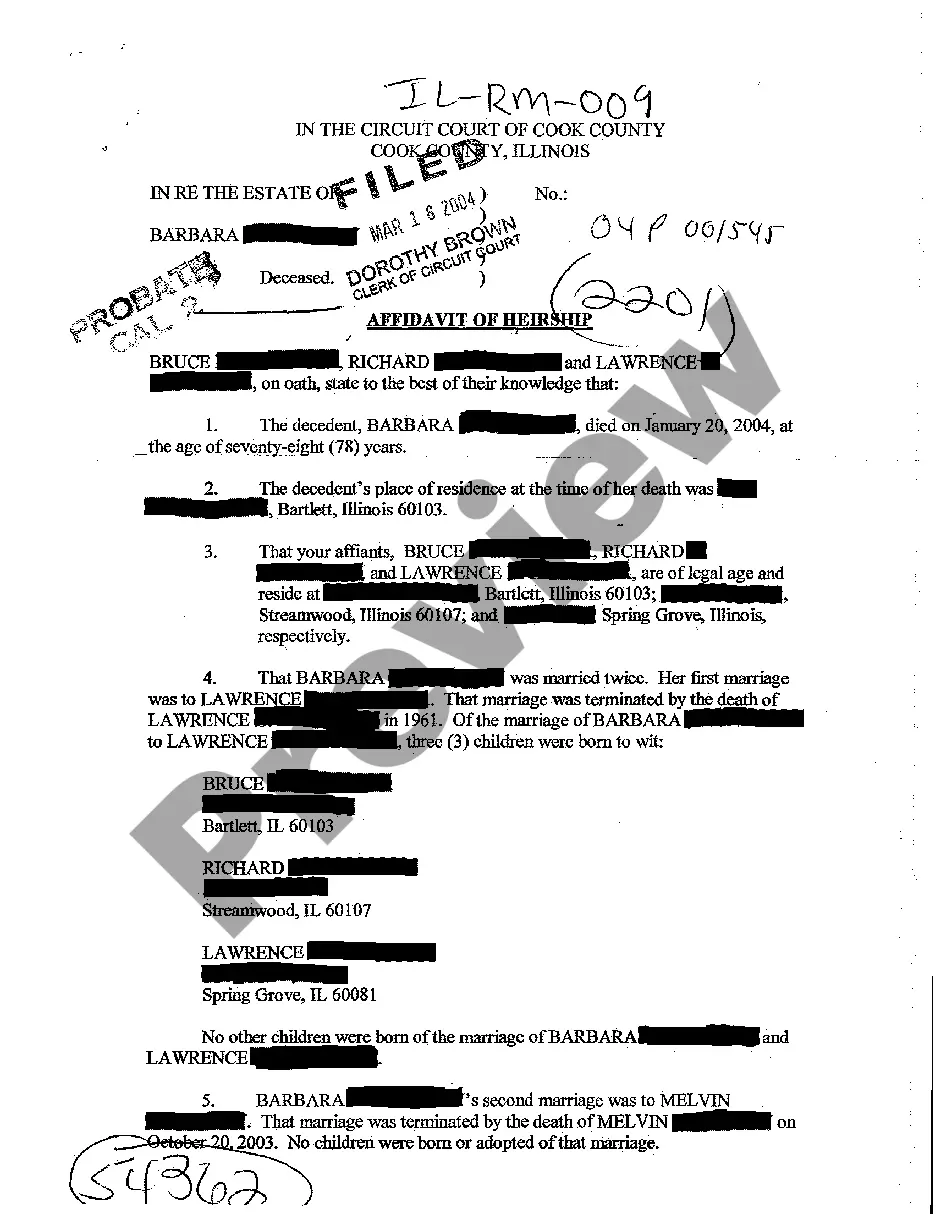

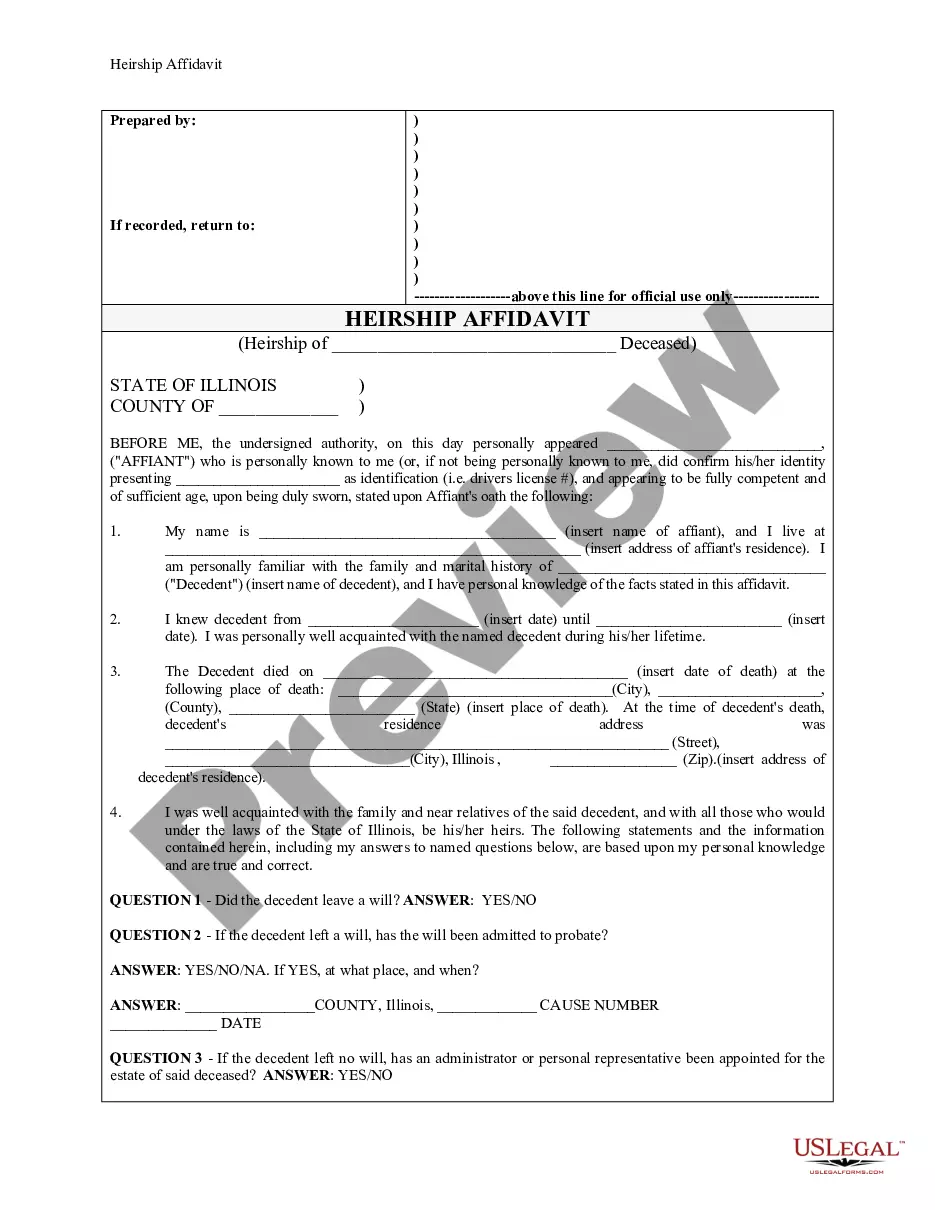

Cook Illinois Affidavit Of Heirship - Descent

Description

How to fill out Illinois Affidavit Of Heirship - Descent?

Regardless of social or occupational standing, filling out legal documents is an unfortunate requirement in today’s professional landscape.

Frequently, it’s nearly impossible for someone without any legal background to create these types of documents from the ground up, primarily due to the complicated terminology and legal nuances they entail.

This is where US Legal Forms becomes beneficial.

- Our platform offers a vast collection with over 85,000 ready-made state-specific documents suitable for nearly any legal situation.

- US Legal Forms additionally serves as a valuable resource for partners or legal advisors aiming to enhance their efficiency using our DIY papers.

- Whether you require the Cook Illinois Affidavit Of Heirship - Descent or any other documentation that is applicable in your state or region, US Legal Forms has everything you need at your fingertips.

- Here’s how you can swiftly obtain the Cook Illinois Affidavit Of Heirship - Descent using our dependable platform.

