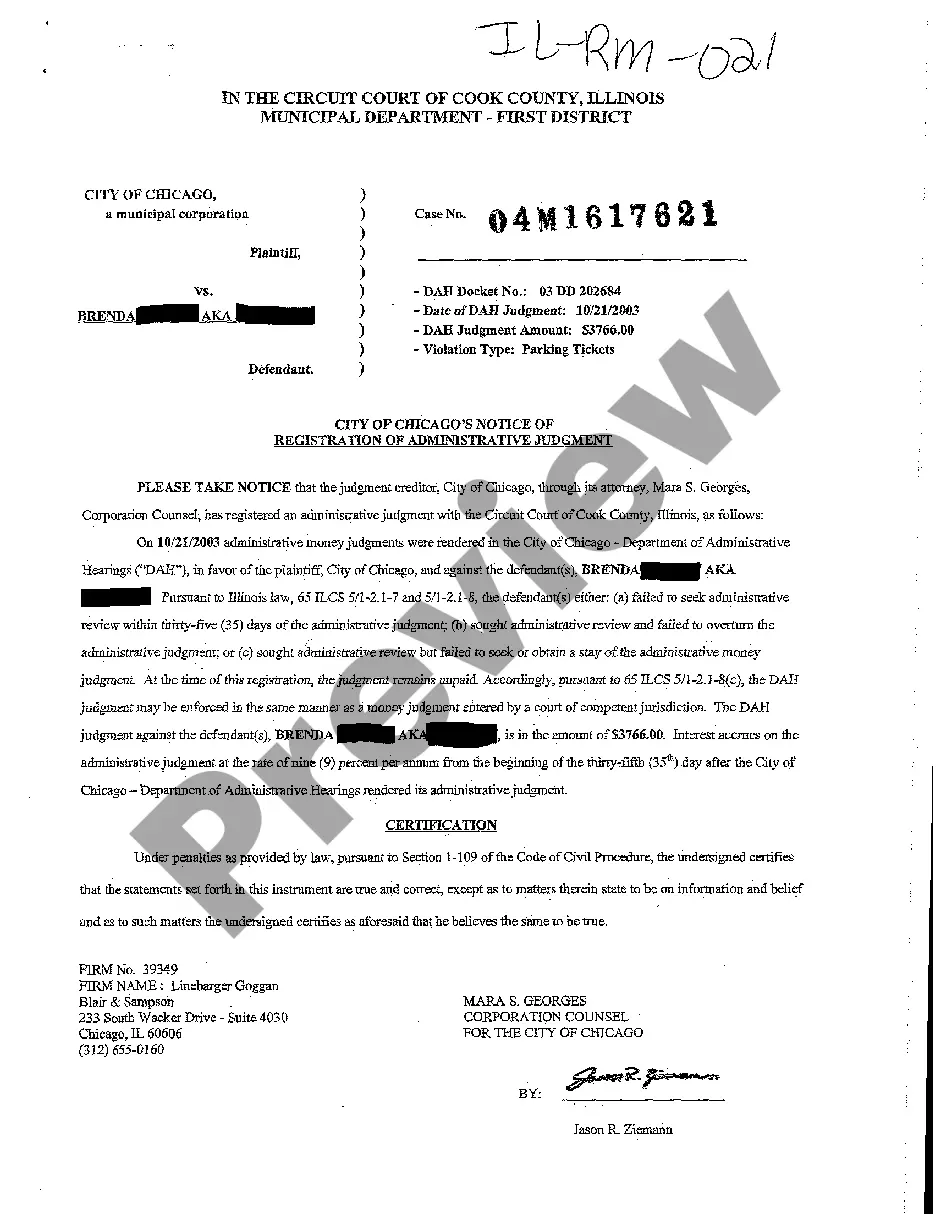

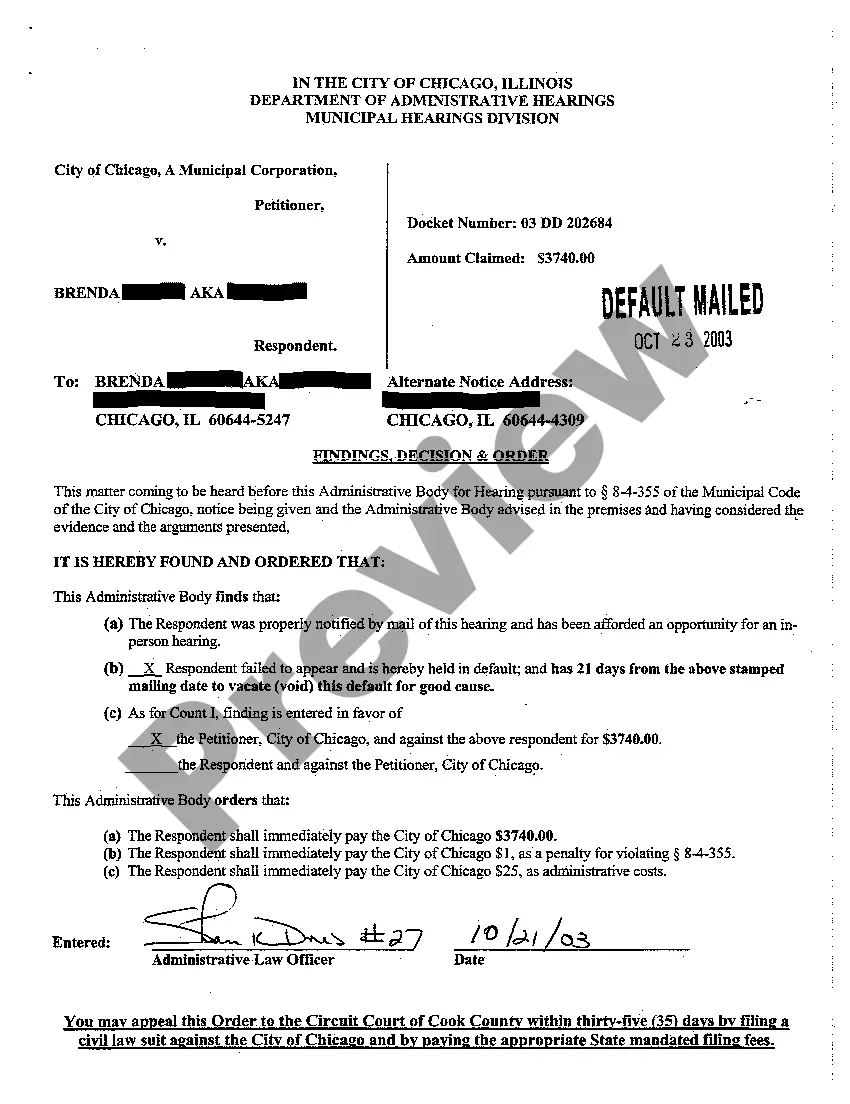

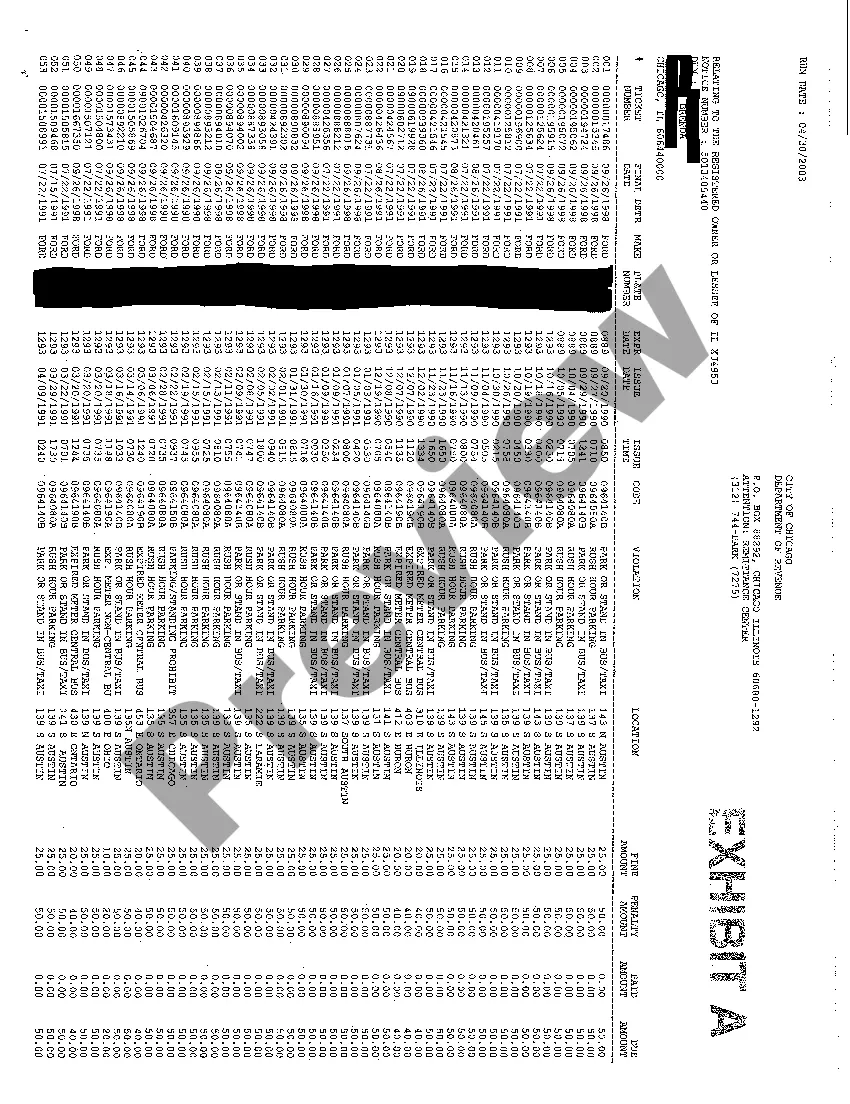

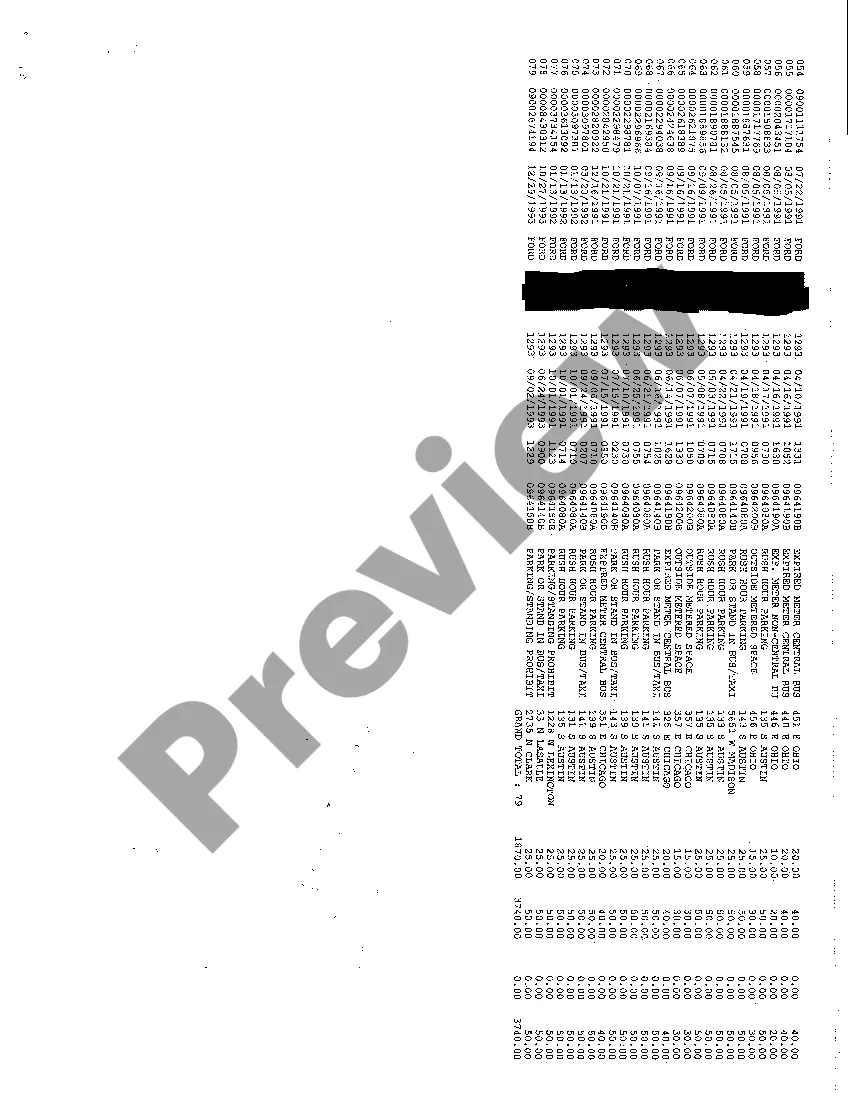

The Chicago Illinois Registration of Administrative Judgment is a legal process that enables parties to enforce administrative judgments and encumber properties owned by judgment debtors within Cook County, Illinois. This registration is governed by specific laws and procedures established by the state and county. Administrative judgments are typically issued by government agencies, such as the Illinois Department of Revenue or the Illinois Department of Employment Security, and usually involve debts owed to these agencies. These judgments can arise from various types of tax-related matters, unemployment insurance contributions, or fines and penalties imposed by administrative bodies. The registration of administrative judgments involves submitting the judgment to the Office of the Cook County Recorder of Deeds. The