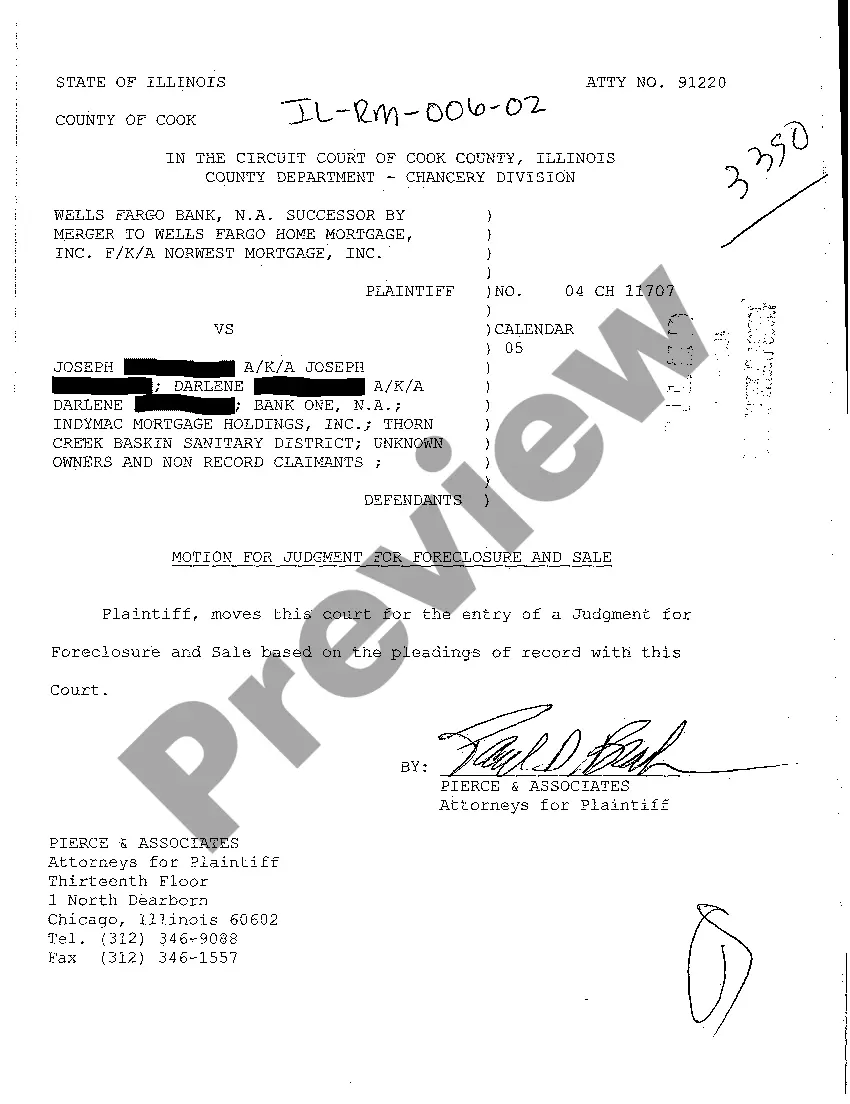

Elgin Illinois Motion For Judgment For Foreclosure And Sale is a legal procedure initiated by a mortgage lender or lien holder to legally enforce their right to sell a property in order to recover the outstanding debt owed by the borrower. This motion is typically filed with the Circuit Court in Elgin, Illinois, and it aims to obtain a judgment that grants the lender the authority to foreclose on the property and hold a public sale (also known as a foreclosure sale) to repay the debt. Keywords: Elgin, Illinois; Motion For Judgment; Foreclosure And Sale; property; mortgage lender; lien holder; legal procedure; outstanding debt; Circuit Court; judgment; public sale; foreclosure sale. Different types of Elgin Illinois Motion For Judgment For Foreclosure And Sale may include: 1. Residential Foreclosure: This type of motion is filed when a residential property is subject to foreclosure due to non-payment of a mortgage or other related financial obligations. 2. Commercial Foreclosure: In the case of commercial properties, such as office buildings, retail spaces, or industrial facilities, this type of motion is filed to initiate the foreclosure process when the borrower fails to fulfill their financial obligations. 3. Judicial Foreclosure: This type of motion involves court-supervised proceedings, where the lender files a lawsuit against the borrower to obtain a judgment for the foreclosure and sale of the property. 4. Non-Judicial Foreclosure: In some cases, the mortgage or deed of trust includes a power of sale clause, which allows the lender to proceed with a foreclosure sale without involving the court system. This type of motion is filed to enforce the power of sale and sell the property. 5. Tax Foreclosure: When a property owner fails to pay their property taxes in Elgin, Illinois, the local government may initiate a foreclosure action to recover the unpaid taxes. A motion for judgment for foreclosure and sale is filed by the government entity in charge of tax collection. 6. Consent Foreclosure: In certain situations, the borrower and lender mutually agree to proceed with a consent foreclosure, where the borrower willingly surrenders the property to the lender to avoid further legal action. A motion for judgment for foreclosure and sale is still filed, but with the consent of both parties. It is important to note that specific procedures and requirements may vary depending on the jurisdiction and the terms of the mortgage or deed of trust. It is always advisable for borrowers facing foreclosure to seek legal assistance to understand and address their specific situation effectively.

Elgin Illinois Motion For Judgment For Foreclosure And Sale

Description

How to fill out Elgin Illinois Motion For Judgment For Foreclosure And Sale?

If you are looking for a relevant form, it’s difficult to find a better service than the US Legal Forms website – one of the most extensive libraries on the internet. Here you can get a huge number of document samples for business and personal purposes by categories and states, or key phrases. Using our advanced search function, discovering the newest Elgin Illinois Motion For Judgment For Foreclosure And Sale is as easy as 1-2-3. Furthermore, the relevance of each record is verified by a group of professional lawyers that on a regular basis check the templates on our platform and revise them in accordance with the most recent state and county laws.

If you already know about our system and have an account, all you should do to get the Elgin Illinois Motion For Judgment For Foreclosure And Sale is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the sample you need. Look at its information and use the Preview function (if available) to explore its content. If it doesn’t meet your needs, use the Search field near the top of the screen to find the appropriate record.

- Affirm your choice. Click the Buy now option. After that, select your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Receive the template. Indicate the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Elgin Illinois Motion For Judgment For Foreclosure And Sale.

Every single template you save in your profile does not have an expiration date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to have an extra copy for editing or creating a hard copy, you may come back and save it once again anytime.

Make use of the US Legal Forms extensive catalogue to get access to the Elgin Illinois Motion For Judgment For Foreclosure And Sale you were seeking and a huge number of other professional and state-specific templates on a single platform!