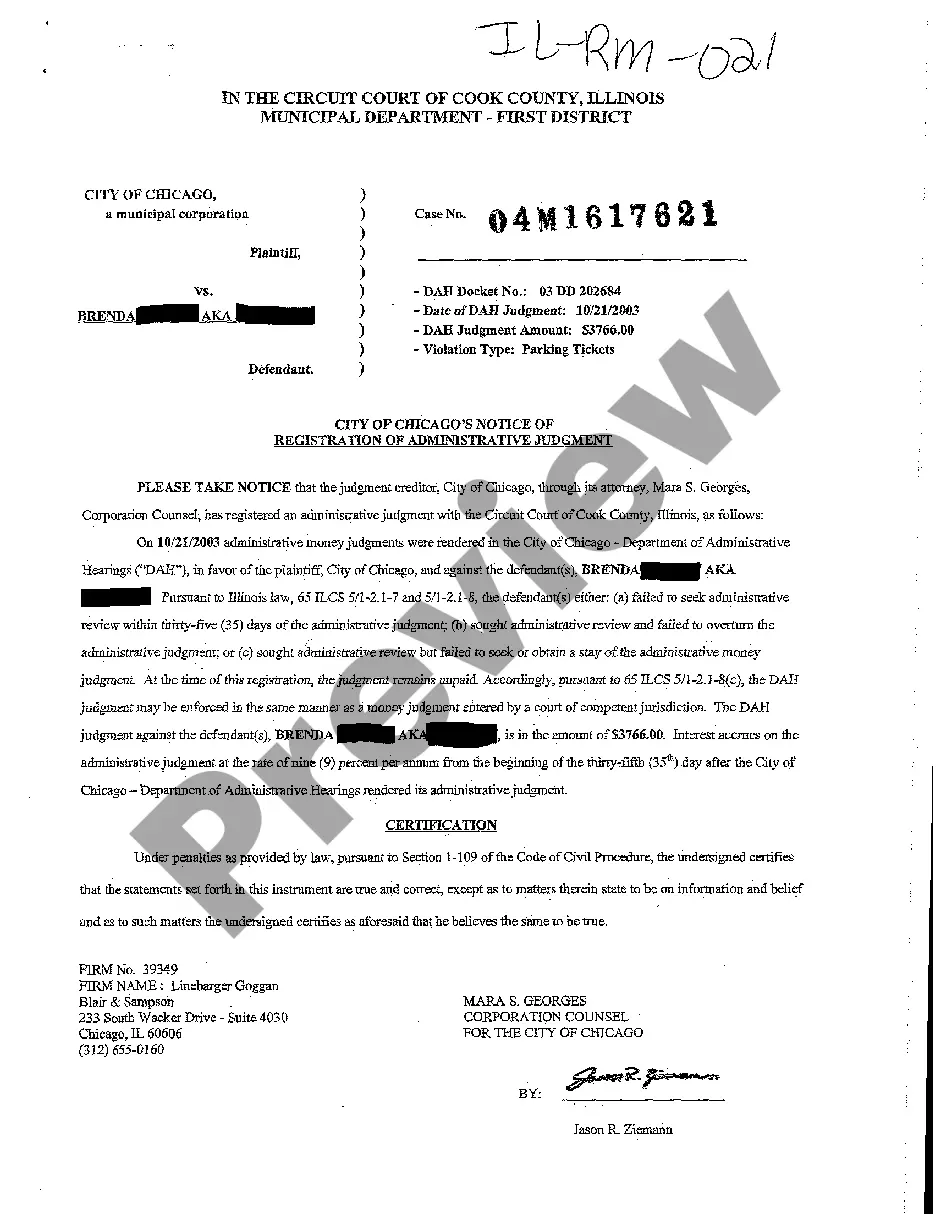

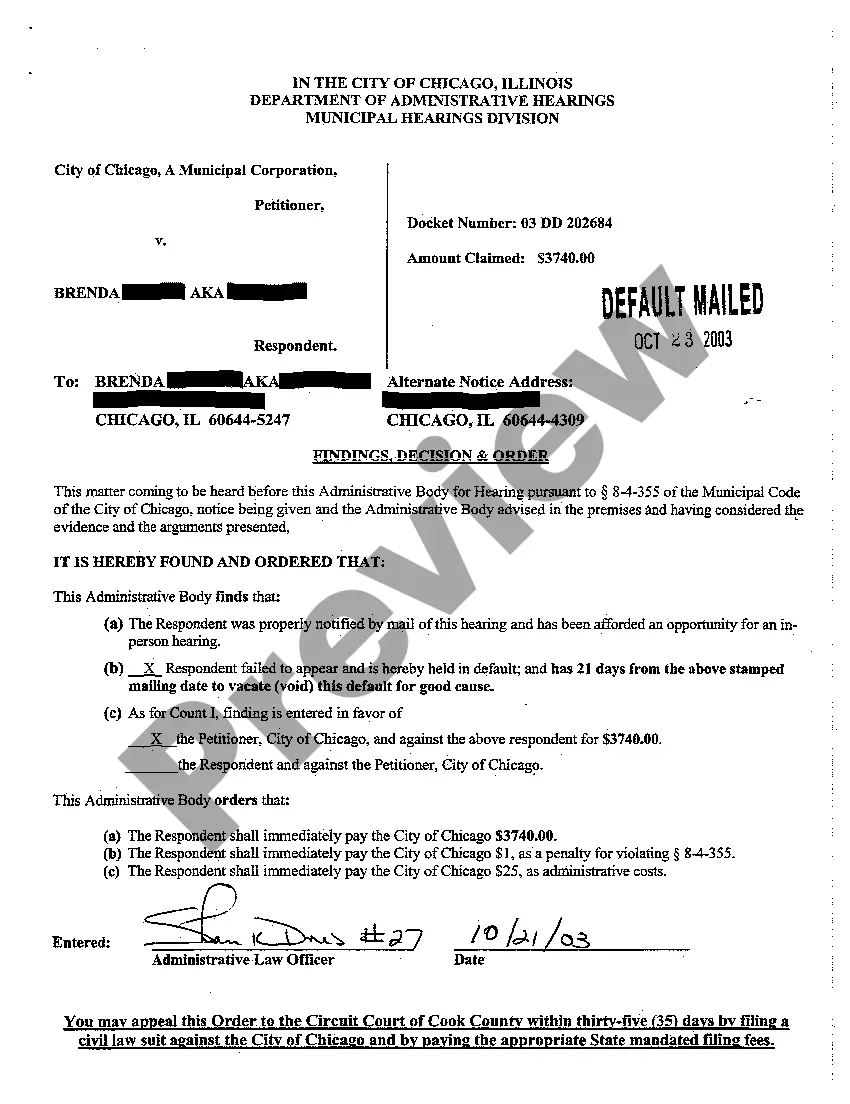

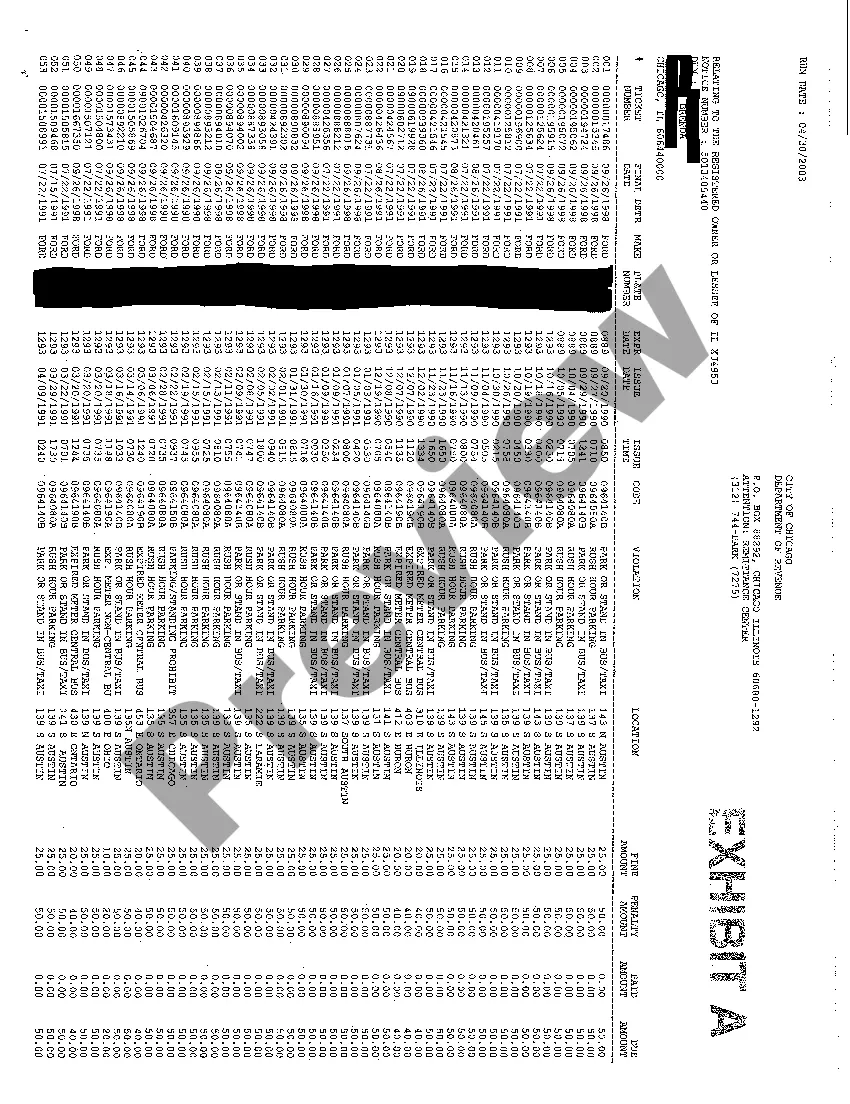

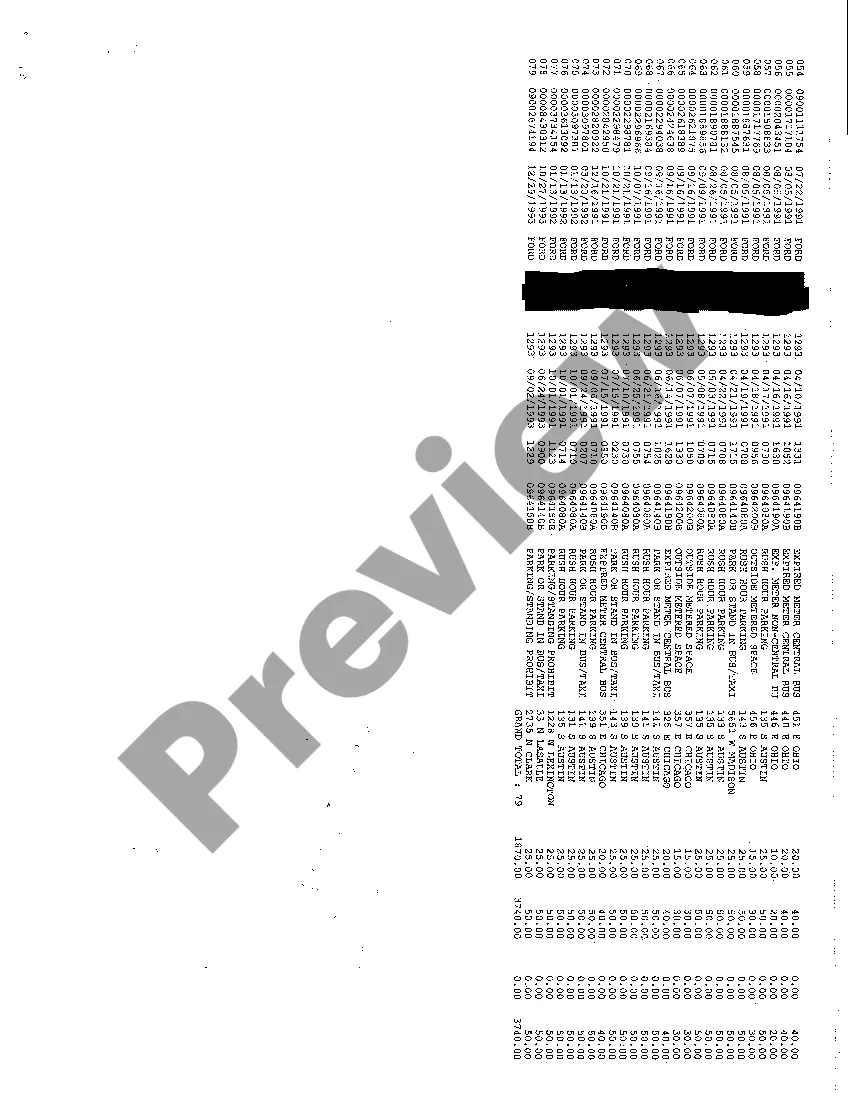

Elgin Illinois Registration of Administrative Judgment serves as an essential legal procedure that allows the enforcement and collection of unpaid administrative judgments in Elgin, Illinois. It ensures that individuals or entities are held accountable for their outstanding debts owed to the government or other parties. The registration of administrative judgments provides a means to convert an administrative ruling or decision into a legally enforceable judgment. When an administrative agency, such as a government department or regulatory authority, issues a judgment against an individual or business for non-compliance or other violations, it can be registered with the court system in Elgin. Upon registration, the administrative judgment is treated as an equivalent to a civil judgment rendered by a court. This allows the judgment creditor (the party owed the debt) to take legal action and employ various collection methods to ensure the debt is paid. There are different types of