purpose of registration is to create a lien against the judgment debtor's property, ensuring that the debt is acknowledged and the judgment creditor has a legal claim to the property. Once registered, the administrative judgment essentially functions as a lien against the debtor's real estate assets within Cook County. There are different types of administrative judgments that can be registered in Chicago, Illinois. These may include: 1. Tax Liens: These judgments arise from unpaid taxes owed to various governmental bodies. They can encompass income taxes, property taxes, sales taxes, and other tax liabilities. 2. Unemployment Compensation Judgments: This type of administrative judgment is issued by the Illinois Department of Employment Security in cases where employers fail to properly contribute to the state's unemployment insurance program. 3. Fine and Penalty Judgments: These judgments result from violations of regulations and ordinances established by administrative bodies, such as building code violations, health code violations, or environmental violations. These fines and penalties can be registered to create a lien against the debtor's property. All types of administrative judgments must be properly documented, and the necessary paperwork, including the judgment itself, must be filed with the Cook County Recorder of Deeds. The filing should include details of the judgment, such as the name and address of the judgment debtor, the amount owed, and any relevant identifying information. Once registered, the administrative judgment becomes a public record accessible to anyone searching property records within Cook County. This means that potential buyers, creditors, or other parties with an interest in the property will find the judgment when conducting a title search. In conclusion, the Chicago Illinois Registration of Administrative Judgment is a legal process that allows government agencies and other entities to establish a lien on the property of judgment debtors within Cook County. This registration provides a means for enforcing administrative judgments and ensuring that debts owed to government bodies are properly acknowledged and addressed.

Chicago Illinois Registration Of Administrative Judgment

Description

How to fill out Chicago Illinois Registration Of Administrative Judgment?

If you are searching for a valid form template, it’s difficult to find a more convenient platform than the US Legal Forms site – probably the most extensive libraries on the internet. With this library, you can get thousands of form samples for business and personal purposes by categories and regions, or keywords. With our high-quality search feature, finding the newest Chicago Illinois Registration Of Administrative Judgment is as elementary as 1-2-3. In addition, the relevance of each file is proved by a team of expert attorneys that regularly check the templates on our website and revise them in accordance with the newest state and county laws.

