The Joliet Illinois Motion for Judgment for Foreclosure and Sale is a legal process initiated by a lender or mortgagee seeking to foreclose on a property due to the borrower's default on a mortgage or loan agreement. This motion is filed with the court and plays a crucial role in the foreclosure process in Joliet, Illinois. When a homeowner fails to make timely mortgage payments or violates terms and conditions outlined in the loan agreement, the lender can file a Motion for Judgment for Foreclosure and Sale. This legal document enables the lender to request the court's permission to foreclose on the property and sell it at a public auction to recoup the outstanding debt. There are different types of Joliet Illinois Motion for Judgment for Foreclosure and Sale that may be filed depending on the specific circumstances: 1. Summary Judgment: This motion is typically filed when there is no genuine dispute over the essential facts of the case, and the lender believes they are entitled to foreclosure as a matter of law. It seeks a swift judgment without the need for a full trial. 2. Judgment of Foreclosure and Sale: This motion is filed when the lender is seeking a judgment that grants them the right to foreclose on the property and sell it at auction. It involves providing evidence of the borrower's default and demonstrating that the lender has followed all necessary legal procedures. 3. Strict Foreclosure: In some cases, a lender may request a strict foreclosure judgment if there is significant equity in the property and the borrower's default is not substantial. This type of judgment allows the lender to assume ownership of the property without the need for a sale. 4. Deficiency Judgment: In scenarios where the sale of the property through foreclosure does not cover the full outstanding debt, the lender may request a deficiency judgment. This type of judgment allows the lender to seek the remaining balance from the borrower outside the foreclosure process. The Joliet Illinois Motion for Judgment for Foreclosure and Sale must comply with all local laws and regulations, and the court's approval is required for foreclosure proceedings to proceed. It is crucial for borrowers facing foreclosure to consult with a qualified attorney to understand their rights, explore potential defenses, and navigate the legal complexities of the process.

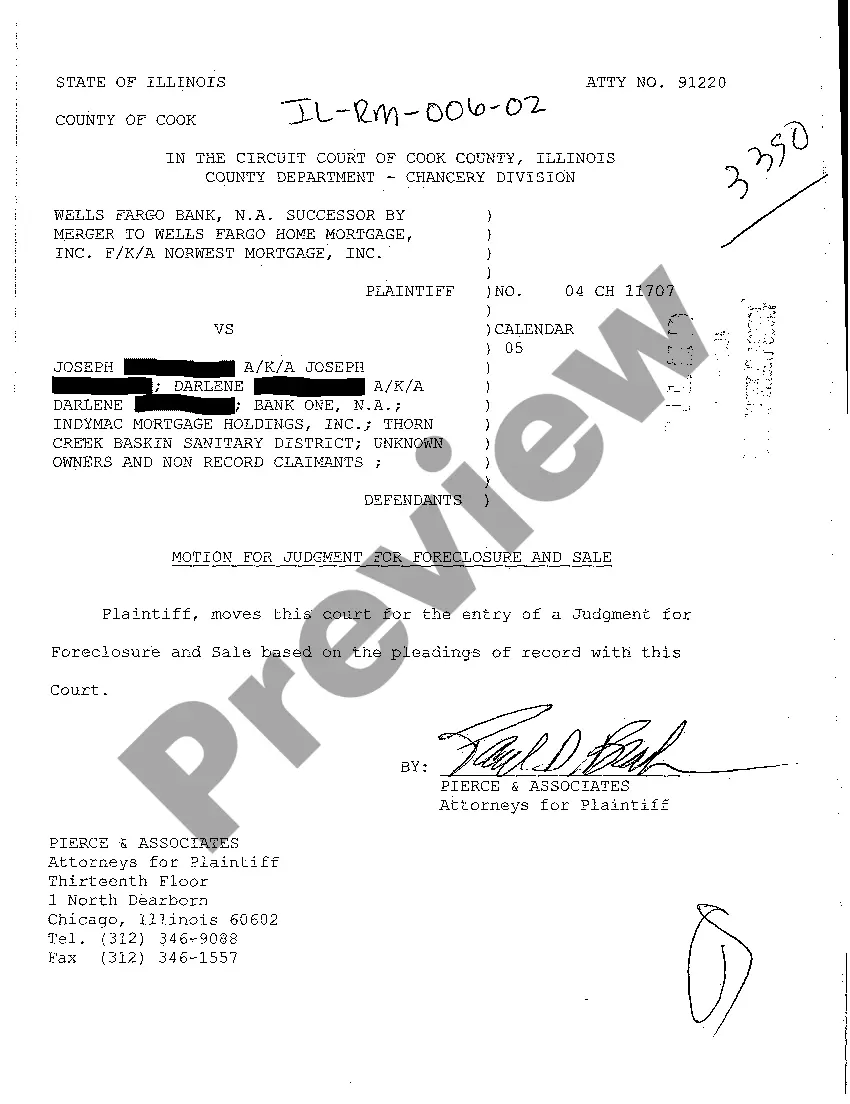

Joliet Illinois Motion For Judgment For Foreclosure And Sale

State:

Illinois

City:

Joliet

Control #:

IL-RM-006-02

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Motion For Judgment For Foreclosure And Sale

The Joliet Illinois Motion for Judgment for Foreclosure and Sale is a legal process initiated by a lender or mortgagee seeking to foreclose on a property due to the borrower's default on a mortgage or loan agreement. This motion is filed with the court and plays a crucial role in the foreclosure process in Joliet, Illinois. When a homeowner fails to make timely mortgage payments or violates terms and conditions outlined in the loan agreement, the lender can file a Motion for Judgment for Foreclosure and Sale. This legal document enables the lender to request the court's permission to foreclose on the property and sell it at a public auction to recoup the outstanding debt. There are different types of Joliet Illinois Motion for Judgment for Foreclosure and Sale that may be filed depending on the specific circumstances: 1. Summary Judgment: This motion is typically filed when there is no genuine dispute over the essential facts of the case, and the lender believes they are entitled to foreclosure as a matter of law. It seeks a swift judgment without the need for a full trial. 2. Judgment of Foreclosure and Sale: This motion is filed when the lender is seeking a judgment that grants them the right to foreclose on the property and sell it at auction. It involves providing evidence of the borrower's default and demonstrating that the lender has followed all necessary legal procedures. 3. Strict Foreclosure: In some cases, a lender may request a strict foreclosure judgment if there is significant equity in the property and the borrower's default is not substantial. This type of judgment allows the lender to assume ownership of the property without the need for a sale. 4. Deficiency Judgment: In scenarios where the sale of the property through foreclosure does not cover the full outstanding debt, the lender may request a deficiency judgment. This type of judgment allows the lender to seek the remaining balance from the borrower outside the foreclosure process. The Joliet Illinois Motion for Judgment for Foreclosure and Sale must comply with all local laws and regulations, and the court's approval is required for foreclosure proceedings to proceed. It is crucial for borrowers facing foreclosure to consult with a qualified attorney to understand their rights, explore potential defenses, and navigate the legal complexities of the process.

How to fill out Joliet Illinois Motion For Judgment For Foreclosure And Sale?

If you’ve already utilized our service before, log in to your account and save the Joliet Illinois Motion For Judgment For Foreclosure And Sale on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Joliet Illinois Motion For Judgment For Foreclosure And Sale. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!