administrative judgments that can be registered in Elgin, Illinois: 1. Tax Liens: When an individual or business fails to pay their taxes, local tax authorities may issue a tax lien against their property or assets. By registering this tax lien as an administrative judgment, the government gains greater leverage to collect the unpaid taxes. 2. Regulatory Fines: Regulatory agencies, such as the Environmental Protection Agency or the Occupational Safety and Health Administration, may issue fines for non-compliance with regulations. These fines can be registered as administrative judgments, allowing the agencies to pursue collections through legal means. 3. Unpaid Municipal Utility Bills: If an individual or business fails to pay their municipal utility bills, such as water or sewage charges, the municipality can register the outstanding amount as an administrative judgment. This provides a legal path for the municipality to recover the unpaid bills. 4. Unpaid Parking Tickets: When parking violations go unresolved, the municipality can convert them into administrative judgments by registering them with the court. This strengthens the municipality's ability to collect the due fines and penalties. In conclusion, Elgin Illinois Registration of Administrative Judgment is a crucial process that enables the enforcement and collection of unpaid administrative judgments. By converting administrative rulings into legally enforceable judgments, it empowers judgment creditors to pursue collections through legal means. Tax liens, regulatory fines, unpaid municipal utility bills, and unpaid parking tickets are some examples of the different types of administrative judgments that can be registered in Elgin, Illinois.

Elgin Illinois Registration Of Administrative Judgment

Description

How to fill out Elgin Illinois Registration Of Administrative Judgment?

Benefit from the US Legal Forms and obtain instant access to any form template you need. Our beneficial platform with a huge number of document templates allows you to find and get virtually any document sample you require. It is possible to export, complete, and certify the Elgin Illinois Registration Of Administrative Judgment in a couple of minutes instead of surfing the Net for many hours attempting to find the right template.

Using our library is a superb way to improve the safety of your record submissions. Our experienced legal professionals on a regular basis review all the documents to make certain that the forms are relevant for a particular state and compliant with new laws and polices.

How do you get the Elgin Illinois Registration Of Administrative Judgment? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. In addition, you can find all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, follow the instructions listed below:

- Open the page with the form you require. Make certain that it is the form you were hoping to find: examine its title and description, and use the Preview feature if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Save the document. Pick the format to get the Elgin Illinois Registration Of Administrative Judgment and modify and complete, or sign it for your needs.

US Legal Forms is among the most extensive and reliable document libraries on the web. Our company is always ready to help you in any legal case, even if it is just downloading the Elgin Illinois Registration Of Administrative Judgment.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!