- If you are already a registered user, you can simply Log In to your account to retrieve the desired form.

Form popularity

FAQ

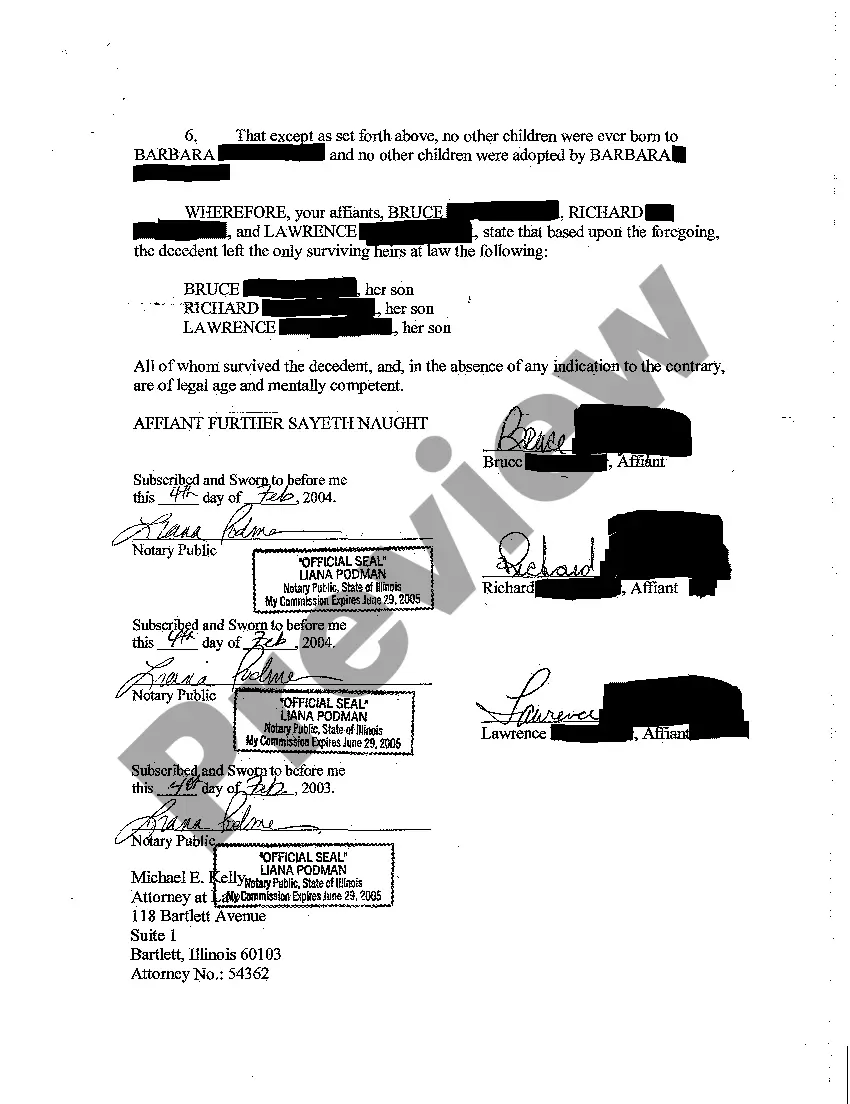

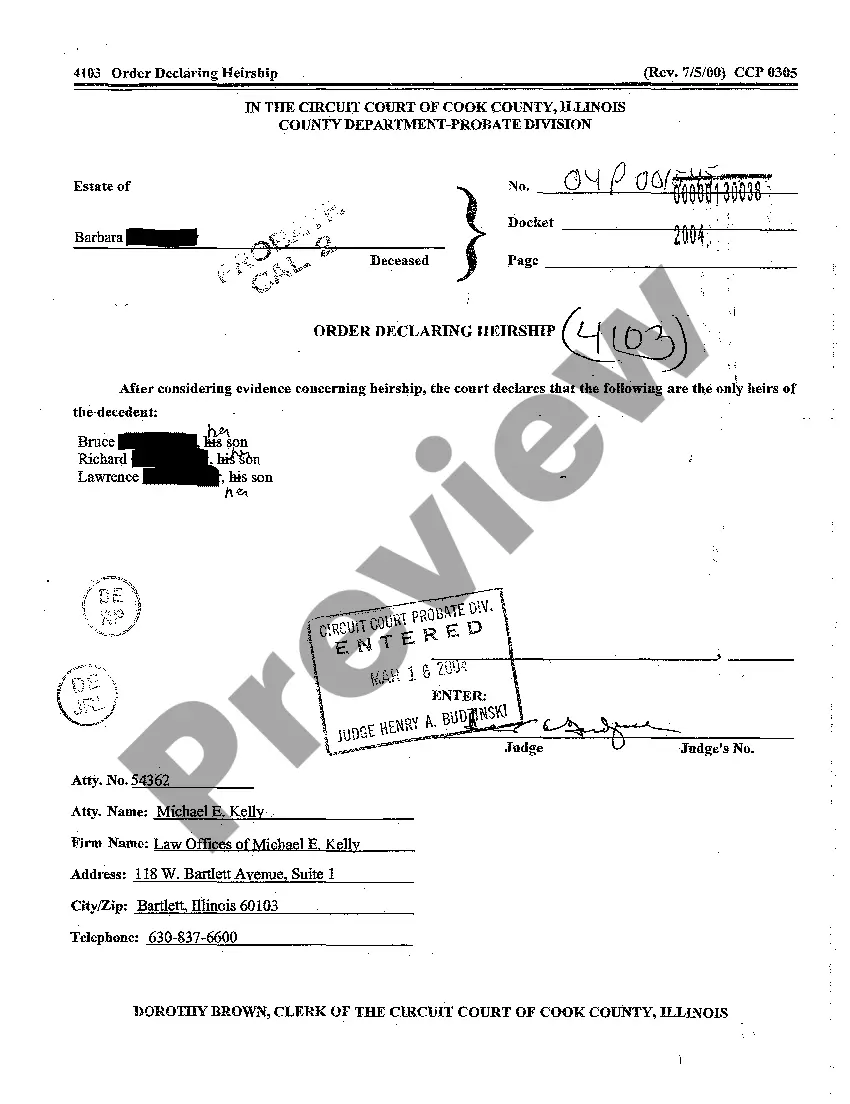

Filling out an affidavit of heirship involves providing accurate information about the deceased, such as their full name, date of death, and relationship to the heirs. You should also list the names and addresses of all heirs. It is critical to have the document notarized for it to be legally binding. Platforms like USLegalForms can guide you through the steps, making it easier to create an effective Cook Illinois Affidavit Of Heirship - Descent.

Yes, you can sell a house using an affidavit of heirship, provided you follow the legal guidelines in Illinois. The affidavit serves to establish ownership based on succession rather than a formal will. However, it is recommended to work with a real estate professional to handle the transaction. The USLegalForms platform offers resources to help you complete the affidavit correctly, ensuring a smoother selling process.

