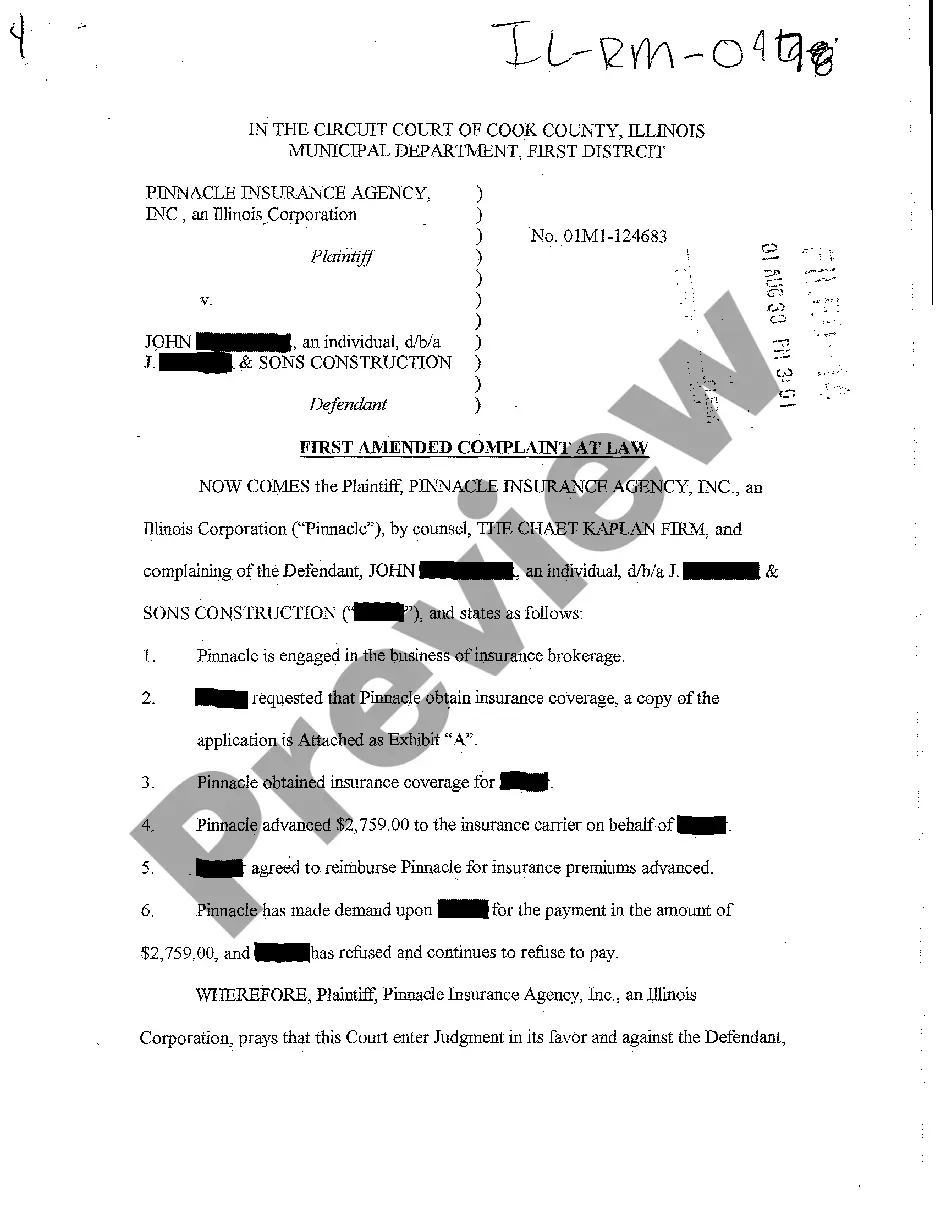

Elgin Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid An Elgin, Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid is a legal document filed by an insurance broker in Elgin, Illinois, seeking reimbursement of advanced premium payments made to an insurance company. When an insurance broker collects premiums on behalf of an insured individual or business, they are responsible for remitting those funds to the insurance company. In some cases, the broker may collect premiums in advance of the policy period to ensure coverage is in effect from the start date. However, there are instances where the insurance coverage does not go into effect due to various reasons, such as a denial of the application or the insurance company's failure to issue the policy. In such cases, the insurance broker is entitled to a refund of the advanced premium paid on behalf of the insured. The First Amended Complaint is a legal document that outlines the broker's claim against the insurance company for repayment of the advanced premium. It includes details about the policies for which the advanced premium was paid, the amount of the premium, and the circumstances leading to the denial or non-issuance of the policies. The complaint may also elaborate on any contractual agreements between the broker and the insurance company regarding premium collection and repayment. Additionally, it may include information on the broker's efforts to resolve the matter outside of litigation, such as communications or negotiations with the insurance company. The Elgin, Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid can be filed in various situations, including: 1. Denial of Insurance Application: When the insurance company denies an application for insurance coverage after the advanced premium has been paid, the broker can seek reimbursement through this complaint. 2. Failure to Issue the Policy: If the insurance company fails to issue the policy even after receiving the advanced premium, the broker can file this complaint to recover the funds. 3. Policy Cancellation: In cases where the policy is canceled by the insurance company before its effective date, the broker can seek repayment of the advanced premium through this legal action. 4. Rescission of Policy: If the insurance company rescinds the policy after the advanced premium has been paid, the broker can file the complaint to recover the funds. In conclusion, an Elgin, Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid is a legal document used by insurance brokers to seek reimbursement for advanced premiums paid on behalf of insured individuals or businesses. It is relevant in various situations where the insurance coverage is denied, not issued, canceled, or rescinded.

Elgin Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid

Description

How to fill out Elgin Illinois First Amended Complaint At Law By Insurance Broker For Repayment Of Advanced Premium Paid?

Benefit from the US Legal Forms and have immediate access to any form sample you need. Our beneficial website with a large number of documents makes it simple to find and obtain almost any document sample you require. You are able to save, complete, and sign the Elgin Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid in a couple of minutes instead of surfing the Net for several hours trying to find the right template.

Using our catalog is a wonderful way to increase the safety of your document filing. Our experienced legal professionals on a regular basis check all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you get the Elgin Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid? If you already have a profile, just log in to the account. The Download button will appear on all the samples you look at. Furthermore, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Find the template you need. Make certain that it is the form you were seeking: examine its title and description, and use the Preview option when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the downloading procedure. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Select the format to obtain the Elgin Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy template libraries on the web. Our company is always ready to help you in virtually any legal case, even if it is just downloading the Elgin Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!