The Naperville Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid is a legal document filed by an insurance broker in Naperville, Illinois seeking the repayment of advanced premiums that were paid on behalf of a client. This complaint is typically filed when the insurance broker has advanced premium funds to the insurance company, but the policyholder later cancels the insurance policy before its expiration date, making the advanced premium refundable. In this complaint, the insurance broker alleges that they are entitled to reimbursement of the advanced premium paid, as per the terms of their agreement with the insurance company. They argue that the insurance company has a duty to return the advanced premium if the policyholder cancels the policy early, and they seek a court order to compel the reimbursement. Key terms and relevant keywords for this complaint include: 1. Naperville, Illinois: This refers to the geographical location where the complaint is filed, establishing the jurisdiction of the court. 2. First Amended Complaint: This indicates that there might have been a previous complaint filed by the insurance broker, and this is the amended version, which includes additional or modified claims. 3. Law: This emphasizes that the complaint is filed in a court of law, highlighting the legal nature of the matter. 4. Insurance Broker: This refers to the party filing the complaint, who is acting as an intermediary between the insurance company and the policyholder. 5. Repayment: The main objective of the complaint is to seek the return of the advanced premium paid. 6. Advanced Premium Paid: This is the amount of money the insurance broker paid upfront to the insurance company on behalf of the policyholder. 7. Reimbursement: This term highlights the insurance broker's claim for being repaid the advanced premium funds. 8. Insurance Company: The entity from which the insurance broker is seeking reimbursement. 9. Policyholder: This refers to the individual for whom the insurance policy was initially issued. 10. Terms and Conditions: The complaint may reference the agreed-upon terms and conditions between the insurance broker and the insurance company, which outline the circumstances under which the advanced premium is refundable. 11. Court Order: The insurance broker requests a court order to enforce the reimbursement, indicating their intention to involve the legal system if necessary. It is important to note that while variations of the complaint may exist, depending on the specific circumstances of each case, the overall objective remains the same — securing the repayment of the advanced premium paid by the insurance broker on behalf of the policyholder.

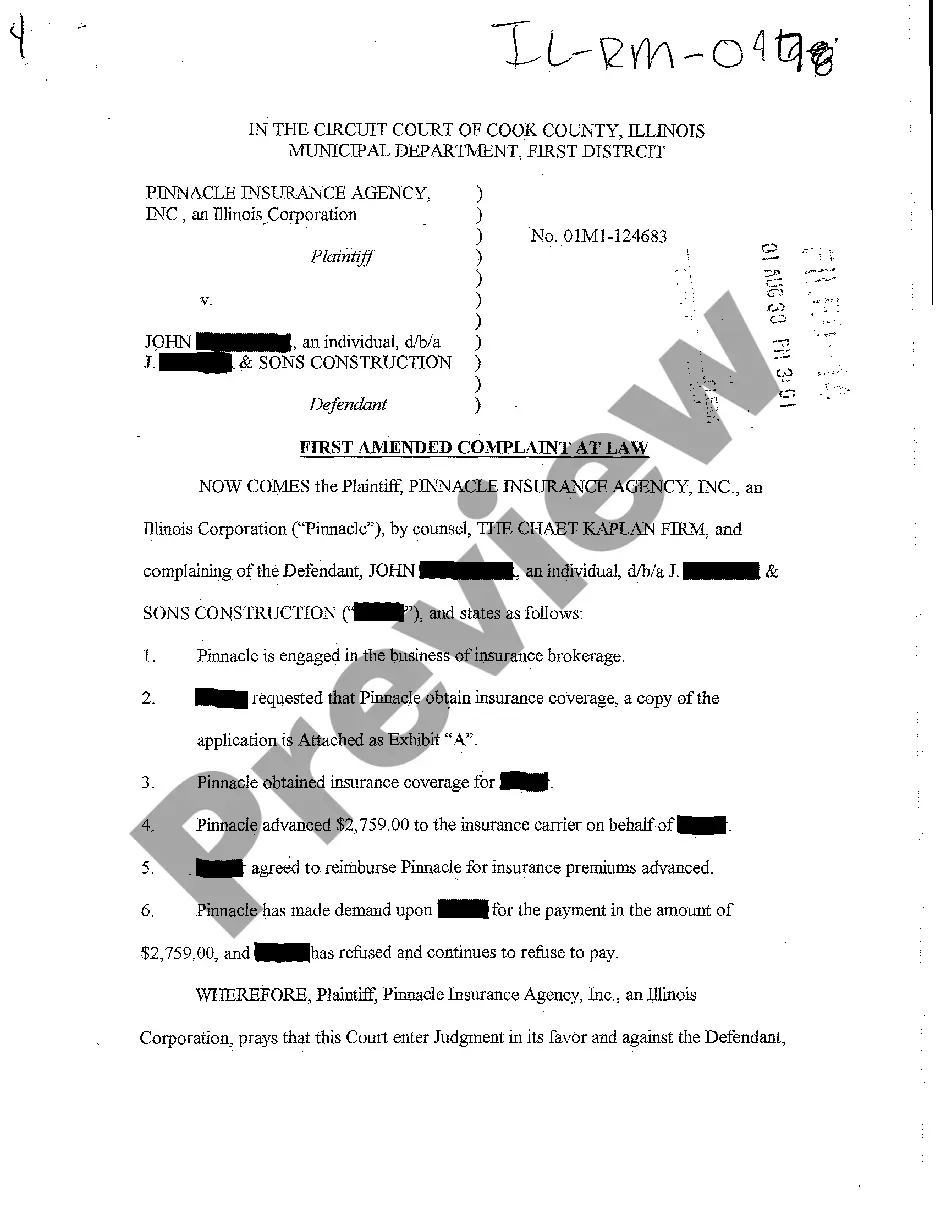

Naperville Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid

Description

How to fill out Naperville Illinois First Amended Complaint At Law By Insurance Broker For Repayment Of Advanced Premium Paid?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Naperville Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Naperville Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Naperville Illinois First Amended Complaint At Law by Insurance Broker for Repayment of Advanced Premium Paid. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!