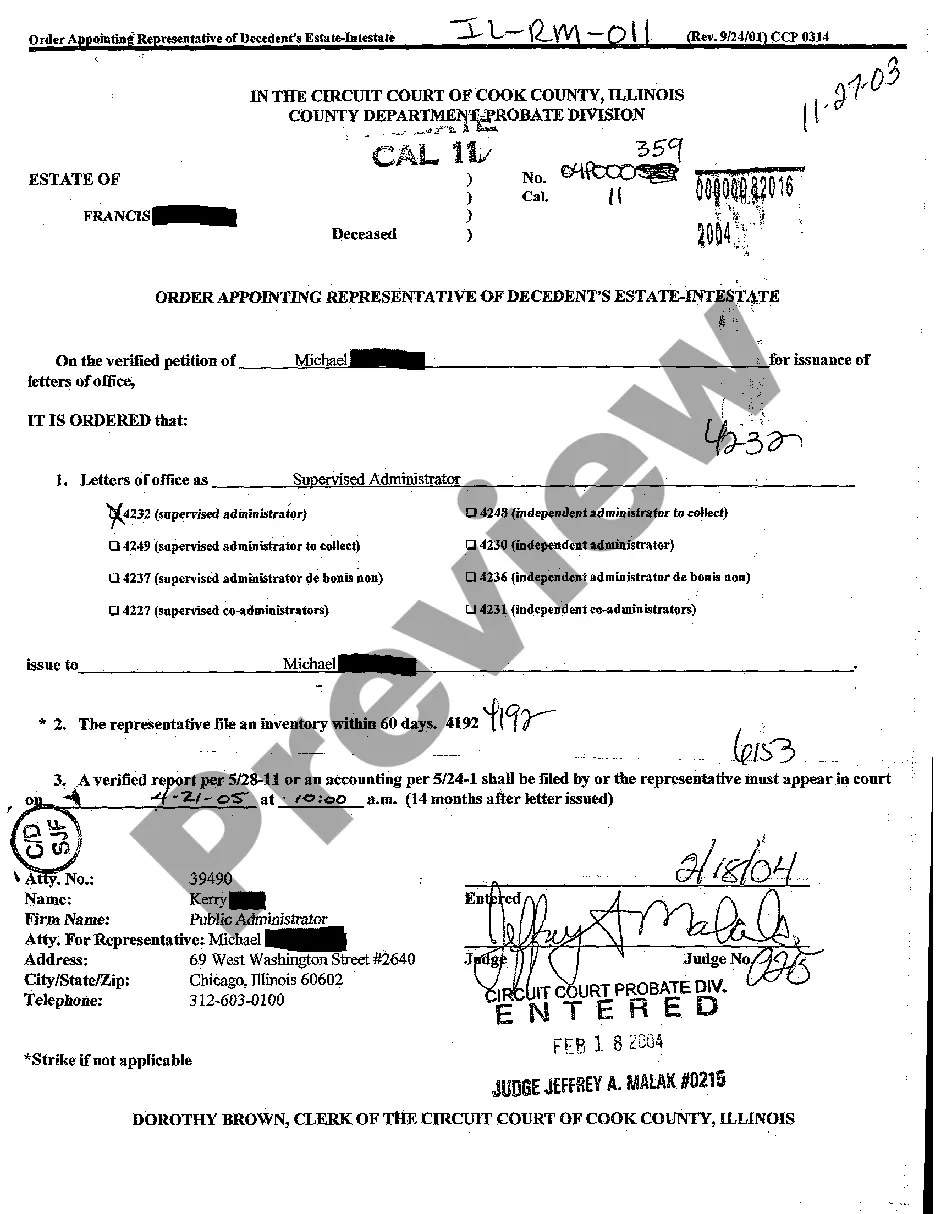

Cook Illinois Order Appointing Representative Of Decedent's Estate - Intestate

Description

How to fill out Illinois Order Appointing Representative Of Decedent's Estate - Intestate?

Obtaining verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and professional purposes and various real-world situations.

All the files are accurately categorized by purpose and jurisdictional areas, making it as quick and simple as pie to locate the Cook Illinois Order Appointing Representative Of Decedent's Estate - Intestate.

Maintaining documents organized and in accordance with legal stipulations is extremely important. Take advantage of the US Legal Forms library to always have critical document templates readily available for any requirements!

- For those already acquainted with our library and have accessed it previously, acquiring the Cook Illinois Order Appointing Representative Of Decedent's Estate - Intestate only takes a few clicks.

- Simply Log In to your account, select the document, and hit Download to save it onto your device.

- This procedure will require just a few extra steps for newcomers.

- Follow the instructions below to begin with the most comprehensive online form catalog:

- Examine the Preview mode and form description. Ensure you’ve chosen the right one that fulfills your needs and completely aligns with your local regulatory requirements.

Form popularity

FAQ

Section 2 AEL. Defines who personal representatives are and they include executors and administrators. They administer the estate of the deceased. An executor is appointed by will while an administrator is appointed by the Court.