If you already know about our system and have a registered account, all you need to get the Chicago Illinois Registration Of Administrative Judgment is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

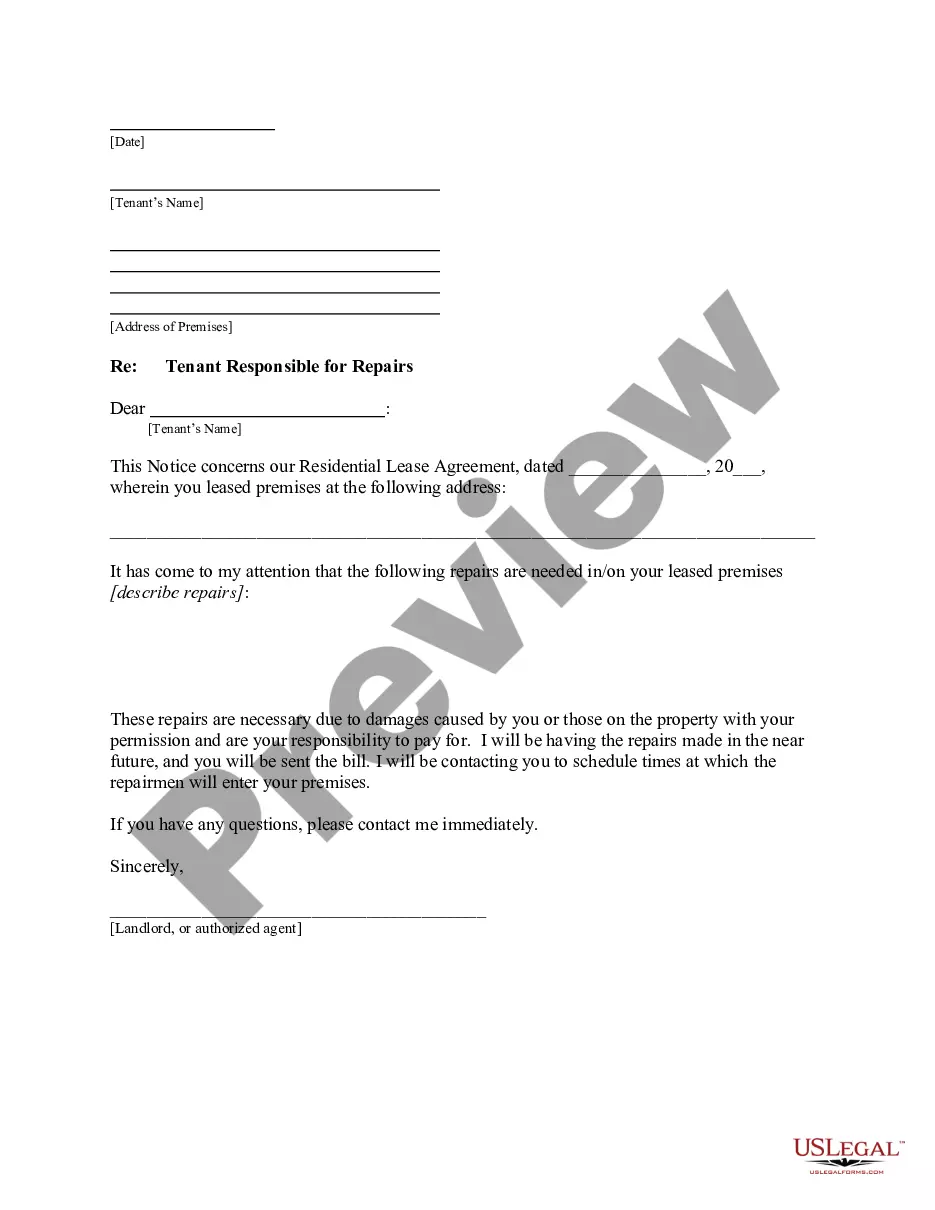

- Make sure you have discovered the form you want. Read its explanation and use the Preview feature to see its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to discover the proper record.

- Affirm your choice. Select the Buy now option. Next, select your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the template. Choose the format and save it to your system.

- Make adjustments. Fill out, revise, print, and sign the received Chicago Illinois Registration Of Administrative Judgment.

Each template you add to your user profile has no expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to get an extra version for enhancing or creating a hard copy, you can return and save it once more at any time.

Take advantage of the US Legal Forms extensive catalogue to get access to the Chicago Illinois Registration Of Administrative Judgment you were seeking and thousands of other professional and state-specific templates in one place!