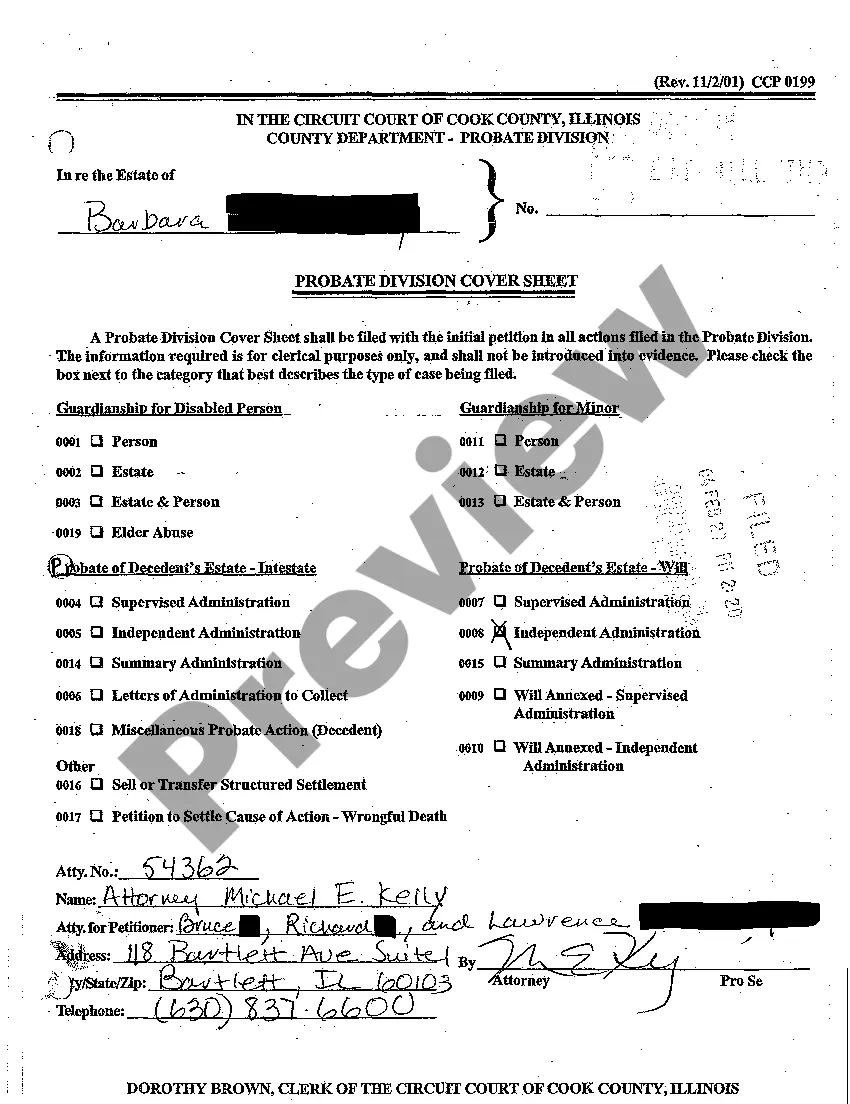

To file a will in Cook County, Illinois after a death, you must submit the original will to the probate court. You will also need to complete specific forms, including a petition for probate. Consider consulting a legal professional to ensure you follow all necessary procedures. Using an online platform like USLegalForms can simplify this process, guiding you through the required steps.

Filling out an affidavit of heirship form requires you to provide specific information about the deceased and the heirs. Start by detailing the decedent’s information followed by the relationship of each heir in the Cook Illinois Affidavit Of Heirship - Descent. Make sure the document is clear and legible, and do not forget to get it notarized. You can find step-by-step guides and templates on platforms like USLegalForms for assistance.

Usually, an affidavit of heirship is completed by someone knowledgeable about the deceased's family relations, such as a family member or close friend. The person is responsible for providing accurate details in the Cook Illinois Affidavit Of Heirship - Descent to establish the rightful heirs. It is important to ensure all information is verified to prevent legal issues. Using resources from USLegalForms can also guide you in this process.

You do not necessarily need a lawyer to draft an affidavit of heirs in Illinois. If you understand the documentation requirements, you can complete the Cook Illinois Affidavit Of Heirship - Descent on your own. However, consulting a legal professional can help avoid errors and ensure compliance with state laws. Services like USLegalForms provide valuable resources if legal assistance is needed.

Proof of heirship in Illinois refers to the documentation that establishes a person's legal right to inherit from a deceased relative. The Cook Illinois Affidavit Of Heirship - Descent serves as the primary evidence of this right. This document identifies the heirs and their relationship to the deceased, which is crucial for estate matters. To ensure accuracy, consider utilizing professional services such as USLegalForms.

You may file your own affidavit of heirship with the appropriate county office in Illinois. Be sure to complete the Cook Illinois Affidavit Of Heirship - Descent correctly and ensure that you have notarized it. Filing correctly ensures heirs can access the deceased's assets without unnecessary delays. Using services like USLegalForms can provide clarity on the filing process.

Yes, you can create your own affidavit of heirship in Illinois. However, it is crucial to follow the state guidelines accurately to avoid any legal complications. Creating a valid Cook Illinois Affidavit Of Heirship - Descent involves providing essential information about the deceased and the heirs. You may find resourceful templates through platforms like USLegalForms.

In Illinois, the Cook Illinois Affidavit Of Heirship - Descent typically requires notarization to ensure its validity. A notary public verifies the identity of the persons involved and the authenticity of their signatures. This process adds an essential layer of credibility to the document. It is recommended to consult with an expert or utilize a reliable service like USLegalForms for assistance.