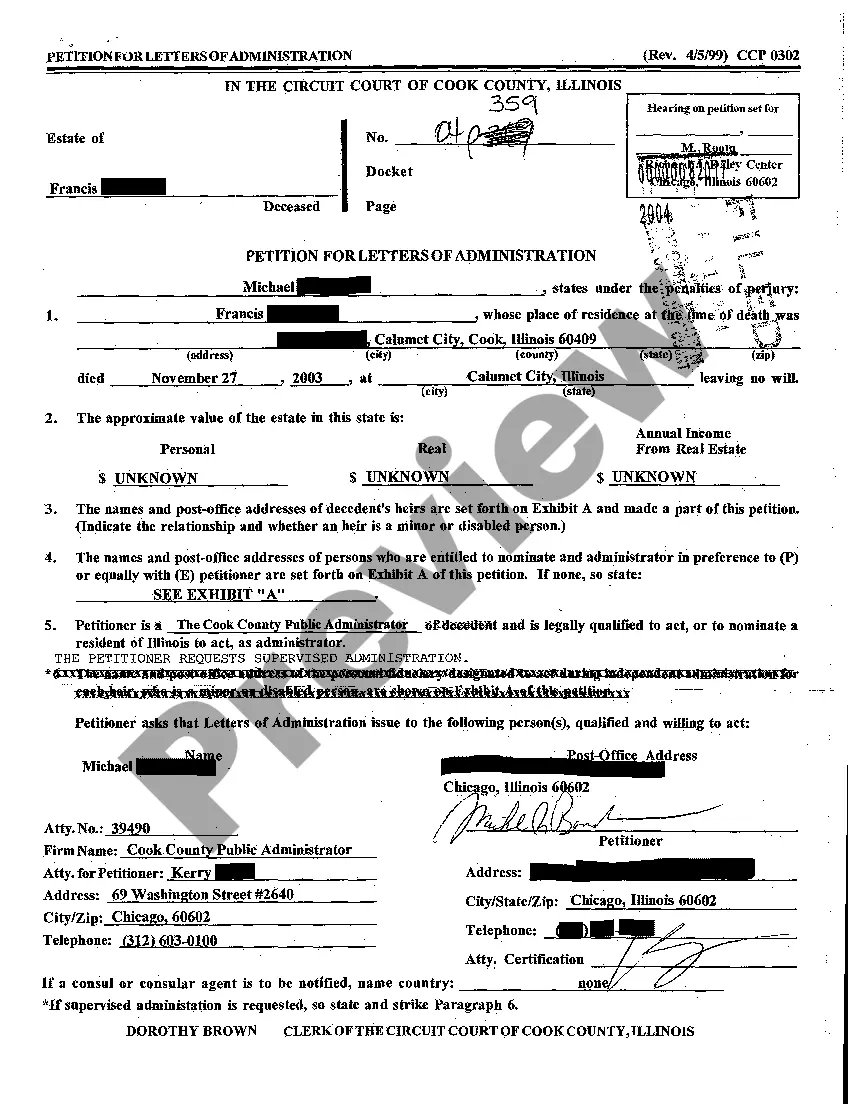

Petitioning the Court In Illinois, executors who are tasked with administering an estate must begin the process by petitioning the probate court in the county where the decedent resided for a letter of testamentary, or a letter of administration.

An administrator is also referred to as an executor. However, legally speaking, an administrator is appointed by a court when the decedent has not named an executor in their will or if a named executor refuses or is unable to assume the responsibilities. A court cannot force a named executor to fulfill their duties.

Most people file to become an estate executor after the person who owns the estate names that person as executor. An Illinois Circuit Court that has jurisdiction where the estate is located formally appoints an executor of an estate. Any qualifying adult can be named the executor of someone's estate.

Rates might vary from $10 an hour up to $50 an hour or more. I am aware of at least one court case in which a $50 an hour fee was approved by the court. Ultimately, the reasonableness of the fee must be determined by the court.

Like many other states, Illinois also prohibits people who have felony convictions from serving as executor.

An Executor is appointed by the Master of the High Court in terms of the Administration of Estates Act, 66 of 1965 (hereinafter referred to as ?the Act?). The Act gives an appointed Executor certain rights and responsibilities, and it also sets out the consequences where the responsibilities of an Executor are not met.

The qualifications to serve as an executor or administrator are: 1) individual is 18 years or older; 2) a United States resident; 3) not a convicted felon; and 4) not under a legal disability.

In most cases, the court will not have go beyond the first six classes to successfully appoint an administrator of the estate....A person must: Be at least 18 years of age; Be a United States resident; Be of sound mind and mentally competent to handle matters of the estate; and. Not have been convicted of a felony.

This means that the executor or administrator will not have to obtain court orders or file estate documents in court during probate. The estate will be administered without court supervision, unless an interested person asks the court to become involved.